India Chocolate Market Size, Share, Trends and Forecast by Type, Product Form, Packaging Type, Distribution Channel, and Region, 2026-2034

India Chocolate Market Summary:

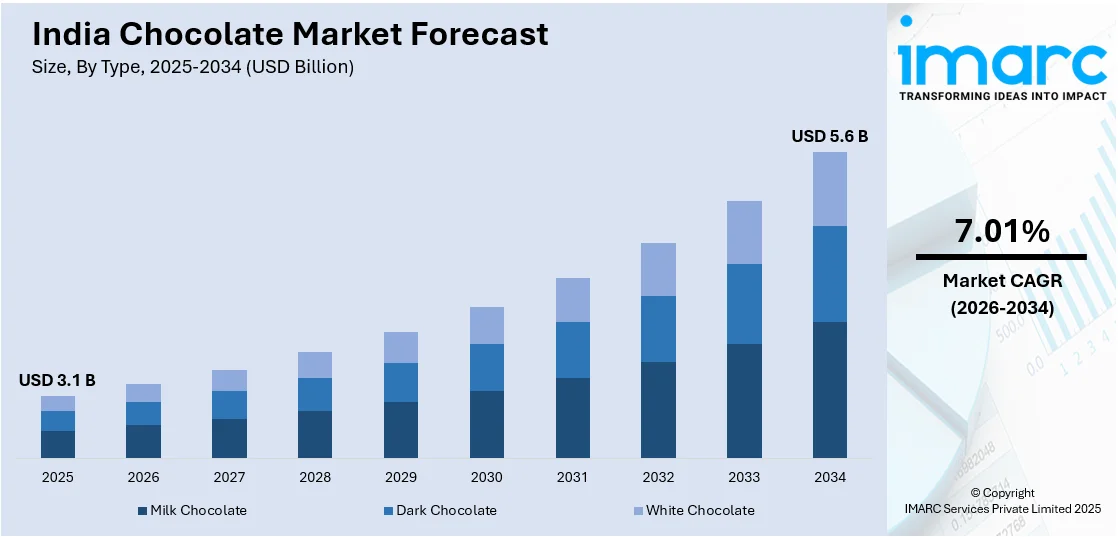

The India chocolate market size was valued at USD 3.05 Billion in 2025 and is projected to reach USD 5.62 Billion by 2034, growing at a compound annual growth rate of 7.01% from 2026-2034.

The Indian chocolate market is growing at a very swift pace due to the rise in disposable incomes, growing urbanization, and changing patterns of consumer behavior, which are increasingly transitioned toward indulgent confectionery products. The growing trend of Western diets among the young generation, along with the growing preference for chocolate as a gift option during occasions, is driving the India chocolate market. Artisanal chocolate products are becoming popular among urban health-conscious consumers due to their distinct tastes.

Key Takeaways and Insights:

- By Type: Milk chocolate dominates the market with a share of 67% in 2025, driven by its widespread appeal across all age groups, creamy taste profile, and versatility in various confectionery applications from candy bars to gifting products.

- By Product Form: Moulded leads the market with a share of 58% in 2025, owing to its aesthetic appeal, customization possibilities, and suitability for premium gifting occasions, particularly during festivals like Diwali and Raksha Bandhan.

- By Packaging: Boxed chocolate represents the largest segment with a market share of 50% in 2025, attributed to the strong gifting culture in India and the perception of boxed chocolates as premium and sophisticated presents.

