India Crawler Crane Market Size, Share, Trends and Forecast by Type, Capacity, End User, and Region, 2025-2033

India Crawler Crane Market Overview:

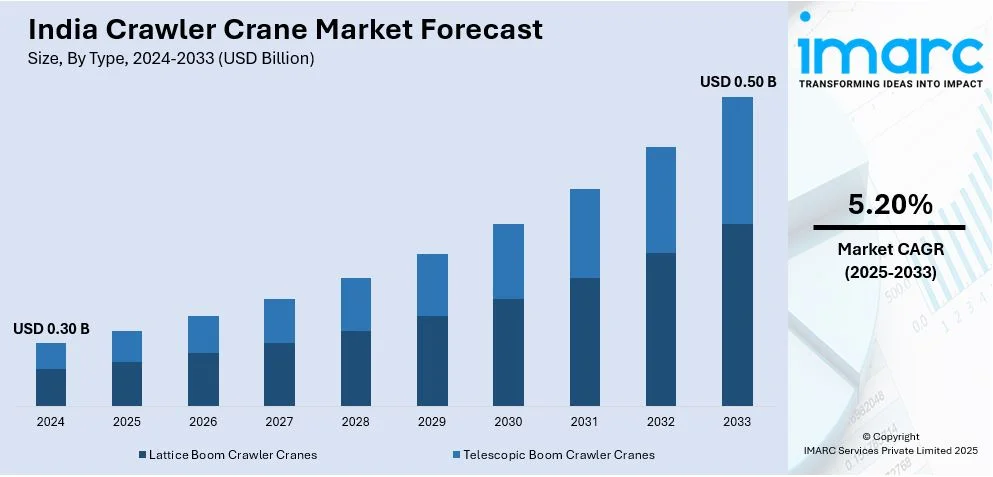

The India crawler crane market size reached USD 0.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 0.50 Billion by 2033, exhibiting a growth rate (CAGR) of 5.20% during 2025-2033. The rapid infrastructure development, increasing government investments in construction and industrial projects, rising demand for high capacity lifting equipment, expanding urbanization, growth in the renewable energy sector, advancements in crane technology, and the increasing adoption of rental services for cost-effective project execution are some of the key factors positively impacting the India crawler crane market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.30 Billion |

| Market Forecast in 2033 | USD 0.50 Billion |

| Market Growth Rate (2025-2033) | 5.20% |

India Crawler Crane Market Trends:

Increasing Demand for High-Capacity Cranes

The rising complexity and scale of infrastructure projects in India lead to a demand for high-capacity crawler cranes, which is propelling the India crawler cranes market growth. According to an industry report, the infrastructure sector in India is expected to grow rapidly. With planned investments of USD 1.4 Trillion by 2025 in the infrastructure sector, the need for crawler cranes to support large-scale construction activities has surged significantly. Industries such as power generation, steel, and oil and gas require cranes that can lift extremely heavy loads while maintaining stability and precision. High-rise construction projects and bridge development also contribute to this demand, as these projects often involve handling large, prefabricated components that require specialized lifting solutions. Additionally, high-capacity crawler cranes offer enhanced efficiency and safety, reducing manual labor and operational time. Construction companies prefer cranes with advanced load monitoring systems to ensure precise execution of lifts. Despite their high costs, companies are increasingly investing in these machines due to their long-term benefits, including reduced downtime and operational reliability. Rental companies are also expanding their fleet of high-capacity cranes to meet the growing demand. The preference for such cranes is further driven by their ability to operate in challenging terrains, ensuring their relevance in large-scale industrial projects.

Adoption of Advanced Technologies and Sustainable Practices

Continual technological advancements and sustainability concerns are positively influencing the India crawler crane market outlook. Manufacturers are equipping cranes with digital features such as remote monitoring, telematics, and automated safety systems to enhance performance and reduce downtime. These technologies enable predictive maintenance, ensuring early detection of potential failures and minimizing operational disruptions. Additionally, the requirement for fuel-efficient and eco-friendly cranes is increasing as companies strive for carbon emission reduction and abide by environmental laws. Hybrid and electric-powered crawler cranes are emerging as viable alternatives, offering reduced fuel consumption and lower operating costs. For instance, on February 7, 2023, Action Construction Equipment (ACE) introduced the first mobile crane in India that is entirely electric. ACE also introduced a 180-tonne capacity indigenously developed crawler crane. With its advanced technology and anti-toppling characteristics, the crawler crane outperforms traditional machinery in terms of on-site safety. This crane's superstructure, boom, and chassis are constructed from materials with great structural strength for increased durability. Automation is also playing a crucial role, with semi-autonomous features improving precision and safety. Furthermore, digital integration allows for real-time performance tracking, optimizing workflow efficiency. The focus on sustainability and innovation is driving manufacturers to develop cranes that balance efficiency, affordability, and environmental responsibility.

