India Cold Chain Transport Market Size, Share, Trends and Forecast by Type, Application, Equipment, and Region, 2025-2033

India Cold Chain Transport Market Overview:

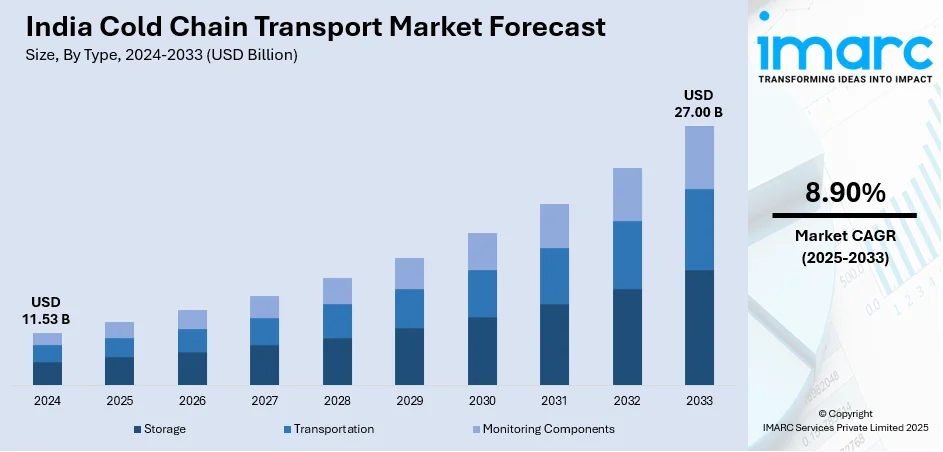

The India cold chain transport market size reached USD 11.53 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.00 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The rising adoption of automation, artificial intelligence (AI)-driven optimization, and blockchain for enhanced efficiency and transparency and increasing sustainability efforts to balance operational cost efficiency with environmental responsibility are some of the key factors bolstering the growth of the market in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.53 Billion |

| Market Forecast in 2033 | USD 27.00 Billion |

| Market Growth Rate (2025-2033) | 8.90% |

India Cold Chain Transport Market Trends:

Increasing Adoption of Automation and Digitalization in Cold Chain Logistics

The integration of automation and digitalization in cold chain logistics is transforming the efficiency and reliability of temperature-sensitive transportation. Advanced warehouse management systems enhance inventory oversight, minimize human mistakes, and improve order fulfillment speeds. Automated sorting and robotic handling systems ensure precise handling of perishable goods, minimizing damage and optimizing space utilization in cold storage facilities. Real-time monitoring through the Internet of Things (IoT)-enabled temperature sensors are improving visibility across the supply chain, allowing logistics providers to maintain consistent temperature conditions and mitigate risks of spoilage or product degradation. Artificial intelligence (AI) and predictive analytics are essential in contributing significantly for optimizing delivery routes, reducing fuel utilization, and forecasting demand fluctuations. The use of machine learning (ML) algorithms is enhancing cold chain logistics by predicting potential disruptions and enabling proactive decision-making. Blockchain technology is further strengthening supply chain transparency by ensuring tamper-proof record-keeping, securing shipment data, and preventing fraud in temperature-sensitive logistics. Companies are heavily investing in smart cold chain infrastructure, integrating digital platforms that provide real-time analytics, automated compliance tracking, and remote fleet management. In 2023, Carrier Transicold launched its Lynx™ Fleet digital platform in India at REFCOLD India 2023 to enhance cold chain logistics. The platform offered real-time monitoring, automated processes, and improved fuel efficiency, helping businesses optimize fleet performance, reduce logistics failures, and lower operational costs. Such advancements are setting new benchmarks for efficiency and reliability in India’s evolving cold chain ecosystem.

