India Cold Brew Coffee Market Size, Share, Trends and Forecast by Type, Category, Distribution Channel, and Region, 2025-2033

India Cold Brew Coffee Market Size and Share:

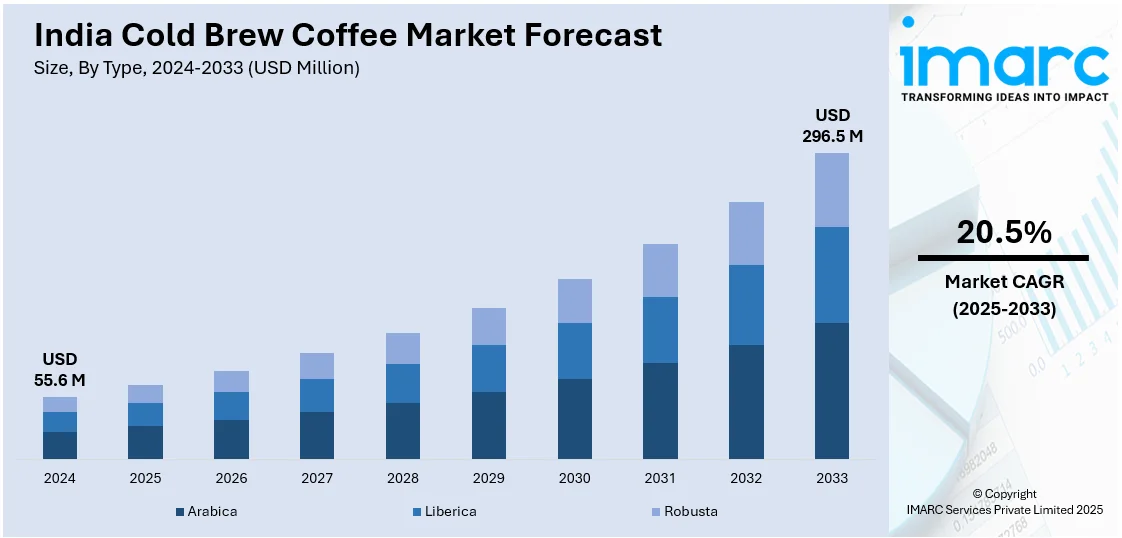

The India cold brew coffee market size reached USD 55.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 296.5 Million by 2033, exhibiting a growth rate (CAGR) of 20.5% during 2025-2033. The market is driven by an expanding café culture, increasing disposable incomes, a growing preference for premium and innovative beverages, and evolving consumer tastes that embrace global coffee trends, leading to higher demand for ready-to-drink and artisanal cold brew coffee options across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 55.6 Million |

| Market Forecast in 2033 | USD 296.5 Million |

| Market Growth Rate 2025-2033 | 20.5% |

India Cold Brew Coffee Market Trends:

Burgeoning Café Culture

India's urban scenario has seen a tremendous change with the spread of cafés, which have become a part of the social scene in cities and towns. Cafés are becoming one of the go-to places for social interaction, work, and recreation, creating a thriving coffee culture. This change in culture has generated a greater interest in various coffee options, and cold brew has become a preferred option among consumers looking for new and refreshing experiences. The popularity of specialty cafés has exposed the consumer to a range of coffee brewing methods, including cold brew, which is enjoyed for its smooth taste and reduced acidity. Exposures to this range of brewing methods have developed Indian consumers' coffee palettes to sophisticated levels, propelling demand for high-quality coffee products. Café culture has also popularized 'grab-and-go' drinks, reflecting the urban lifestyle of speed and pace, fashionable, adding to the appeal of ready-to-consume cold brew coffee drinks. This cultural transformation is not limited to urban cities but has infiltrated tier-II and tier-III cities as well, pointing toward a general approval and fervor for coffee drinking throughout the nation. The penetration of the café culture has played a key role in propelling cold brew coffee to a larger populace, thus expanding its market reach.

