Kitchen Appliances Market Size, Share, Trends, and Forecast by Product Type, Structure, Fuel Type, Application, Distribution Channel, and Region, 2025-2033

Kitchen Appliances Market Size and Share:

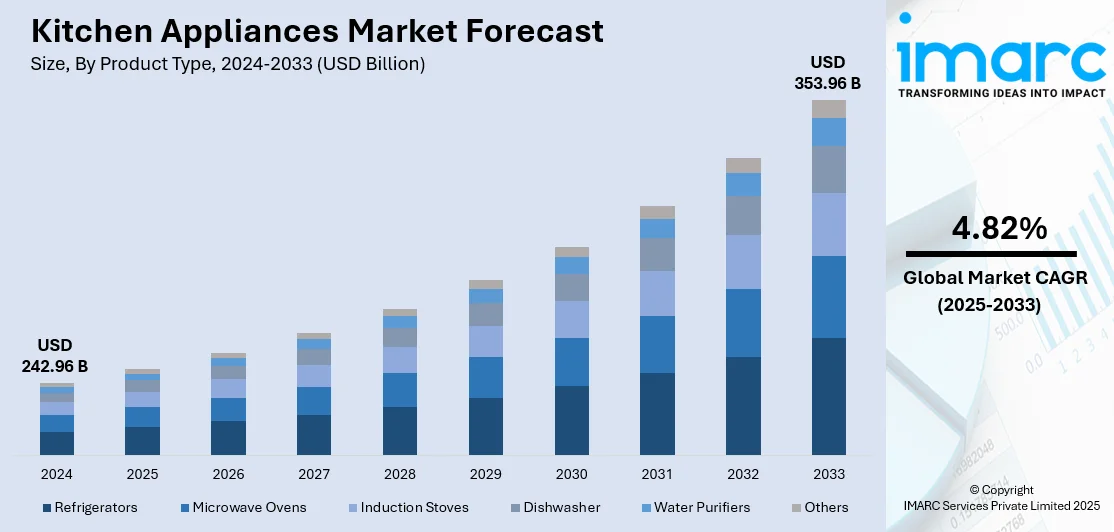

The global kitchen appliances market size was valued at USD 242.96 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 353.96 Billion by 2033, exhibiting a CAGR of 4.82% during 2025-2033. North America currently dominates the market, holding a significant market share of over 42.2% in 2024. The significant growth in the online retail and e-commerce sector and emerging technological advancements in appliances are some of the major factors contributing to the kitchen appliances market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 242.96 Billion |

| Market Forecast in 2033 | USD 353.96 Billion |

| Market Growth Rate 2025-2033 | 4.82% |

The market for kitchen appliances is driven by several key factors, including rising urbanization, increasing disposable incomes, and changing consumer lifestyles. As more people move to urban areas and adopt fast-paced routines, the demand for convenient, time-saving kitchen solutions grows. Technological advancements, such as smart and energy-efficient appliances, are also fueling market expansion. Consumers are increasingly drawn to appliances with Wi-Fi connectivity, voice control, and automation features. The popularity of modular kitchens and home renovation trends further boosts demand for stylish and compact kitchen devices. Additionally, growing awareness of sustainability has led to a preference for eco-friendly, energy-saving products. The rise of e-commerce platforms and digital marketing also contributes by offering consumers wider access and easier purchasing options.

The market for kitchen appliances in the United States is driven by high disposable income, increasing demand for smart and connected appliances, and a strong focus on energy efficiency. Consumers are embracing modern kitchen solutions that offer convenience, automation, and integration with smart home systems. The growing trend of home remodeling and open kitchen designs also fuels the need for aesthetically appealing and space-saving appliances. Additionally, heightened awareness of sustainability is pushing demand for eco-friendly, ENERGY STAR-rated products. E-commerce growth, coupled with strong retail infrastructure, enables easier access to a wide range of appliances, further boosting market growth across the country. For instance, in May 2024, Thermomix, the maker of the industry-leading all-in-one Wi-Fi-connected cooking appliance, the TM6, presented the Thermomix® Sensor, a ground-breaking smart thermometer that makes it easier and more accurate to check the core temperature of food, just in time for World Baking Day on May 17. This innovative smart thermometer will revolutionize how foodies approach baking, grilling, and cooking by guaranteeing accuracy and assurance in each dish.

