India Cosmetic Pigments Market Size, Share, Trends and Forecast by Elemental Composition, Type, Application, and Region, 2025-2033

India Cosmetic Pigments Market Overview:

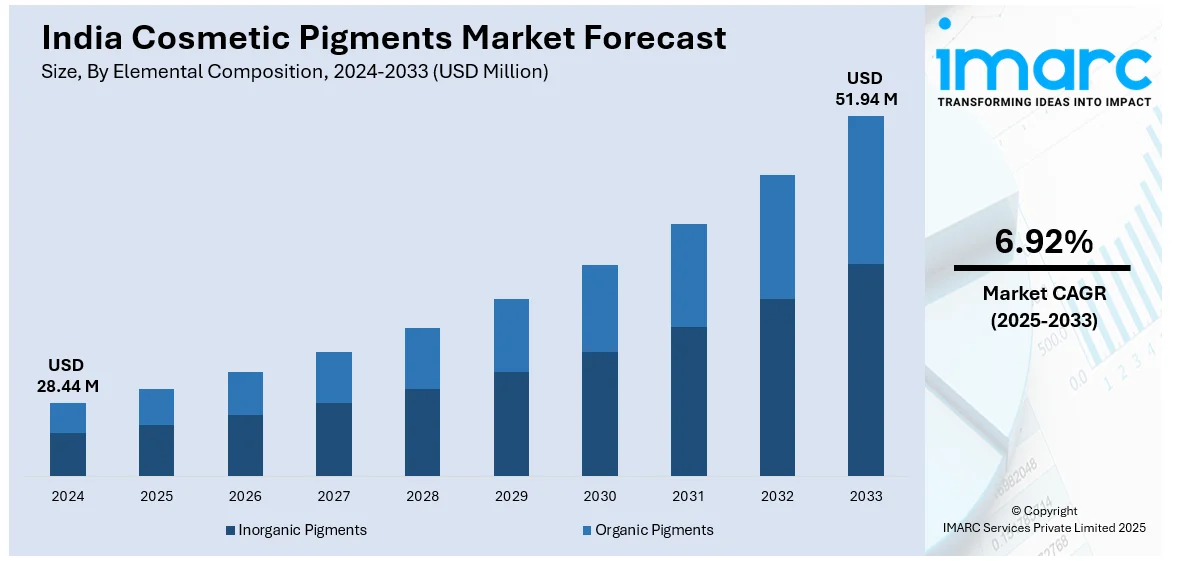

The India cosmetic pigments market size reached USD 28.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 51.94 Million by 2033, exhibiting a growth rate (CAGR) of 6.92% during 2025-2033. The increasing demand for personal grooming, expanding urban population, growth of the beauty and personal care industry, rising influence of social media, global beauty trends, innovations in natural and sustainable pigments, and inflating disposable income levels of the consumers are some of the factors augmenting the India cosmetic pigments market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.44 Million |

| Market Forecast in 2033 | USD 51.94 Million |

| Market Growth Rate 2025-2033 | 6.92% |

India Cosmetic Pigments Market Trends:

Shift Toward Natural and Sustainable Pigments

The shift toward natural and sustainable alternatives, driven by consumer preference for clean-label and eco-conscious products, is positively impacting the India cosmetic pigments market outlook. Traditional pigments derived from synthetic chemicals, such as heavy metals and petroleum-based compounds, are increasingly facing scrutiny due to safety concerns, environmental impact, and regulatory restrictions. The development of natural pigments sourced from plant, mineral, or microbial origins is gaining traction. These include botanical extracts, iron oxides, mica, beetroot pigments, chlorophyll derivatives, and fermented colorants, which are perceived as safer and more skin compatible. Additionally, leading cosmetic manufacturers in India are investing in research and development (R&D) activities to improve the stability, brightness, and shelf life of natural pigments. For instance, a research article published on October 10, 2024, examined the formulation of herbal lipsticks using natural colorants derived from purple cabbage and marigold as alternatives to synthetic dyes. Formulations were evaluated for stability, pH, melting point, breaking strength, and application quality. The samples showed good stability, acceptable pH (5.3–6.7), and melting points between 51.8°C and 61.6°C. The results confirm that these natural pigments are suitable for safe, skin-friendly lipstick formulations. Moreover, brands are incorporating biodegradable and ethically sourced pigments in formulations, particularly in categories like lipsticks, foundations, and eyeshadows, which enhances the market appeal. The transition towards sustainable pigment is also supported by India's ayurvedic and herbal heritage, which boosts consumer trust in plant-based and naturally derived beauty solutions.

