India Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

India Co-Working Office Space Market Size and Share:

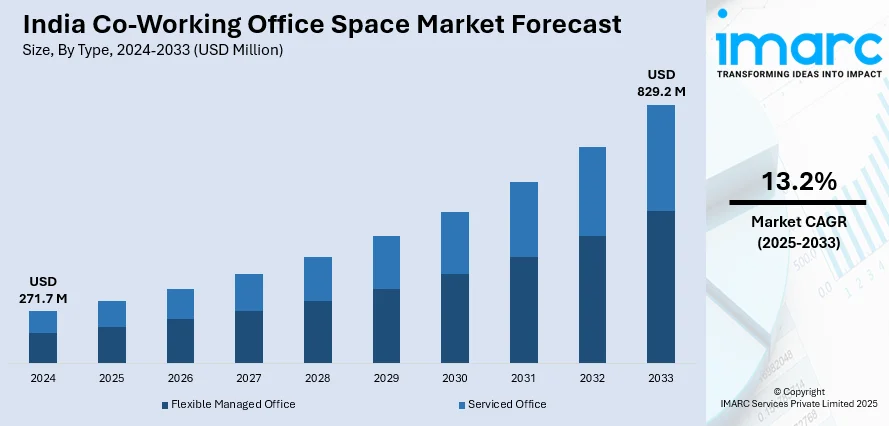

The India co-working office space market size reached USD 271.7 Million in 2024. The market is expected to reach USD 829.2 Million by 2033, exhibiting a growth rate (CAGR) of 13.2% during 2025-2033. The market growth is attributed to the rising demand for flexible workspaces, cost-efficiency for startups, hybrid work adoption, increased focus on employee well-being, expansion of tech hubs beyond metros, corporate demand for managed offices, growing freelancer and SME base, real estate optimization by enterprises, short-term lease preferences, and infrastructure development.

Market Insights:

- Based on region, the market has been categorized into North India, South India, East India, and West India.

- On the basis of type, the market is divided into flexible managed office and serviced office.

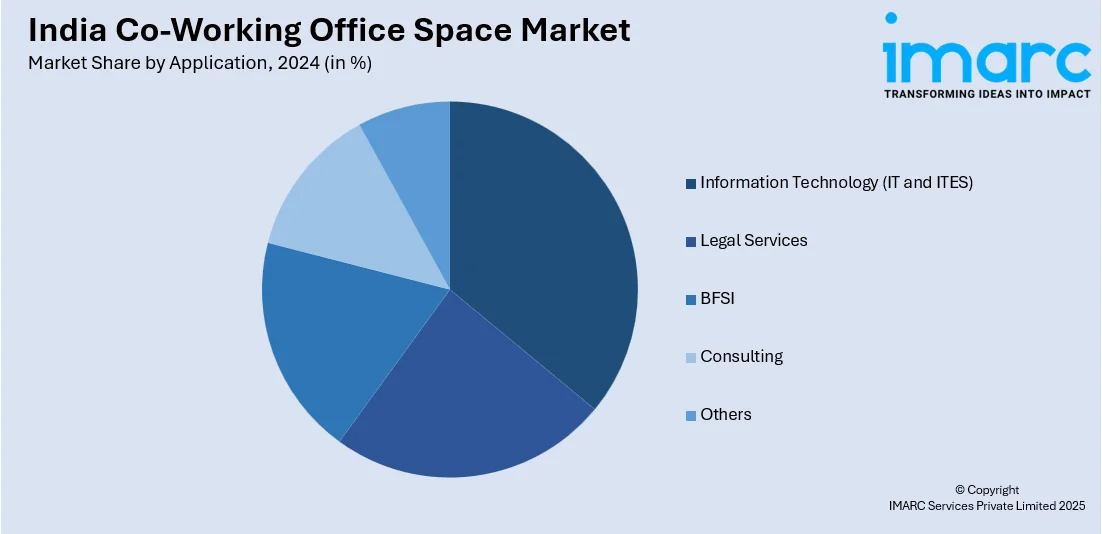

- Based on the application, the market is segmented into information technology (IT and ITES), legal services, BFSI, consulting, and others.

- On the basis of end user, the market is categorized as personal user, small scale company, large scale company, and others.