Kitchen Appliances Market Trends:

The significant growth in the online retail and e-commerce sector

The market is driven by the substantial growth in online retail and the e-commerce sector. According to reports, with more than 33% of the global population making online purchases, eCommerce has become a USD 6.8 Trillion sector and is expected to hit the USD 8 Trillion threshold by 2027. Moreover, the ease and accessibility provided by online shopping platforms allow consumers to explore, compare, and buy a wide range of kitchen appliances from the comfort of their homes, thereby impacting market growth. Furthermore, the e-commerce industry is promoting the growth of product diversity and the accessibility of various kitchen appliances, thereby serving as another key factor driving growth. Besides this, customers have access to several options, ranging from necessities like refrigerators and stoves to innovative and smart appliances catering to modern lifestyles, thus accelerating product adoption. Furthermore, competitive pricing and attractive discounts offered by e-commerce platforms are enticing budget-conscious consumers, thus propelling the market growth.

The emerging technological advancements in appliances

The market is driven by the widespread adoption of smart kitchen appliances. These devices come with sensors and connectivity options, enabling users to manage them from a distance using smartphone applications. According to research, the worldwide smartphone market experienced a 10% year-on-year growth in Q1 2024, reaching 296.2 Million units. For instance, voice recognition technology is gaining traction allowing users to issue commands to their appliances effortlessly which enhances user convenience and adds an element of sophistication to kitchen operations. Furthermore, the integration of artificial intelligence (AI) and machine learning algorithms into appliances has unlocked new levels of automation and customization, representing another major growth-inducing factor. Along with this, AI-powered appliances can adapt to user preferences, optimize cooking processes, and even suggest recipes based on available ingredients, thus propelling market growth. Besides this, manufacturers are incorporating eco-friendly features and improving insulation to reduce energy consumption and minimize environmental impact, thus creating a positive kitchen appliances market outlook.

The recent onset of the coronavirus disease (COVID-19) pandemic

The onset of the COVID-19 pandemic impacted various industries, including the kitchen appliances market. For instance, 78% of U.S. consumers report eating at home more frequently to save money amidst rising food costs. In addition, the implementation of several initiatives, social distancing norms, and growing awareness regarding healthy lifestyles among individuals are influencing the market growth. Moreover, the growing focus on home cooking and dining during lockdowns allowed individuals to spend more time at home, resulting in experimentation with home-cooked meals, thus representing another major growth-inducing factor. As a result, there was increased interest in upgrading kitchen devices to enhance cooking efficiency and convenience. Along with this, appliances such as ovens, microwaves, and food processors experienced rising demand as individuals sought to replicate restaurant-quality meals at home, thus propelling the market growth. Furthermore, the pandemic accelerated the adoption of smart kitchen appliances, allowing consumers to embrace connected devices that could be controlled remotely via smartphones, allowing for more flexible cooking and meal planning, thus creating a positive market outlook.

Kitchen Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global kitchen appliances market, along with forecasts at the global, and regional levels from 2025-2033. The market has been categorized based on product type, structure, fuel type, application, and distribution channel.

Analysis by Product Type:

- Refrigerators

- Microwave Ovens

- Induction Stoves

- Dishwasher

- Water Purifiers

- Others

Refrigerators stand as the largest product type in 2024, holding around 35.0% of the market. Refrigerators are widely used in residential kitchens, which is an important part of modern households. They serve the vital role of keeping perishable items fresh for longer periods, reducing food wastage, and ensuring a steady supply of chilled beverages and frozen goods, offering convenience to the daily lives of individuals, thus contributing to market growth. Besides this, an increasing demand for refrigerators in commercial settings such as restaurants, supermarkets, and food processing plants, is propelling the market growth. They maintain food safety standards and preserve the quality of ingredients. Moreover, the rising refrigerator demand in restaurants for storing fresh produce, meat, and dairy products, ensures that the final dishes served to customers are of the highest quality, thus representing another major growth-inducing factor.

