India Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2026-2034

India Confectionery Market Summary:

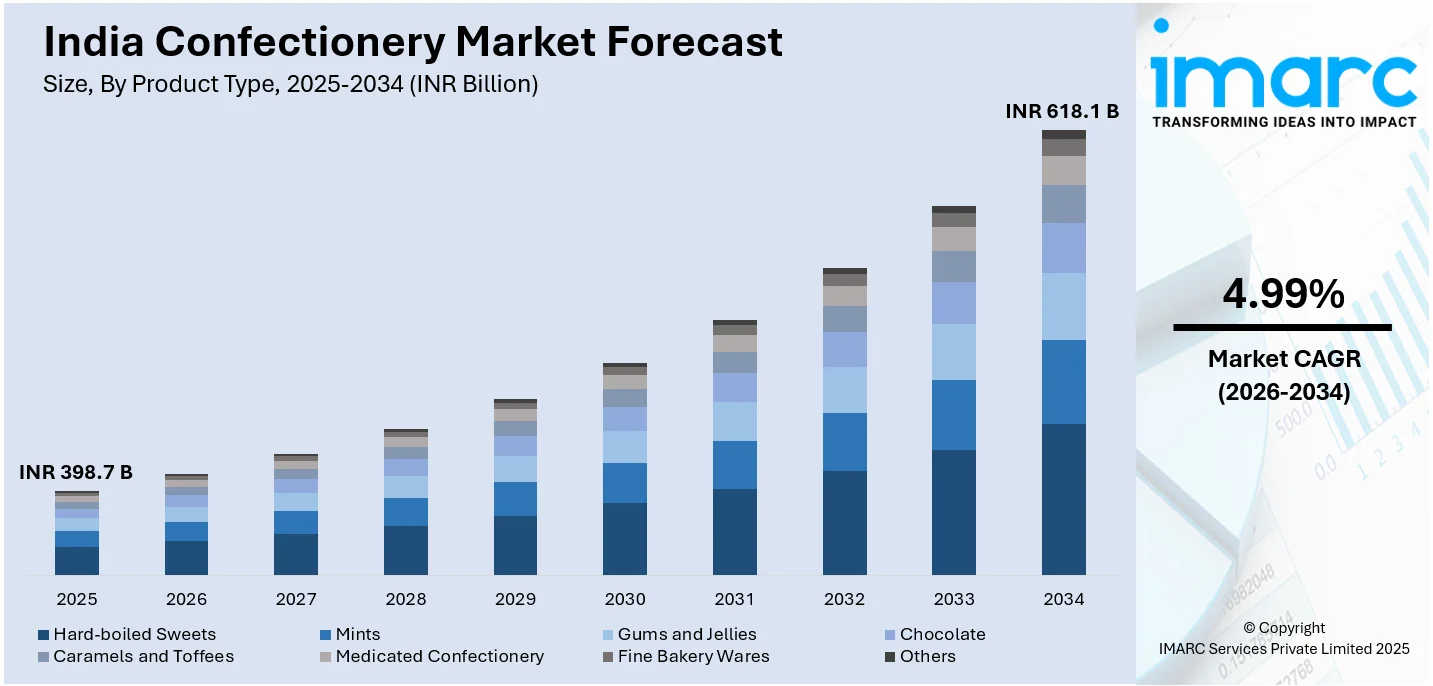

The India confectionery market size was valued at INR 398.71 Billion in 2025 and is projected to reach INR 618.10 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

The Indian confectionery market demonstrates robust expansion driven by rising urbanization and evolving consumer preferences toward indulgent treats. Growing middle-class population with increasing disposable incomes fuels demand for diverse confectionery products. The cultural significance of sweets during festivals and celebrations reinforces market growth. Modern retail expansion and e-commerce penetration enhance product accessibility across urban and semi-urban regions, strengthening the India confectionery market share.