Market Size and Forecast:

- 2024 Market Size: USD 271.7 Million

- 2033 Projected Market Size: USD 829.2 Million

- CAGR (2025-2033): 13.2%

- West and Central India: Largest Region in 2024

India Co-Working Office Space Market Trends:

Growth in Tier 2 Cities

The co-working office space market in India is seeing strong momentum in Tier 2 cities such as Jaipur, Indore, Kochi, Lucknow, and Coimbatore. With improved infrastructure, lower real estate costs, and rising talent pools, these cities are becoming attractive hubs for startups, remote teams, and even large enterprises. Companies are expanding beyond metro areas to tap into local markets, reduce operational expenses, and offer employees more location flexibility. Co-working operators are seizing the opportunity by launching new centers in these cities, often with localized pricing and amenities suited to regional demand. For instance, in May 2025, IWG, the UK-based coworking leader, announced its plans to launch its premium brand Signature in India, anticipating growth in the office rental market. Targeting Tier II and III cities, IWG plans 40–50 new centers by 2025, expanding its existing network significantly, particularly in Bengaluru and other key locations. This, in turn, is propelling the co-working office space market growth in India. Government incentives for regional business growth and the shift to hybrid work have further supported this trend. As digital connectivity improves and businesses embrace distributed teams, Tier 2 cities are becoming critical drivers in the next phase of India’s co-working expansion, contributing significantly to the market’s geographic and economic diversification.

To get more information on this market, Request Sample

Rising Enterprise Adoption

Enterprise adoption is playing a major role in driving India co-working office space market growth. Large companies are increasingly choosing co-working spaces to support hybrid work models, decentralize operations, and provide regional access points for employees. These spaces offer flexibility in lease terms, scalability, and ready-to-use infrastructure advantages over traditional long-term leases. Companies in IT, consulting, and financial services are leading this trend, setting up satellite offices in both metro and Tier 2 cities. Co-working providers are responding by customizing spaces to meet enterprise-level standards, including dedicated floors, branded office designs, secure networks, and access control. This shift helps corporates reduce overhead costs, improve employee satisfaction, and maintain operational agility. With rising corporate participation and sustained demand, enterprise usage is becoming a core segment of India’s co-working landscape, significantly augmenting the co-working office space market share in India in the coming years. According to the report published by the India Brand Equity Foundation (IBEF), India's co-working office space is projected to expand significantly, reaching 125 million sq. ft by March 2027, an increase from 80 million sq. ft in December 2024. This growth is expected to occur at a compound annual growth rate (CAGR) of 21-22%. The share of co-working spaces in the commercial office market could also double to between 12.5% and 13.5% by FY27, primarily driven by demand from start-ups and IT companies.

Financial Performance Trends in Rental Income, Seat Pricing, and Occupancy Rate

The market is witnessing robust financial momentum, propelled by consistent rental income growth, dynamic seat pricing strategies, and improving occupancy rates. Operators are leveraging flexible pricing models, such as pay-per-use, dedicated desks, and private cabins—to cater to a diverse clientele, including startups, SMEs, and large enterprises. Seat pricing in Tier-I cities like Mumbai and Bengaluru has shown moderate inflation due to rising demand and limited premium inventory, while Tier-II cities are witnessing price stabilization driven by increased supply. Moreover, occupancy rates in top-performing centers have rebounded to pre-pandemic levels. Moreover, long-term leases and managed office solutions are contributing to predictable income streams, reducing financial volatility. Besides this, revenue diversification through value-added services, such as concierge, event hosting, and business support, has emerged as a key profitability driver. These financial metrics underscore the operational resilience and commercial viability of the co-working model across India’s urban centers.

Geographical Leadership and Growth of Premium Co-Working Spaces in Metropolitan Areas

Bengaluru has emerged as one of the most important centers of the market, commanding significant share in terms of both supply and demand. As the country’s technology and innovation hub, Bengaluru offers a strong base of startups, IT firms, and global capability centers that actively seek agile, collaborative work environments. This is creating a positive India co-working office space market outlook. NCR (Delhi-Gurgaon-Noida) and Mumbai benefit from their role as corporate and financial hubs, respectively. Apart from that, tier-I cities continue to dominate in terms of operational profitability, infrastructure readiness, and enterprise-grade co-working formats. However, there is a noticeable surge in the development of premium co-working spaces in Tier-II metros such as Pune, Hyderabad, and Chennai. These cities are attracting remote satellite teams and back-office operations due to cost advantages and a growing talent pool. Developers are also increasingly incorporating co-working formats within mixed-use commercial real estate projects in emerging urban zones, thus accelerating the geographical diversification of the Indian co-working ecosystem.

