India Chimneys & Built-in Hobs Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033

Market Overview:

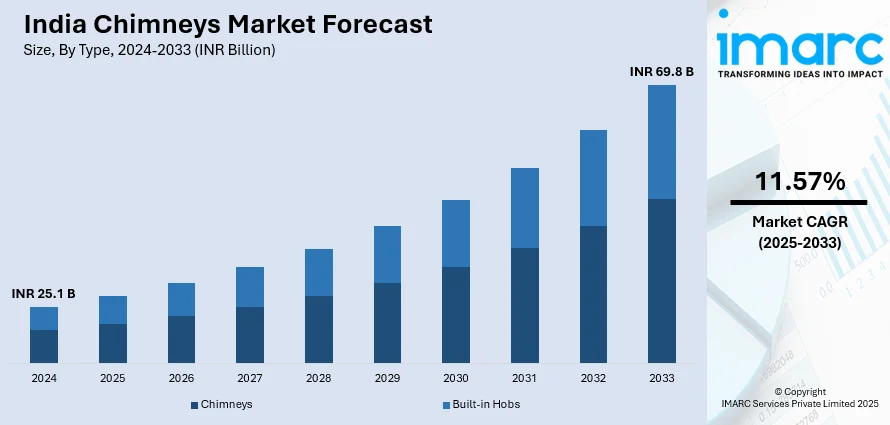

The India chimneys & built-in hobs market size reached INR 25.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach INR 69.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.57% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 25.1 Billion |

|

Market Forecast in 2033

|

INR 69.8 Billion |

| Market Growth Rate 2025-2033 | 11.57% |

Chimney, or kitchen hood, refers to an appliance that absorbs fumes/smoke produced in the kitchen. On the other hand, built-in hobs are the gas stovetops that are permanently installed on the kitchen counter surface. Both chimney and built-in hobs are among popular additions in the modular kitchens as these appliances help in keeping the kitchen clean, along with adding style and decor. The cooking method of Indian food entails lots of sautéing and frying. The spluttering mixture of the spices and frying of ingredients produce clouds of fumes filled with oil, spices, organic matter, moisture, and leave its impression on the kitchen ceiling and tiles. In such conditions, kitchen chimney acts as an essential ventilation device that vents out smoke, moisture, grease filled-air, food particles, etc., and reduces indoor pollution. Furthermore, built-in hobs provide convenience, better safety, and faster cooking. Owing to this, these kitchen appliances are widely installed in households, restaurants, cafes, and other eateries across India.

To get more information of this market, Request Sample

One of the primary factors driving the market growth is the surging adoption of modular kitchen appliances in urban and semi-urban areas of the country. Besides this, the high demand for such appliances is buoyed by the rising living standards of the consumers supported by their increasing disposable income levels. This has led to the wide availability of such appliances, at varied price ranges, catering to different income group consumers. Furthermore, rapid urbanization, coupled with the increasing construction of villas, luxury apartments, and renovation of existing kitchens, are significantly boosting the sales of premium-quality kitchen appliances in India. Various technological advancements, along with the increasing penetration of smart devices, have led to the launch of smart kitchen appliances with wireless connectivity options. These appliances can be controlled remotely through wireless, internet, or bluetooth-based devices, thereby are being widely installed, particularly in smart homes. Other than this, the rising health-consciousness, especially among the urbanized and millennial population, has bolstered the demand for kitchen appliances for maintaining hygienic and oil/smoke-free cooking conditions, thereby propelling the market growth. Moreover, their wide availability across various online and offline distribution channels, coupled with the growing popularity of advanced and modular products, will continue to fuel the growth of the Indian chimneys and built-in hobs market in the coming years.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India chimneys & built-in hobs market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type and end-user.

