India Concrete Equipment Market Size, Share, Trends and Forecast by Equipment, Technology, Capacity, and Region, 2025-2033

India Concrete Equipment Market Overview:

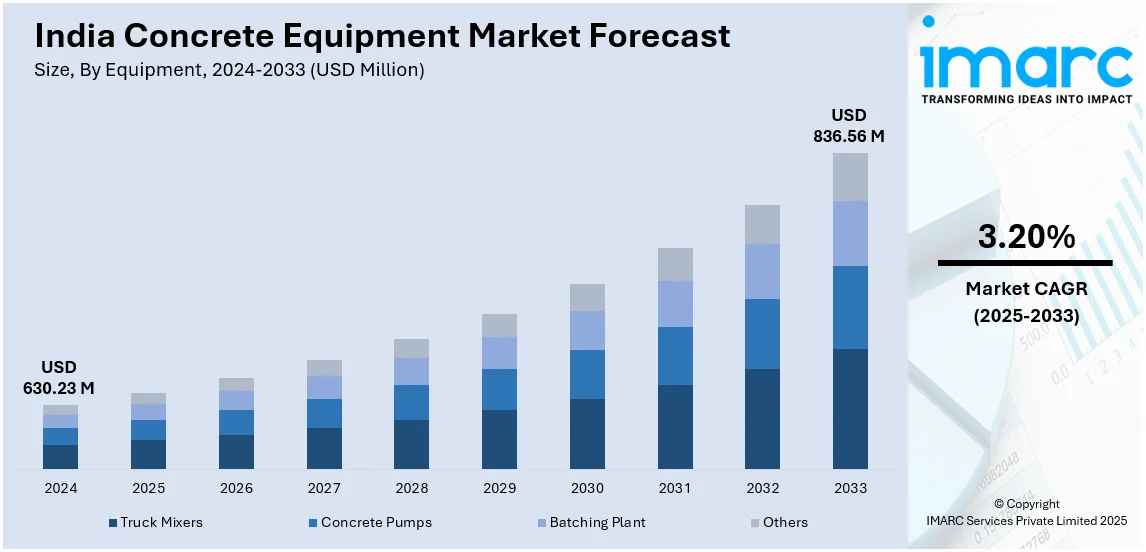

The India concrete equipment market size reached USD 630.23 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 836.56 Million by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. Infrastructure development, urbanization, and real estate growth are driving the India concrete equipment market share because of the escalating demand for construction machinery. Besides this, government investments, rising property prices, and advanced building technologies are further fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 630.23 Million |

| Market Forecast in 2033 | USD 836.56 Million |

| Market Growth Rate (2025-2033) | 3.20% |

India Concrete Equipment Market Trends:

Infrastructure Development

Infrastructure development is significantly influencing the India concrete equipment market outlook due to increasing construction activities nationwide. The government is heavily investing in highways, expressways, metro projects, and smart cities to boost economic growth. Large-scale projects like Bharatmala, Sagarmala, and bullet train corridors require advanced concrete equipment for timely execution. India's National Highway (NH) network expanded from 65,569 km in 2004 to 1,46,145 km in 2024, accelerating demand for concrete batching plants, transit mixers, and concrete pumps. Four-lane NH stretches grew 2.6 times to 48,422 km, while High-Speed Corridors increased from 93 km to 2,138 km, further fueling equipment needs. The NH construction pace rose 2.8 times, reaching 33.8 km/day in 2023-24, significantly improving India’s road infrastructure. Smart city initiatives are accelerating the construction of bridges, flyovers, and urban infrastructure, driving concrete machinery adoption. Metro rail expansions in multiple cities require high-performance concrete equipment for tunneling and elevated structures. Increased spending on rural roads under Pradhan Mantri Gram Sadak Yojana is supporting demand for concrete mixers. Large-scale airport modernization and railway station redevelopment projects are further fueling equipment demand. Expansion of power plants, irrigation projects, and water supply infrastructure is driving concrete equipment sales.

To get more information on this market, Request Sample

Rising Housing Demand and Real Estate Growth

Rapid population migration to cities is increasing the need for residential and commercial infrastructure development. Expanding metropolitan areas are driving large-scale housing projects, malls, and office spaces requiring concrete machinery. Government initiatives like Smart Cities Mission are accelerating urban infrastructure projects, further fueling India concrete equipment market growth. According to IBEF the real estate sector is set for strong growth, with a projected 9.2% CAGR from 2023 to 2028, influencing concrete equipment adoption. Increased foreign investments in real estate are supporting high-rise construction, requiring advanced concrete pumping systems. Expansion of metro networks and transport hubs is catalyzing the need for specialized concrete equipment. Inflating disposable income is catalyzing the demand for luxury apartments and commercial complexes, requiring efficient concrete solutions. The growing rental market and rising property prices in 2024 are contributing to overall market expansion. The shift toward sustainable and green buildings is encouraging the use of high-quality concrete technology. Precast construction methods are gaining traction, increasing demand for automated concrete batching plants and mixers. Growth in ready-mix concrete usage is fueling the need for transit mixers and concrete pumps, strengthening market prospects.