Key Takeaways and Insights:

- By Product Type: Chocolate dominates the market with a share of 36.5% in 2025, attributed to both the growing consumer preference for high-end confections and the cultural trend toward presenting expensive chocolates as gifts during festivals and festive occasions. Urbanization and exposure to Western culture have made it more popular among younger consumers.

- By Age Group: Adult leads the market with a share of 45.0% in 2025. The primary forces behind this dominance include adult-oriented marketing methods that highlight nostalgic branding and complex flavor advancements, high-end pleasures, health-conscious buying habits, and the demand for sugar-free options.

- By Price Point: Economy holds the largest segment with a market share of 49.6% in 2025, reflecting the price-sensitive nature of Indian consumers and the widespread availability of affordable confectionery products across traditional retail channels and kirana stores nationwide.

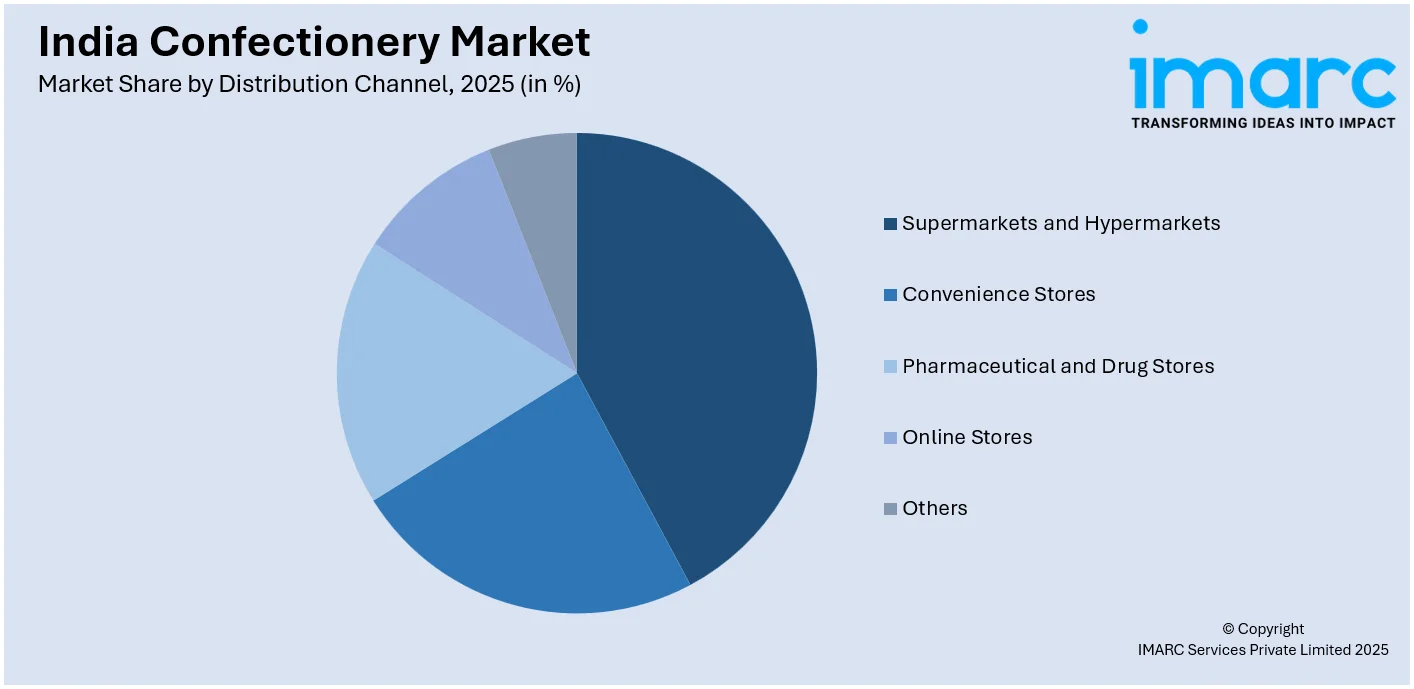

- By Distribution Channel: Supermarkets and hypermarkets exhibit a clear dominance in the market with 42.3% share in 2025, driven by extensive product range, systematic shelf arrangements, attractive promotional offers, and enhanced shopping experiences in organized retail formats across metropolitan cities.

