India Coffee Beans Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

India Coffee Beans Market Summary:

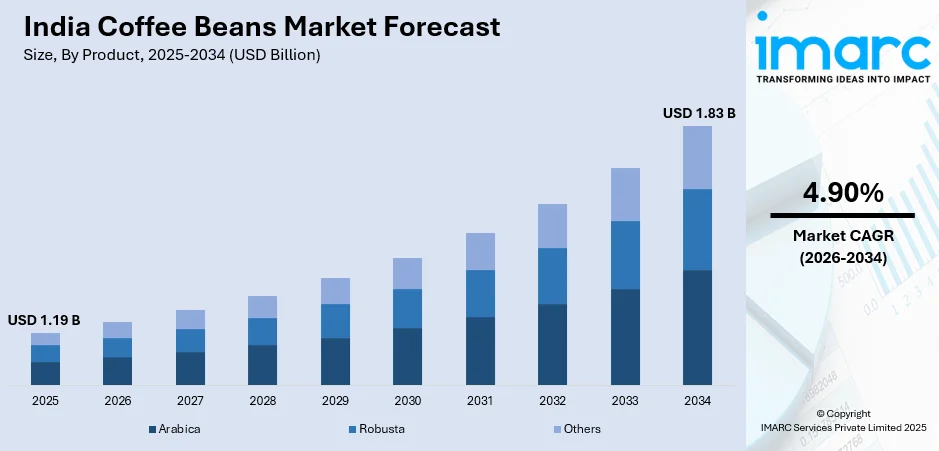

The India coffee beans market size was valued at USD 1.19 Billion in 2025 and is projected to reach USD 1.83 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034.

The growing cafe culture among urban young, rising disposable incomes, and changing consumer tastes toward premium and specialty coffee products are all contributing factors to the robust rise of the Indian coffee bean market. The country's emergence as a significant global coffee producer, coupled with growing domestic consumption patterns, supports sustained market development. The proliferation of specialty coffee chains, expanding e-commerce platforms, and innovative product offerings are transforming coffee consumption habits nationwide, contributing to the India coffee beans market share.

Key Takeaways and Insights:

- By Product: Robusta dominates the market with a share of 59% in 2025, owing to its higher caffeine content, stronger flavor profile preferred for instant coffee and espresso blends, and cost-effectiveness compared to Arabica. Karnataka's favorable growing conditions support robust production levels.

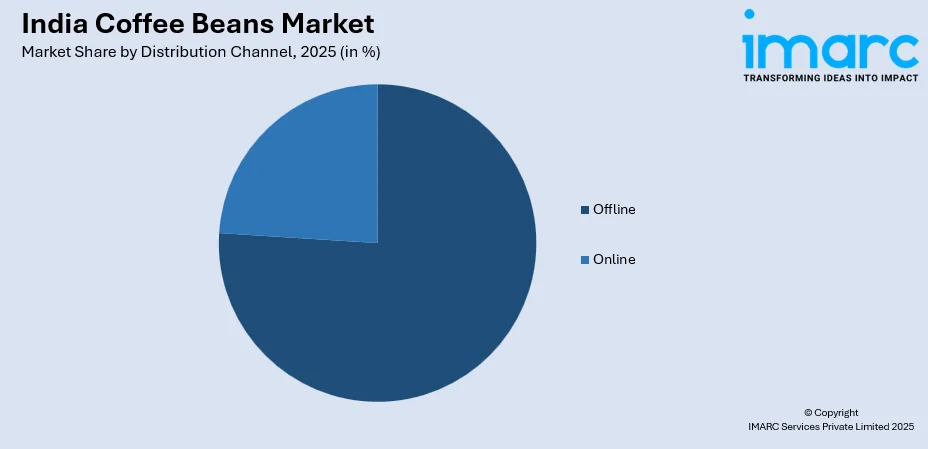

- By Distribution Channel: Offline leads the market with a share of 76% in 2025. This dominance is driven by the widespread presence of supermarkets, hypermarkets, specialty stores, and traditional retail outlets offering consumers direct product inspection and immediate availability.

- By End User: Food and beverages represent the largest segment with a market share of 81% in 2025, reflecting the primary application of coffee beans in cafés, restaurants, quick-service establishments, instant coffee manufacturing, and ready-to-drink beverage production across India.

- By Region: South India is the biggest region with 55% share in 2025, driven by engagement of Karnataka, Kerala, and Tamil Nadu in national coffee production, deeply embedded coffee culture, and concentration of processing infrastructure.

- Key Players: Key players drive the India coffee beans market by expanding their retail presence, investing in sustainable sourcing practices, and strengthening distribution networks. Their focus on product innovation, quality enhancement, and strategic partnerships with coffee growers supports market development and consumer awareness.

