India Cold Pressed Juices Market Size, Share, Trends and Forecast by Category, Distribution Channel, and Region, 2025-2033

India Cold Pressed Juices Market Overview:

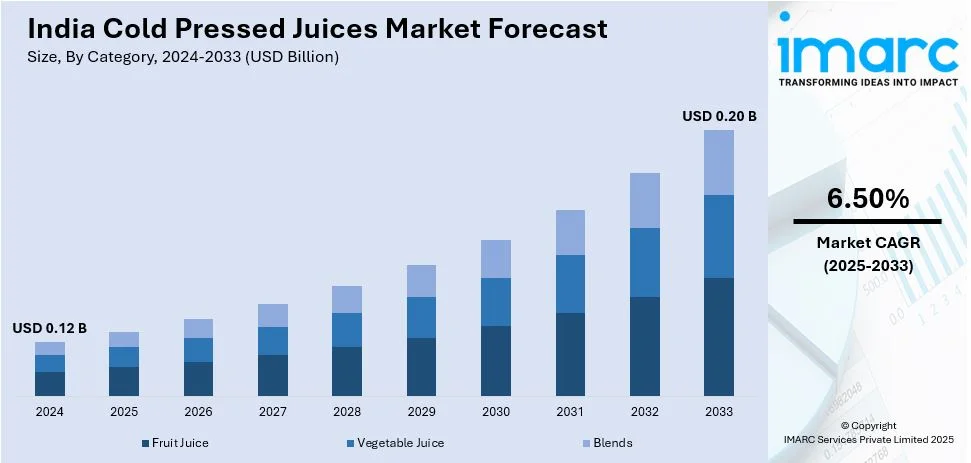

The India cold pressed juices market size reached USD 0.12 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.20 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is driven by rising health consciousness, augmenting demand for natural and nutrient-rich beverages, and a shift toward immunity-improving products post-COVID-19. Expanding retail and online distribution channels, along with innovative flavors and functional ingredients, are making these juices more accessible, fueling the India cold pressed juices market growth across urban and tier-2/3 cities.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.12 Billion |

| Market Forecast in 2033 | USD 0.20 Billion |

| Market Growth Rate (2025-2033) | 6.50% |

India Cold Pressed Juices Market Trends:

Rising Health Consciousness Driving Demand for Cold-Pressed Juices

The increasing health consciousness among consumers is significantly supporting the India cold pressed juices market growth. A 2024 scientific study on a rare ginger species found in Arunachal Pradesh, India, Zingiber sianginensis, showed that it had twice the amount of 6-gingerol as common ginger, thus enhancing its antioxidant properties. A total of 158 bioactive compounds were identified by the study, which also showed the extract to reduce oxidative stress biomarkers, suggesting further applications in natural health. This finding has the potential for great improvement in a popular functional beverage rich in antioxidants, as the market for cold-pressed ginger juices is gaining traction in India. With a growing awareness of the benefits of such natural and nutrient-rich beverages, more individuals are shifting from traditional sugary drinks to cold-pressed juices. These juices are perceived as healthier alternatives as they are made without heat or preservatives, retaining essential vitamins, minerals, and enzymes. The urban population, especially millennials and Gen Z, is leading this trend, prioritizing wellness and preventive healthcare. Additionally, the COVID-19 pandemic has accelerated this shift, as consumers are now more focused on enhancing immunity and maintaining a healthy lifestyle. Brands are capitalizing on this trend by offering innovative flavors, organic options, and functional juices infused with superfoods such as turmeric, ginger, and moringa. This health-driven demand is expected to continue shaping the market in the coming years.

To get more information on this market, Request Sample

Expansion of Retail and Online Distribution Channels

The cold-pressed juices market in India is witnessing a transformation in its distribution landscape, with both retail and online channels expanding rapidly. Therefore, this is creating a positive India cold pressed juices market outlook. Supermarkets, hypermarkets, and specialty health stores are increasingly stocking cold-pressed juices, making them more accessible to consumers. Simultaneously, the rise of e-commerce platforms and direct-to-consumer (D2C) models has revolutionized the way these products are purchased. According to a research report released by the IMARC Group, the size of the e-commerce market in India accelerated to USD 92.7 Billion in 2023. The market is estimated to reach USD 259.0 Billion in 2032, growing at a CAGR of 29.3% from 2024 to 2032. Additionally, online delivery services, subscription models, and partnerships with food delivery apps have made it convenient for consumers to access fresh, cold-pressed juices at their doorstep. This dual-channel approach is helping brands reach a wider audience, including tier-2 and tier-3 cities, where health trends are gaining traction. Moreover, the integration of technology, such as cold chain logistics and eco-friendly packaging, is enhancing product quality and shelf life, further enhancing consumer confidence and market growth.