Analysis by Structure:

- Built-In

- Free Stand

Free-stand leads the market with around 70.0% of market share in 2024. Free-standing kitchen appliances find their utility in various settings, from residential kitchens to commercial establishments such as restaurants, hotels, and catering services. In addition, the increasing demand for free-stand products due to their flexibility, and freedom to place them wherever it suits their needs while ensuring the kitchen layouts can be easily adapted to accommodate changes in design or functional preferences are contributing to the market growth. Moreover, the widespread adoption of free-stand products that require minimal installation effort simplifies the setup process, making it accessible to several users, including homeowners and businesses, thus representing another major growth-inducing factor. Besides this, free-standing appliances are more budget-friendly which makes them an attractive choice for individual consumers and businesses looking to outfit their kitchens without breaking the bank, thus accelerating the kitchen appliances market demand.

Analysis by Fuel Type:

- Cooking Gas

- Electricity

- Others

Cooking gas or liquefied petroleum gas (LPG) is primarily employed in stovetops and ovens for cooking purposes due to its convenience, efficiency, and versatility. In addition, it offers instant heat, allowing for quicker cooking times, which reduces cooking durations, thus influencing marketing growth. It also provides precise control over the flame's intensity which enables cooks to adjust heat levels swiftly, which is essential for delicate recipes that require precise temperature management. Moreover, cooking gas maintains a consistent heat source which ensures uniform cooking results and minimizes the risk of burnt or undercooked food, thus representing another major growth-inducing factor. Besides this, it is a clean-burning fuel, producing fewer emissions and reducing the impact on the environment compared to some other cooking methods, thus augmenting the market growth.

Analysis by Application:

- Residential

- Commercial

Residential leads the market with around 78.9% of market share in 2024. The rising demand for kitchen appliances in residential applications is influencing the market growth. These appliances are primarily employed in households, to serve as essential tools in daily culinary endeavors and streamline cooking processes, making them more efficient and convenient. Moreover, the widespread adoption of several kitchen appliances, including refrigerators, ovens, microwaves, blenders, and dishwashers, represents another major growth-inducing factor. Along with this, the growing trend of home cooking is encouraging individuals to seek healthier and cost-effective dining options, thus resulting in investment in high-quality kitchen appliances to prepare their meals at home, thus propelling the market growth. Apart from this, the shift toward home-cooked meals is escalating the demand for appliances that facilitate food preparation, storage, and preservation, thus augmenting the market growth. Additionally, the evolution of kitchen appliances with innovative features, energy efficiency, and user-friendly interfaces are creating a positive market outlook.