To get more information on this market Request Sample

The India coffee beans market continues to witness remarkable growth, fueled by the country's expanding café culture, rising urbanization, and increasing consumer sophistication toward specialty coffee offerings. Young professionals and millennials are increasingly adopting coffee as their preferred beverage, driving demand across organized retail channels and specialty coffee establishments. India's coffee exports reached a record USD 1.8 Billion in financial year 2024-25, reflecting a 40.2% growth from the previous year and demonstrating the country's strengthening position in global coffee trade. The government's supportive initiatives, including the Coffee Board's 10-year roadmap targeting doubled production by 2034 and the India-EFTA Trade Agreement offering zero-duty access to premium European markets, further enhance market prospects. Additionally, the growing trend toward sustainable and ethically sourced coffee beans among environmentally conscious consumers is reshaping purchasing patterns and encouraging premium product adoption.

India Coffee Beans Market Trends:

Rising Specialty Coffee Culture and Premiumization

The India coffee beans market is witnessing a significant shift toward specialty and premium coffee consumption. Single-origin beans, artisanal mixes, and specialist brewing techniques are becoming more and more popular among urban customers, especially millennials and Gen Z. Coffee enthusiasts are exploring diverse flavor profiles, origin-specific beans, and sustainable sourcing practices. This premiumization trend is driving the growth of specialty coffee roasters and cafés offering curated coffee experiences. The emphasis on bean-to-cup transparency and regional identity of Indian coffee estates is deepening consumer appreciation for quality coffee.

Expansion of Ready-to-Drink Coffee Segment

The ready-to-drink coffee segment is experiencing rapid expansion in India, driven by convenience-seeking consumers and evolving lifestyle preferences. Modern trade formats, quick-commerce platforms, and expanding retail distribution networks are making RTD coffee products increasingly accessible. Brands are launching innovative flavored variants, cold brews, and premium packaged coffee beverages targeting health-conscious consumers. The segment's growth reflects changing consumption patterns among working professionals seeking portable, high-quality coffee options compatible with their fast-paced urban lifestyles.

Sustainability and Ethical Sourcing Emphasis

Sustainability has emerged as a defining trend in the India coffee beans market, with consumers and businesses increasingly prioritizing eco-friendly practices. Coffee brands are emphasizing transparent sourcing, direct farmer partnerships, and organic certification to meet consumer demands for ethically produced products. The growing awareness of environmental issues, fair trade practices, and carbon-neutral operations is influencing purchasing decisions. Indian coffee's shade-grown cultivation methods and agroforestry practices are gaining global recognition for their environmental sustainability and unique flavor characteristics.

Market Outlook 2026-2034:

The India coffee beans market outlook remains optimistic, supported by favorable demographic trends, expanding café culture, and government initiatives promoting domestic consumption and exports. The market generated a revenue of USD 1.19 Billion in 2025 and is projected to reach a revenue of USD 1.83 Billion by 2034, growing at a compound annual growth rate of 4.90% from 2026-2034. Continued investments in coffee processing infrastructure, specialty coffee retail expansion, and digital commerce integration will sustain market momentum. The growing preference for premium products among young consumers and increasing penetration in tier-two and tier-three cities present significant growth opportunities.

India Coffee Beans Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Robusta | 59% |

| Distribution Channel | Offline | 76% |

| End User | Food and Beverages | 81% |

| Region | South India | 55% |

Product Insights:

- Arabica

- Robusta

- Others

Robusta dominates with a market share of 59% of the total India coffee beans market in 2025.

Robusta coffee beans hold the dominant position in India's coffee production landscape, accounting for approximately 72% of total national output. This variety thrives in the tropical conditions of Karnataka's Kodagu and Chikmagalur districts, Kerala's Wayanad region, and Tamil Nadu's coffee-growing areas. Robusta's higher caffeine content and stronger flavor profile make it the preferred choice for instant coffee manufacturing, espresso blends, and commercial coffee preparations consumed across India's growing café segment. The variety's adaptability to lower altitudes and warmer climates enables cultivation across diverse agro-ecological zones, ensuring stable production volumes throughout the year.

The demand for Robusta beans is further supported by their cost-effectiveness and consistent supply from India's well-established cultivation regions. Robusta beans typically sell at one-third the price of Arabica, making them economically attractive for large-scale commercial applications. India's Kaapi Royale grade Robusta has gained international recognition for its specialty quality, rich cocoa flavor profile, smooth mouthfeel, and reduced bitterness compared to typical Robusta variants, commanding premium prices in discerning global export markets including Italy and Germany.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline leads with a share of 76% of the total India coffee beans market in 2025.

