India Commercial Property Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Application, and Region, 2025-2033

India Commercial Property Insurance Market Overview:

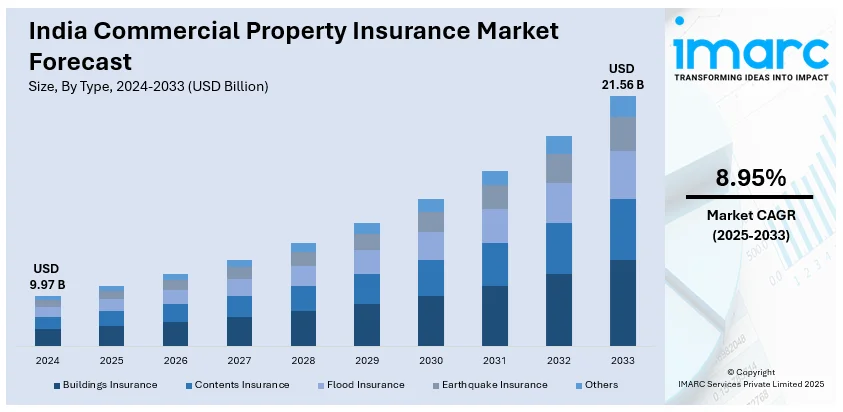

The India commercial property insurance market size reached USD 9.97 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 21.56 Billion by 2033, exhibiting a growth rate (CAGR) of 8.95% during 2025-2033. Rapid urbanization, increasing infrastructure investments, rising awareness of risk management, stringent regulatory mandates, growing adoption of parametric insurance, technological advancements in underwriting and claims processing, and heightened demand for comprehensive coverage against natural disasters are some of the major factors positively impacting the India commercial property insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.97 Billion |

| Market Forecast in 2033 | USD 21.56 Billion |

| Market Growth Rate (2025-2033) | 8.95% |

India Commercial Property Insurance Market Trends:

Urbanization Impacting Commercial Property Insurance in India

Rapid urbanization is significantly propelling the India commercial property insurance market growth. According to IBEF, urban population in India is expected to rise from 340 million in 2008 to 590 million by 2030. As cities expand and infrastructure development accelerates, the demand for comprehensive property insurance coverage is increasing. The urban transformation results in increased commercial property investment, such as office buildings, shopping malls, warehouses, and mixed-use buildings, all of which need protection from financial hazards such as natural calamities, fire, and robbery. The higher property values, population density, and exposure to environmental threats from concentrated businesses within urban areas amplify risk exposure. Insurers are responding by providing specifically tailored policies for risks in urban settings, including fire in urban areas, damages caused by pollution, and civil unrest. Insurers are also increasing coverage for tall buildings, intelligent infrastructure, and commercial complexes that have novel technology and green design. As metropolitan regions expand, government regulations regarding building safety, environmental compliance, and disaster resilience are also becoming stricter. The growing prevalence of smart cities and urban technology solutions is further shaping the insurance landscape. The integration of technology, regulatory changes, and shifting business landscapes will drive new opportunities for commercial property insurance providers in India's expanding urban centers.

To get more information on this market, Request Sample

Regulatory Reforms and Initiatives

Regulatory changes are significantly influencing the India commercial property insurance market outlook. Regulatory reforms are democratizing policies and making them customer oriented. The emphasis is on streamlining the process of issuing policies, closing gaps in coverage, and promoting wider participation by all sizes and types of businesses. Insurers are given greater freedom in structuring products, which allows them to design solutions that are highly customized for industry-specific risks. Regulatory models are also insisting on higher policy wording standardization, so as to promote uniformity and decrease ambiguities during claim settlements. The major focus is on enhancing consumer understanding through transparency campaigns. New business models are being promoted, facilitating digital platforms and bancassurance arrangements for expanding market reach. Regulatory authorities are also enhancing compliance practices to protect policyholders' interests, making sure that claim settlements are done equitably and without undue delay. Additionally, the Union Budget 2025 has raised the sectoral cap for the insurance industry from 74% to 100%, strengthening market growth through increased investment opportunities. These reforms are driving increased trust and participation in commercial property insurance, making it a more integral part of business risk management.

India Commercial Property Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, enterprise size, and application.

Type Insights:

- Buildings Insurance

- Contents Insurance

- Flood Insurance

- Earthquake Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes buildings insurance, contents insurance, flood insurance, earthquake insurance, and others.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large-Scale Enterprise

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes small and medium-sized enterprises, and large-scale enterprises.

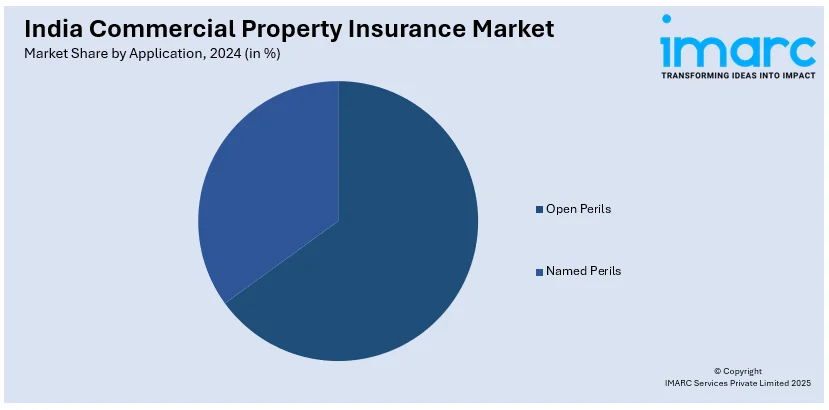

Application Insights:

- Open Perils

- Named Perils

The report has provided a detailed breakup and analysis of the market based on the application. This includes open perils and named perils.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Commercial Property Insurance Market News:

- On January 28, 2025, Generali Group launched its Global Corporate & Commercial (GC&C) division in India under Future Generali India Insurance, effective January 1. GC&C India offers insurance products for medium and large enterprises, including property, liability, financial lines, engineering, marine, cyber, and parametric insurance, along with advisory services. This strategic move aligns with India's focus on infrastructure development and industrial growth, enhancing Generali's ability to address critical business risks.

India Commercial Property Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Buildings Insurance, Contents Insurance, Flood Insurance, Earthquake Insurance, Others |

| Enterprise Sizes Covered | Small and Medium-sized enterprises, Large-Scale Enterprises |

| Applications Covered | Open Perils, Named Perils |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India commercial property insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India commercial property insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India commercial property insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial property insurance market in India was valued at USD 9.97 Billion in 2024.

The India commercial property insurance market is projected to exhibit a CAGR of 8.95% during 2025-2033, reaching a value of USD 21.56 Billion by 2033.

The market is fueled by growing awareness of risk coverage, industrial expansion, and regulatory support. Increasing occurrences of natural disasters, fire hazards, and cyber incidents prompt businesses to seek comprehensive coverage. Digital platforms are also simplifying policy access and renewal, driving higher adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)