India Cold Chain Logistics Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Cold Chain Logistics Market Size and Share:

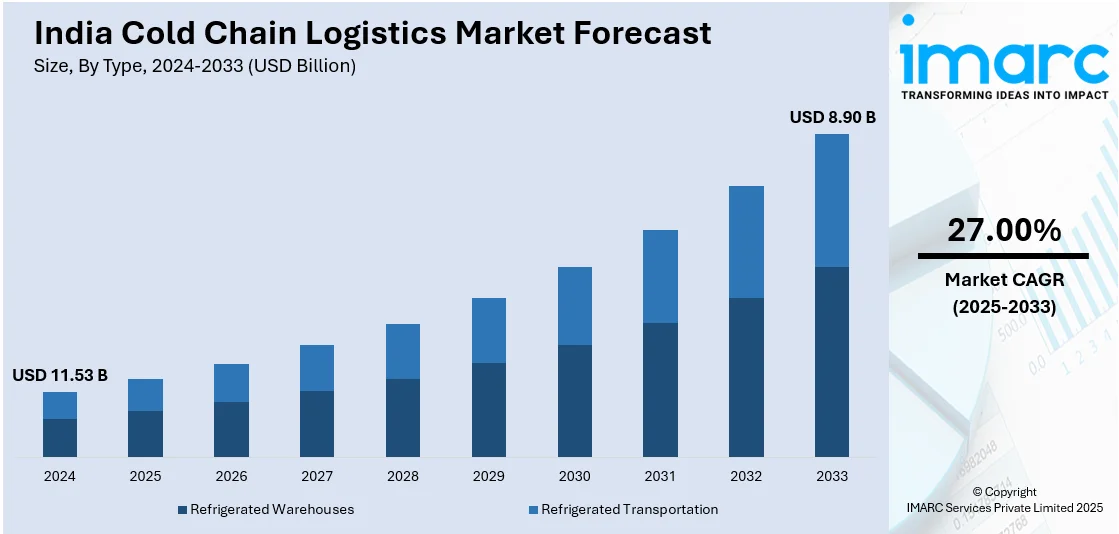

The India cold chain logistics market size reached USD 11.53 Billion in 2024. The market is expected to reach USD 27.00 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The market growth is attributed to rising investments in advanced cold storage and temperature-controlled infrastructure to support the food and beverage (F&B), pharmaceutical, and chemical industries. Additionally, companies are integrating internet of things (IoT), automation, and sustainable solutions to enhance efficiency, reduce losses, meet regulatory standards, and expand infrastructure across urban and rural areas.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into refrigerated warehouses and refrigerated transportation (railways, airways, roadways, and waterways).

