India Diesel Generator Market Size, Share, Trends and Forecast by Capacity, Application, Mobility, End User, and Region, 2025-2033

India Diesel Generator Market Overview:

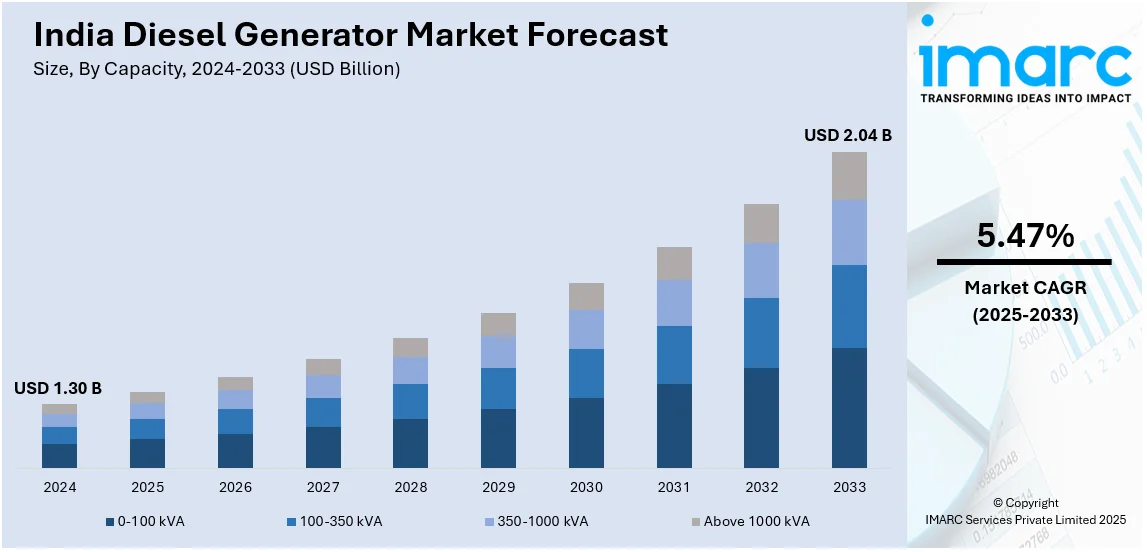

The India diesel generator market size reached USD 1.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.04 Billion by 2033, exhibiting a growth rate (CAGR) of 5.47% during 2025-2033. Rising power outages, growing industrialization, increasing construction activities, expanding data centers, growing demand for reliable backup power, government infrastructure projects, rural electrification, rapid urbanization, and advancements in fuel-efficient generator technologies are driving the growth of the India diesel generator market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.30 Billion |

| Market Forecast in 2033 | USD 2.04 Billion |

| Market Growth Rate (2025-2033) | 5.47% |

India Diesel Generator Market Trends:

Expansion of Infrastructure Development Projects

India is experiencing a remarkable boom in infrastructure development, covering areas of transport, urban expansion, and power. This growth is a crucial stimulus for the diesel generator industry, as the projects tend to demand consistent, on-site power solutions to enable seamless operations. The government's emphasis on building better transport systems has resulted in huge investments in metro rail extensions and highway development. India, in September 2024, announced an investment of INR 3 trillion in metro rail projects to enhance urban mobility and decongest cities. Such massive projects require an uninterrupted power supply for construction work, thus boosting the demand for diesel generators. Furthermore, urbanization has led to the growth of smart cities and residential projects. The government's plans to create around 100 smart cities that need strong infrastructure, including stable power sources. Diesel generators play a crucial role in providing backup power during grid failures, ensuring the uninterrupted operation of essential services in urban areas, which in turn drives the market growth. In addition to this, inflation in renewable energy projects, like wind and solar farms, is usually characterized by development in areas far from towns where grid connectivity is low, supporting the demand for diesel generators.

To get more information on this market, Request Sample

Rising Demand in the Commercial Sector

India's commercial industry, including IT services, healthcare, hospitality, and retail, is expanding fast. Such growth requires a reliable supply of power to keep operations running smoothly, particularly in areas where grid reliability cannot be guaranteed. Diesel generators offer a consistent backup power option, ensuring business continuity within this vital industry. Additionally, hospitals and clinics depend greatly on uninterrupted power to sustain life-support equipment and services. The Indian government's intention to raise public health expenditure to 2.5% of GDP by 2025 has prompted the construction of new healthcare facilities, which have a strong backup power solution requirement. This is also helping to drive the market further because diesel generators tend to be the choice in most situations owing to their efficiency and reliability in the event of emergencies. In addition, the rapid development of hotels, restaurants, and retail stores is fueling demand for diesel generators. These facilities need a steady power supply to improve customer satisfaction and avoid loss of revenue because of power outages. As the service sector grows, the use of diesel generators as backup power becomes more prominent.