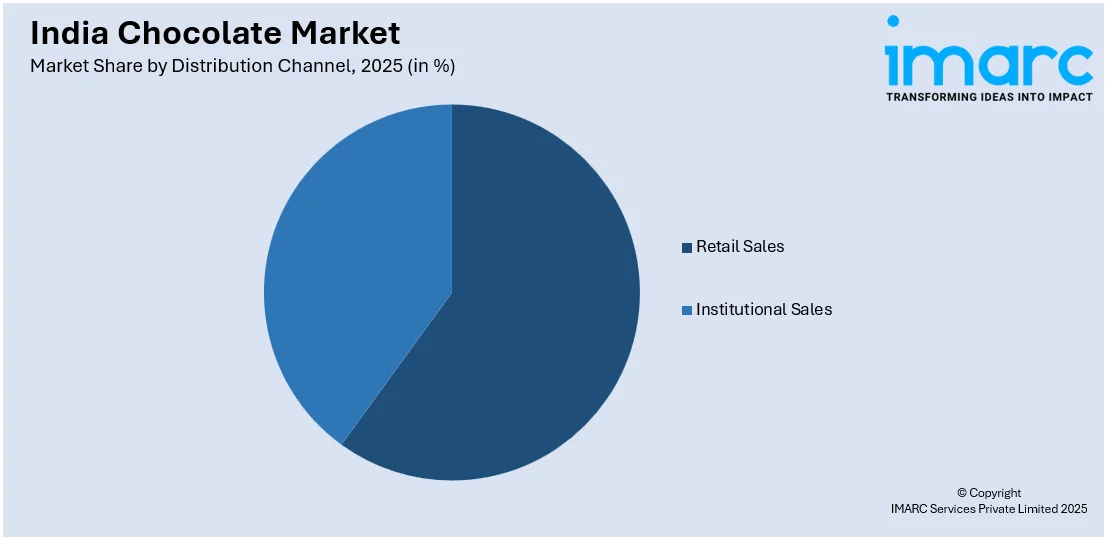

- By Distribution Channel: Retail sales dominates the market with a share of 78% in 2025, supported by the extensive network of supermarkets, hypermarkets, convenience stores, and traditional retail outlets across urban and semi-urban areas.

- By Region: North India leads the market with a share of 38% in 2025, driven by higher disposable incomes, concentrated urban population in Delhi-NCR, and strong festive consumption patterns in states like Punjab, Haryana, and Uttar Pradesh.

- Key Players: The India chocolate market exhibits a moderately consolidated competitive structure, with multinational corporations competing alongside established domestic dairy cooperatives and emerging artisanal producers. Leading players leverage extensive distribution networks, aggressive marketing strategies, and continuous product innovation to maintain market dominance. Some of the key players operating in the market include Amul (GCMMF), DS Group, Ferrero India Private Limited, Hershey India Private Limited, ITC Limited, Lotus Chocolate Co. Ltd., Mars International India Private Limited, Mondelez India Foods Private Limited, and Nestlé India Ltd.

To get more information on this market Request Sample

The India chocolate market is undergoing a significant transformation characterized by premiumization, health-conscious innovations, and digital marketing expansion. The country's youthful demographic represents a massive consumer base with evolving taste preferences and lifestyle aspirations influenced by Western consumption patterns. In March 2024, Cargill unveiled its NatureFresh Professional block chocolates and chocolate chips tailored for Indian bakers at AAHAR 2024, signaling broader product innovation in quality and formulation by global players. Rising middle-class purchasing power enables more consumers to afford discretionary indulgences, while the growing penetration of organized retail and e-commerce platforms enhances product accessibility. Chocolate manufacturers are responding to consumer demand by introducing sugar-free, organic, and dark chocolate variants that align with wellness trends. The integration of traditional Indian flavors such as cardamom, saffron, and masala chai with premium cocoa formulations is creating culturally resonant products that appeal to domestic consumers and export markets alike.

India Chocolate Market Trends:

Rising Demand for Premium and Artisanal Chocolates

Indian consumers are increasingly gravitating toward premium and artisanal chocolate products offering superior taste profiles and unique flavor combinations. Growing exposure to international chocolate brands through travel and digital platforms has elevated consumer expectations regarding quality and presentation. For example, in July 2025 Manam Chocolate’s boutique café and retail store in New Delhi showcased its bean-to-bar process and reported a 125% year-on-year growth, highlighting how experiential and craft chocolate brands are resonating with discerning buyers. Bean-to-bar chocolate makers and boutique chocolatiers are gaining prominence in metropolitan cities, catering to discerning consumers seeking ethically sourced and handcrafted products with sophisticated packaging.

Integration of Health and Wellness Attributes

Health consciousness among Indian consumers is reshaping the chocolate market landscape, driving demand for products with reduced sugar content, higher cocoa percentages, and functional ingredients. Dark chocolate variants marketed for their antioxidant properties are experiencing accelerated adoption among health-aware consumers. In December 2025, Nutrachoco launched a range of “wellness chocolates” specifically tailored for women, couples, and Gen Z shoppers that focus on balanced nutrition and reduced sugar formulations, reflecting how companies are innovating to meet health-oriented preferences. Manufacturers are launching innovative chocolate formulations that feature organic, vegan, and gluten-free options, enriched with superfoods, probiotics, and Ayurvedic ingredients.

