India Chemical Logistics Market Size, Share, Trends and Forecast by Type, Service, and Region, 2025-2033

India Chemical Logistics Market Overview:

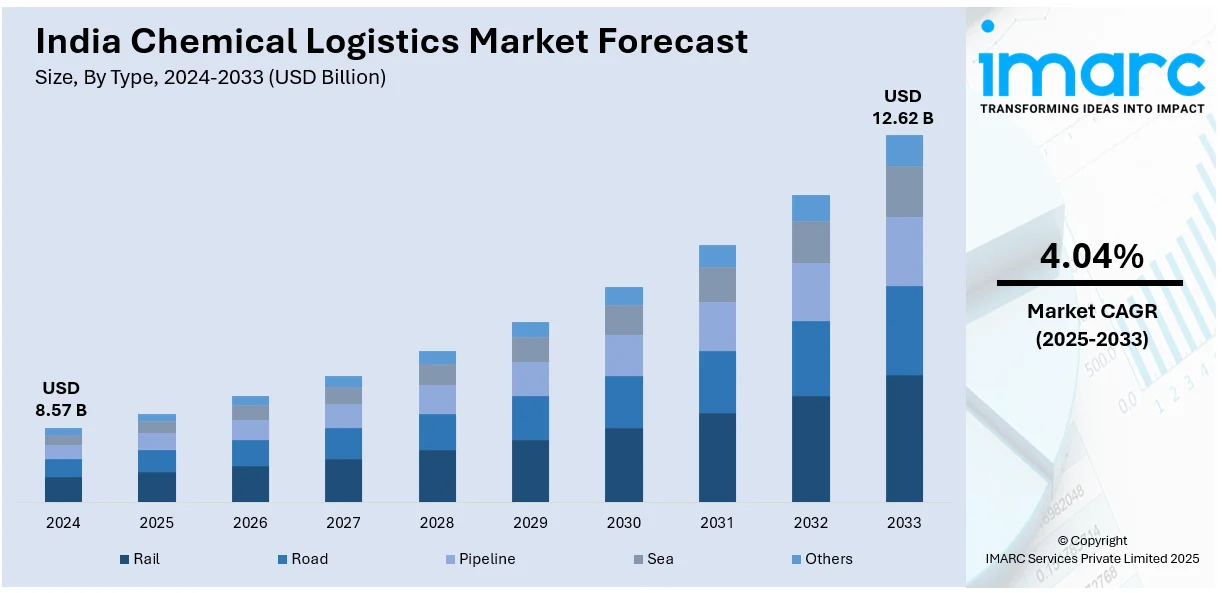

The India chemical logistics market size reached USD 8.57 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.62 Billion by 2033, exhibiting a growth rate (CAGR) of 4.04% during 2025-2033. Industrial growth, increasing chemical production, rising demand for specialized storage and transportation, government regulations on hazardous materials, expansion of pharmaceutical and agrochemical sectors, advancements in supply chain technology, and increasing export-import activities in chemicals are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.57 Billion |

| Market Forecast in 2033 | USD 12.62 Billion |

| Market Growth Rate (2025-2033) | 4.04% |

India Chemical Logistics Market Trends:

Prioritizing Safety and Efficiency in Chemical Logistics

The chemical logistics sector in India is putting more emphasis on safety and security while transporting hazardous products. Industry leaders and government entities are working together to improve operational processes and infrastructure. Discussions are heating up over standardized practices, such as the safe handling and transit of risky items, as well as addressing possible vulnerabilities that pose transportation concerns. Adoption of global best practices, maintaining compliance with international standards, and installing advanced monitoring systems for secure transmission are all receiving more attention. As chemical transportation safety becomes a national priority, stakeholders are actively engaged in communication and knowledge sharing to raise logistical standards, mitigate risks, and assure operational excellence across the chemical supply chain. For example, in July 2023, the Indian Chemical Council's Nicer Globe initiative hosted the 'NG-LOG NEXT - 2023' conference at The Lalit Hotel in Mumbai. This national-level event brought together industry leaders, government officials, and international experts to discuss critical topics such as safety in logistics transport operations, guidelines on transporting dangerous goods, and addressing security vulnerabilities in chemical transportation.