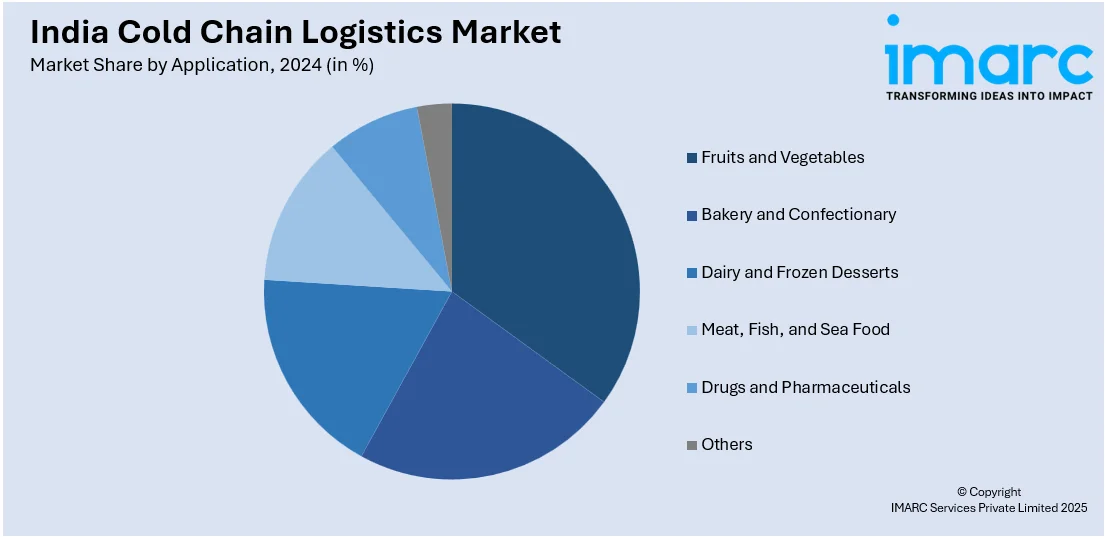

- On the basis of application, the market has been divided into fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and sea food, drugs and pharmaceuticals, and others.

Market Size and Forecast:

- 2024 Market Size: USD 11.53 Billion

- 2033 Projected Market Size: USD 27.00 Billion

- CAGR (2025-2033): 8.90%

India Cold Chain Logistics Market Trends:

Growing Investments in Cold Storage and Warehousing

Companies in India are expanding their storage capacities for catering to the rising demand for perishable goods across sectors such as food and beverage (F&B), pharmaceuticals, and chemicals. The entry of multinational logistics firms and domestic players into temperature-controlled warehousing is improving supply chain efficiency and reducing transit losses. Technologies such as automated storage and retrieval systems (ASRS), Internet of Things (IoT)-enabled sensors, and energy-efficient cooling solutions are being adopted to enhance operational efficiency. The shift towards multi-temperature warehousing, allowing storage of products at different temperature ranges within a single facility, is also gaining traction. With government incentives promoting cold storage infrastructure, major industry players are scaling their investments to establish strategically located distribution hubs. This expansion is ensuring greater availability of temperature-controlled storage solutions across urban and rural areas. In 2024, A.P. Moller - Maersk announced a new 260,000 sq. ft. cold store facility in Mehsana, Gujarat, designed to store frozen processed food for HyFun Foods. The facility featured advanced temperature-controlled solutions, sustainable energy, and modern warehouse management systems. This investment aligned with Maersk's commitment to provide integrated, end-to-end cold chain logistics and achieving NetZero emissions by 2040.

To get more information on this market, Request Sample

Rising Need for Temperature-Controlled Pharma Logistics

With stringent regulatory requirements, pharmaceutical companies are prioritizing cold chain infrastructure to maintain product stability. The expansion of domestic vaccine production, biosimilars, and personalized medicine in India is increasing the need for specialized storage and transportation solutions. Advanced technologies like IoT-enabled temperature monitoring, automated cold storage systems, and blockchain-based traceability are enhancing supply chain efficiency and compliance. The rise of biopharmaceutical exports and clinical trials further necessitates reliable cold chain networks that can manage diverse temperature ranges, including controlled room temperature and ultra-low freezing conditions. Investments in dedicated healthcare logistics facilities, refrigerated transport fleets, and pharmaceutical-grade warehouses are improving distribution capabilities. As the healthcare industry grows, temperature-controlled logistics is becoming a critical component of pharmaceutical supply chain management. In 2024, UPS launched a specialized healthcare-focused, temperature-controlled pharma facility in Hyderabad. The facility ensured that sensitive pharmaceutical products were stored within required temperature ranges (+15°C to +25°C, +2°C to +8°C), enhancing security and efficiency in the supply chain. It met strict Good Distribution Practice (GDP) standards and supported the growing Indian healthcare market.

Blockchain-Based Traceability Systems for Cold Chain Transparency

The use of blockchain technology is propelling India cold chain logistics market share by offering tamper-proof records of temperature, product origin, and handling activities along the supply chain. This technology of distributed ledgers facilitates maximum transparency and accountability from farm to fork, allowing stakeholders to monitor products in real-time and authenticate compliance with safety requirements. Blockchain networks are highly useful in pharmaceutical cold chains, where product integrity and regulatory compliance are the highest priority. The technology supports instant data sharing among a network of parties such as manufacturers, logistics companies, regulatory agencies, and end consumers without compromising data security and preventing tampering. Smart contracts integrated in blockchain platforms can trigger automatic notifications when temperature excursions happen, enact corrective measures, and support thorough audit trails for regulatory audits. This increased traceability functionality is leading to customer confidence in cold chain products and allowing quicker response to quality concerns.

