India Chemotherapy Market Size, Share, Trends and Forecast by Drugs, Cancer Type, Route of Administration, Distribution Channel, and Region, 2025-2033

India Chemotherapy Market Overview:

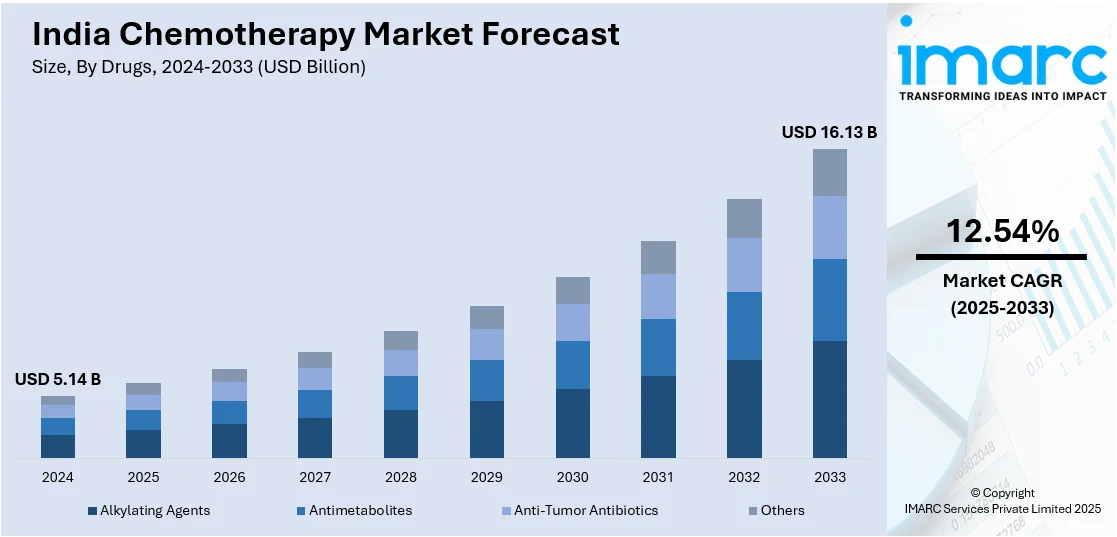

The India chemotherapy market size reached USD 5.14 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 16.13 Billion by 2033, exhibiting a growth rate (CAGR) of 12.54% during . The India chemotherapy market is primarily driven by rising cancer incidence, increasing accessibility to affordable generic drugs, advancements in diagnostic technologies, growing awareness about the importance of early cancer detection among consumers, elevating adoption of combination therapies, and the introduction of targeted cancer treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.14 Billion |

| Market Forecast in 2033 | USD 16.13 Billion |

| Market Growth Rate 2025-2033 | 12.54% |

India Chemotherapy Market Trends:

Rising Cancer Incidences

One of the main accelerators of the market for chemotherapy in India is the surging rate of cancer across the nation. In 2022, India recorded approximately 1,461,427 new cancer cases, with a crude incidence rate of 100.4 per 100,000 people. The main reasons for this include rising urbanization, lifestyle choices, and growing environmental pollution. As per the Indian Council of Medical Research (ICMR), the incidence of cancer, including breast, lung, cervical, and colorectal cancers, is set to rise further in the near-term. The spread of cancer has led to the escalating need for the right treatments, making chemotherapy an essential element of oncology treatment. Additionally, technological development in diagnostic testing has contributed to the early identification of cancer, thus encouraging patients undergoing chemotherapy. An increasing number of hospitals and medical centers are provided with advanced testing equipment; as such, screening for cancer is becoming more accessible. This is in turn being encouraged by favorable government policies, such as the National Program for Prevention and Control of Cancer, Diabetes, Cardiovascular Diseases, and Stroke (NPCDCS), which encourages treatment and early identification.

To get more information on this market, Request Sample

Expanding Access to Affordable Chemotherapy Drugs

The other key driver of the Indian chemotherapy market is the growing availability of low-cost chemotherapy drugs, especially through the growth of the domestic pharmaceutical sector and government policies. India is a leading manufacturer of generic drugs, and domestic players produce a vast array of low-cost chemotherapy drugs. Prominent Indian pharmaceutical firms like Sun Pharma, Dr. Reddy's Laboratories, and Cipla have brought the cost of chemotherapy drugs down very substantially compared to their international counterparts, thus putting treatment within affordable reach for a greater number of patients. In addition, government schemes like the Pradhan Mantri Bhartiya Janaushadhi Pariyojana (PMBJP) also focus on increasing the accessibility of essential medications, including chemotherapeutic medicines. Moreover, public health programs such as Pradhan Mantri Jan Arogya Yojana (PMJAY) provide financing to economically poor patients so that they can undergo cancer care that is life-saving. All these initiatives have led to an increase in the adoption rates of chemotherapy, particularly in the semi-urban and rural areas, where cost has always been a constraint for seeking treatment.