Digital Commerce and Quick-Commerce Expansion

The proliferation of e-commerce platforms and quick-commerce services is transforming chocolate distribution and consumption patterns across India. Online retailers offer consumers convenient access to diverse chocolate products, including imported brands and specialty variants unavailable in traditional retail channels. During Valentine’s Day, quick commerce platforms such as Swiggy Instamart saw peak delivery rates of up to 581 chocolates and 324 roses per minute, more than double the previous year, highlighting how same-day and rapid delivery is reshaping impulse chocolate purchases. Quick-commerce platforms enabling rapid delivery are capturing impulse purchase occasions while social media marketing drives brand awareness among digitally connected millennial and Generation Z consumers.

Market Outlook 2026-2034:

Being aided by positive demographic shifts, urbanization, and improving consumer sophistication, the prospects for the Indian chocolate market appear positive during the forecast period. Investment in the enhancement of the supply abilities of the Indian chocolate market by multinational companies in terms of increased capacity and strong distribution networks will further boost growth in the Indian chocolate market during the next few years. The growth of e-commerce platforms, along with the gift-giving habits of consumers, will further propel the Indian chocolate market during the next few years, thus opening doors for premium segments in the Indian chocolate market. The market generated a revenue of USD 3.05 Billion in 2025 and is projected to reach a revenue of USD 5.62 Billion by 2034, growing at a compound annual growth rate of 7.01% from 2026-2034.

India Chocolate Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Milk Chocolate |

67% |

|

Product Form |

Moulded |

58% |

|

Packaging Type |

Boxed Chocolate |

50% |

|

Distribution Channel |

Retail Sales |

78% |

|

Region |

North India |

38% |

Type Insights:

- Milk Chocolate

- Dark Chocolate

- White Chocolate

The milk chocolate dominates with a market share of 67% of the total India chocolate market in 2025.

Milk chocolate maintains its dominant position in the India chocolate market due to its universal appeal across diverse consumer demographics and age groups. The smooth, creamy texture and balanced sweetness profile make milk chocolate the preferred choice for everyday consumption, gifting occasions, and incorporation into various confectionery applications. In September 2025, Mondelez India expanded its flagship Cadbury Dairy Milk portfolio with the launch of “Cadbury Dairy Milk Milkinis,” a crème‑filled milk chocolate variant designed to appeal to younger and on‑the‑go consumers, illustrating ongoing innovation within the milk chocolate segment. Leading manufacturers continue to innovate within this segment by introducing new flavor variants, filling combinations, and format innovations that cater to evolving preferences.

The ubiquity of milk chocolate variants in all price segments, starting from value for money variants all the way to premium variants, ensures penetration in all segments of the population. Brand recall value, along with nostalgic consumption, in the case of heritage brands, ensures a loyal clientele base in the milk chocolate category in the Indian market. The use of milk chocolate in gifting, as well as everyday consumption occasions, also ensures a strong leadership position in the Indian market.

Product Form Insights:

- Moulded

- Countline

- Others

The moulded leads with a share of 58% of the total India chocolate market in 2025.

Moulded chocolates have the largest market share based on the product form due to the fact that they offer the greatest flexibility as far as designs and packaging are concerned. This makes them highly visual and therefore preferred for special occasions such as festivals and business events. Technologists have developed expertise in the process of chocolate molding, and such expertise offers the advantage of innovative designs and customized products that are sought after for higher engagement levels and differentiation in competitive markets.

The premium positioning of moulded chocolate bars and boxed assortments enables manufacturers to achieve higher profit margins compared to other product forms. Consumer perception of moulded chocolates as sophisticated and indulgent products drives their preference for personal consumption and gifting purposes alike. The ability to incorporate diverse fillings, textures, and flavor combinations within moulded formats provides manufacturers with extensive opportunities for product innovation and premiumization strategies.

Packaging Type Insights:

- Pouches and Bags

- Boxed Chocolate

- Others

The boxed chocolate dominates with a market share of 50% of the total India chocolate market in 2025.

Boxed chocolates dominate the packaging segment driven by the strong gifting culture prevalent across Indian society during festivals and celebrations. The perception of boxed chocolates as premium, elegant, and sophisticated gifts makes them the preferred choice during Diwali, Raksha Bandhan, and various religious occasions. In Raksha Bandhan 2025, chocolate gift packs overtook traditional sweets as the primary gifting choice among many younger consumers, with NielsenIQ reporting that sales of chocolate gifts grew by about 34% compared to the previous year and online searches for chocolate gift packs nearly tripled versus sweets, highlighting the growing appeal of boxed chocolates for festive gifting. Corporate gifting practices and wedding favor traditions further contribute to sustained demand for attractively packaged chocolate assortments that convey thoughtfulness and quality to recipients across personal and professional relationships.