Some of the other trends in the market include,

- National Gas Grid Expansion Empowering LNG-Fuelled Reefer Trucking: India's build-out of the national gas grid is making LNG a more viable, cleaner-burning fuel option for refrigerated trucking. This shift cuts operational expenses as well as carbon output and enhances the cold chain logistics business's sustainability image. LNG-fueled reefer trucks are increasingly becoming more economically viable with expanding refilling infrastructure along key transportation routes.

- Government-Subsidized Bulk-Cold-Storage Schemes: Government programs are encouraging the development of large cold storage facilities through financial incentives and subsidies, especially in agriculture belts. These schemes work towards mitigating post-harvest losses and enhancing farmer incomes by making cold storage affordable. The programs target developing shared cold storage infrastructure that can be accessed by various stakeholders in rural and semi-urban belts.

- Pharma Biologics and Vaccine Pipeline Growth: India's rising pharmaceutical industry growth, especially in biologic and vaccine manufacture, is generating the need for ultra-low temperature storage and transport technologies. Pharmaceutical plants are spending on high-tech cold chain facilities for clinical trials and commercial delivery of temperature-sensitive pharmaceuticals. This growth entails the creation of stand-alone pharmaceutical-grade cold storage facilities and unique transportation networks.

- E-Grocery Last-mile Refrigerated Demand: The fast growth of online grocery stores is generating new demand for last-mile refrigerated delivery service in urban areas, which is augmenting the cold chain logistics market size in India. Organizations are investing in temperature-control delivery vehicles and micro-fulfillment centers to preserve product quality during final delivery. This trend is resulting in innovation in portable refrigeration technology and optimization of routes for temperature-sensitive deliveries.

- Power-Grid Instability in Tier-2/3 Cities: Grid instability and frequent power outages in small cities are posing problems to cold chain operations and propelling investments in backup power solutions. Solar power systems, battery storage, and diesel generators are being implemented by companies to support cold storage operations with no interruptions. Such a challenge is triggering the development of energy-efficient refrigeration technology and alternative power solutions for cold chain facilities.

- Partnership Models: Strategic alliances between pharmaceutical/food companies and third-party logistics providers are building integrated cold chain solutions. These partnerships utilize specialized skills and infrastructure to deliver end-to-end temperature-controlled logistics solutions. The alliances provide smaller firms with access to advanced cold chain capabilities without incurring huge capital outlay.

Growth Drivers of the India Cold Chain Logistics Market:

The market is growing mainly due to the government's efforts to reduce food wastage by enhancing cold storage facilities in rural and urban regions. Increased consumer demand for fresh and processed products, together with pharmaceutical exports on the rise, is generating significant demand for temperature-controlled logistics services. The growth of organized retail chains and e-commerce websites has hastened the demand for efficient cold chain networks to preserve product quality along the distribution chain. Advances in technology, such as IoT integration, automation, and green refrigeration systems, are allowing operators to control costs while delivering quality service. This in turn is propelling the India cold chain logistics market growth. Also, government schemes like the Pradhan Mantri Kisan Sampada Yojana are offering financial assistance for cold chain infrastructure building, which is also helping farmers. Increased consciousness regarding food quality and safety among consumers is leading to demand for efficient cold chain services in different product categories.

Opportunities in the India Cold Chain Logistics Market:

Upgrade of specialized cold chain corridors linking major agricultural belts with consumption hubs offers major expansion opportunities for logistics players. Use of renewable energy options like solar power in cold storage has the potential for cost savings and sustainability enhancements. Creation of new pharmaceutical production clusters in tier-2 cities provides opportunities for specialty healthcare logistics services and infrastructure development. Combining the forces of technology firms and logistics companies can yield creative solutions for real-time tracking, predictive insights, and supply chain optimization. Increasing export value of Indian pharma and agri products to global markets calls for strong cold chain facilities and offers good business prospects. Innovation in last-mile cold chain delivery solutions for the rapidly growing e-grocery market has high market potential in urban markets. Public-private collaborations for cold chain infrastructure establishment have the ability to tap government assistance while infusing market development with private sector innovation and efficiency.

