India Defibrillator Market Size, Share, Trends and Forecast by Product Type, End-User, and Region, 2025-2033

India Defibrillator Market Overview:

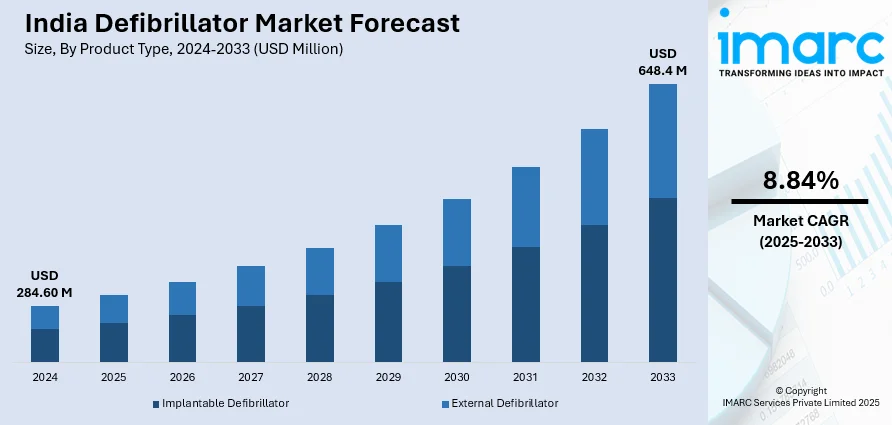

The India defibrillator market size reached USD 284.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 648.4 Million by 2033, exhibiting a growth rate (CAGR) of 8.84% during 2025-2033. Government initiatives mandating automated external defibrillator (AED) installations in public spaces, rising incidence of cardiovascular diseases, escalating demand for technologically advanced defibrillators, and expansion of healthcare infrastructures in rural and urban areas are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 284.60 Million |

| Market Forecast in 2033 | USD 648.4 Million |

| Market Growth Rate 2025-2033 | 8.84% |

India Defibrillator Market Trends:

Rising Prevalence of Cardiovascular Diseases and Cardiac Arrests

One of the key drivers behind the growth in the India defibrillator market is the escalating frequency of cardiovascular disease (CVD) incidences, such as sudden cardiac arrests, heart failure, and arrhythmias. As per the Indian Heart Association, India carries almost 60% of the world's heart disease burden even though it has less than 20% of the world's population. This is due to increased sedentary behavior, smoking, poor diets, and stress among both urban and rural populations. Sudden cardiac arrest, in particular, is a time-critical condition, and defibrillators play a vital life-saving role. The Indian healthcare sector has seen an upsurge in demand for both implantable cardioverter-defibrillators (ICDs) and automated external defibrillators (AEDs), particularly in hospitals and ambulances, to fulfill emergency response needs. Furthermore, since CVDs are now rising among younger age groups too, demand for long-term cardiac rhythm management devices such as ICDs and wearable defibrillators has risen. Both private and public sectors of healthcare are countering the move by placing investments in hi-tech diagnostic and treatment facilities, thus driving even faster the installment of defibrillators throughout India's increasing clinical network.

To get more information on this market, Request Sample

Growing Awareness and Adoption of Preventive Healthcare and Corporate Wellness Programs

Another driver of the India defibrillator market is increased awareness toward preventive healthcare and the rise of corporate wellness programs. In contrast to the immediate influence of disease burden or intervention from the government, this pattern is influenced by attitudinal change and healthy behavior among organizations and individuals. With a growing middle class, greater health literacy, and expanding disposable income level, more Indians are assuming responsibility for their health—resulting in higher interest in preventive diagnostics, wearable health devices, and emergency preparedness equipment like defibrillators. Corporates, especially from the IT, manufacturing, and financial industries, are also making greater investments in health and wellness infrastructure within workplaces. Numerous corporates now incorporate AEDs into their in-house medical kits as a standard part of occupational health and safety standards. Corporates typically engage the services of health tech companies or medical practitioners to hold training sessions for cardiopulmonary resuscitation (CPR) and AED operations, further desensitizing the use of such devices outside conventional clinical environments.

India Defibrillator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and end-user.

Product Type Insights:

- Implantable Defibrillator

- Transvenous Implantable Cardioverter Defibrillator (T-ICDs)

- Subcutaneous Implantable Cardioverter Defibrillator (S-ICDs)

- Cardiac Resynchronization Therapy Defibrillator (CRT-D)

- External Defibrillator

- Manual External Defibrillator

- Automated External Defibrillator (AEDs)

- Wearable Cardioverter Defibrillator (WCDs)

The report has provided a detailed breakup and analysis of the market based on the product type. This includes implantable defibrillator (transvenous implantable cardioverter defibrillator (T-ICDs), subcutaneous implantable cardioverter defibrillator (S-ICDs), and cardiac resynchronization therapy defibrillator (CRT-D)) and external defibrillator (manual external defibrillator, automated external defibrillator (AEDs), and wearable cardioverter defibrillator (WCDs)).

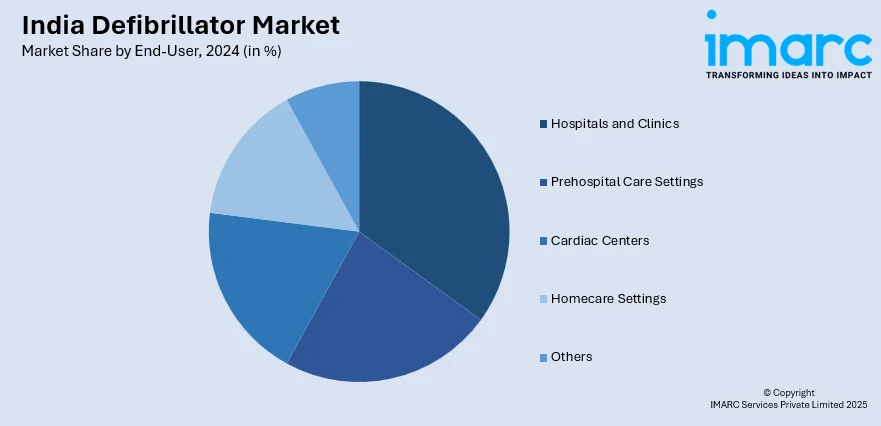

End-User Insights:

- Hospitals and Clinics

- Prehospital Care Settings

- Cardiac Centers

- Homecare Settings

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes hospitals and clinics, prehospital care settings, cardiac centers, homecare settings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Defibrillator Market News:

- November 2024: Schiller India installed its FRED PA-1 defibrillator at the Western Railway Headquarters, Churchgate, through a collaboration with the Rotary Club of Bombay Airport in an effort to boost emergency cardiac response. Special focus was placed on empowering railway officials through a hands-on CPR training session.

- March 2024: Stryker launched the LIFEPAK CR2 AED, featuring QUIK-STEP electrodes and CPR coaching technology, at Criticare 2024 in Kolkata. This introduction enhances emergency cardiac care capabilities in India.

India Defibrillator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| End-Users Covered | Hospitals and Clinics, Prehospital Care Settings, Cardiac Centers, Homecare Settings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India defibrillator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India defibrillator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India defibrillator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The defibrillator market in India was valued at USD 284.60 Million in 2024.

The India defibrillator market is projected to exhibit a CAGR of 8.84% during 2025-2033, reaching a value of USD 648.4 Million by 2033.

The India defibrillator market is fueled by the growing prevalence of cardiovascular diseases, increased awareness about sudden cardiac arrest, and expanding healthcare infrastructure. Government initiatives promoting public access defibrillation and technological advancements in devices also significantly contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)