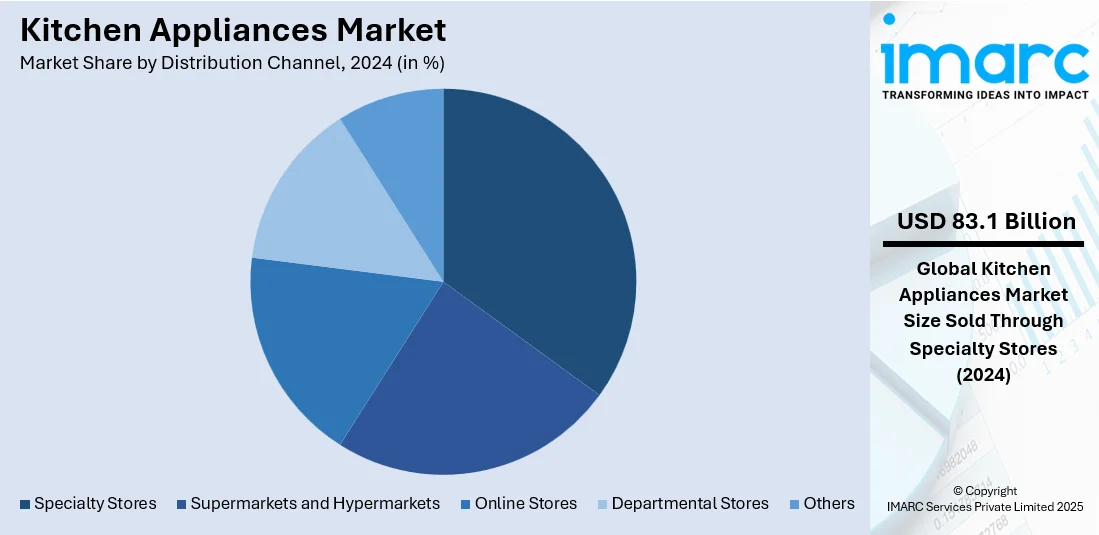

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Departmental Stores

- Others

Specialty stores lead the market with around 34.2% of market share in 2024. Specialty stores concentrate solely on kitchen appliances, allowing them to provide in-depth knowledge and guidance to customers. Consumers often turn to specialty stores as they can rely on the specialized knowledge of the staff to help them make informed decisions about which appliances best suit their needs. Moreover, several types of brands and models are available in specialty stores that cater specifically to the kitchen appliance market which ensures that customers can access high-quality products, enabling them to choose appliances that align with their preferences, budget, and requirements, representing another major growth-inducing factor. Besides this, the growing emphasis on customer service and specialty stores prioritize personalized attention, ensuring that customers receive detailed information about product features, warranties, and maintenance which fosters trust and confidence among consumers, making them more likely to make a purchase, thus accelerating the product adoption rate.

Regional Analysis:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.2%. The North America market is driven by the growing economy, allowing consumers to invest in innovative and high-quality appliances that make daily tasks more efficient. Additionally, North American consumers are increasingly health-conscious and time-sensitive, which is escalating the demand for appliances that facilitate healthier cooking and save precious time in their busy lives, thus propelling market growth. Moreover, leading brands are introducing cutting-edge technologies, energy-efficient solutions, and smart home integration features, to meet the evolving demands of consumers which attracts customers seeking the latest and most convenient kitchen appliances, thus representing another major growth-inducing factor. Furthermore, the widespread presence of retail giants and e-commerce platforms in North America is essential in distribution channels providing consumers with easy access to several appliances, thereby driving sales and market growth.

Key Regional Takeaways:

United States Kitchen Appliances Market Analysis

In 2024, the United States accounted for over 88.20% of the kitchen appliances market in North America. United States is experiencing a surge in kitchen appliance adoption due to the growing online retail and e-commerce sector, which has expanded access to a wide range of products, competitive pricing, and convenient doorstep delivery. For instance, in 2024, US eCommerce sales increases 2.8% from the previous quarter and a 7.2% increase compared to the same quarter last year. Consumers are increasingly purchasing smart and energy-efficient kitchen appliances online, driven by attractive discounts, detailed product comparisons, and customer reviews. The rising demand for multifunctional appliances that cater to busy lifestyles is further boosting sales. Online platforms are enhancing customer engagement through virtual showrooms and AI-driven recommendations, making it easier for buyers to select suitable products. The emergence of direct-to-consumer brands and exclusive online product launches is also playing a significant role in market expansion. Subscription-based services for kitchen appliances, coupled with flexible financing options, are encouraging consumers to upgrade their existing setups. The online retail and e-commerce sector continues to influence the kitchen appliances industry by introducing new shopping trends, fostering brand loyalty, and streamlining logistics for enhanced consumer satisfaction.

Asia Pacific Kitchen Appliances Market Analysis

Asia-Pacific is witnessing a rising kitchen appliances adoption due to growing supermarkets and hypermarkets, offering a wide variety of products under one roof. According to reports, there are 66,225 supermarkets in India as of January 23, 2025, which is an 3.88% increase from 2023. These retail spaces provide an extensive selection of kitchen appliances, catering to different consumer preferences and budgets. The expansion of supermarkets and hypermarkets in both urban and suburban areas is creating easy access to advanced kitchen appliances, attracting shoppers with exclusive in-store discounts and promotional campaigns. Consumers are increasingly drawn to smart and energy-efficient appliances showcased in experiential zones within these stores, allowing hands-on product demonstrations before purchase. The integration of digital payment options, loyalty programs, and bundled offers is further enhancing consumer engagement. Retailers are collaborating with kitchen appliances manufacturers to introduce limited-time discounts and financing plans, making premium products more affordable. The supermarkets and hypermarkets expansion are reshaping the kitchen appliances landscape by fostering brand visibility, improving consumer trust, and streamlining supply chain operations for seamless product availability