India Crawler Crane Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, capacity, and end user

Type Insights:

- Lattice Boom Crawler Cranes

- Telescopic Boom Crawler Cranes

The report has provided a detailed breakup and analysis of the market based on the type. This includes lattice boom crawler cranes and telescopic boom crawler cranes.

Capacity Insights:

- Below 50 Metric Tons

- 50 to 250 Metric Tons

- 250 to 450 Metric Tons

- More than 450 Metric Tons

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes below 50 metric tons, 50 to 250 metric tons, 250 to 450 metric tons, and more than 450 metric tons.

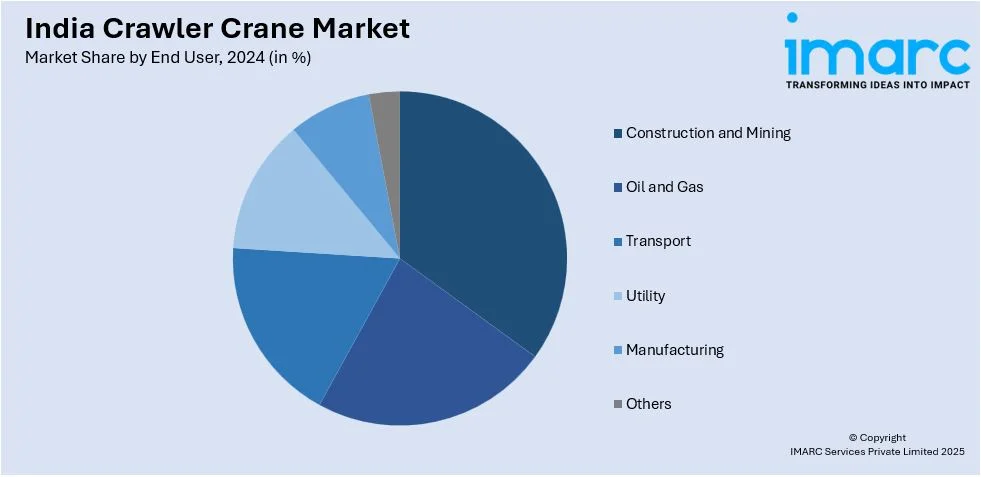

End User Insights:

- Construction and Mining

- Oil and Gas

- Transport

- Utility

- Manufacturing

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes construction and mining, oil and gas, transport, utility, manufacturing, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Crawler Crane Market News:

- On August 2, 2023, one of the biggest crane rental firms in India, Sanghvi Movers Limited (SML), has received eight SCC7500A 750-ton crawler cranes from SANY India. With 45 SANY cranes overall, this acquisition increases SML's fleet to 10 SCC7500A cranes, securing its position as India's top supplier of hoisting solutions. The SCC7500A has a maximum boom length of 108 meters and a luffing jib combination of up to 96 meters + 96 meters. It is intended for use in wind energy, cement, petrochemicals, refineries, steel mills, and power plants.

- On June 20, 2024, Action Construction Equipment (ACE) announced ongoing discussions with Japan's KATO WORKS CO. to establish a joint venture in India. This collaboration aims to manufacture medium and large-sized cranes, including crawler cranes, truck cranes, and rough terrain cranes, targeting the expanding Indian market. The venture also plans to leverage developed technologies to introduce value-added products for export to other countries from India.

India Crawler Crane Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Lattice Boom Crawler Cranes, Telescopic Boom Crawler Cranes |

| Capacities Covered | Below 50 Metric Tons, 50 to 250 Metric Tons, 250 to 450 Metric Tons, More than 450 Metric Tons |

| End Users Covered | Construction and Mining, Oil and Gas, Transport, Utility, Manufacturing, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India crawler crane market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India crawler crane market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India crawler crane industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The crawler crane market in India was valued at USD 0.30 Billion in 2024.

The India crawler crane market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 0.50 Billion by 2033.

Infrastructure development, urban construction projects, and industrial expansion are driving crawler crane demand in India. Their ability to handle heavy loads and operate in challenging terrains makes them essential for large-scale construction and mining operations. Increasing focus on mechanization, efficiency, and safe material handling supports market growth, while investments in advanced crane technology enhance operational productivity.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)