Integration of Advanced Technologies and Emphasis on Sustainable Infrastructure

The co-working office space providers in India are rapidly adopting advanced technologies to enhance operational efficiency and user experience. The integration of Internet of Things (IoT) solutions has enabled real-time monitoring of occupancy levels, energy consumption, and maintenance needs, facilitating smarter space utilization and reduced overheads. Furthermore, artificial Intelligence (AI) is being deployed for automated visitor management, predictive maintenance, and resource scheduling. As per the India co-working office space market forecast, these advancements will help operators provide a seamless, tech-enabled work environment that appeals to digital-native startups and corporate clients alike. In addition to this, sustainability has become a critical focus area, with increasing preference for green-certified buildings and energy-efficient infrastructure. Several co-working operators are adopting IGBC or LEED-certified design elements, incorporating renewable energy sources, and implementing waste management systems. Also, the growing demand for wellness-centric, tech-driven, and environmentally responsible office spaces reflects a shift in occupier preferences. As a result, the fusion of technology and sustainability is shaping the next phase of growth in the co-working segment.

Challenges in India Co-Working Office Space Market:

According to the India co-working office space market analysis, market faces several structural and cultural challenges. The rise of permanent remote work policies and hybrid models, particularly among IT and tech firms, has tempered long-term demand in certain urban pockets. Additionally, resistance from traditional corporate hierarchies and legacy office cultures hinders adoption, especially in sectors that prioritize controlled environments and centralized management. Market saturation in core metros has also intensified competition, pressuring margins for smaller operators. In response, leading co-working firms are pivoting toward differentiated offerings, such as managed office solutions, enterprise-focused centers, and wellness-enhanced environments. Operators are also adapting through tech-enabled flexibility, offering custom-built office modules, mobile app-based access control, and dynamic pricing models. By focusing on experience design, client-specific customization, and operational agility, players are attempting to offset demand uncertainty while aligning with the evolving workplace preferences of the modern workforce.

India Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Co-Working Office Space Market News:

- In August 2025, the Kerala government launched a neurodiversity-friendly coworking facility named “i by Infopark” at Ernakulam South Metro Station. Spanning 48,000 sq ft with 582 seats, the hub is designed to support over 550 professionals, offering modern amenities and flexible leasing options. Targeting gig workers, freelancers, multinational corporations, and Global Capability Centres (GCCs), the initiative aims to promote inclusive employment and innovation. The state’s Chief minister indicated that similar models could be replicated across Kerala based on the success of this pilot.

- In July 2025, Smartworks Coworking Spaces launched its much-anticipated initial public offering (IPO). The IPO was scaled down from an initially planned INR 550 Crore fresh issue to INR 445 Crore, accompanied by a reduced offer-for-sale (OFS), raising a total of approximately INR 582.56 crore. The issue received robust investor interest.

- In June 2025, 91Springboard expanded its footprint by launching six new coworking centers across Mumbai, Delhi-NCR, and Pune, adding approximately 3,600 desks and over 170,000 square feet of workspace to its portfolio. With this expansion, the company now offers around 30,000 desks across more than 1.5 million square feet in India, reinforcing its presence in the flexible workspace sector. These new hubs are expected to offer intuitive, flexible work environments tailored to a broad range of users, thereby expanding the co-working office space market size in India.

- In April 2025, Ofis Square has opened a new 30,000 sq ft coworking space in Gurugram, just 100 meters from MG Road Metro Station and 15 minutes by car from IGI Airport. The 30,000 sq ft workspace features over 520 desks, private cabins, advanced conference rooms with IoT integration, etc., fostering creativity and productivity. The launch reinforces Ofis Square’s commitment to delivering inspiring, intelligently designed work environments tailored to modern professionals.

- In May 2025, Realty firm Sumadhura Group launched its co-working brand, Workship, with an initial 1.3 lakh sq ft center in Whitefield, Bengaluru. The company plans to expand by adding three more centers, targeting premium managed office spaces to meet rising demand from sectors like IT, agri-tech, and pharma.

- In January 2025, iSprout launched its first coworking facility in Gurugram, expanding its presence to 23 centers in India. The new 50,000 sq. ft. space features over 900 seating arrangements, catering to the growing demand for flexible work environments. The company plans further expansions across NCR and India in 2025.

India Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The co-working office space market in India was valued at USD 271.7 Million in 2024.

The India co-working office space market is projected to exhibit a CAGR of 13.2% during 2025-2033, reaching a value of USD 829.2 Million by 2033.

The growing utilization of remote and hybrid work arrangements is creating the need for well-equipped, flexible work environments. Large corporations are using co-working spaces to support satellite teams, project-based work, and employee mobility. Besides this, rapid urbanization, rising real estate costs, and the requirement for shorter lease commitments are making co-working options attractive across metropolitan cities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)