India CT Scanners Market Size, Share, Trends and Forecast by Technology, Modality, Device Architecture, Application, End User, and Region, 2025-2033

India CT Scanners Market Overview:

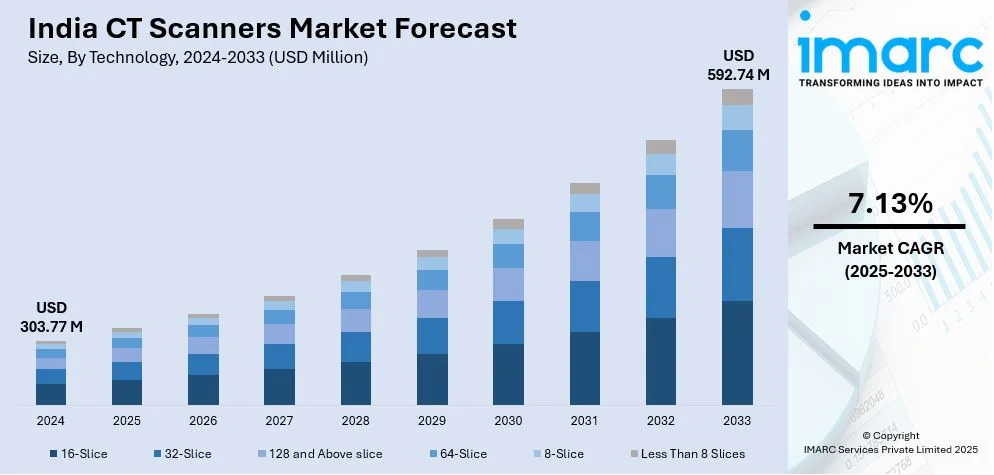

The India CT scanners market size reached USD 303.77 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 592.74 Million by 2033, exhibiting a growth rate (CAGR) of 7.13% during 2025-2033. The market is stimulated by growing investments in healthcare, increasing incidence of chronic diseases, and rising demand for sophisticated imaging technologies. Diversification of diagnostic services in Tier 2 and Tier 3 cities, government programs such as Ayushman Bharat, and AI-powered radiology innovations are also contributing to market expansion in hospitals and diagnostic centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 303.77 Million |

| Market Forecast in 2033 | USD 592.74 Million |

| Market Growth Rate 2025-2033 | 7.13% |

India CT Scanners Market Trends:

Rising Demand for Advanced Imaging Technologies

The India CT scanner market is observing growing adoption of high-slice and AI-enabled imaging technologies. Healthcare professionals are giving preference to advanced multi-slice CT scanners that provide higher image resolution, shorter scan times, and less radiation exposure. AI-based image reconstruction and computer-aided diagnostics are finding favor, enhancing accuracy and workflow efficiency. The need for dual-energy and spectral CT scanners is also increasing due to their potential to discriminate between tissue compositions and improve the detection of disease. Government programs to upgrade diagnostic equipment, as well as increased spending on private health facilities, are also driving the transition to more technologically advanced systems. As hospitals and diagnostic facilities aim to enhance patient outcomes, the usage of advanced CT scanning solutions will continue to grow in urban and semi-urban areas.

To get more information on this market, Request Sample

Expansion of Diagnostic Imaging Services in Tier 2 & Tier 3 Cities

The India CT scanner market is expanding rapidly in Tier 2 and Tier 3 cities, where diagnostic services are growing at a CAGR of 25%, surpassing the 10% growth in metro areas. These cities now contribute 40% of India's diagnostic sector revenue, driven by increased healthcare access through the Ayushman Bharat program. Private diagnostic chains are expanding with cost-effective models like public-private partnerships and rental-based scanner deployment. The affordability of refurbished CT scanners is further aiding penetration in semi-urban and rural areas. Manufacturers are introducing portable and lower-slice CT scanners with remote connectivity to meet local needs, ensuring wider adoption of advanced imaging technologies.