India Diesel Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on capacity, application, mobility, and end user.

Capacity Insights:

- 0-100 kVA

- 100-350 kVA

- 350-1000 kVA

- Above 1000 kVA

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes 0-100 kVA, 100-350 kVA, 350-1000 kVA, and above 1000 kVA.

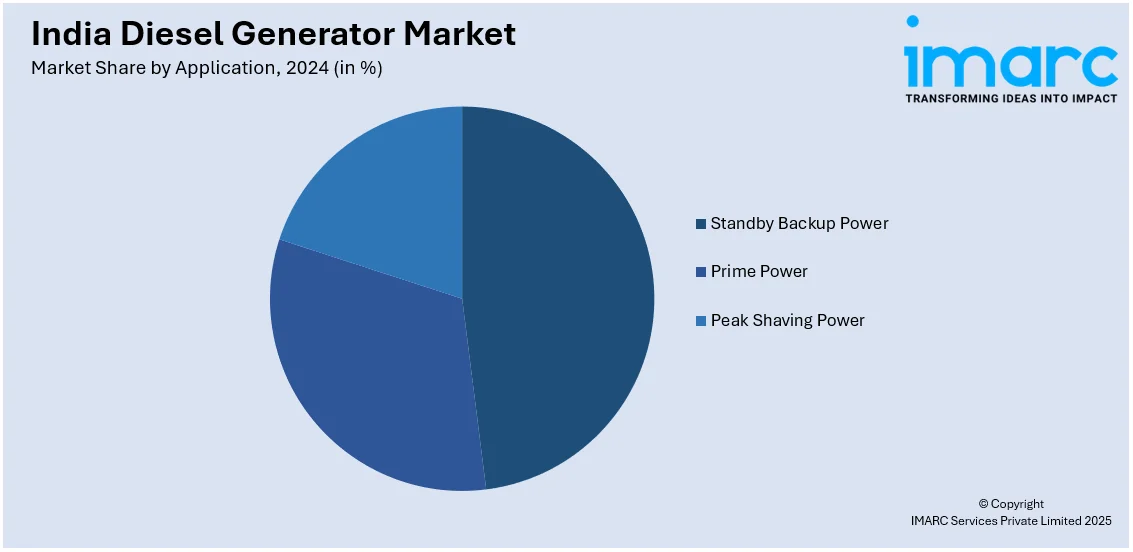

Application Insights:

- Standby Backup Power

- Prime Power

- Peak Shaving Power

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes standby backup power, prime power, and peak shaving power.

Mobility Insights:

- Stationary

- Portable

The report has provided a detailed breakup and analysis of the market based on the mobility. This includes stationary and portable.

End User Insights:

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Diesel Generator Market News:

- January 2025: Cummins Group unveiled its next-generation HELM™ engine platforms at the Bharat Mobility Global Expo 2025. These platforms feature the high-performance L10 engine, an advanced Hydrogen Fuel Delivery System (FDS) with Type IV onboard storage vessels, and the B6.7N natural gas engine.

- June 2024: Power Engineering (India) Pvt Ltd unveiled new CPCB IV+ certified diesel generators in India, taking a big step toward lowering air pollution from diesel generator installations. The generators, with power ratings ranging from 10 kVA to 750 kVA, are intended to eliminate dangerous pollutants, improve fuel efficiency, and increase generator longevity.

India Diesel Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Capacities Covered | 0-100 kVA, 100-350 kVA, 350-1000 kVA, Above 1000 kVA |

| Applications Covered | Standby Backup Power, Prime Power, Peak Shaving Power |

| Mobilites Covered | Stationary, Portable |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India diesel generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India diesel generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India diesel generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India diesel generator market size reached USD 1.30 Billion in 2024.

The India diesel generator market is expected to reach USD 2.04 Billion by 2033, exhibiting a CAGR of 5.47% during 2025-2033.

Market growth is driven by the increasing demand for reliable power backup solutions in residential, commercial, and industrial sectors. Frequent power outages, growing infrastructure development, and rising investments in manufacturing and construction industries also fuel the demand for diesel generators. Additionally, the need for uninterrupted power supply in remote and off-grid locations further supports market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)