Challenges in the India Cold Chain Logistics Market:

According to India cold chain logistics market analysis, excessive capital investment needs for the creation of temperature-controlled transportation and storage infrastructure are major entry barriers to new players and small-scale operators. Poor power availability and recurrent outages in semi-urban and rural locations limit operation and enhance reliance on high-cost backup power systems. Fragmentation in India's agricultural market presents challenges in attaining economies of scale and maximizing cold chain usage across markets. Lack of skilled technicians and trained staff for handling high-tech cold chain equipment slows down operations and maintenance of refrigeration systems. Stringent regulatory requirements and compliance standards of states add complexity in operations for companies having pan-India cold chain networks. Insufficient awareness among farmers and small-scale industries regarding cold chain advantages leads to under-utilization of existing infrastructure and services. Pricing pressure and quality issues in the market are created by competition from unorganized players with lower-cost services and no temperature controls.

India Cold Chain Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Refrigerated Warehouses

- Refrigerated Transportation

- Railways

- Airways

- Roadways

- Waterways

The report has provided a detailed breakup and analysis of the market based on the type. This includes refrigerated warehouses and refrigerated transportation (railways, airways, roadways, and waterways).

Application Insights:

- Fruits and Vegetables

- Bakery and Confectionary

- Dairy and Frozen Desserts

- Meat, Fish, and Sea Food

- Drugs and Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, bakery and confectionary, dairy and frozen desserts, meat, fish, and sea food, drugs and pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Logistics Market News:

- In August 2025, Celcius Logistics has introduced 'Celcius+', a dedicated logistics division focusing on the pharmaceutical cold supply chain, with an initial investment of INR 50 Crore. The company plans to deploy 100 new refrigerated vehicles along critical pharmaceutical routes, earmarking INR 35 Crore for this initiative. The remaining funds will be directed towards developing a pharma courier service catering to urban and semi-urban markets. To support this expansion, Celcius also plans to hire 30–40 professionals with expertise in pharmaceutical logistics and regulatory compliance.

- In June 2025, DP World has launched a 110,000 sq. ft. temperature-controlled warehouse in Taloja, Navi Mumbai, boosting India’s cold chain logistics infrastructure. This facility is designed to serve industries like pharmaceuticals, dairy, frozen foods, and perishable agriculture. With 11,000 pallet positions spread across various temperature zones, the warehouse is strategically positioned near major transportation routes. It is equipped with state-of-the-art refrigeration systems that use sustainable refrigerants, aiming to enhance energy efficiency and minimize emissions.

- In May 2024, the Department of Animal Husbandry & Dairying (DAHD) and UNDP India signed an MoU to digitize vaccine cold chain management, strengthen capacity development, and optimize communication strategies. This partnership aimed to ensure proper vaccine storage and distribution, using real-time monitoring and AI technology. It helped improve animal health and vaccination coverage, particularly for diseases like Foot and Mouth Disease (FMD).

- In April 2024, Bootes and CargoPeople announced a collaboration to launch net-zero cold storage in India, aiming to reduce food waste and address energy demand challenges. The project aligned with India's net-zero 2070 goals and focused on affordable cold storage for farmers. The partnership targeted $1 in projects for net-zero cold storage over the next five years.

India Cold Chain Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Applications Covered | Fruits and Vegetables, Bakery and Confectionary, Dairy and Frozen Desserts, Meat, Fish, and Sea Food, Drugs and Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain logistics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain logistics market in India was valued at USD 11.53 Billion in 2024.

The cold chain logistics market in India is projected to reach USD 27.00 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033.

Rising investments in advanced cold storage, temperature-controlled infrastructure, and integration of IoT, automation, and sustainable solutions are key drivers. The growing demand across diverse sectors like food and beverage (F&B), pharmaceuticals, and chemicals is also contributing to the market's growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)