India Debt Collection Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

India Debt Collection Software Market Overview:

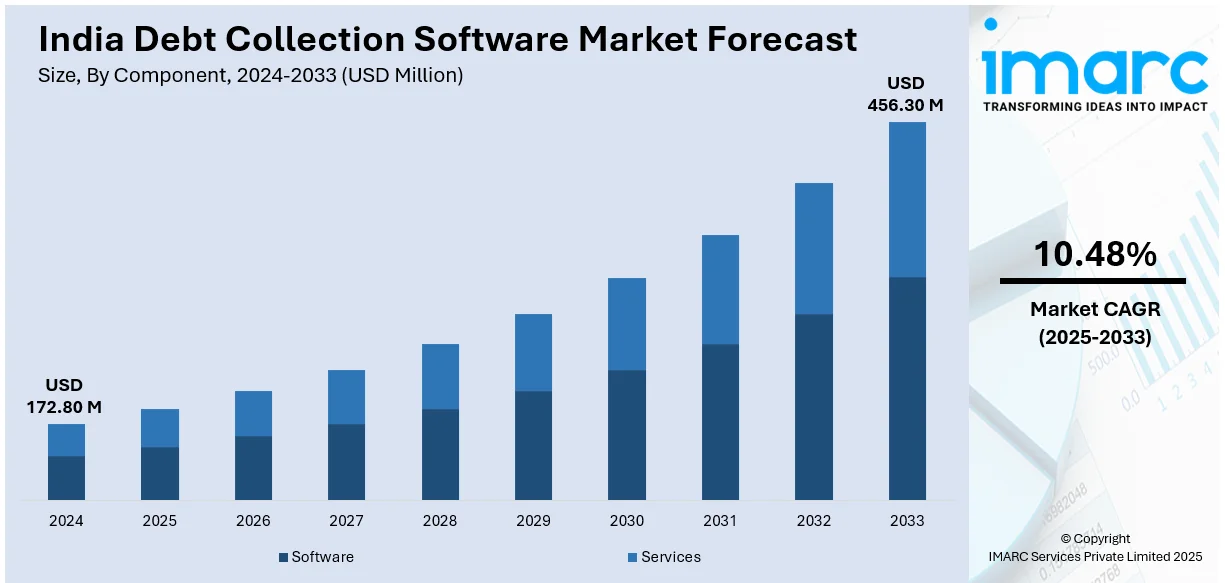

The India debt collection software market size reached USD 172.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 456.30 Million by 2033, exhibiting a growth rate (CAGR) of 10.48% during 2025-2033. The India debt collection software market is expanding due to rising digital adoption, AI-driven automation, and regulatory compliance demands. Businesses are integrating predictive analytics, mobile-friendly interfaces, and secure data management to enhance recovery efficiency, reduce operational costs, and ensure transparency in debt collection processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 172.80 Million |

| Market Forecast in 2033 | USD 456.30 Million |

| Market Growth Rate 2025-2033 | 10.48% |

India Debt Collection Software Market Trends:

Growing Digital Adoption in Debt Recovery

India's debt collection software is also seeing the tide shift in the direction of digital-first platforms, with financial institutions and organizations emphasizing automation for better efficiency. Businesses are also adding more AI-driven analytics, machine learning algorithms, and cloud platforms to make the process of collection simpler and maximize recovery rates. Demand for automated workflow and predictive analysis is influencing spending on cutting-edge debt recovery software. Recently, there have been a few fintech companies that introduced upgrades to their collection platforms that incorporate AI for enhanced borrower profiling and payment forecasting. On top of that, regulatory efforts supporting digital financial inclusion are further propelling the use of technology-backed debt management solutions. Lenders are emphasizing mobile-supporting interfaces and instant payment monitoring to boost user experience. Companies are utilizing chatbot-driven collections, AI-driven negotiations, and custom repayment solutions to enhance connection and reduce defaults. The use of omnichannel communications, such as SMS, email, and WhatsApp, is additionally enhancing debt recovery efficiency. As the digital revolution gains momentum, companies will increasingly depend on data-driven debt collection practices, cutting operational expenditure and enhancing compliance. The emphasis on real-time analytics and automatic decision-making is improving debt collection precision, keeping disputes to a minimum, and enabling better cash flow for lenders. This growing dependence on digital solutions is anticipated to fortify debt collection activities across sectors.