To get more information on this market, Request Sample

Rising Demand for Sustainable and Energy-Efficient Cold Chain Solutions

Businesses are incorporating environment-friendly refrigeration solutions, including solar-powered cold storage facilities and energy-efficient reefer vehicles, to minimize carbon emissions and cut operational expenses. The growing consciousness about climate change and the regulatory demands for reducing carbon emissions are prompting logistics companies to invest in alternative cooling methods, like phase-change materials and liquid nitrogen refrigeration. Companies are incorporating waste heat recovery systems and enhancing energy use in cold storage facilities to boost overall efficiency. With the focus of multinational companies and regulatory agencies on green supply chains, India’s cold chain transport industry is transforming eco-friendly logistics practices, seeking to harmonize cost-effectiveness with sustainability objectives. In 2025, the Indian startup Enhanced Innovations introduced the Phloton active-cooling vaccine carrier, created for transporting vaccines in the final delivery phase. It includes a 14-hour lithium battery reserve, support for solar charging, and real-time temperature tracking to keep within the 2°C to 8°C range. The system is adaptable for various applications, such as agriculture and biomedical research, focusing on a market valued at INR 1,100 crore ($126 Billion).

India Cold Chain Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, application, and equipment.

Type Insights:

- Storage

- Transportation

- Monitoring Components

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage, transportation, and monitoring components.

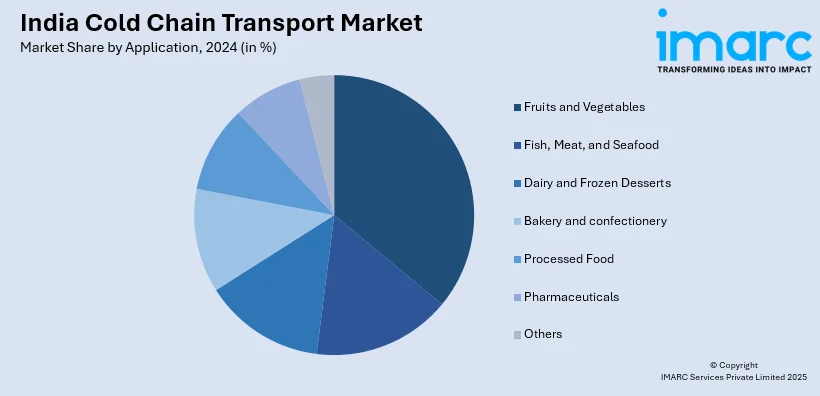

Application Insights:

- Fruits and Vegetables

- Fish, Meat, and Seafood

- Dairy and Frozen Desserts

- Bakery and confectionery

- Processed Food

- Pharmaceuticals

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes fruits and vegetables, fish, meat, and seafood, dairy and frozen desserts, bakery and confectionery, processed food, pharmaceuticals, and others.

Equipment Insights:

- Storage Equipment

- Transportation Equipment

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes storage equipment and transportation equipment.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Chain Transport Market News:

- In January 2025, FedEx introduced its enhanced supply chain service, FedEx Surround®, in India. The AI-driven platform provides immediate shipment visibility, predictive insights, and improved handling features, including cold chain assistance for delicate shipments. It delivers customized service standards to sectors such as healthcare, aerospace, and technology, guaranteeing prompt and safe deliveries.

- In September 2024, Yellowings Delivery Services, in partnership with Jubilant FoodWorks, introduced India’s inaugural fully electric reefer pickup truck. This cutting-edge truck, created for moving temperature-sensitive items, lowered carbon emissions and had a payload capacity of 1 ton, providing a range of up to 160 km. The initiative additionally encouraged gender diversity by hiring female drivers, which supported both sustainability and inclusivity in cold chain logistics.

India Cold Chain Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Storage, Transportation, Monitoring Components |

| Applications Covered | Fruits and Vegetables, Fish, Meat, and Seafood, Dairy and Frozen Desserts, Bakery and confectionery, Processed Food, Pharmaceuticals, Others |

| Equipments Covered | Storage Equipment, Transportation Equipment |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold chain transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold chain transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold chain transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cold chain transport market in India was valued at USD 11.53 Billion in 2024.

The India cold chain transport market is projected to exhibit a (CAGR) of 8.90% during 2025-2033, reaching a value of USD 27.00 Billion by 2033.

Increased need for cold-sensitive products, especially in pharmaceuticals, perishables, and dairy industries, is propelling India's cold chain transportation business. Growth of organized retail, e-commerce, and food processing businesses, coupled with infrastructure development and government-sponsored cold storage initiatives, are enhancing logistics strength and facilitating assured, compliant, and timely movement of chilled and frozen products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)