To get more information on this market, Request Sample

Increasing Disposable Incomes

India's economic landscape has seen a substantial rise in disposable incomes, enabling consumers to allocate more resources toward lifestyle and leisure activities, including premium beverage consumption. This economic empowerment has led to a shift in consumer preferences toward high-quality and innovative products like cold brew coffee. The enhanced purchasing power has made specialty coffee more accessible to a larger segment of the population. Consumers are now more willing to explore and invest in unique coffee experiences, such as cold brew, which was previously considered a niche segment. This willingness to spend on premium products is a testament to the evolving consumer mindset that values quality and exclusivity. The correlation between rising incomes and coffee consumption is evident in the escalating domestic demand for coffee. As consumers' economic capabilities expand, there is a discernible trend toward embracing global food and beverage trends, with cold brew coffee standing out as a prominent example. This trend underscores the potential for sustained growth in the cold brew coffee market, driven by a highly affluent and adventurous consumer base.

India Cold Brew Coffee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, category, and distribution channel.

Type Insights:

- Arabica

- Liberica

- Robusta

The report has provided a detailed breakup and analysis of the market based on the type. This includes arabica, liberica, and robusta.

Category Insights:

- Traditional

- Decaf

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes traditional and decaf.

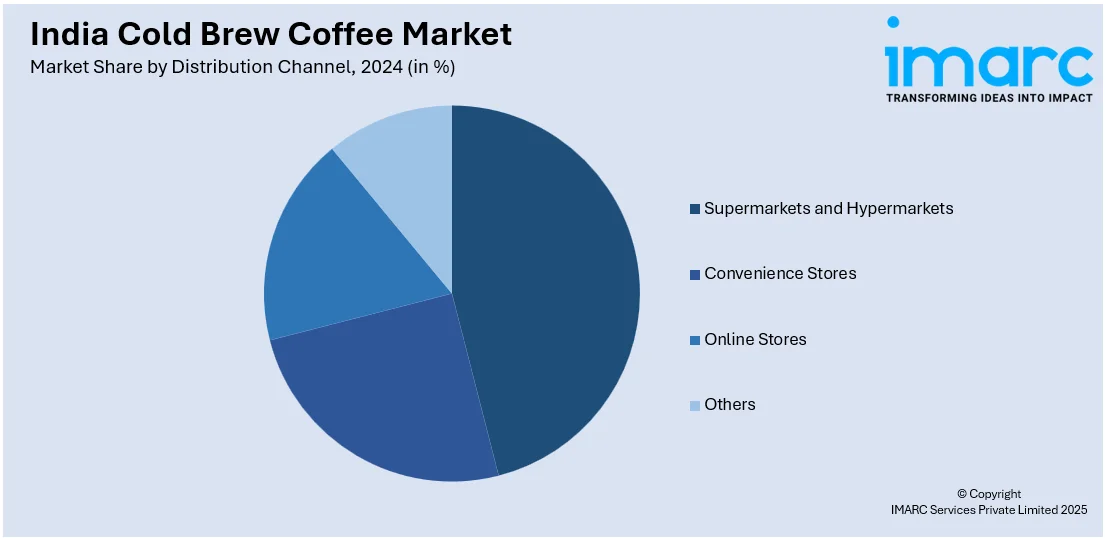

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Brew Coffee Market News:

- December 2024: Quaffine is India's first cold brew coffee liqueur, produced using 100% Arabica beans from Chikmagalur, which has earned international acclaim. The liqueur goes through an exclusive 18-step process, making it a product that can be used in shots, cocktails, and even desserts, with the company offering several recipe suggestions on their website.

- May 2024: Himmaleh Spirits has rolled out Bandarful, a handcrafted cold-brew coffee liqueur that is crafted with locally procured ingredients such as medium dark single estate Arabica coffee beans and hyperlocal rice, celebrating the variegated terroir of India.

India Cold Brew Coffee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Arabica, Liberica, Robusta |

| Categories Covered | Traditional, Decaf |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold brew coffee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold brew coffee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold brew coffee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold brew coffee market in India was valued at USD 55.6 Million in 2024.

The India cold brew coffee market is projected to exhibit a CAGR of 20.5% during 2025-2033, reaching a value of USD 296.5 Million by 2033.

The market is driven by a growing café culture, rising disposable incomes, and an increasing preference for premium and innovative beverages. Expanding urban lifestyles, evolving consumer tastes, and the rising popularity of ready-to-drink formats are also fueling demand for cold brew coffee across India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)