India Consumer Credit Market Size, Share, Trends and Forecast by Credit Type, Service Type, Issuer, Payment Method and Region, 2025-2033

India Consumer Credit Market Overview:

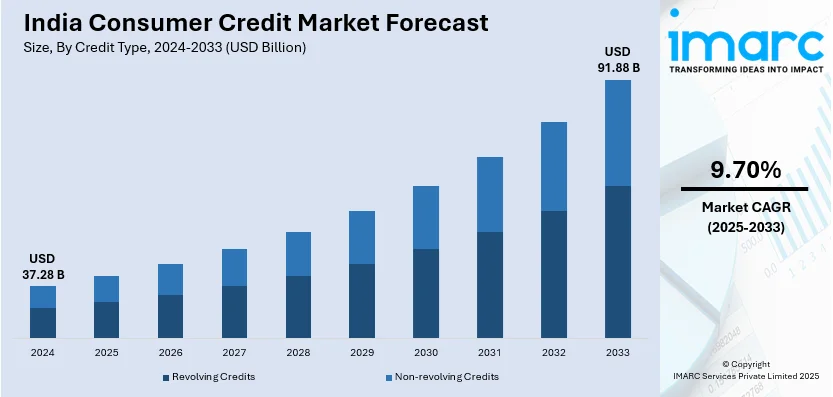

The India consumer credit market size reached USD 37.28 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 91.88 Billion by 2033, exhibiting a growth rate (CAGR) of 9.70% during 2025-2033. The India consumer credit market share is fueled by growing middle-class population, expanding retail and e-commerce segments, and easy access to credit through online platforms. Government initiatives toward financial inclusion, low interest rates, and rising disposable incomes also contribute to high demand for consumer credit.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.28 Billion |

| Market Forecast in 2033 | USD 91.88 Billion |

| Market Growth Rate 2025-2033 | 9.70% |

India Consumer Credit Market Trends:

Growing Popularity of Digital and Online Lending Platforms

The rapid growth of digital and online lending platforms is one of the most prominent trends influencing the India consumer credit market outlook. Fintech and digitalization, challenge traditional models by means of technology-based solutions that allow for fast and convenient access to credit. Industry reports suggest that the share of digital lending is expected to account for 5% of the total retail loans by FY28, from 1.8% in FY22 and nearly 2.5% in FY24. This may be accompanied by a compounded annual growth rate of 40%. Paytm, PhonePe, and other digital lenders are making consumer credit more widely available, specifically to rural and underserved communities. These platforms use artificial intelligence, data analytics, and machine learning for credit assessments, thus improving turnaround time for loan approvals and providing customized lending options. The seamless experience of applying for loans via mobile phones with instant money disbursal and further lesser documentation has largely been attracting consumers to digital lending products. This trend is particularly suited for the younger generation that has grown accustomed to the ease of online transactions and is beginning to be comfortable with digital financial services, generating further growth for the consumer credit market.

To get more information on this market, Request Sample

Rising Demand for Buy Now, Pay Later (BNPL) Services

Another important trend in the world of Indian consumer credit has been the growing acceptance of Buy Now and Pay Later schemes. Whereby consumers are allowed to purchase goods and services using BNPL and pay up for them through staggered payments, these have gained quite an impressive amount of attention, especially amongst younger, tech-savvy consumers. The remarkable growth of e-commerce has really brought BNPL to the checkout counter at many locations and allowed customers to pay conveniently for their purchases. BNPL schemes appeal to customers as flexible repayment options that come with little or no interest, which makes them a good substitute for traditional credit cards. Research shows that users of these services spend an average of 30-50% more for each transaction than conventional payment methods allow. This increase in AOV is, however, very favorable for retailers, as it helps to boost their revenues. The simple logic behind this is that less upfront expense on BNPL makes buying seem possible even though the total price is higher. Because of increased financial inclusion and growing digital payment platforms, consumers are adopting BNPL into their spending patterns. BNPL is likely to proliferate in retail, travel, and healthcare owing to instant credit approvals and minimal paperwork as it drives the India consumer credit market growth.

India Consumer Credit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on credit type, service type, issuer, and payment method.

Credit Type Insights:

- Revolving Credits

- Non-revolving Credits

The report has provided a detailed breakup and analysis of the market based on the credit type. This includes revolving credits, and non-revolving credits.

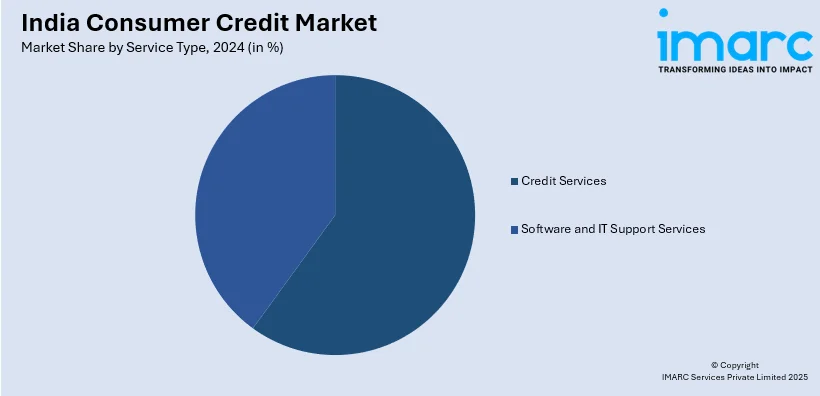

Service Type Insights:

- Credit Services

- Software and IT Support Services

The report has provided a detailed breakup and analysis of the market based on the service type. This includes credit services, and software and IT support services.

Issuer Insights:

- Banks and Finance Companies

- Credit Unions

- Others

The report has provided a detailed breakup and analysis of the market based on the issuer. This includes banks and finance companies, credit unions, and others.

Payment Method Insights:

- Direct Deposit

- Debit Card

- Others

The report has provided a detailed breakup and analysis of the market based on the payment method. This includes direct deposit, debit card, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Consumer Credit Market News:

- In December 2024, HDFC Bank revealed that it is utilizing synergies from its merger by transforming HDFC home loan clients into credit card holders and consumer durable borrowers. HDFC Bank is independently seeking to establish securitization as a new method for raising funds. Additionally, the bank expects various metrics, such as loan growth and loan-deposit ratio, to revert to pre-merger levels by 2027.

- In December 2024, ICICI Bank and Times Internet, the digital division of The Times of India Group, revealed the introduction of a super-premium co-branded metal credit card. Backed by Visa, the ‘Times Black ICICI Bank Credit Card’ offers outstanding experiences, travel perks, luxury lifestyle amenities, and tailored privileges aimed at meeting the preferences of affluent individuals.

India Consumer Credit Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Credit Types Covered | Revolving Credits, Non-revolving Credits |

| Service Types Covered | Credit Services, Software and IT Support Services |

| Issuers Covered | Banks and Finance Companies, Credit Unions, Others |

| Payment Methods Covered | Direct Deposit, Debit Card, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India consumer credit market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India consumer credit market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India consumer credit industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The consumer credit market in India was valued at USD 37.28 Billion in 2024.

The India consumer credit market is projected to exhibit a CAGR of 9.70% during 2025-2033, reaching a value of USD 91.88 Billion by 2033.

The India consumer credit market is driven by rising disposable incomes, increased smartphone and internet penetration, and growing awareness of credit facilities. Easy access to digital lending platforms, favorable demographics, and supportive government initiatives are also encouraging more consumers to adopt credit for lifestyle, education, and personal expenses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)