Europe Kitchen Appliances Market Analysis

The growing adoption of kitchen appliances is being driven by a significant shift toward home-cooked meals, escalating the demand for appliances that simplify food preparation. According to reports, 50.8% of adults in Germany cook their hot meals daily or nearly every day using fresh, basic ingredients. Consumers increasingly seek efficient, stylish, and technologically advanced solutions to enhance convenience and elevate their cooking experience. This trend is fuelling the demand for refrigerators, ovens, blenders, and food processors, as households prioritize fresh, home-prepared meals. Brands are responding with innovative features, such as smart controls, energy efficiency, and multifunctional designs, catering to evolving consumer needs. The surge in health-conscious lifestyles and rising disposable incomes further accelerate this shift, making kitchen appliances a necessity rather than a luxury. Additionally, cultural influences, especially in markets like India, encourage appliance manufacturers to blend tradition with modernity, offering designs that reflect heritage while embracing contemporary convenience.

Latin America Kitchen Appliances Market Analysis

Latin America is witnessing increasing kitchen appliances adoption due to growing residential due to growing disposable income, enabling households to invest in modern and energy-efficient appliances. According to reports, Latin America's total disposable income is expected to grow by nearly 60% from 2021 to 2040. The rising number of residential constructions and renovations is fuelling the demand for premium and multifunctional kitchen appliances that enhance cooking efficiency. Consumers are increasingly opting for technologically advanced appliances that simplify food preparation, contributing to the shift toward smart and automated solutions. The demand for compact and space-saving kitchen appliances is also rising, particularly in urban areas, as living spaces become more optimized. Higher disposable income is encouraging homeowners to upgrade their existing appliances, leading to greater market penetration for high-end brands.

Middle East and Africa Kitchen Appliances Market Analysis

Middle East and Africa is experiencing rising kitchen appliances adoption due to growing investment in commercial sector, driving the expansion of hotels, restaurants, and catering services. For instance, in 2023, foreign investors accounted for 45% of total commercial property transactions in Dubai. The increasing number of food service establishments is fuelling the demand for high-capacity, durable, and technologically advanced kitchen appliances to support large-scale meal preparation. Businesses are investing in energy-efficient and automated appliances to optimize operational efficiency while maintaining food quality. The expansion of shopping malls and commercial complexes is contributing to the rise in kitchen appliances installations in food courts and dining spaces. The commercial sector is also witnessing higher demand for specialized appliances tailored for quick-service restaurants and cloud kitchens. Increased investment in smart kitchen solutions is further enhancing the efficiency of food preparation and storage processes.

Competitive Landscape:

The kitchen appliances market is highly competitive, with key players including Whirlpool, Samsung, LG, Electrolux, Bosch, and Haier dominating global sales. These companies focus on innovation, energy efficiency, and smart technology integration to maintain market share. Emerging brands and regional players are also gaining traction by offering cost-effective and localized solutions. E-commerce expansion and shifting consumer preferences toward modular and smart kitchens are intensifying competition. Continuous product development, brand loyalty, and after-sales service play crucial roles in maintaining competitiveness. Sustainability and eco-friendly designs are becoming essential differentiators in a market driven by both functionality and aesthetic appeal.

The report provides a comprehensive analysis of the competitive landscape in the kitchen appliances market with detailed profiles of all major companies, including:

- Whirlpool Corporation

- AB Electrolux

- Samsung Electronics Co. Ltd.

- LG Electronics

- Winia Daewoo Electronics

- Panasonic Corporation

- Haier Group Corporation

- BSH Hausgeräte GmbH

- Miele & Cie. KG

- Sub-Zero Group, Inc.

Latest News and Developments:

- April 2025: Geek, an Indian digital-first kitchen appliance brand, secured INR 4 Crore funding via 'Startup Singam' to develop AI/IoT-powered kitchen solutions like Geek ARIA. Their products (e.g., Robocook, Airocook) address India's high kitchen time (13.5+ weekly hours) with tech-driven efficiency. With 4.3 lakh units sold, 1,200+ influencer partnerships, and 5M+ YouTube views, they aim to disrupt India's appliance market via smart, healthy solutions, localized manufacturing, and digital-first strategies.