To get more information on this market, Request Sample

Rising Demand for Specialized Chemical Logistics Solutions

India’s chemical and petrochemical industries are experiencing a shift toward customized supply chain solutions to enhance efficiency, compliance, and sustainability. Companies are integrating advanced technology and global best practices to streamline logistics operations, ensuring safer and more cost-effective transportation. With the sector’s rapid growth, logistics providers are focusing on specialized handling, regulatory compliance, and real-time tracking to meet the industry's evolving needs. The increasing demand for seamless distribution networks has led to the expansion of dedicated supply chain services that cater specifically to chemical and hazardous material logistics. This shift reflects the industry's need for enhanced risk management, operational transparency, and strategic partnerships to support long-term scalability and sustainable growth in India’s expanding chemical market. For instance, in January 2019, Logistics Plus Inc. launched 'Logistics Plus Chemical SCM' in Thane, India, to cater to the chemical and petrochemical sectors' supply chain needs. This division offers 3.5PL and 4PL solutions, leveraging advanced technologies and global expertise to enhance value for clients. The initiative aligns with India's robust chemical industry growth, positioning Logistics Plus to support this expanding market.

India Chemical Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and service.

Type Insights:

- Rail

- Road

- Pipeline

- Sea

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes rail, road, pipeline, sea, and others.

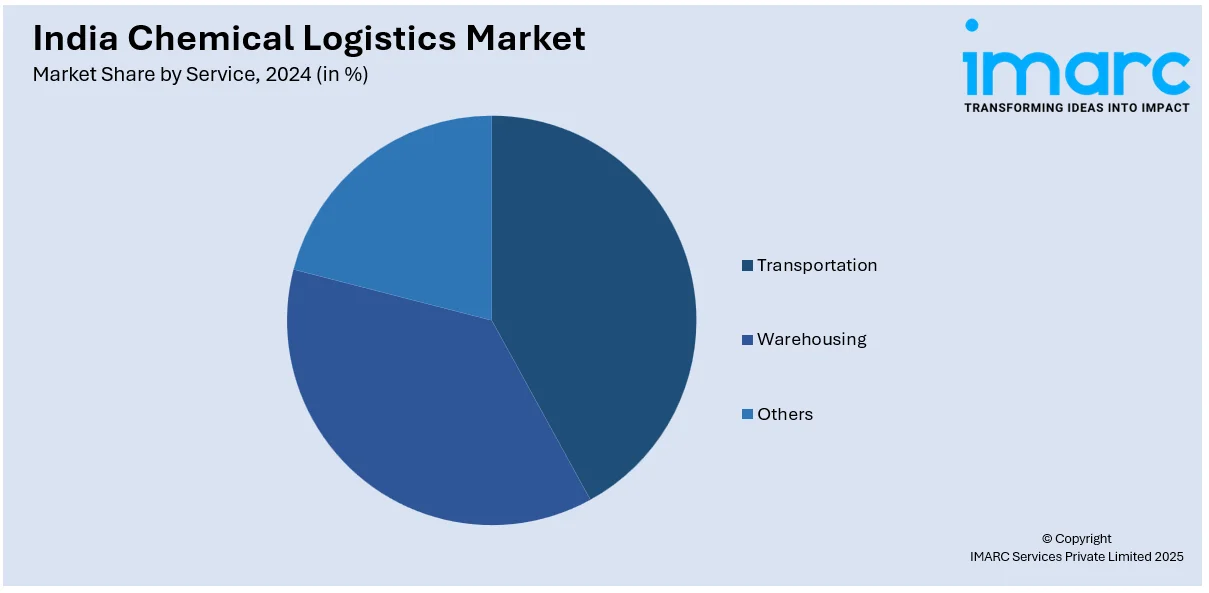

Service Insights:

- Transportation

- Warehousing

- Others

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes transportation, warehousing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chemical Logistics Market News:

- In February 2025, Transport Corporation of India (TCI) transferred its chemical logistics division to TCI Chemlog through a slump sale agreement. As part of this transaction, TCI Chemlog issued 100,000 equity shares with a face value of INR 100 each, at a premium of INR 4,424 per share, to TCI.

- In April 2024, Rhenus Logistics and Brenntag collaborated to introduce India's first fully electric truck for chemical logistics. This initiative aims to reduce carbon emissions in last-mile deliveries around Bhiwandi, near Mumbai, aligning with both companies' environmental goals.

India Chemical Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rail, Road, Pipeline, Sea, Others |

| Services Covered | Transportation, Warehousing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India chemical logistics market performed so far and how will it perform in the coming years?

- What is the breakup of the India chemical logistics market on the basis of type?

- What is the breakup of the India chemical logistics market on the basis of service?

- What are the various stages in the value chain of the India chemical logistics market?

- What are the key driving factors and challenges in the India chemical logistics market?

- What is the structure of the India chemical logistics market and who are the key players?

- What is the degree of competition in the India chemical logistics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chemical logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chemical logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chemical logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)