Increasing Focus on AI and Automation in Radiology

India CT scanner market is transforming due to AI and automation that are enhancing radiology workflow optimization, accuracy, and efficiency. AI-driven image reconstruction algorithms are reducing radiation exposure and noise while improving scan clarity. Radiologist workload is being streamlined driven by AI-aided diagnostics and automated reporting applications that allows faster and more accurate interpretation of results. One of the emerging trends is the adoption of cloud-based imaging technologies, which allow teleradiology services and remote scan access. In order to cater to the rising need for automated detection of anomalies and predictive analytics, key players are investing in CT scanner software powered by AI. The market is shifting towards more complex and data-centric diagnostic solutions as healthcare providers leverage AI-fueled imaging.

India CT Scanners Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, modality, device architecture, application, and end user.

Technology Insights:

- 16-Slice

- 32-Slice

- 128 and Above slice

- 64-Slice

- 8-Slice

- Less Than 8 Slices

The report has provided a detailed breakup and analysis of the market based on the technology. This includes 16-slice, 32-slice, 128 and above slice, 64-slice, 8-slice, and less than 8 slices.

Modality Insights:

- Fixed

- Mobile

A detailed breakup and analysis of the market based on the modality have also been provided in the report. This includes fixed, and mobile.

Device Architecture Insights:

- O-Arm

- C-Arm

The report has provided a detailed breakup and analysis of the market based on the device architecture. This includes O-arm, and C-arm.

Application Insights:

.webp)

- Cardiology

- Oncology

- Neurology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cardiology, oncology, neurology, and others.

End User Insights:

- Hospital

- Diagnostic Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, diagnostic centers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India CT Scanners Market News:

- In March 2025, Nura launched “NURA Express,” India’s first CT scan bus, in Kozhikode, Kerala, in collaboration with Fujifilm Healthcare and Dr. Kutty’s Healthcare. This mobile health screening center offers on-site cancer and lifestyle disease screenings for corporate employees and remote communities. Images are analyzed at the NURA Global Innovation Center, with results delivered via a smartphone app. Nura aims to enhance early disease detection and promote proactive healthcare nationwide.

- In August 2024, Fischer Medical Ventures (FMVL), a Chennai-based medical technology firm, is set to launch India’s first locally developed CT scan machines at half the current market price. Following its recent BSE listing, FMVL partnered with Edusoft to expand affordable medical imaging solutions, including X-ray machines. This move aligns with its strategy to enhance accessibility to advanced healthcare technology in India, where CT scan machines typically cost between Rs 50 lakh and Rs 4 crore.

- In July 2024, Trivitron Healthcare launched “Terrene,” India’s first CT scanner approved by BIS, AERB, and CDSCO, ensuring top-tier safety and quality. Manufactured at its AMTZ facility in Visakhapatnam, the scanner aims to enhance healthcare accessibility nationwide. Chairman Dr. GSK Velu emphasized its potential to revolutionize diagnostics, while CEO Chandra Ganjoo highlighted the company’s commitment to innovation. This milestone reinforces Trivitron’s dedication to advancing medical technology in India.

India CT Scanners Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | 16-Slice, 32-Slice, 128 and Above slice, 64-Slice, 8-Slice, Less Than 8 Slices |

| Modalities Covered | Fixed, Mobile |

| Device Architectures Covered | O-Arm, C-Arm |

| Applications Covered | Cardiology, Oncology, Neurology, Others |

| End Users Covered | Hospital, Diagnostic Centers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India CT scanners market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India CT scanners market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India CT scanners industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The CT scanners market in India was valued at USD 303.77 Million in 2024.

The India CT scanners market is projected to exhibit a CAGR of 7.13% during 2025-2033, reaching a value of USD 592.74 Million by 2033.

As conditions like cancer, cardiovascular disorders, and neurological issues are becoming more common, the need for accurate and early diagnosis is promoting the employment of CT scanners across hospitals and diagnostic facilities. Technological advancements in imaging like low-dose radiation and faster scanning are making CT scans safer and more efficient, encouraging wider use. Government initiatives to refine access to healthcare in rural and underserved regions are also contributing to the market growth, as more public and private facilities are equipped with modern imaging systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)