India Concrete Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on equipment, technology, and capacity.

Equipment Insights:

- Truck Mixers

- Concrete Pumps

- Batching Plant

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes truck mixers, concrete pumps, batching plant, and others.

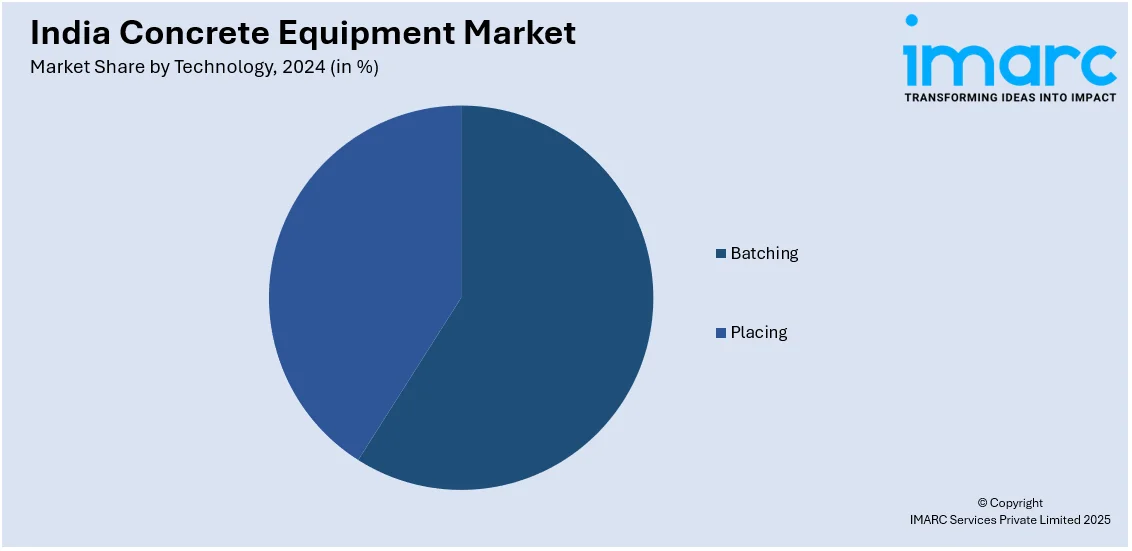

Technology Insights:

- Batching

- Placing

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes batching and placing.

Capacity Insights:

- 150-300 m³/h

- 10-20 m³/h

- 60-150 m³/h

- 20-60 m³/h

- 0-10 m³/h

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes 150-300 m³/h, 10-20 m³/h, 60-150 m³/h, 20-60 m³/h, and 0-10 m³/h.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Concrete Equipment Market News:

- In December 2024, Normet launched a new range of construction equipment in India including cost-effective concrete spraying machines and a hydraulic breaker to enhance efficiency. Unveiled at bauma CONEXPO India 2024, these innovations aim to support tunneling and underground construction, catering to India's growing infrastructure needs with advanced and affordable solutions.

- In July 2024, AJAX Engineering introduced Concrete GPT, an AI-driven platform for India's construction industry. Powered by GPT-4, it offers technical insights, maintenance tips, and regulatory updates in multiple languages. With chatbot, voice, and WhatsApp support, it enhances project efficiency and skill development, strengthening concrete equipment operations and innovation in the industry.

India Concrete Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipments Covered | Truck Mixers, Concrete Pumps, Batching Plant, Others |

| Technologies Covered | Batching, Placing |

| Capacities Covered | 150-300 m³/h, 10-20 m³/h, 60-150 m³/h, 20-60 m³/h, 0-10 m³/h |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India concrete equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India concrete equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India concrete equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The concrete equipment market in India was valued at USD 630.23 Million in 2024.

The India concrete equipment market is projected to exhibit a (CAGR) of 3.20% during 2025-2033, reaching a value of USD 836.56 Million by 2033.

Urbanization, infrastructural growth, and high-scale building projects under government schemes like Smart Cities and Bharatmala propel the India concrete equipment market. Amplifying demand for advanced, cost-effective construction methods propels equipment uptake. Growing investments in transport and real estate sectors further boost demand for concrete mixers, pumps, and batching plants.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)