India Construction Demolition Waste Recycling Market Size, Share, Trends and Forecast by Material, Source, Service, and Region, 2025-2033

India Construction Demolition Waste Recycling Market Overview:

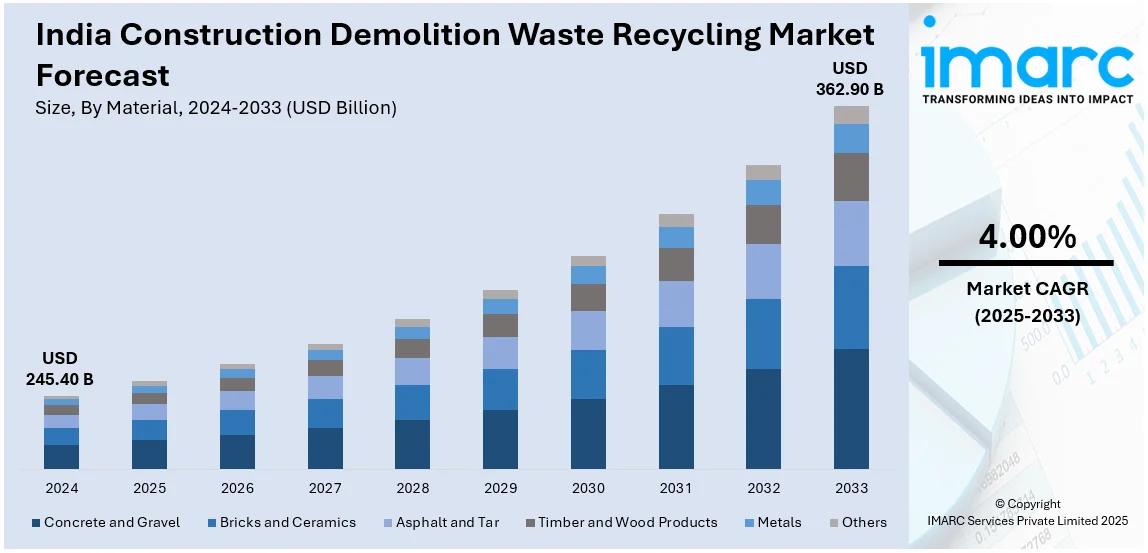

The India construction demolition waste recycling market size reached USD 245.40 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 362.90 Billion by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033. The rising construction activities, government regulations on waste management, increasing environmental awareness, adoption of sustainable building practices, advancements in recycling technologies, incentives for circular economy initiatives, and the expanding role of public-private partnerships in waste recycling infrastructure are some of the factors positively impacting India construction demolition waste recycling market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 245.40 Billion |

| Market Forecast in 2033 | USD 362.90 Billion |

| Market Growth Rate (2025-2033) | 4.00% |

India Construction Demolition Waste Recycling Market Trends:

Rising Demand for Recycled Construction Materials

The government's push for sustainable infrastructure and the rising adoption of recycled materials are positively influencing the India construction and demolition waste recycling market outlook. According to an industry report, the infrastructure sector in India is expected to grow rapidly. With planned investments of USD 1.4 Trillion by 2025 in the infrastructure sector, there is a growing emphasis on utilizing recycled aggregates, manufactured sand (M-sand), and reclaimed concrete in road construction, real estate projects, and large-scale infrastructure developments. Increasing awareness of the environmental impact of virgin material extraction and landfill accumulation is further accelerating the demand for construction and demolition (C&D) waste recycling solutions across India. The Bureau of Indian Standards (BIS) and Indian Roads Congress (IRC) have introduced guidelines supporting the use of recycled materials in non-structural and structural applications. Leading construction firms are incorporating recycled products to meet sustainability targets and green building certification requirements, such as those set by the Indian Green Building Council (IGBC). Additionally, cost benefits associated with recycled materials, especially in major urban areas where raw material transportation is expensive, are driving adoption. The shift towards sustainable procurement policies among government and private developers is reinforcing market growth.

To get more information on this market, Request Sample

Government Regulations and Policy Support Driving Recycling Initiatives

The market is experiencing significant growth due to stringent regulations and policy interventions. According to an industry report, the Ministry of Environment, Forest and Climate Change (MoEFCC) introduced the Construction and Demolition Waste Management Rules, 2024, mandating the proper segregation, collection, and recycling of C&D waste. It comprises the reconstruction and demolition debris that must be recycled beginning in the fiscal year 2025–2026. The recycling goal is 50% for 2025–2026 and 100% for 2026–2027. Urban local bodies (ULBs) are enforcing compliance through penalties and incentives. The Swachh Bharat Mission and Smart Cities Mission also promote sustainable waste management practices, encouraging the establishment of C&D waste recycling plants across major urban centers. Large-scale infrastructure projects are required to integrate recycled aggregates and secondary raw materials into construction activities, driving demand for processed waste materials. Additionally, state-level policies that mandate the recycled materials in government construction projects reinforce India construction and demolition waste recycling market growth. The growing emphasis on circular economy principles is also accelerating adoption.

