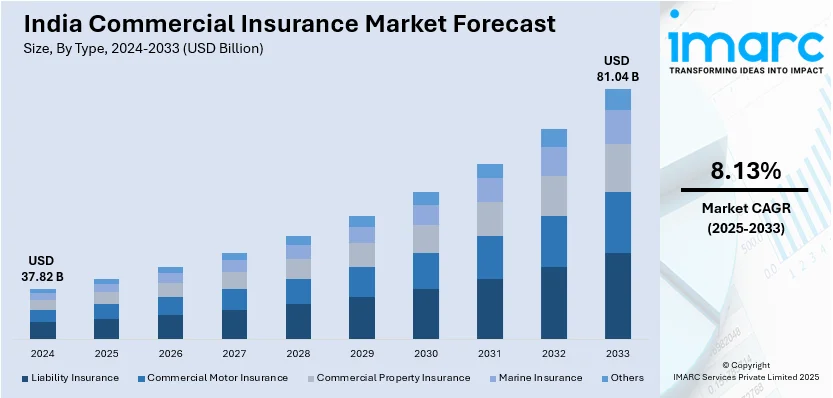

India Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel,Industry Vertical, and Region, 2025-2033

India Commercial Insurance Market Overview:

The India commercial insurance market size reached USD 37.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 81.04 Billion by 2033, exhibiting a growth rate (CAGR) of 8.13% during 2025-2033. India’s commercial insurance market is expanding due to rising enterprise risk awareness, increasing infrastructure investments, and digital transformation. Moreover, insurers are enhancing coverage solutions and adopting advanced technology to streamline operations, improve policy management, and offer customized risk protection, strengthening business resilience and market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.82 Billion |

| Market Forecast in 2033 | USD 81.04 Billion |

| Market Growth Rate (2025-2033) | 8.13% |

India Commercial Insurance Market Trends:

Expanding Coverage Solutions for Enterprises

India's industrial insurance sector is transforming significantly as industries ask for risk security in detail. Growing industry output, heavy spending on infrastructure development, and escalating digital challenges are generating great demand for specific types of insurance packages. In addition, enterprises currently need greater exposure than classical schemes to help combat industry-focused dangers, allowing companies to protect funds and develop continuity. The insurer is upgrading service to deliver, making the insurance market solid and robust by integrating specialized covers and risk management schemes. For example, in January 2025, Generali Group launched Global Corporate & Commercial (GC&C) India within Future Generali India Insurance to address growing commercial insurance demand. This initiative enhances market competition by introducing a broader range of coverage options, including property, liability, marine, cyber, and financial risk insurance. The presence of a global player like Generali strengthens insurance accessibility for enterprises, ensuring businesses can mitigate risks effectively in an evolving economic landscape. The expansion of specialized insurance coverage benefits industries by reducing financial vulnerabilities and improving risk management frameworks. Indian enterprises gain access to solutions that protect against sector-specific challenges, including infrastructure failures, cyberattacks, and supply chain disruptions with the entry of more insurers offering customized policies. As more businesses recognize the importance of comprehensive risk coverage, the commercial insurance market in India continues to expand, fostering greater financial security and market resilience.

To get more information on this market, Request Sample

Technology Integration Enhancing Operational Efficiency

The Indian commercial insurance business is experiencing a shift in integrating technology. Policy management, claims processing, and risk analysis are getting digitally enhanced to make operations more efficient and the customer experience better. In addition, cloud-based infrastructure and data analytics enable insurers to automate processes, improve precision, and expedite turnaround time. This change is imperative since organizations need speedier policy issuance, automated claim settlement, and integrated risk management solutions. For example, in August 2024, HDFC ERGO partnered with Xceedance to implement Duck Creek’s SaaS core insurance systems in India. This collaboration modernizes commercial insurance operations by integrating cloud-native applications for policy administration, claims processing, billing, and data insights. By leveraging SaaS-based solutions, HDFC ERGO aims to accelerate product rollouts, enhance digital capabilities, and strengthen intermediary engagement, improving the overall efficiency of the insurance ecosystem. Technology adoption in commercial insurance is driving cost efficiency, scalability, and real-time data analytics. Insurers implementing advanced digital solutions can provide faster, more accurate risk assessments and policy management, ensuring businesses receive the coverage they need without delays. Additionally, digital platforms help reduce fraudulent claims and improve underwriting accuracy, benefiting both insurers and policyholders.

India Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-Sized Enterprises.

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium-sized enterprises.

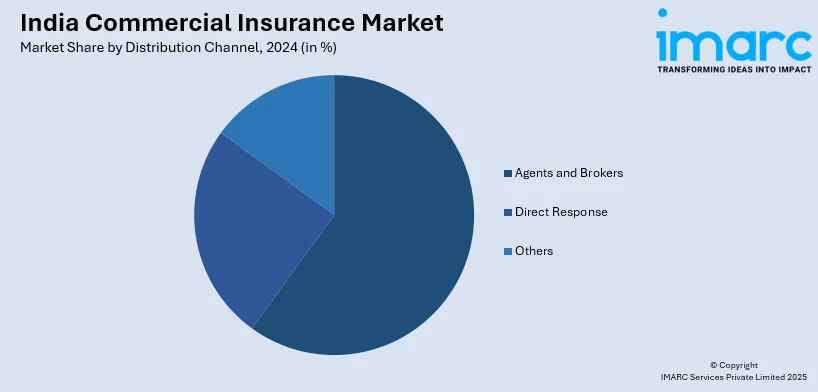

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Insurance Market News:

- March 2025: Bajaj Finserv highlighted strong growth prospects for India's insurance sector, citing low penetration and rising demand. This development strengthens the commercial insurance market by driving higher coverage adoption, expanding industry participation, and supporting long-term market growth through increased financial security.

- March 2025: First Policy introduced enhanced property insurance solutions in India, covering warehouses, construction projects, and financial fraud. This strengthens the commercial insurance market by improving risk coverage, increasing asset protection, and ensuring business continuity against natural disasters, cyber threats, and operational disruptions.

India Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-Sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India commercial insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the India commercial insurance market on the basis of type?

- What is the breakup of the India commercial insurance market on the basis of enterprise size?

- What is the breakup of the India commercial insurance market on the basis of distribution channel?

- What is the breakup of the India commercial insurance market on the basis of industry vertical?

- What are the various stages in the value chain of the India commercial insurance market?

- What are the key driving factors and challenges in the India commercial insurance market?

- What is the structure of the India commercial insurance market and who are the key players?

- What is the degree of competition in the India commercial insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)