India Digital Banking Market Size, Share, Trends and Forecast by Services, Deployment Type, Technology, Industries, and Region, 2025-2033

India Digital Banking Market Overview:

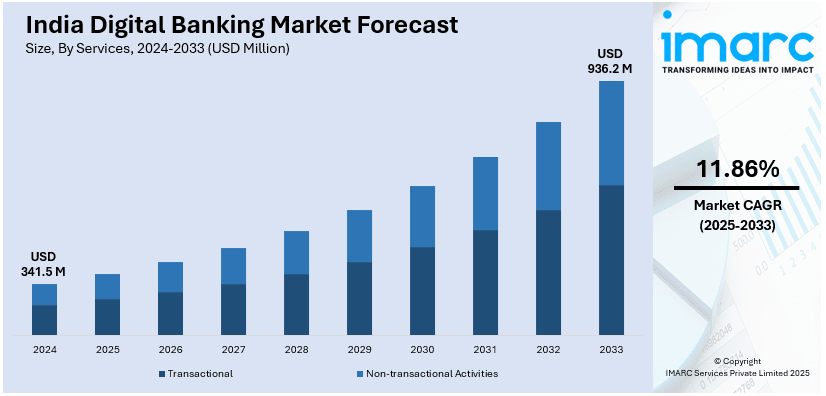

The India digital banking market size reached USD 341.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 936.2 Million by 2033, exhibiting a growth rate (CAGR) of 11.86% during 2025-2033. The market is witnessing significant growth, driven by the rise of mobile banking and digital wallets and the growth of neobanks and fintech innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 341.5 Million |

| Market Forecast in 2033 | USD 936.2 Million |

| Market Growth Rate 2025-2033 | 11.86% |

India Digital Banking Market Trends:

Rise of Mobile Banking and Digital Wallets

In India, one of the major trends driving the digital banking market is the rapid growth of mobile banking and digital wallets. An increasing number of Indians are adopting mobile banking solutions to carry out their finances owing to increasing smartphone penetration and access to high-speed internet. Digital wallets such as Paytm, PhonePe, and Google Pay have gained enormous popularity, allowing consumers to execute real-time transactions, pay bills, or transfer cash with extreme ease. These platforms offer additional incentivizes to tech-savvy consumers in the form of cashback, loyalty rewards, and financial management tools, thereby enriching consumer experience. The shift towards mobile banking is further supported by the Indian government's push for a cashless economy with initiatives such as the Digital India campaign promoting digital payments and financial inclusion to realize its vision. QR code-based payments have witnessed massive adoption in recent years, and the availability of instant payment systems like the Unified Payments Interface (UPI) is widening the expanse of digital banking. For instance, in October 2024, the Unified Payments Interface (UPI) set a record by processing 16.58 billion transactions in one month, highlighting its crucial role in India's digital transformation. This trend is expected to continue growing as more consumers and businesses embrace mobile-based solutions, further transforming the landscape of banking in India.

To get more information on this market, Request Sample

Growth of Neobanks and Fintech Innovations

Growing fintech innovations is another vital trend in the Indian digital banking sector. Neobanks are banks that operate almost entirely online and do not have any physical branch presence. In India, they have gained considerable acceptance in the younger, tech-savvy demographic. They provide a minimalistic banking offering available on mobile applications and allow customers to access savings accounts, checking accounts, loans, and investments without going through traditional banking infrastructure. For instance, in July 2024, BranchX, a leading neobank, launched India’s first personal loan solution via ONDC, promoting financial inclusion for 1.4 billion people with a paperless process for young professionals, entrepreneurs, and the emerging middle class. The increase of fintech startups has also led to the development of innovative financial products tailored to underserved market segments, including small businesses, self-employed individuals, and low-income groups. By leveraging artificial intelligence, machine learning, and big data, these digital platforms are offering personalized financial services that cater to specific customer needs. Moreover, the regulatory environment in India has evolved to support fintech innovation, with the Reserve Bank of India (RBI) and the government taking steps to create a more inclusive financial ecosystem. The combination of tech-driven solutions, regulatory support, and consumer demand for faster, more accessible banking is positioning neobanks and fintech players to play a pivotal role in reshaping India’s digital banking landscape.

India Digital Banking Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on services, deployment type, technology, and industries.

Services Insights:

- Transactional

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Non-transactional Activities

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

The report has provided a detailed breakup and analysis of the market based on the services. This includes transactional (cash deposits and withdrawals, fund transfers, auto-debit/auto-credit services, loans) and non-transactional activities (information security, risk management, financial planning, stock advisory).

Deployment Type Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment type have also been provided in the report. This includes on-premises and cloud.

Technology Insights:

- Internet Banking

- Digital Payments

- Mobile Banking

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes internet banking, digital payments, and mobile banking.

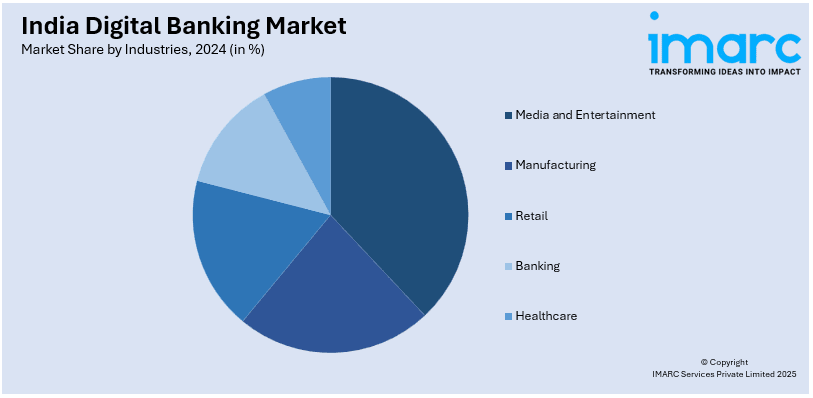

Industries Insights:

- Media and Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

A detailed breakup and analysis of the market based on the industries have also been provided in the report. This includes media and entertainment, manufacturing, retail, banking, and healthcare.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Banking Market News:

- In January 2025, CRED, led by Kunal Shah, partnered with the Reserve Bank of India to launch the e₹ wallet, becoming the first fintech to roll out a CBDC pilot. Backed by Tiger Global and Peak XV, CRED will introduce the service to select users, with Yes Bank facilitating CBDC issuance.

- In December 2024, DC Wallet partnered with AFC India Limited, a government-owned firm, to promote digital rupee adoption. This follows the Reserve Bank of India's CBDC testing on Ripple’s XRP ledger. Despite being launched two years ago, the digital rupee faces limited adoption, prompting this public-private effort to explore growth opportunities.

India Digital Banking Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered |

|

| Deployment Types Covered | On-Premises, Cloud |

| Technologies Covered | Internet Banking, Digital Payments, Mobile Banking |

| Industries Covered | Media and Entertainment, Manufacturing, Retail, Banking, Healthcare |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital banking market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital banking market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital banking industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital banking market in India was valued at USD 341.5 Billion in 2024.

The India digital banking market is projected to exhibit a CAGR of 11.86% during 2025-2033, reaching a value of USD 936.2 Million by 2033.

The surge in digital adoption across urban and rural areas is transforming banking in India. Consumers now expect seamless, 24/7 access to financial services, driving demand for digital platforms. Supportive government policies, real-time payment systems like UPI, and the rise of fintech startups are reshaping how individuals and businesses manage money, propelling the digital banking market forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)