India Construction Demolition Waste Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, source, and service.

Material Insights:

- Concrete and Gravel

- Bricks and Ceramics

- Asphalt and Tar

- Timber and Wood Products

- Metals

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes concrete and gravel, bricks and ceramics, asphalt and tar, timber and wood products, metals, and others.

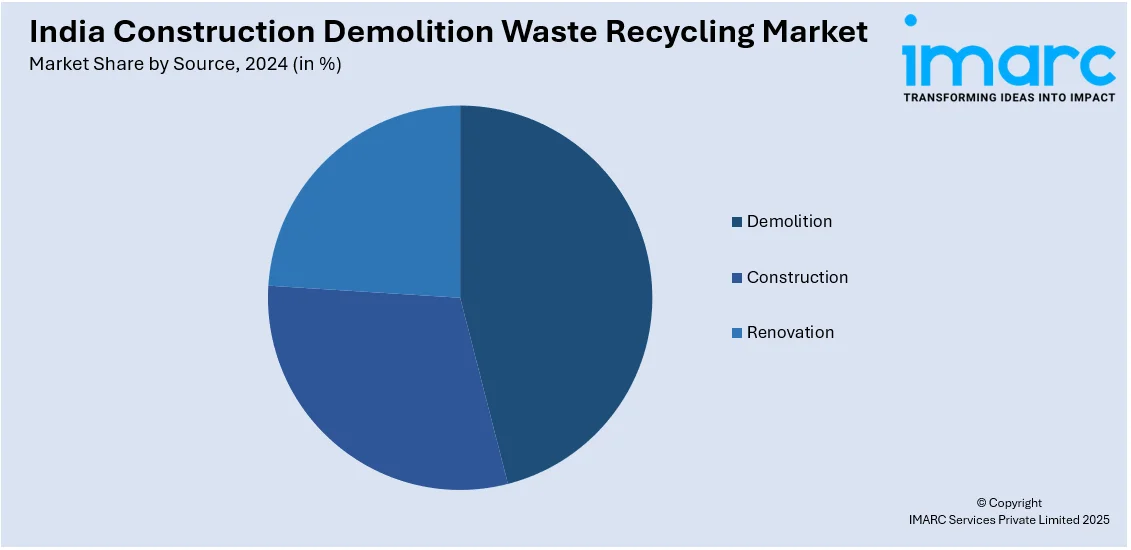

Source Insights:

- Demolition

- Construction

- Renovation

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes demolition, construction, and renovation.

Service Insights:

- Disposal

- Collection

The report has provided a detailed breakup and analysis of the market based on the service. This includes disposal and collection.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Construction Demolition Waste Recycling Market News:

- On October 26, 2023, the Tiruchi Corporation issued a tender to establish a construction and demolition (C&D) waste recycling plant, aiming to address the growing issue of C&D waste in the city. The proposed facility is designed to process approximately 100 Tonnes of waste daily, converting it into reusable materials such as bricks and paver blocks. This initiative aligns with the Corporation's broader waste management strategy to promote environmental sustainability and resource efficiency.

- On March 7, 2024, the Nagpur Municipal Corporation (NMC) announced the completion of trial runs for central India's inaugural construction and demolition (C&D) waste recycling plant, located at the Bhandewadi dumping yard. The facility, constructed by Hyderabad C&D Waste Pvt Ltd on a five-acre site, has a daily processing capacity of 150 metric Tonnes and will produce five types of by-products. The plant will serve all ten zones of the city, allowing government agencies, individuals, and private organizations to utilize its services for a fee, with the private operator managing the plant for 20 years before transferring ownership to the NMC.

India Construction Demolition Waste Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Concrete and Gravel, Bricks and Ceramics, Asphalt and Tar, Timber and Wood Products, Metals, Others |

| Sources Covered | Demolition, Construction, Renovation |

| Services Covered | Disposal, Collection |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India construction demolition waste recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the India construction demolition waste recycling market on the basis of material?

- What is the breakup of the India construction demolition waste recycling market on the basis of source?

- What is the breakup of the India construction demolition waste recycling market on the basis of service?

- What is the breakup of the India construction demolition waste recycling market on the basis of region?

- What are the various stages in the value chain of the India construction demolition waste recycling market?

- What are the key driving factors and challenges in the India construction demolition waste recycling market?

- What is the structure of the India construction demolition waste recycling market and who are the key players?

- What is the degree of competition in the India construction demolition waste recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India construction demolition waste recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India construction demolition waste recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India construction demolition waste recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)