India Cold Pressed Juices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on category and distribution channel.

Category Insights:

- Fruit Juice

- Vegetable Juice

- Blends

The report has provided a detailed breakup and analysis of the market based on the category. This includes fruit juice, vegetable juice, and blends.

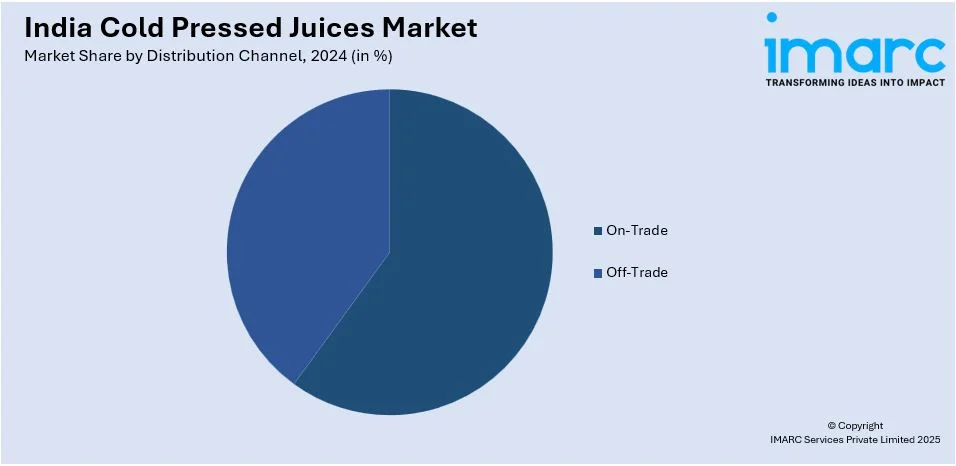

Distribution Channel Insights:

- On-Trade

- Off-Trade

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade, and off-trade (supermarkets/hypermarkets, convenience/grocery stores, online stores, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cold Pressed Juices Market News:

- March 01, 2025: Pluckk launched a brand new clean range of cold-pressed juices in India, additionally free from preservatives, coming into the ₹1,100 Crore (approximately USD 134.15 Million) packaged juice market, which is growing at an annual rate of 15%. The juices are available in 10 unique flavors and have a 21-day shelf life due to HPP technology, with 100% fruit and zero added sugar. With the growing receptivity towards healthier beverage options and carriers of health benefits, Pluckk's foray into the main Indian cities will solidify its role as the leading cold-pressed juice player in the Indian beverage segment.

- April 3, 2024: Mumbai-based startup The Fresh Press raised an undisclosed amount in a pre-Series A round from Gruhas Collective Consumer Fund to drive growth amid India's growing cold-pressed juice market. The brand has established a total of 36 stores throughout the country and plans to expand its network in southern and northern urban areas to as many as 1,000 quick-service restaurant locations. With natural and healthy beverages witnessing a great demand in India, this investment will strengthen The Fresh Press’s market footprint substantially.

India Cold Pressed Juices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Fruit Juice, Vegetable Juice, Blends |

| Distribution Channels Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India cold pressed juices market performed so far and how will it perform in the coming years?

- What is the breakup of the India cold pressed juices market on the basis of category?

- What is the breakup of the India cold pressed juices market on the basis of distribution channel?

- What is the breakup of the India cold pressed juices market on the basis of region?

- What are the various stages in the value chain of the India cold pressed juices market?

- What are the key driving factors and challenges in the India cold pressed juices market?

- What is the structure of the India cold pressed juices market and who are the key players?

- What is the degree of competition in the India cold pressed juices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cold pressed juices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cold pressed juices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cold pressed juices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)