India Dehumidifier Market Size, Share, Trends and Forecast by Type, Coverage Area, and Region, 2025-2033

India Dehumidifier Market Overview:

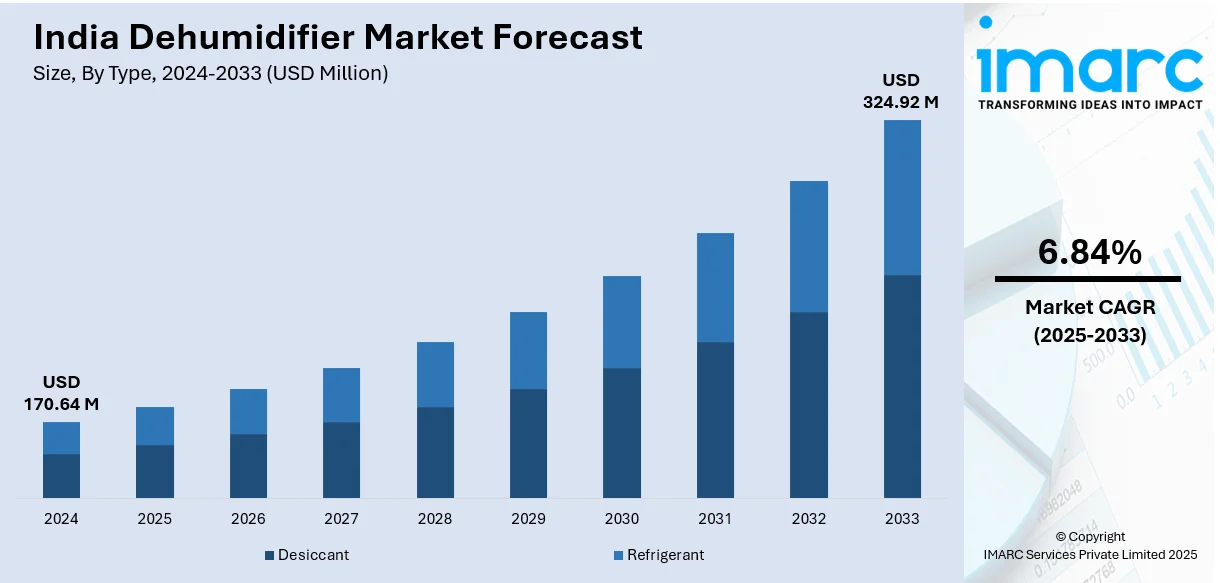

The India dehumidifier market size reached USD 170.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 324.92 Million by 2033, exhibiting a growth rate (CAGR) of 6.84% during 2025-2033. The India dehumidifier market is driven by the growing humidity levels because of climate change, increasing demand for energy-efficient and eco-friendly products, and the rise of e-commerce platforms, which enhance accessibility, offer user education, and expand reach to urban and rural buyers alike.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.64 Million |

| Market Forecast in 2033 | USD 324.92 Million |

| Market Growth Rate 2025-2033 | 6.84% |

India Dehumidifier Market Trends:

Growing Humidity Levels and Climate Change

The dehumidifier market in India is largely influenced by the rising humidity levels in different areas throughout the country. Shifting climate patterns, such as hotter summers and unpredictable rainfall, are increasing moisture levels inside, resulting in greater need for dehumidification solutions. Residences, workplaces, and retail spaces in humid climates, especially coastal locations, encounter problems like mold development, unpleasant smells, and harm to delicate electronics or stored items. As climate change leads to extended humidity, dehumidifiers are crucial for managing indoor air quality and maintaining the state of buildings and belongings. In 2024, Down to Earth reported that humid heatwaves were affecting several parts of India, including Odisha, West Bengal, and Maharashtra, due to high moisture levels in the atmosphere. This was caused by anticyclones, western disturbances, and global warming, all contributing to increased humidity and heat. This trend motivates residential and commercial sectors to invest in dehumidifiers, resulting in an expanding market.

To get more information on this market, Request Sample

Increasing Focus on Sustainable and Eco-Friendly Products

With people becoming more aware about environmental issues, there is a higher need for energy-efficient and eco-friendly items, such as dehumidifiers. Producers are reacting by creating models that require less energy, incorporate recyclable materials, and utilize environmentally-safe refrigerants, in line with international sustainability movements and India's initiative for energy conservation. For instance, in 2025, Bry-Air announced plans to introduce novel technologies aimed at combating climate change and promoting sustainability as part of its 60th anniversary celebrations. The company has filed 7 patents, focusing on areas such as NMP, carbon capture, recovery, and air-to-water generators for green hydrogen. Additionally, Bry-Air is making significant advancements in energy-efficient dehumidifiers, with new innovations for Lithium-ion Cell manufacturing and reduced operational costs. As concerns about climate change increase and the necessity to lower carbon footprints rises, individuals are focusing on products that provide performance while also reducing environmental harm. This emphasis on sustainability is especially crucial in the dehumidifier sector, where buyers look for products that enhance air quality and save energy simultaneously.