- By Region: North India represents the largest region with 32.8% share in 2025, underpinned by high population density, robust urban hubs like Delhi NCR, and a long-standing tradition of sweet consumption during festivals, weddings, and religious occasions.

- Key Players: Key players drive the India confectionery market by expanding product portfolios, introducing innovative flavors, and strengthening nationwide distribution networks. Their investments in premium offerings, health-conscious alternatives, and strategic partnerships boost awareness and accelerate adoption across diverse consumer segments. Some of the key players operating in the market are Candico India Ltd, Parle Products Pvt. Ltd, Haldiram Foods International Pvt. Ltd, Lotte India Corporation Ltd, MTR Foods Pvt. Ltd, and Flury’s Swiss Confectionery Pvt Ltd.

To get more information on this market Request Sample

The dynamic growth trajectories of the confectionery market in India are being driven by the blend of modern indulgence tastes and traditional sweet consumption patterns. Growing disposable incomes in urban and semi-urban areas enable consumers to try out upscale chocolates, handcrafted goods, and inventive flavor combinations that blend local tastes with Western confectionery. The holiday gifting culture that is deeply embedded in Indian customs drives significant seasonal demand, with chocolates rapidly replacing traditional mithai at celebrations like Diwali, Raksha Bandhan, and wedding ceremonies. The expanding modern retail infrastructure, which includes supermarkets, hypermarkets, and convenience stores, has enhanced product visibility and accessibility, especially in tier-II and tier-III cities. Additionally, the rapid growth of e-commerce platforms and quick commerce services allows businesses to access previously unreached populations.

India Confectionery Market Trends:

Premiumization and Artisanal Offerings

Premium and artisanal confectionary items are becoming more and more popular among Indian consumers who are looking for distinctive flavor profiles and refined taste experiences. By incorporating traditional Indian spices like cardamom, jaggery, paan, and masala chai into premium cocoa concoctions, artisanal chocolatiers are inventing. High-end desi-flavored bars, such cardamom-ghee-moong lentil chocolate and chilli-infused dark variations, have been introduced to the market by startup chocolatiers, who use native tastes to satisfy local consumers seeking elegant yet culturally appropriate chocolates.

Health-Conscious Confectionery Innovation

Growing health awareness among Indian consumers drives substantial demand for sugar-free, low-calorie, and functional confectionery options. Manufacturers are responding with products featuring natural sweeteners like stevia and jaggery, reduced sugar content, and fortified ingredients offering health benefits. In October 2024, Zydus Wellness introduced Sugar Free D'lite cookies in flavors including choco chip, yummy berries, and mocha hazelnut, targeting health-conscious consumers seeking indulgent treats without compromising wellness goals.

Digital Transformation and E-commerce Expansion

The Indian confectionery industry is undergoing a significant digital change as a result of e-commerce and rapid commerce platforms changing old distribution routes and customer purchasing habits. Online retail platforms and quick commerce services have greatly improved product accessibility in urban and semi-urban locations, particularly during holiday seasons when demand is at its peak. By combining digital marketing strategies, influencer collaborations, customized campaigns, and social media engagement, brands may effectively reach a greater variety of customer groups. E-commerce candy sales continue to exhibit strong growth momentum in metropolitan areas as consumers embrace the convenience of online shopping.

Market Outlook 2026-2034:

The confectionery industry prognosis in India is still positive due to ongoing urbanization, growing disposable incomes, and changing consumer tastes for high-end and health-conscious goods. Market penetration will be accelerated by flavor innovation, eco-friendly packaging projects, and growth into tier-II and tier-III cities. Product accessibility is improved by the ongoing development of contemporary retail formats and e-commerce platforms, and sustained growth across a variety of consumer segments across the country is supported by strategic investments in cold-chain infrastructure and manufacturing capacity. The market generated a revenue of INR 398.71 Billion in 2025 and is projected to reach a revenue of INR 618.10 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

India Confectionery Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Chocolate |

36.5% |

|

Age Group |

Adult |

45.0% |

|

Price Point |

Economy |

49.6% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

42.3% |

|

Region |

North India |

32.8% |

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

Chocolate dominates with a market share of 36.5% of the total India confectionery market in 2025.