To get more information on this market, Request Sample

Increased Focus on Compliance and Security

With rising concerns over consumer data protection and regulatory compliance, businesses in the Indian debt collection software market are prioritizing secure, transparent, and legally compliant solutions. Enhanced regulatory frameworks and strict enforcement of debt recovery guidelines are pushing organizations to adopt software that ensures adherence to compliance standards. Debt collection agencies and financial institutions are investing in compliance-driven platforms that offer automated documentation, audit trails, and regulatory reporting features. Recently, a major update in financial regulations mandated stricter debt collection practices, increasing demand for tools that support automated audit trails and secure data management. Companies are integrating multi-layered security measures, such as encrypted databases and AI-driven fraud detection, to mitigate risks. The introduction of privacy laws and consumer protection regulations is further driving software adoption that prioritizes ethical and transparent debt collection. Businesses are also focusing on AI-powered voice analytics to ensure adherence to communication guidelines, reducing disputes and legal risks. Additionally, the demand for automated dispute resolution and compliance reporting features is rising as organizations aim to minimize errors and improve accountability. As regulatory scrutiny grows, enterprises are leveraging compliance-focused software to maintain transparency, safeguard customer data, and avoid legal challenges, ensuring sustainable and efficient debt recovery processes.

India Debt Collection Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, and end user.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

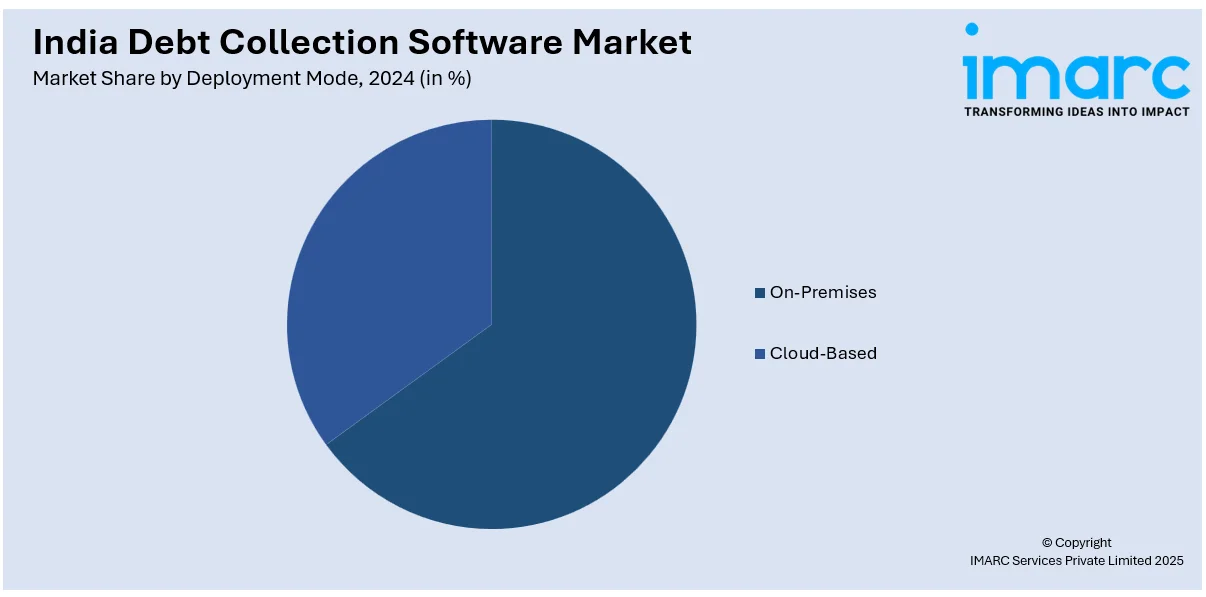

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Small and Medium Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium enterprises and large enterprises.

End User Insights:

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom and Utilities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes financial institutions, collection agencies, healthcare, government, telecom and utilities, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Debt Collection Software Market News:

- March 2025: Perfios acquired AI-powered debt collection firm CreditNirvana, enhancing its debt management and recovery solutions. This expansion strengthens India’s debt collection software industry by integrating AI-driven automation, improving efficiency, and reducing recovery costs, enabling financial institutions to optimize debt collection and risk management.

- October 2024: Neowise launched AI-driven debt collection software, NeoBot and NeoSight, in collaboration with Sarvam AI. These solutions enhance efficiency by 15% and reduce costs by 33%, improving debt recovery, borrower engagement, and compliance. This innovation strengthens India's debt collection software segment by optimizing loan recovery processes.

India Debt Collection Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Covered | Software, Services |

| Deployment Mode Covered | On-Premises, Cloud-Based |

| Organization Size Covered | Small and Medium Enterprises, Large Enterprises |

| End User Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India debt collection software market performed so far and how will it perform in the coming years?

- What is the breakup of the India debt collection software market on the basis of type?

- What is the breakup of the India debt collection software market on the basis of lease type?

- What is the breakup of the India debt collection software market on the basis of service provider type?

- What is the breakup of the India debt collection software market on the basis of tenure?

- What are the various stages in the value chain of the India debt collection software market?

- What are the key driving factors and challenges in the India debt collection software market?

- What is the structure of the India debt collection software market and who are the key players?

- What is the degree of competition in the India debt collection software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India debt collection software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India debt collection software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India debt collection software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)