The offline distribution channel maintains commanding leadership in India's coffee beans market, driven by the extensive network of supermarkets, hypermarkets, specialty food stores, and traditional retail establishments. Consumers continue to prefer physical retail outlets for purchasing coffee beans due to the ability to inspect product freshness, compare varieties, and receive personalized recommendations from knowledgeable store staff. Modern trade formats are enhancing the shopping experience through dedicated coffee sections featuring curated selections, brewing demonstrations, and sampling opportunities that build consumer confidence in purchase decisions.

The proliferation of organized retail chains across metropolitan and tier-two cities has significantly expanded coffee bean accessibility to diverse consumer segments. Major retail players are strategically partnering with specialty coffee brands to offer premium single-origin and artisanal coffee beans, responding to evolving consumer demand for quality products through convenient offline touchpoints. Traditional grocery stores continue serving price-conscious consumers in semi-urban and rural areas, while specialty gourmet stores cater to discerning coffee enthusiasts seeking rare varietals, estate-specific offerings, and internationally sourced beans unavailable through mainstream retail channels.

End User Insights:

- Personal Care

- Food and Beverages

- Pharmaceutical

Food and beverages exhibit a clear dominance with an 81% share of the total India coffee beans market in 2025.

The food and beverages segment represents the primary consumption channel for coffee beans in India, encompassing cafés, restaurants, quick-service establishments, hotels, and food manufacturing facilities. The rapid expansion of café culture, particularly among urban youth and working professionals, has significantly boosted demand for quality coffee beans. Premium dining establishments, boutique hotels, and corporate catering services are increasingly emphasizing specialty coffee offerings as part of their culinary experience, sourcing estate-specific beans to differentiate their beverage menus and attract discerning consumers.

The instant coffee and ready-to-drink beverage manufacturing sector constitutes a substantial portion of food and beverages demand. India's position as one of the world's major instant coffee producers and exporters underscores the segment's importance, with value-added coffee products accounting for nearly 38% of total coffee exports. Major food and beverage companies are increasingly sourcing high-quality Indian coffee beans for their diverse product lines, driving sustained demand growth across the segment. The emergence of functional coffee beverages, flavored variants, and convenient cold brew formats has further expanded application opportunities within the food and beverages industry nationwide.

Regional Insights:

- North India

- South India

- East India

- West India

South India represents the leading region with a 55% share of the total India coffee beans market in 2025.

South India dominates the coffee beans market as the nation's primary coffee production and consumption hub. Karnataka leads national production followed by Kerala and Tamil Nadu, with these three states collectively accounting for the vast majority of India's coffee output. The region's Western and Eastern Ghats provide ideal agro-climatic conditions for coffee cultivation, featuring optimal rainfall patterns, moderate temperatures, and well-drained slopes that support both Arabica and Robusta varieties. The deeply embedded coffee culture in South Indian households, particularly the traditional filter coffee preparation using brass decoction sets, drives sustained domestic consumption across generations.

The concentration of coffee processing infrastructure, roasting facilities, curing works, and export terminals in Karnataka and Kerala strengthens South India's market position. Karnataka's Chikmagalur region, historically known as the birthplace of Indian coffee cultivation houses numerous specialty coffee estates gaining international recognition. The presence of established farmer cooperatives, research institutions under the Coffee Board, and direct trade networks connecting growers with global buyers reinforces the region's dominant position in national production.

Market Dynamics:

Growth Drivers:

Why is the India Coffee Beans Market Growing?

Expanding Café Culture and Urbanization

India's coffee beans market is experiencing significant growth propelled by the rapid expansion of café culture across metropolitan and emerging urban centers. The proliferation of specialty coffee chains, independent roasteries, and café-style quick-service restaurants has transformed coffee consumption from a traditional beverage to a lifestyle experience. Young professionals, millennials, and Gen Z consumers are increasingly frequenting cafés for social interaction, remote work, and premium coffee experiences. The urbanization trend is creating new consumption centers in tier-two and tier-three cities, where rising disposable incomes enable premium spending patterns. Coffee retail chains are strategically expanding into these emerging markets, introducing quality coffee experiences to previously underserved consumer segments. The substantial growth of India's specialty coffee café market demonstrates the segment's considerable potential and widespread consumer acceptance of premium coffee experiences.