The chocolate segment maintains commanding leadership in India's confectionery landscape, driven by growing consumer preference for premium treats and cultural shifts toward gifting high-end chocolates during festivals and celebrations. Urbanization, greater exposure to Western culture, and a younger population have significantly augmented the popularity of both domestic and international chocolate brands. Leading manufacturers continue introducing exotic flavor offerings, limited-edition packs, and health-oriented ingredients such as dark chocolate variants with reduced sugar content.

The segment benefits from strong brand recognition and emotional connections that major players have cultivated over decades of consistent market presence and consumer engagement. Pack innovation and promotional strategies, particularly targeting seasonal and impulse buying occasions, have contributed to sustained demand across diverse consumer segments. Leading manufacturers continue reporting robust revenue growth, reflecting strong consumer demand for established chocolate brands across the country. Growing retail penetration and internet access have facilitated chocolate distribution throughout metropolitan areas and emerging tier-II cities, reinforcing the segment's dominant market position.

Age Group Insights:

- Children

- Adult

- Geriatric

Adult leads with a share of 45.0% of the total India confectionery market in 2025.

Adults constitute the primary consumer demographic in India's confectionery market, driven by diverse consumption occasions ranging from personal indulgence to corporate gifting and various social gatherings. This segment demonstrates heightened health awareness, pushing strong demand for sugar-free, low-calorie, and functional confectionery items that align with wellness objectives and dietary considerations. Marketing strategies intensely focus on adult consumers through nostalgic branding, premium packaging, and sophisticated flavor innovations that appeal to discerning palates seeking unique taste experiences.

The adult segment exhibits strong purchasing power and demonstrates willingness to pay premium prices for high-quality confectionery products that deliver superior taste experiences and sophisticated flavor profiles. Busy urban lifestyles and increased exposure to modern retail outlets have facilitated convenience-driven purchasing patterns among working professionals seeking indulgent treats. The well-established trend of gifting confectioneries during festivals, corporate events, weddings, and personal celebrations has solidified adults as the primary demand generator within the market.

Price Point Insights:

- Economy

- Mid-range

- Luxury

Economy exhibits a clear dominance with a 49.6% share of the total India confectionery market in 2025.

Economy-priced confectionery products command substantial market share, reflecting the price-sensitive nature of the Indian consumer base and the widespread availability of affordable treats across diverse retail channels. The segment benefits from strong penetration in traditional kirana stores, which remain integral to India's retail landscape and account for a significant portion of confectionery distribution. Manufacturers strategically offer smaller pack sizes and value packs to maintain accessibility for consumers across various economic strata.

The economy segment demonstrates remarkable resilience across various economic cycles, with consumers consistently purchasing affordable confectionery products for daily consumption and occasional indulgent treats. Intense competition among both organized and unorganized players within this segment creates significant pricing pressures while simultaneously driving continuous innovation in product formulations, packaging designs, and value propositions. Rural and semi-urban markets, comprising a substantial portion of India's population, predominantly favor economy-priced products, ensuring sustained demand growth throughout the forecast period.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

Supermarkets and hypermarkets represent the leading segment with a 42.3% share of the total India confectionery market in 2025.

Supermarkets and hypermarkets dominate India's confectionery distribution landscape, providing consumers with extensive product ranges, systematic shelf arrangements, and attractive promotional offers. Modern retail establishments facilitate impulse purchases through strategic product placements and eye-catching displays. The organized retail sector's expansion across metropolitan cities and tier-I regions has enhanced product visibility and accessibility, enabling brands to reach diverse consumer segments effectively.