- February 2025: LG Electronics presented its expanded "Fit & Max" kitchen lineup at Kitchen and Bath Industry Show (KBIS) 2025, featuring Zero Clearance™ technology for minimal space wastage and flexible installation. The refrigerators include slimmer Thin Door designs (55mm) without compromising insulation, enhanced storage capacity, and Dual Ice Solution. The Flush Depth dishwasher integrates QuadWash™ Pro and Dynamic Heat Dry™ for efficient 1-hour cycles. All innovations prioritize seamless aesthetics, space efficiency, and advanced performance, offering a streamlined, built-in kitchen experience.

- February 2025: JennAir unveiled its latest luxury kitchen innovations, highlighting cutting-edge design and performance. Key features include the JennAir 36" Downdraft Induction Cooktop with powerful, space-saving ventilation; the Gallery of Leather Cuts showcasing tactile, ethical design panels with SlimTech™ Insulation technology in refrigerators; and the Defiant Lounge, featuring professional-style induction ranges and advanced wine columns.

- February 2025: Samsung showcased its advanced Bespoke AI home appliances, featuring the Bespoke 4-Door Flex™ Refrigerator with AI Family Hub™+, AI Laundry Combo™, and Slide-in Induction Range. These appliances integrate AI and LCD screens to enhance connectivity and personalize user experiences. The event also highlighted Samsung’s AI Energy Mode in SmartThings Energy and Samsung Care services. Additionally, the premium 2025 Dacor Induction Range was introduced, offering powerful, efficient cooking with innovative features like a 7” Sync Burner and Dual Four-part Pure Convection™ system, blending luxury design with smart functionality.

- February 2025: Midea introduced an innovative Easy to Install Over-the-Range Microwave. This new microwave is designed to simplify kitchen upgrades by allowing easy, one-person installation using a unique "push and snap" mechanism, eliminating the need for professional installers and reducing costs.

- January 2025: BSH, Bosch Group’s home appliance division showcased the Bosch 100 Series French Door Bottom Mount refrigerator-the first Matter-enabled appliance available globally at CES 2025. BSH highlights innovations like AI-powered ovens, smart espresso machines, and integrated Home Connect platform, promoting seamless device interoperability and consumer flexibility in smart home ecosystems.

Kitchen Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Refrigerators, Microwave Ovens, Induction Stoves, Dishwasher, Water Purifiers, Others |

| Structures Covered | Built-In, Free Stand |

| Fuel Types Covered | Cooking Gas, Electricity, Others |

| Applications Covered | Residential, Commercial |

| Distribution Channels Covered | Supermarkets And Hypermarkets, Specialty Stores, Online Stores, Departmental Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Whirlpool Corporation, AB Electrolux, Samsung Electronics Co. Ltd., LG Electronics, Winia Daewoo Electronics, Panasonic Corporation, Haier Group Corporation, BSH Hausgeräte GmbH, Miele & Cie. KG, Sub-Zero Group, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the kitchen appliances market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global kitchen appliances market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchen appliances market was valued at USD 242.96 Billion in 2024.

The kitchen appliances market is projected to exhibit a CAGR of 4.82% during 2025-2033, reaching a value of USD 353.96 Billion by 2033.

Key factors driving the kitchen appliances market include rising urbanization, increasing disposable incomes, and growing demand for smart and energy-efficient appliances. Changing lifestyles, busy schedules, and the trend toward modular kitchens also boost demand. Technological advancements and e-commerce growth further support market expansion by offering convenience and product variety.

North America currently dominates the kitchen appliances market due to rising smart home adoption, high disposable income, energy efficiency trends, and demand for premium, tech-integrated kitchen appliances.

Some of the major players in the kitchen appliances market include Whirlpool Corporation, AB Electrolux, Samsung Electronics Co. Ltd., LG Electronics, Winia Daewoo Electronics, Panasonic Corporation, Haier Group Corporation, BSH Hausgeräte GmbH, Miele & Cie. KG, Sub-Zero Group, Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)