Government Initiatives and Export Promotion Programs

The Indian Government's proactive support for the coffee sector is significantly contributing to market growth. The Coffee Board of India has launched a comprehensive long-term roadmap targeting doubled coffee production and exports, including establishment of numerous Farmer Producer Organizations and identification of specialty coffee growers for premium export markets. The India-EFTA Trade and Economic Partnership Agreement offers zero-duty access for Indian coffee exports to Switzerland, Norway, and Iceland, opening lucrative European markets. Additionally, the reduction of Goods and Services Tax on instant coffee is expected to lower retail prices substantially, stimulating domestic consumption. The Integrated Coffee Development Project provides subsidies per hectare for plantation development, supporting production expansion across traditional and non-traditional coffee-growing regions including Andhra Pradesh, Odisha, and the North-Eastern states.

Rising Consumer Preference for Premium and Specialty Coffee

Consumer preferences are evolving toward premium and specialty coffee products, driving demand for high-quality coffee beans in the Indian market. Discerning consumers are increasingly seeking single-origin beans, artisanal blends, and coffee with clear provenance and traceability. The specialty coffee market in India is expected to grow significantly, with consumers willing to pay premium prices for exceptional taste profiles and sustainable sourcing. Indian coffee brands emphasizing regional identity, estate-specific origins from renowned growing regions like Chikmagalur and Coorg, and direct farmer relationships are gaining substantial consumer following. The growing home brewing trend has encouraged consumers to invest in quality coffee beans and brewing equipment, expanding retail demand. India's homegrown specialty coffee brands are successfully positioning Indian-origin beans as premium products in both domestic and international markets, building recognition for the country's diverse coffee heritage.

Market Restraints:

What Challenges the India Coffee Beans Market is Facing?

Climate Change Impact on Coffee Cultivation

Climate change poses significant challenges to India's coffee production, with unpredictable weather patterns, erratic rainfall, and temperature fluctuations affecting crop yields and quality. Rising temperatures increase vulnerability to pests and diseases, while unseasonal rains during harvest season cause berry splitting and quality deterioration, forcing farmers to invest in mechanical dryers.

Traditional Tea Dominance in Beverage Consumption

India's historically tea-dominant beverage culture presents market penetration challenges for coffee beans. Tea's strong cultural significance, particularly in North and East India, creates substantial consumer preference barriers that limit coffee adoption among traditional households. Deeply ingrained tea-drinking habits passed through generations, combined with tea's affordability and widespread availability, make it difficult for coffee to gain equivalent acceptance in these regions. The average Indian coffee consumption remains considerably below the global average, indicating substantial room for growth but also highlighting existing consumption limitations and the need for sustained awareness campaigns to shift beverage preferences.

Infrastructure and Supply Chain Limitations

Inadequate infrastructure including underdeveloped cold chain facilities, storage limitations, and transportation challenges in remote coffee-growing regions affect product quality and market efficiency. Poor road connectivity in hilly plantation areas delays harvest transportation, while insufficient warehousing leads to improper storage conditions that compromise bean quality and freshness. Small-scale farmers, who constitute the majority of coffee holdings with limited landholdings, often lack access to modern processing technologies, quality testing equipment, and efficient drying facilities.

Competitive Landscape:

The India coffee beans market features a dynamic competitive landscape characterized by the presence of established domestic players, international coffee chains, and emerging specialty roasters. Key participants compete through product innovation, retail expansion, sustainable sourcing practices, and brand differentiation strategies. Companies are investing in direct farmer partnerships, roasting infrastructure, and omnichannel distribution networks to strengthen market positions. The market structure includes large integrated producers managing entire value chains, specialty roasters focusing on premium segments, and retail chains emphasizing consumer experience. Strategic acquisitions, franchise partnerships, and geographic expansion into tier-two and tier-three cities are common competitive strategies driving market consolidation and growth.

Recent Developments:

- In September 2025, Blue Tokai Coffee Roasters raised USD 25 Million in bridge funding to accelerate domestic and international expansion. The capital will support new roastery and bakery facilities in Bengaluru and Gurgaon, while advancing the company's entry into the Middle East.

India Coffee Beans Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Arabica, Robusta, Others |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Personal Care, Food and Beverages, Pharmaceutical |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India coffee beans market size was valued at USD 1.19 Billion in 2025.

The India coffee beans market is expected to grow at a compound annual growth rate of 4.90% from 2026-2034 to reach USD 1.83 Billion by 2034.

Robusta dominated the market with a share of 59%, driven by its higher caffeine content, cost-effectiveness, and widespread use in instant coffee manufacturing and espresso blends across India's expanding café segment.

Key factors driving the India coffee beans market include expanding café culture among urban youth, rising disposable incomes, government initiatives promoting coffee production and exports, and growing consumer preference for premium and specialty coffee products.

Major challenges include climate change impacts on coffee cultivation causing yield fluctuations, traditional tea dominance limiting market penetration in certain regions, infrastructure limitations affecting supply chain efficiency, and price volatility impacting farmer profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)