The number of organized retail outlets in India has expanded significantly over recent years, demonstrating substantial growth in modern trade channels across metropolitan and tier-II cities. Leading retail chains dedicate substantial shelf space to confectionery products, enhancing consumer discovery and purchase convenience through strategic product placement and promotional displays. The channel's dominance is reinforced by enhanced cold-chain logistics and storage facilities that maintain product quality, particularly for chocolate and temperature-sensitive confectionery items throughout the supply chain.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India leads the market with a share of 32.8% of the total India confectionery market in 2025.

High population density, strong metropolitan centers like Delhi NCR, and ingrained customs of consuming sweets during festivals, weddings, and religious events support North India's continued dominance in the market. Because organized retail and e-commerce platforms are more visible, the region exhibits significant receptivity to foreign brands and a variety of cuisines. The demand for both traditional and modern confectionery items has increased due to changing retail environments, rising disposable incomes, and aspirational buying patterns.

Improved cold-chain infrastructure and established distribution networks that facilitate efficient product delivery across urban and semi-urban markets benefit the region. During the holiday season, major cities like Delhi, Lucknow, and Chandigarh are prominent consumer hubs that produce substantial sales volumes. As consumers seek out handcrafted chocolates and sophisticated gifts for social and professional occasions, the luxury segments of North India's confectionery market are also expanding quickly.

Market Dynamics:

Growth Drivers:

Why is the India Confectionery Market Growing?

Rising Disposable Incomes and Evolving Lifestyles

One of the main factors propelling the growth of the confectionery market in India is the country's growing middle class and expanding disposable incomes. Discretionary spending on decadent and high-end food items rises significantly as household financial stability improves. Due to urbanization, consumers are now exposed to sophisticated items and international brands, which has increased their expenditure on once-luxury delights. Young professionals in urban locations who are looking for convenient, high-quality, and distinctive confectionary options are especially affected by this trend. The expanding middle class in India is greatly increasing the consumption of confections across all product categories because to their growing purchasing power. Convenient, ready-to-eat confections that fulfill immediate desires and provide moments of indulgence are in high demand due to changes in lifestyle brought about by hectic urban schedules.

Cultural Significance of Gifting and Festive Celebrations

The deep-rooted tradition of gifting during festivals like Diwali, Eid, Raksha Bandhan, and wedding celebrations drives significant seasonal demand for confectionery products throughout the year. Gifting hampers containing chocolates, traditional sweets, and sugar confectionery experience substantial sales spikes during festive periods, highlighting the cultural importance of sweets in Indian celebrations. Chocolates are increasingly replacing traditional mithai in modern gifting choices, reflecting evolving consumer preferences toward contemporary confectionery options. Approximately 70% of India's confectionery sales occur around festivals, underscoring the profound impact of cultural celebrations on market dynamics. Manufacturers strategically launch limited-edition products, festive packaging, and premium gift collections to capitalize on heightened seasonal demand.

Expansion of Modern Retail and E-commerce Platforms

The spread of contemporary retail formats, such as supermarkets, hypermarkets, and convenience stores, has significantly improved the accessibility of confectionery products in India's urban and semi-urban areas. These well-organized stores offer wide product selections, alluring promotions, and improved shopping experiences that promote impulsive purchases and brand exploration. Confectionery distribution has been transformed by the explosive rise of e-commerce platforms and fast commerce services, which allow companies to directly access consumers in previously untapped markets. Digital retail channels are especially appealing to urban consumers and younger demographics because they provide doorstep delivery, competitive pricing, and convenience. Particularly during holiday seasons, when demand for confectionery products rises, quick commerce platforms have made a big contribution to industry expansion.

Market Restraints:

What Challenges the India Confectionery Market is Facing?

