India Computational Fluid Dynamics Market Size, Share, Trends and Forecast by Deployment Model, End-User, and Region, 2025-2033

India Computational Fluid Dynamics Market Overview:

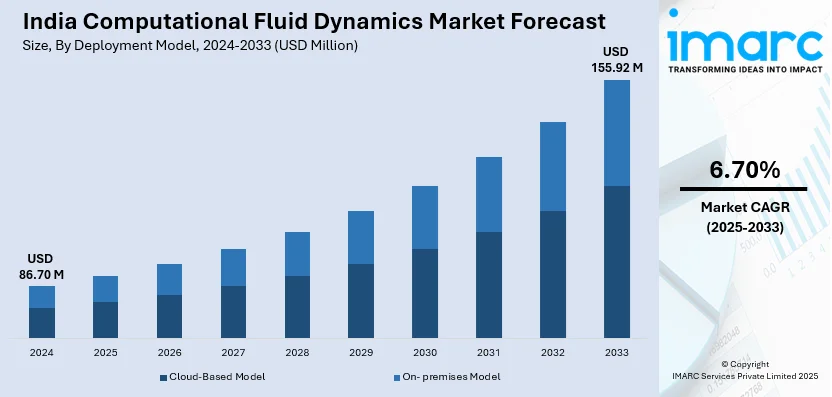

The India computational fluid dynamics market size reached USD 86.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 155.92 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is expanding with the rising demand in industries such as aerospace, automotive, and energy. Moreover, technological advancements in simulation technology and the availability of skilled personnel are propelling the use of CFD for optimal design and performance analysis across different industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 86.70 Million |

| Market Forecast in 2033 | USD 155.92 Million |

| Market Growth Rate 2025-2033 | 6.70% |

India Computational Fluid Dynamics Market Trends:

Increasing Adoption of CFD in Automotive and Aerospace Industries

In India, the application of computational fluid dynamics (CFD) is increasing significantly in the automotive and aerospace sectors. Enterprises are increasingly using CFD simulations to maximize vehicle designs, save fuel, and enhance safety features. The automotive industry, which is among the largest industries for the application of CFD, utilizes this technique for aerodynamic performance, heat management, and minimizing noise. For instance, in April 2024, Ansys announced the launch of Fluent 2024 R1, featuring a web-based user interface and enhanced GPU solver capabilities. These advancements enable quicker and more precise CFD simulations, advantages for automotive engineers in optimizing vehicle performance and aerodynamics. In addition, with the increased demand for electric vehicles (EVs), CFD is also utilized for designing the battery cooling systems for enhanced performance and efficiency. Meanwhile, CFD is being incorporated in aircraft performance enhancement for well-designed aircraft with low drag and aircraft fuel-efficient engine. With India emerging as a hub for the production of electric vehicles and aerospace, CFD technology demands are on the rise. Furthermore, having the ability to test and correct designs in the virtual environment before the actual implementation through physical models gives significant cost advantages which help make CFD a valuable weapon in these markets with intense competition.

To get more information on this market, Request Sample

Growing Focus on CFD for Renewable Energy and Environmental Applications

In recent years, there has been increasing interest in the use of computational fluid dynamics (CFD) in renewable energy and environmental purposes in India. With India's push towards sustainable development and green energy, CFD is increasingly being applied to maximize wind turbines, solar energy systems, and energy-efficient building designs. CFD simulation enhances the aerodynamic efficiency of wind turbines to achieve improved energy harvesting and minimized expenses in the wind energy sector. For instance, according to recent study, the performance of the Model 1 airfoil (NACA) was investigated through empirical testing and CFD simulations in ANSYS software. The analysis, focusing on pressure and velocity patterns, exhibits a 90% correlation between experimental and simulation results. The study concludes that the optimal performance occurs at an 8° angle of attack, providing valuable insights for improving wind turbine blade design and efficiency. At the same time, CFD is applied in the development of effective heating, ventilation, and air conditioning (HVAC) systems in buildings to conserve energy and minimize carbon footprints. CFD is also being applied in environmental fields like pollution modeling, water treatment, and waste management to evaluate fluid behavior and optimize systems for improved environmental impact management. As India keeps investing in renewable energy initiatives and clean technologies, the need for CFD applications for these kinds of projects is likely to rise, fueling the growth of the market and helping the country achieve its sustainability targets.

India Computational Fluid Dynamics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on deployment model and end-user.

Deployment Model Insights:

- Cloud-Based Model

- On- premises Model

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based model and on- premises model.

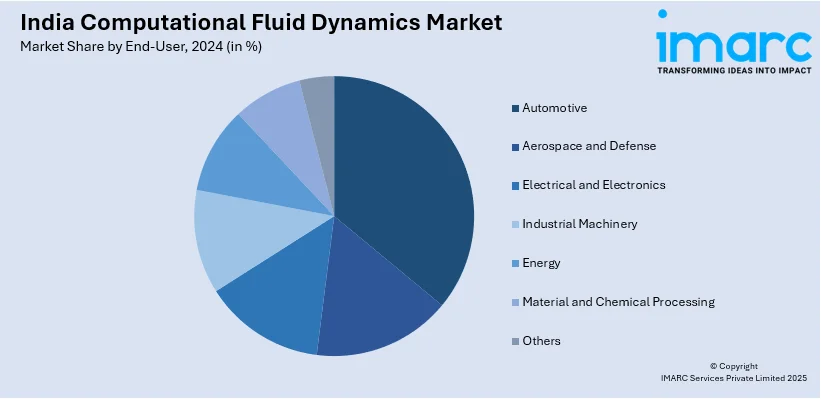

End-User Insights:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Industrial Machinery

- Energy

- Material and Chemical Processing

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes automotive, aerospace and defense, electrical and electronics, industrial machinery, energy, material and chemical processing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Computational Fluid Dynamics Market News:

- In May 2024, ISRO announced the development of the PraVaHa CFD software to simulate aerodynamic and aerothermal behavior in aerospace vehicles during launch and re-entry. It supports the design of launch vehicles, crew modules, and missiles, aiding academic institutions and advancing India's self-reliance goals.

India Computational Fluid Dynamics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | Cloud-Based Model, On- premises Model |

| End-Users Covered | Automotive, Aerospace and Defense, Electrical and Electronics, Industrial Machinery, Energy, Material and Chemical Processing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India computational fluid dynamics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India computational fluid dynamics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India computational fluid dynamics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India computational fluid dynamics market was valued at USD 86.70 Million in 2024.

The India computational fluid dynamics market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 155.92 Million by 2033.

The India computational fluid dynamics (CFD) market is driven by expanding automotive, aerospace, oil & gas, and energy sectors demanding enhanced design optimization and simulation capabilities. Adoption of cloud computing, AI-driven modeling tools, and rising academia–industry collaborations further boost growth. Additionally, government-backed smart manufacturing and digital India initiatives support CFD integration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)