The innovative packaging designs, use of sustainable materials, and providing customization options are some of the ways in which manufacturers have been trying to distinguish their products in the competitive market landscape. Premium boxed chocolates with artistic presentations, multi-tier arrangements, and reusable packaging are finding favor among consumers for memorable gifting experiences that can leave a lasting impression. Further, the rise of personalized packaging solutions and limited-edition festive collections allows brands to command premium pricing, all while fostering emotional connections with consumers.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail Sales

- Institutional Sales

The retail sales leads with a share of 78% of the total India chocolate market in 2025.

Retail sales channels maintain overwhelming dominance in chocolate distribution, supported by the extensive network of supermarkets, hypermarkets, convenience stores, and traditional kirana shops across urban and rural India. The expansion of organized retail formats in smaller cities and towns is enhancing product accessibility and driving market penetration in previously underserved regions. Modern retail environments with dedicated confectionery sections encourage consumer exploration, impulse purchases, and trial of new product variants.

The growth of e-commerce and quick-commerce platforms is emerging as a significant retail channel, particularly for impulse purchases and festive gifting occasions. Online retailers offer consumers access to diverse product assortments, competitive pricing, and convenient doorstep delivery that accelerates digital channel adoption. The integration of omnichannel strategies by leading manufacturers ensures seamless consumer experiences across physical and digital retail touchpoints, maximizing market reach and consumer engagement opportunities.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 38% share of the total India chocolate market in 2025.

North India leads the regional chocolate market driven by the concentration of high-income urban populations in the Delhi-National Capital Region and surrounding metropolitan areas. The region's strong festive consumption culture, particularly during Diwali, Karwa Chauth, and wedding seasons, generates substantial chocolate gifting demand throughout the year. Higher per capita chocolate consumption rates reflect the region's relatively advanced retail infrastructure, consumer sophistication, and westernized lifestyle preferences among younger demographic segments.

The presence of major manufacturing facilities and distribution hubs in North India ensures efficient product availability and optimal freshness across retail channels. Growing disposable incomes and evolving consumption patterns among younger demographics in Punjab, Haryana, and Uttar Pradesh continue to drive regional market expansion. The proliferation of modern retail formats and quick-commerce services in northern metropolitan cities further accelerates chocolate consumption and market penetration opportunities.

Market Dynamics:

Growth Drivers:

Why is the India Chocolate Market Growing?

Rising Middle-Class Population and Disposable Incomes

The expansion of India's middle-class population and corresponding growth in household disposable incomes represent fundamental drivers of chocolate market expansion. Economic development and employment growth are enabling more consumers to afford discretionary food products, including premium confectionery items. The aspiration for quality lifestyle experiences among upwardly mobile consumers translates into increased spending on indulgent treats and gift-worthy chocolates. In FY25, Lotte India, strengthened by its merger with Havmor, projected revenue of over ₹2,000 crore and aims for a ₹3,000 crore turnover by 2027, reflecting how confectionery firms are expanding capacity and product lines to capture demand from increasingly affluent consumers. Rising per capita income levels in both urban and rural areas are expanding the addressable consumer base for chocolate manufacturers. The growing culture of personal indulgence and self-reward among working professionals creates consistent demand for everyday chocolate consumption occasions.

Expanding Organized Retail and E-Commerce Penetration

The rapid expansion of organized retail formats across India is significantly enhancing chocolate product accessibility and visibility. Supermarkets, hypermarkets, and convenience store chains offer dedicated confectionery sections with extensive product assortments that encourage consumer exploration and trial purchases. Modern retail environments with air-conditioning and attractive merchandising ensure optimal product quality and presentation. In 2025, the Retailers Association of India reported continued full‑year growth in Indian retail sales across regions, with modern trade channels, such as supermarkets and hypermarkets, playing a key role in expanding product reach and visibility amid rising consumer demand. Simultaneously, e-commerce platforms and quick-commerce services are revolutionizing chocolate distribution by enabling convenient access to diverse products, including imported and specialty variants. Digital channels facilitate impulse purchasing, subscription models, and personalized gifting options that drive incremental consumption occasions.