India Chemotherapy Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on drugs, cancer type, route of administration, and distribution channel.

Drugs Insights:

- Alkylating Agents

- Antimetabolites

- Anti-Tumor Antibiotics

- Others

The report has provided a detailed breakup and analysis of the market based on the drugs. This includes alkylating agents, antimetabolites, anti-tumor antibiotics, and others.

Cancer Type Insights:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Blood Cancer

- Liver Cancer

- Others

A detailed breakup and analysis of the market based on the cancer type have also been provided in the report. This includes breast cancer, lung cancer, colorectal cancer, prostate cancer, blood cancer, liver cancer, and others.

Route of Administration Insights:

- Oral

- Parenteral

- Others

The report has provided a detailed breakup and analysis of the market based on the route of administration. This includes oral, parenteral, and others.

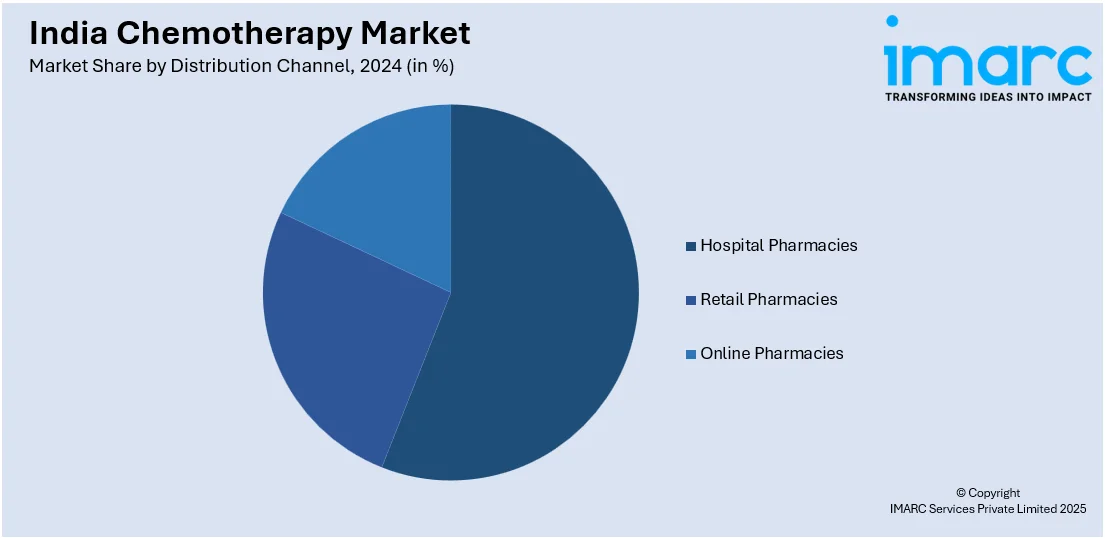

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Chemotherapy Market News:

- August 2024: A new day care and chemotherapy ward at Sri Krishna Medical College and Hospital (SKMCH) in Muzaffarpur was inaugurated. This expansion enhances local cancer treatment options, reducing the need for patients to travel to distant facilities. Such developments contribute to the growth of India's chemotherapy market by easier accessibility and demand for oncology services.

- February 2024: NexCAR19, India's first indigenous CAR-T cell therapy, was developed through a collaboration between ImmunoACT and the U.S. National Cancer Institute. This therapy provides an advanced treatment option for certain blood cancers, reducing dependency on expensive imported therapies.

India Chemotherapy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drugs Covered | Alkylating Agents, Antimetabolites, Anti-Tumor Antibiotics, Others |

| Cancer Types Covered | Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Blood Cancer, Liver Cancer, Others |

| Routes of Administration Covered | Oral, Parenteral, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India chemotherapy market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India chemotherapy market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India chemotherapy industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chemotherapy market in India was valued at USD 5.14 Billion in 2024.

The India chemotherapy market is projected to exhibit a CAGR of 12.54% during 2025-2033, reaching a value of USD 16.13 Billion by 2033.

The key growth drivers of India’s chemotherapy market include a rising cancer incidence that increases demand for treatment, widespread availability of affordable generic chemotherapy drugs via local pharmaceutical manufacturers, and expanded healthcare infrastructure and insurance coverage, improving access to chemotherapy services across diverse regions in India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)