Rising Health Consciousness and Sugar Concerns

Traditional patterns of confectionery consumption are facing serious difficulties due to growing understanding of the negative consequences of excessive sugar consumption on health issues such as diabetes, obesity, and cardiovascular illnesses. Manufacturers are under pressure to reformulate products with less sugar and natural ingredients as health-conscious consumers actively cut back on their sugar intake and look for healthier alternatives. Consumer views and industry strategy are also impacted by regulatory concerns about possible sugar tariffs and more stringent labeling regulations.

Fluctuating Raw Material Prices

Manufacturers of confections have constant difficulties due to the price volatility of essential raw ingredients like sugar, cocoa, palm oil, and packaging materials. Production costs and profitability are strongly impacted by global supply chain interruptions and commodity price variations, which compel businesses to regularly modify their pricing strategies. Particularly in the price-sensitive economy segment where margins are still narrow and competitive pressures are still present, these cost pressures may result in consumer discontent and decreased demand.

Intense Competition and Supply Chain Complexity

Both organized international corporations and a large number of unorganized local manufacturers compete fiercely in the Indian confectionery sector, putting tremendous pressure on prices across all market categories. In order to maintain product quality and freshness throughout various locations, supply chain complexity in India's varied climate conditions necessitates sophisticated logistics and cold-chain solutions. Additionally, national distribution methods for firms aiming for broad market penetration become more challenging due to the retail infrastructure's substantial reliance on traditional kirana outlets.

Competitive Landscape:

The confectionery market in India is characterized by a highly competitive structure, with both established global firms and up-and-coming indigenous players vying for market dominance. While Indian enterprises concentrate on regional preferences, price-competitive offers, and localized flavor developments, major international competitors use their worldwide knowledge, robust brand portfolios, and wide distribution networks to maintain leadership positions. Continuous product innovation, premiumization tactics, and aggressive marketing campaigns aimed at various customer categories are all fueled by the competitive climate. To increase their market presence, industry players aggressively develop omnichannel distribution strategies, improve cold-chain infrastructure, and increase manufacturing capacity. Through strategic alliances, acquisitions, and R&D expenditures, businesses can respond to changing consumer demands for luxury indulgence experiences, sustainable packaging, and healthier options.

Some of the key players operating in the industry include:

- Candico India Ltd

- Parle Products Pvt. Ltd

- Haldiram Foods International Pvt. Ltd

- Lotte India Corporation Ltd

- MTR Foods Pvt. Ltd

- Flury’s Swiss Confectionery Pvt Ltd

Recent Developments:

- In January 2025, South Korea-based Lotte Wellfood, formerly Lotte Confectionery, announced plans to launch 'Pepero,' its well-known biscuit stick with chocolate coating, in India. Pepero is one of Lotte's most popular confections in Korea and will be introduced in the Indian market. The company will manufacture Pepero at its Haryana facility, marking the first time this confection is produced outside of Korea.

- In September 2024, Annapurna Swadisht successfully acquired Madhur Confectioners Private Limited (MCPL), a manufacturer of a variety of confections including lollipops and flavored sweets. This acquisition strengthens Annapurna Swadisht's position in the Indian confectionery market and expands its product portfolio.

India Confectionery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion INR |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Candico India Ltd, Parle Products Pvt. Ltd, Haldiram Foods International Pvt. Ltd, Lotte India Corporation Ltd, MTR Foods Pvt. Ltd, Flury’s Swiss Confectionery Pvt Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India confectionery market size was valued at INR 398.71 Billion in 2025.

The India confectionery market is expected to grow at a compound annual growth rate of 4.99% from 2026-2034 to reach INR 618.10 Billion by 2034.

Chocolate dominated the market with a share of 36.5%, driven by growing consumer preference for premium treats and cultural transitions toward gifting high-end chocolates during festivals and celebrations.

Key factors driving the India confectionery market include rising disposable incomes, urbanization, cultural significance of gifting, expansion of modern retail, and growing e-commerce penetration.

Major challenges include rising health consciousness about sugar consumption, fluctuating raw material prices, intense competition from organized and unorganized players, and supply chain complexities in managing product freshness across diverse climatic conditions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)