Strong Festive Gifting Culture and Changing Consumer Preferences

India's vibrant festival calendar and strong gifting traditions create substantial seasonal demand peaks for chocolate products. Chocolates have progressively replaced traditional sweets as preferred gifts during Diwali, Raksha Bandhan, Eid, Christmas, and various regional celebrations. In 2024, Mars Wrigley India strategically expanded into India’s festive gifting segment with the launch of its premium Galaxy Jewels chocolate gift packs, positioned to capture demand beyond everyday treats and specifically targeting the robust gifting market during festivals, highlighting how companies are tailoring offerings for seasonal demand spikes. Corporate gifting practices further amplify chocolate demand during festive seasons and year-end occasions. The younger generation's preference for contemporary gifting options and the perception of chocolates as sophisticated, modern presents reinforce this cultural shift. Wedding celebrations, birthday parties, and social gatherings increasingly feature premium chocolate products as essential elements of hospitality and celebration.

Market Restraints:

What Challenges the India Chocolate Market is Facing?

Cocoa Price Volatility and Raw Material Costs

Fluctuations in the international prices of cocoa and other raw materials place a heavy burden on chocolate manufacturers doing business in the price-sensitive Indian market. Disruptions in the supply of cocoa beans from producing regions, along with fluctuations in currency exchange and speculative pressures on commodities, increase the fluctuations in the costs of production that will affect profit margins. These volatilities may affect strategies on the price of products and their access to consumers, therefore compelling the manufacturer to balance cost management while sustaining product quality and competitive positioning.

Health Concerns and Sugar Reduction Pressures

Growing health consciousness among Indian consumers and increasing awareness of sugar-related health issues present challenges for traditional chocolate products. Rising diabetes prevalence and obesity concerns are prompting consumers to moderate confectionery consumption or seek healthier alternatives. Regulatory scrutiny regarding sugar content and nutritional labeling requirements adds complexity to product formulation and marketing strategies, requiring manufacturers to reformulate offerings while maintaining taste appeal.

Infrastructure and Cold Chain Limitations

Maintaining chocolate product quality across India's diverse climatic conditions and extensive distribution network presents significant operational challenges for manufacturers. Limited cold chain infrastructure in rural areas and smaller towns restricts market penetration and product assortment availability. Temperature sensitivity of chocolate products requires specialized storage and transportation facilities that add to distribution costs, operational complexity, and limit expansion into emerging markets.

Competitive Landscape:

The chocolate market in India has a moderately low degree of competition, led largely by global players with large country presence through their strong branded products. The main global players in this market maintain their strong hold in the market through their strong branded products with a strong recall value to their consumers, offering an entire range of chocolate products in the mass and premium segments. The main global players in the confectionery market maintain their strong hold in this market through popular daily consumption brands, while some others maintain their hold in the premium market through their luxury gift article or kids' range. The main players in this market, including dairy co-operatives or conglomerates, are largely expanding their range in the chocolate category as the demand for this range is increasing every day.

Some of the key players include:

- Amul (GCMMF)

- DS Group

- Ferrero India Private Limited

- Hershey India Private Limited

- ITC Limited

- Lotus Chocolate Co. Ltd.

- Mars International India Private Limited

- Mondelez India Foods Private Limited

- Nestlé India Ltd.

Recent Developments:

- In July 2025, Swiss chocolate maker Barry Callebaut inaugurated its third chocolate manufacturing facility in Neemrana, Rajasthan, featuring state-of-the-art production lines and warehousing. The 20,000 sqm plant boosts India’s capacity for high-quality chocolate and cocoa products and reflects the company’s strong confidence in long-term growth of the Indian chocolate market.

India Chocolate Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Milk Chocolate, Dark Chocolate, White Chocolate |

| Product Forms Covered | Moulded, Countline, Others |

| Packaging Types Covered | Pouches and Bags, Boxed Chocolate, Others |

| Distribution Channels Covered | Retail Sales, Institutional Sales |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Amul (GCMMF), DS Group, Ferrero India Private Limited, Hershey India Private Limited, ITC Limited, Lotus Chocolate Co. Ltd., Mars International India Private Limited, Mondelez India Foods Private Limited, Nestlé India Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India chocolate market size was valued at USD 3.05 Billion in 2025.

The India chocolate market is expected to grow at a compound annual growth rate of 7.01% from 2026-2034 to reach USD 5.62 Billion by 2034.

Milk chocolate held the largest market share of 67%, driven by its universal appeal across all consumer demographics, smooth taste profile, and extensive availability across price points and retail formats throughout India.

Key factors driving the India chocolate market include rising disposable incomes among the growing middle class, expanding organized retail and e-commerce penetration, strong festive gifting culture, premiumization trends, and the influence of Western consumption patterns among younger demographics.

Major challenges include cocoa price volatility and raw material cost fluctuations, growing health concerns regarding sugar consumption, limited cold chain infrastructure in rural areas, intense competition among established players, and sensitivity to temperature conditions affecting product quality and distribution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)