India Construction Aggregates Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Construction Aggregates Market Overview:

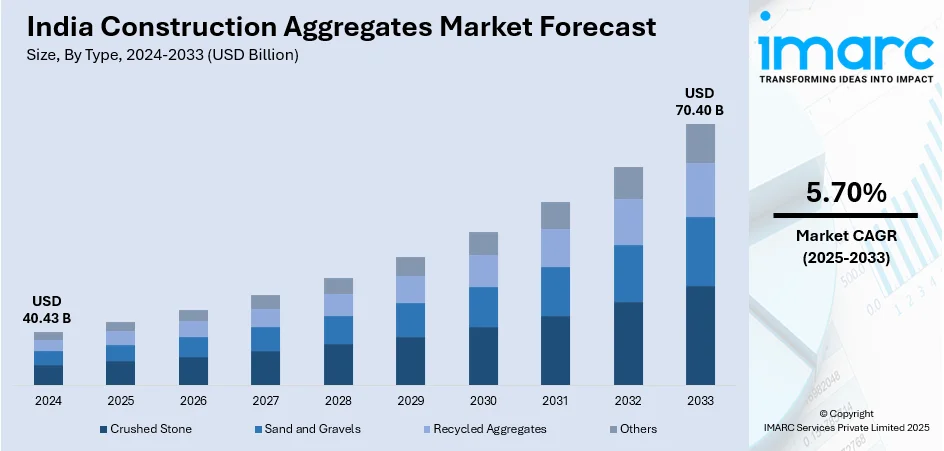

The India construction aggregates market size reached USD 40.43 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 70.40 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is witnessing significant growth, driven by an increased infrastructure development and urbanization, along with the widespread adoption of advanced technologies in aggregate production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 40.43 Billion |

| Market Forecast in 2033 | USD 70.40 Billion |

| Market Growth Rate (2025-2033) | 5.70% |

India Construction Aggregates Market Trends:

Increased Infrastructure Development and Urbanization

This rapid growth of the Indian construction aggregates market can be associated to the rapidly accelerated infrastructural development and urbanization in the country. Initiatives from the Indian government such as the Pradhan Mantri Awas Yojana (PMAY), Bharatmala Pariyojana, and Smart Cities Mission significantly contributed to the demand for the construction aggregates. Projects undertaken under these schemes focus on the setting up of residential units, highways, and urban infrastructure, thus generating the demand for the consumption of aggregates for construction purposes. While metropolitan areas expand, the demand for aggregates in cities for residential, commercial, and industrial construction will also increase. The middle-class population is increasing, which means an increasing demand for housing, transport networks, and public amenities. With these developments, the market trend is likely to continue as India moves towards its vision of becoming a $5 trillion economy by 2025. Sustainable urbanization catches up in the aggregates market with a growing demand for green materials, such as recycled aggregates. For instance, in January 2025, Master Builders Solutions announced expansion into India, aiming to provide sustainable, high-performance construction materials, supporting infrastructure growth, and sustainable building initiatives with its advanced concrete admixture solutions. This shift not only addresses resource conservation but also aligns with global sustainability goals. As urbanization and infrastructure development intensify, the Indian construction aggregates market is poised for steady growth, fostering long-term demand for aggregates across various sectors.

To get more information on this market, Request Sample

Adoption of Technological Advancements in Aggregate Production

The Indian construction aggregates market is undergoing a transformation with the adoption of advanced technologies aimed at enhancing production efficiency, improving product quality, and ensuring sustainability. Innovations such as automation in aggregate production, digital monitoring systems, and the introduction of artificial intelligence (AI) and machine learning (ML) to optimize quarry operations are increasingly becoming commonplace. These technologies are helping producers manage resources more efficiently, reduce costs, and improve the quality of aggregates used in construction projects. In addition to improving operational efficiencies, technological advancements are playing a key role in addressing environmental concerns. The industry is gradually shifting toward more sustainable practices by employing technologies that reduce energy consumption, minimize waste, and limit the environmental impact of aggregate extraction. The rise of alternative materials, such as crushed stone dust and recycled aggregates, has been facilitated by these technological improvements. For instance, in September 2024, Infra.Market became India's largest AAC block manufacturer, producing 3 million cubic meters annually across nine plants, promoting sustainable construction and reducing costs while supporting green building initiatives.

Additionally, the use of data analytics and real-time tracking systems ensures that the supply chain remains flexible and responsive to the dynamic demand for construction aggregates. As these technological advancements continue to gain traction, the Indian construction aggregates market will benefit from more streamlined operations, enhanced product offerings, and a reduced ecological footprint, positioning the industry for long-term sustainability.

India Construction Aggregates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Crushed Stone

- Sand and Gravels

- Recycled Aggregates

- Other

The report has provided a detailed breakup and analysis of the market based on the type. This includes crushed stone, sand and gravels, recycled aggregates, and other.

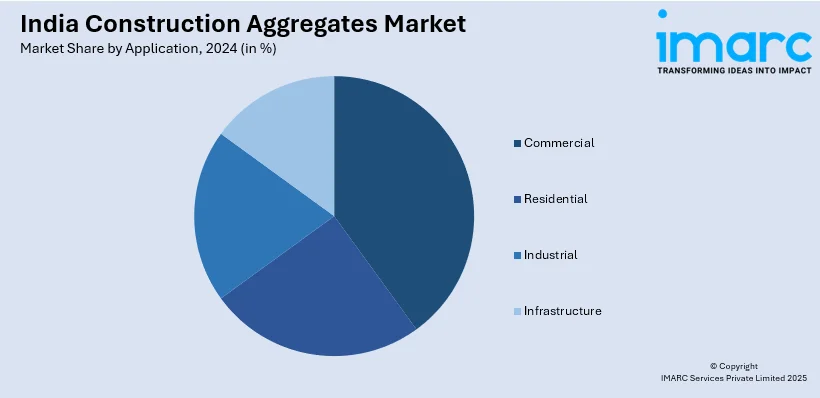

Application Insights:

- Commercial

- Residential

- Industrial

- Infrastructure

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Construction Aggregates Market News:

- In June 2024, SIAM Cement BigBloc Construction Technologies Private Limited-a joint venture between BigBloc Construction Ltd. and SCG International of Thailand announced the launch of its operations in India with an investment of ₹65 crore in the construction of a 2.5-lakh-cubic-meter capacity AAC Wall plant at Kheda in Gujarat. The plant will manufacture AAC Walls under the brand name 'ZMARTBUILD WALL by NXTBLOC' and AAC Blocks to provide advanced walling solutions for the Indian market.

India Construction Aggregates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Crushed Stone, Sand and Gravels, Recycled Aggregates, Other |

| Applications Covered | Commercial, Residential, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India construction aggregates market performed so far and how will it perform in the coming years?

- What is the breakup of the India construction aggregates market on the basis of type?

- What is the breakup of the India construction aggregates market on the basis of application?

- What is the breakup of the India construction aggregates market on the basis of region?

- What are the various stages in the value chain of the India construction aggregates market?

- What are the key driving factors and challenges in the India construction aggregates?

- What is the structure of the India construction aggregates market and who are the key players?

- What is the degree of competition in the India construction aggregates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India construction aggregates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India construction aggregates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India construction aggregates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)