To get more information on this market, Request Sample

Rise of Customized and Functional Pigments

The growing demand for personalization in beauty products through customized and functional pigment solutions is facilitating the India cosmetic pigments market growth. Functional pigments offer added properties such as UV protection, anti-aging benefits, antimicrobial activity, or sensory enhancement. Also, titanium dioxide, zinc oxide, and encapsulated pigments are increasingly integrated into skincare-makeup hybrid products, thereby appealing to India's young, urban consumers who are seeking multifunctional value from cosmetics. In addition to this, the country's diverse skin tones and climate variations increase the need for customization. Furthermore, pigment manufacturers and formulators are developing shade ranges tailored to regional preferences and skin undertones. Apart from this, artificial intelligence (AI) driven beauty apps and virtual try-ons are helping consumers find products that suit their exact skin profiles, further fueling demand for pigment customization. For example, on October 7, 2024, Myntra launched the 'Looks Virtual Try-On' feature, enabling customers to virtually experiment with complete makeup looks, including eye, face, and lip products, directly from their devices. This feature allows users to try on multiple beauty products simultaneously. This trend is influencing product formats across BB creams, foundations, lip colors, and highlighters.

India Cosmetic Pigments Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on elemental composition, type, and application.

Elemental Composition Insights:

- Inorganic Pigments

- Organic Pigments

The report has provided a detailed breakup and analysis of the market based on the elemental composition. This includes inorganic pigments and organic pigments.

Type Insights:

- Special Effect Pigments

- Surface-Treated Pigments

- Nano Pigments

- Natural Colorants

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes special effect pigments, surface-treated pigments, nano pigments, and natural colorants.

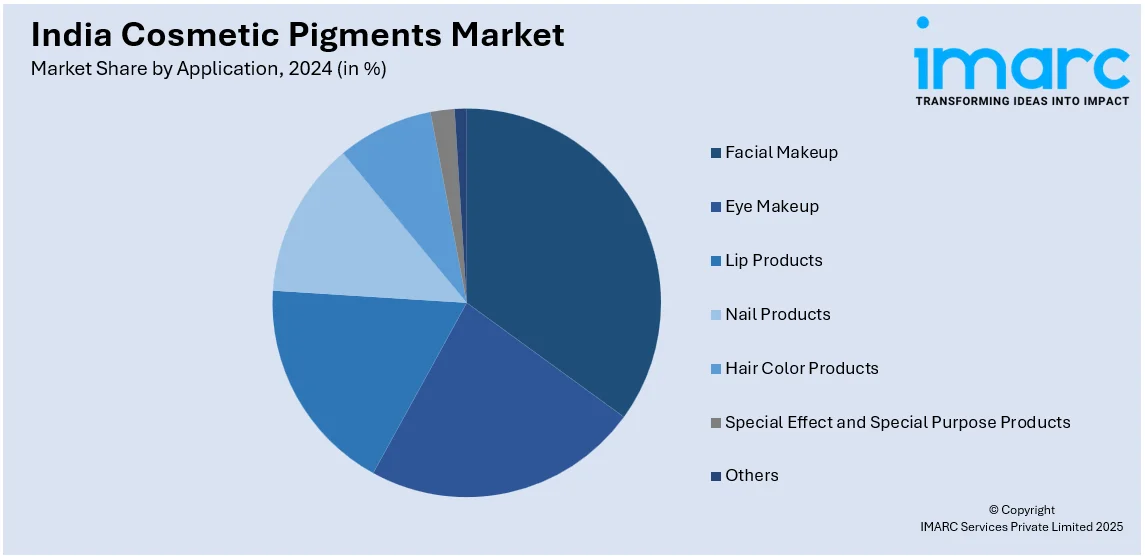

Application Insights:

- Facial Makeup

- Eye Makeup

- Lip Products

- Nail Products

- Hair Color Products

- Special Effect and Special Purpose Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes facial makeup, eye makeup, lip products, nail products, hair color products, special effect and special purpose products, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Cosmetic Pigments Market News:

- On February 18, 2025, HYUE, a premium color cosmetics brand, was launched in India by industry veterans. The brand aims to redefine the premium beauty segment by offering world-class formulations with bold pigments tailored to the preferences of modern Indian consumers. HYUE's philosophy emphasizes celebrating and enhancing natural beauty through high-performance products that seamlessly blend innovation and quality.

India Cosmetic Pigments Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Elemental Compositions Covered | Inorganic Pigments, Organic Pigments |

| Types Covered | Special Effect Pigments, Surface-Treated Pigments, Nano Pigments, Natural Colorants |

| Applications Covered | Facial Makeup, Eye Makeup, Lip Products, Nail Products, Hair Color Products, Special Effect and Special Purpose Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India cosmetic pigments market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India cosmetic pigments market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India cosmetic pigments industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cosmetic pigments market in India was valued at USD 28.44 Million in 2024.

The India cosmetic pigments market is projected to exhibit a CAGR of 6.92% during 2025-2033, reaching a value of USD 51.94 Million by 2033.

The India cosmetic pigments market is driven by rising demand for premium beauty products, increasing consumer preference for vibrant and long-lasting colors, and the growing influence of social media and fashion trends. Expanding personal care industries and innovation in eco-friendly, safe pigments further support market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)