India Coffee Capsule Market Size, Share, Trends and Forecast by Type, Material Type, Sales Channel, and Region, 2025-2033

India Coffee Capsule Market Overview:

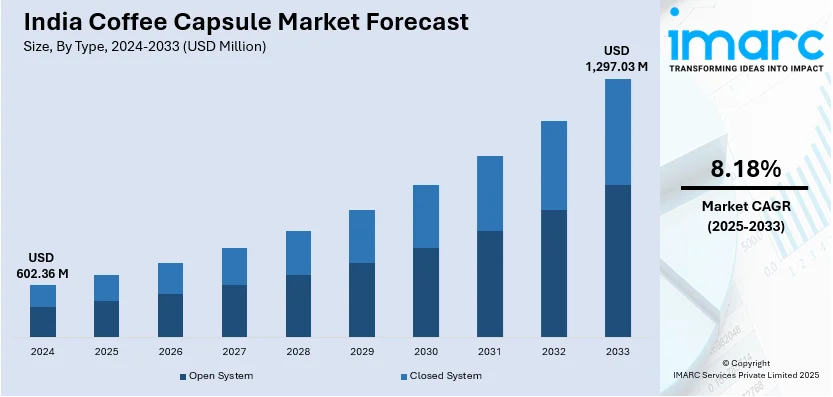

The India coffee capsule market size reached USD 602.36 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,297.03 Million by 2033, exhibiting a growth rate (CAGR) of 8.18% during 2025-2033. The market is expanding due to rising urbanization, premiumization, and increasing adoption of single-serve coffee machines. Moreover, growing café culture and global brand influence, along with evolving consumer preferences and technological advancements, are creating a positive India coffee capsule market outlook.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 602.36 Million |

| Market Forecast in 2033 | USD 1,297.03 Million |

| Market Growth Rate 2025-2033 | 8.18% |

India Coffee Capsule Market Trends:

Rising Urbanization & Premiumization

India’s rapid urbanization is reshaping coffee consumption patterns, with an increasing number of consumers seeking premium, café-style experiences at home. According to the data published by the World Bank, India's urbanization is set to see 600 million people living in cities by 2036 up from 31% in 2011. As disposable incomes rise, urban professionals and millennials are shifting toward high-quality coffee, moving beyond instant varieties to more sophisticated options like coffee capsules. This trend is driven by convenience, consistency, and the desire for a refined taste. This trend is driving significant growth in the India coffee capsule market share, with increasing adoption in households, offices, and premium retail channels. Metropolitan areas such as Mumbai, Delhi, and Bangalore are witnessing a surge in single-serve coffee machine adoption, further fueling the demand for capsules. The influence of global coffee culture, along with an expanding café ecosystem, is reinforcing this preference. Consumers are also exploring international coffee blends, limited-edition flavors, and organic options. Brands are capitalizing on this by offering premium capsules with curated blends, catering to the evolving tastes of urban coffee enthusiasts.

To get more information on this market, Request Sample

Expanding E-commerce Distribution

The rise of e-commerce is transforming the India Coffee Capsule Market, enabling brands to reach a wider consumer base with direct-to-consumer (D2C) sales models. According to the data published by IBEF, the Indian e-commerce industry is set to reach US$ 325 billion by 2030, with GMV hitting US$ 60 billion in FY23, a 22% increase. The online grocery market may rise to US$ 26.93 billion by 2027. Online marketplaces like Amazon, Flipkart, and specialty coffee platforms are making premium coffee capsules easily accessible to urban consumers. Subscription-based models and personalized recommendations are enhancing customer retention, while social media and digital marketing strategies are increasing brand visibility. Consumers prefer online shopping due to convenience, competitive pricing, and a broader variety of flavors and blends. International brands and homegrown startups are leveraging this trend by offering exclusive online deals and limited-edition capsule collections. Additionally, sustainable packaging and organic coffee capsules are gaining traction through eco-conscious e-commerce channels. The growing penetration of high-speed internet and smartphone usage further supports this shift, reinforcing strong India coffee capsule market growth.

India Coffee Capsule Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, material type and sales channel.

Type Insights:

- Open System

- Closed System

The report has provided a detailed breakup and analysis of the market based on the type. This includes open system and closed system.

Material Type Insights:

- Conventional Plastic

- Bioplastics

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes conventional plastic, bioplastics and others.

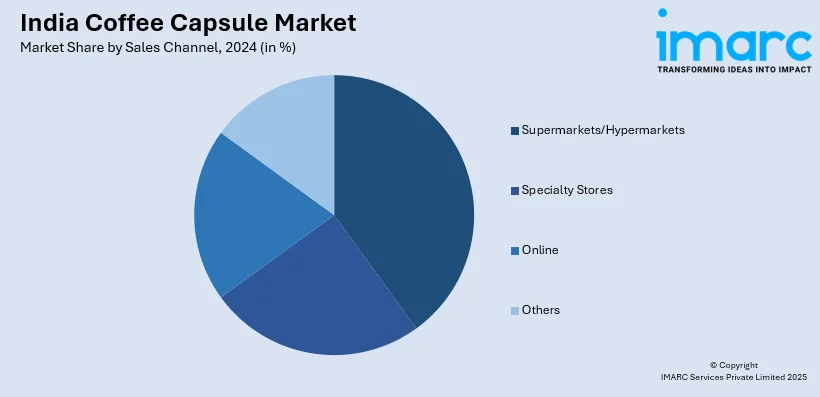

Sales Channel Insights:

- Supermarkets/Hypermarkets

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets/hypermarkets, specialty stores, online and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Coffee Capsule Market News:

- In March 2025, Nespresso launched its first boutique in India at New Delhi’s Select CityWalk Mall, aiming to boost coffee sourcing from local farmers. CEO Philipp Navratil emphasized the rise in demand for premium coffee experiences among younger consumers and announced plans for B2B growth with professional coffee capsule distribution partnerships.

- In November 2024, Barista Coffee launched coffee capsules and machines, targeting the home-brewing market. Aimed at coffee enthusiasts, the new line offers café-quality experience at home, with capsules available at select cafes and online platforms across major Indian cities.

India Coffee Capsule Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open System, Closed System |

| Material Types Covered | Conventional Plastic, Bioplastics, Others |

| Sales Channels Covered | Supermarkets/Hypermarkets, Specialty Stores, Online, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India coffee capsule market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India coffee capsule market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India coffee capsule industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The coffee capsule market in India was valued at USD 602.36 Million in 2024.

The India coffee capsule market is projected to exhibit a CAGR of 8.18% during 2025-2033, reaching a value of USD 1,297.03 Million by 2033.

India coffee capsule market is experiencing notable momentum driven by changing lifestyles, urbanization, and growing affinity for gourmet coffee. The convenience of single-serve systems, rising café culture, and demand for consistent, high-quality brews are also accelerating adoption. Both global and domestic players are further expanding their footprint to capture the rising the market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)