India Cordless Power Tool Market Size, Share, Trends and Forecast by Tool Type, Voltage, End User, and Region, 2025-2033

India Cordless Power Tool Market Overview:

The India cordless power tool market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. The market is driven by rapid infrastructure growth, increasing adoption in construction and automotive sectors, advancements in lithium-ion battery technology, and rising DIY home improvement trends. Expanding e-commerce sector, affordability of rechargeable tools, and rising demand for portable, high-efficiency solutions further accelerate market expansion across industrial and consumer segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Market Growth Rate 2025-2033 | 10.20% |

India Cordless Power Tool Market Trends:

Rising Demand for Battery-Powered Tools

The India cordless power tool market is quickly moving away from the corded to battery-powered alternative, with cordless tools contributing about 30% of total power tool sales in 2023. The change is largely influenced by developments in lithium-ion battery technology, providing better efficiency, longer run time, and lower charging time. Professionals and DIY professionals are increasingly turning towards cordless tools because of their convenience and portability, particularly in the construction, automotive, and woodworking industries. The availability of affordable rechargeable batteries and advancements in brushless motors, which improve tool performance and longevity, are further driving demand. Leading players are expanding their cordless product portfolios and enhancing battery compatibility across tools, driving demand in both industrial and consumer segments. With continuous technological advancements, cordless power tools are increasingly emerging as the preferred choice across various applications.

.webp)

To get more information on this market, Request Sample

Expanding Infrastructure and Construction Activities

The swift growth of India's construction industry, spurred by government projects like Smart Cities and Housing for All, is a key contributor to the market for cordless power tools. The increasing usage of these tools in infrastructure projects, residential development, and commercial building is boosting productivity and lowering dependence on manual labor. Also, rising investment in urbanization, roads, and real estate is fueling demand for high-performance and portable tools. The necessity for increased efficiency in high-rise buildings and remote locations, where power sources are limited, is further solidifying the move toward battery-driven tools. Builders and contractors like using cordless devices because they have flexibility, less setup time, and are easy to operate in changing work situations.

Rising Popularity of DIY and Home Improvement Trends

The India do-it-yourself (DIY) sector, with an estimated worth of around US$5 billion growing at 17% during the next three years, is the key driver of demand for cordless power tools. Online platforms and YouTube tutorials are heightening awareness levels, prompting hobbyists and homeowners to purchase drill machines, impact drivers, and saws for their own use. The popularity of small-sized models that are easy to operate is also propelling adoption. Online stores are increasing market share with promotions, package deal tool kits, and financing. Furthermore, the move toward light, ergonomic designs has increased the attractiveness of these tools to novice consumers. Growing numbers of home business owners and small workshops are also driving demand for economic and effective cordless tools, cementing their place in India's expanding DIY culture.

India Cordless Power Tool Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on tool type, voltage and end user.

Tool Type Insights:

- Drills

- Saws

- Sanders

- Grinders

- Others

The report has provided a detailed breakup and analysis of the market based on the tool type. This includes drills, saws, sanders, grinders, and others.

Voltage Insights:

- Low Voltage (Below 12V)

- Medium Voltage (12V – 18V)

- High Voltage (Above 18V)

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage (below 12V), medium voltage (12V– 18V), and high voltage (above 18V).

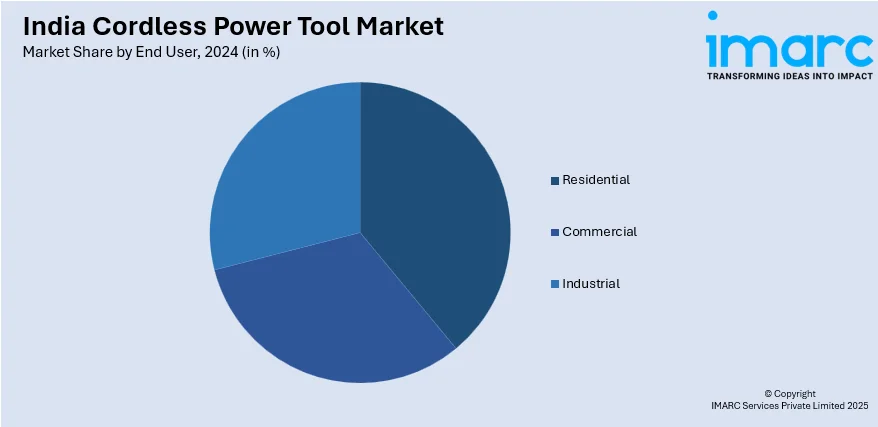

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cordless Power Tool Market News:

- In August 2024, Hilti India launched its Data Driven Services (DDS) platform, integrating IoT technology for enhanced tool management. DDS offers real-time tool tracking, battery health monitoring, and virtual customer support via the ON! TRACK 3 app. Designed to boost productivity and efficiency, it complements Hilti’s Nuron platform. Ashish Markande, Marketing Director, emphasized its role in digital transformation, aligning with Building 4.0 technologies like AI and automation.

India Cordless Power Tool Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Tool Types Covered | Drills, Saws, Sanders, Grinders, Others |

| Voltages Covered | Low Voltage (Below 12V), Medium Voltage (12V – 18V), High Voltage (Above 18V) |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cordless power tool market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cordless power tool market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cordless power tool industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cordless power tool market in India was valued at USD 1.1 Billion in 2024.

The India cordless power tool market is projected to exhibit a CAGR of 10.20% during 2025-2033, reaching a value of USD 2.8 Billion by 2033.

The shift towards automation and improved productivity in manufacturing and maintenance operations is boosting the adoption of cordless power tools across industries. Increasing urbanization and home improvement trends are also contributing to the demand from residential users. Advancements in battery technology, such as lithium-ion batteries, enhance tool performance and runtime, encouraging wider use.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)