Expansion of E-commerce and Online Retail Channels

The swift expansion of e-commerce platforms in India is enhancing the availability of dehumidifiers, allowing them to reach a wider range of users. Due to the ease of searching a variety of brands and models online, shoppers can effortlessly find choices that align with their tastes and financial plans. E-commerce websites provide comprehensive product descriptions, technical details, user feedback, and price comparisons, enabling shoppers to make informed buying choices. Furthermore, the ease of home delivery, various payment choices, and appealing discounts additionally motivate individuals to choose online shopping. The reach of online shopping platforms is expanding from cities into rural areas, providing improved access to high-quality appliances. Promotional sales events are also vital for catalyzing the demand for dehumidifiers. For example, in 2024, the Amazon Great Indian Festival Sale offered up to 75% off on air purifiers and dehumidifiers from popular brands. The sale included top picks like Coway, Dyson, and Sharp air purifiers, along with compact dehumidifiers for small spaces. This limited-time event provided an opportunity to enhance indoor air quality and comfort at discounted prices.

India Dehumidifier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type and coverage area.

Type Insights:

- Desiccant

- Refrigerant

The report has provided a detailed breakup and analysis of the market based on the type. This includes desiccant and refrigerant.

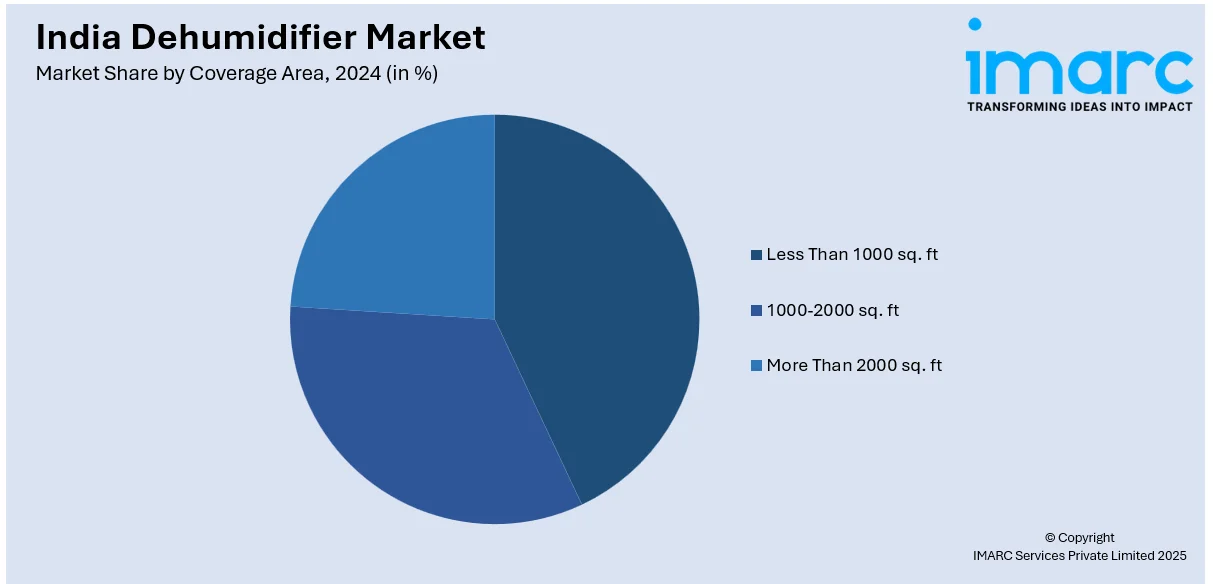

Coverage Area Insights:

- Less Than 1000 sq. ft

- 1000-2000 sq. ft

- More Than 2000 sq. ft

A detailed breakup and analysis of the market based on the coverage area have also been provided in the report. This includes less than 1000 sq. ft, 1000-2000 sq. ft, and more than 2000 sq. ft.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dehumidifier Market News:

- In September 2024, at Anuga FoodTec 2024 Bry-Air showcased its FFB-300 desiccant compact dehumidifier, designed for small-scale food and beverage industry applications. The lightweight, space-saving device offered advanced moisture control, making it ideal for startups in food processing. The product received strong interest at the event, highlighting Bry-Air's alignment with India’s growing F&B industry needs.

- In July 2023, Sharp Business Systems launched its 'CookWonder' Microwave series and an advanced Dehumidifier with an air purifier in India. The dehumidifier used Plasmacluster Technology for air purification. This expansion supported Sharp's commitment to the 'Make in India' initiative and local manufacturing.

India Dehumidifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Desiccant, Refrigerant |

| Coverage Areas Covered | Less Than 1000 sq. ft, 1000-2000 sq. ft, More Than 2000 sq. ft |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dehumidifier market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dehumidifier market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dehumidifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The dehumidifier market in India was valued at USD 170.64 Million in 2024.

The India dehumidifier market is projected to exhibit a CAGR of 6.84% during 2025-2033, reaching a value of USD 324.92 Million by 2033.

The market is driven by indoor air management needs across households, offices, and industrial spaces. Rising humidity levels and increased use of HVAC systems create a requirement for moisture control. Sensitive environments like archives, laboratories, and electronics storage push demand, while residential use is growing in areas prone to dampness and seasonal discomfort.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)