Breakup by Type:

- Chimneys

- Built-in Hobs

Chimneys Market Breakup by Chimney Type:

- Wall Mounted

- Straight Line

- Island

- Downdraft

Chimneys Market Breakup by Suction Power Range:

- Below 1,000 m3/hr

- 1,000-1,500 m3/hr

- Above 1,500 m3/hr

Chimneys Market Breakup by Chimney Filter Type:

- Mesh Filter

- Baffle Filter

- Charcoal Filter

Chimneys Market Breakup by Hood Type:

- Ducted Hood

- Ductless Hood

Chimneys Market Breakup by End-User:

- Commercial

- Residential

Chimneys Market Breakup by Region:

- South

- North

- East

- West

Built-in Hobs Market Breakup by Number of Burners:

- 1-2 Burners

- 3-4 Burners

- More than 4 Burners

Built-in Hobs Market Breakup by Stove Type:

- Gas Hobs

- Induction Hobs

- Hybrid Hobs

- Electric Plate Hobs

Built-in Hobs Market Breakup by End-User:

- Commercial

- Residential

Built-in Hobs Market Breakup by Region:

- South

- North

- East

- West

Competitive Landscape:

The report has also examined the competitive landscape of the market and some of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | INR Billion |

| Segment Coverage | Type, End User, Region |

| Region Covered | South, North, East, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India chimneys & built-in hobs market was valued at INR 25.1 Billion in 2024.

We expect the India chimneys & built-in hobs market to exhibit a CAGR of 11.57% during 2025-2033.

The growing adoption of chimneys & built-in hobs across several households, restaurants, cafes, and other eateries, as they offer easy ventilation, reduce indoor pollution, provide faster cooking, etc., is primarily driving the India chimneys & built-in hobs market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous construction activities, thereby negatively impacting the demand for chimneys & built-in hobs.

Based on the chimney type, the India chimneys market has been segmented into wall mounted, straight line, island, and downdraft. Among these, wall mounted currently holds the largest market share.

Based on the suction power range, the India chimneys market can be divided into below 1,000 m3/hr, 1,000-1,500 m3/hr, and above 1,500 m3/hr. Currently, 1,000-1,500 m3/hr exhibits a clear dominance in the market.

Based on the chimney filter type, the India chimneys market has been bifurcated into mesh filter, baffle filter, and charcoal filter. Among these, baffle filter currently accounts for the majority of the total market share.

Based on the hood type, the India chimneys market can be segmented into ducted hood and ductless hood. Currently, ducted hood exhibits a clear dominance in the market.

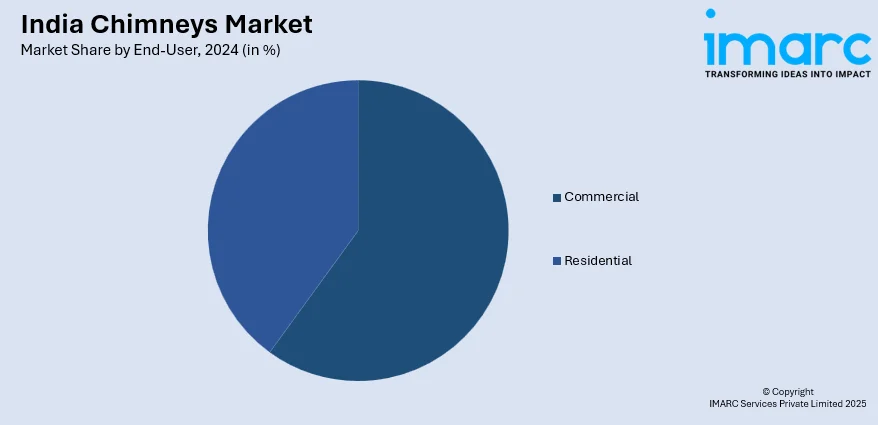

Based on the end-user, the India chimneys market has been divided into commercial and residential, where the residential sector currently holds the largest market share.

Based on the number of burners, the India built-in hobs market can be categorized into 1-2 burners, 3-4 burners, and more than 4 burners. Currently, 3-4 burners account for the majority of the total market share.

Based on the stove type, the India built-in hobs market has been segregated into gas hobs, induction hobs, hybrid hobs, and electric plate hobs. Among these, gas hobs currently exhibit a clear dominance in the market.

Based on the end-user, the India built-in hobs market can be bifurcated into commercial and residential. Currently, the commercial sector holds the largest market share.

On a regional level, the market has been classified into South, North, East, and West, where South currently dominates the India chimneys & built-in hobs market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)