India Digital Business Card Market Size, Share, Trends, and Forecast by Platform, User Type, Vertical, and Region, 2025-2033

India Digital Business Card Market Overview:

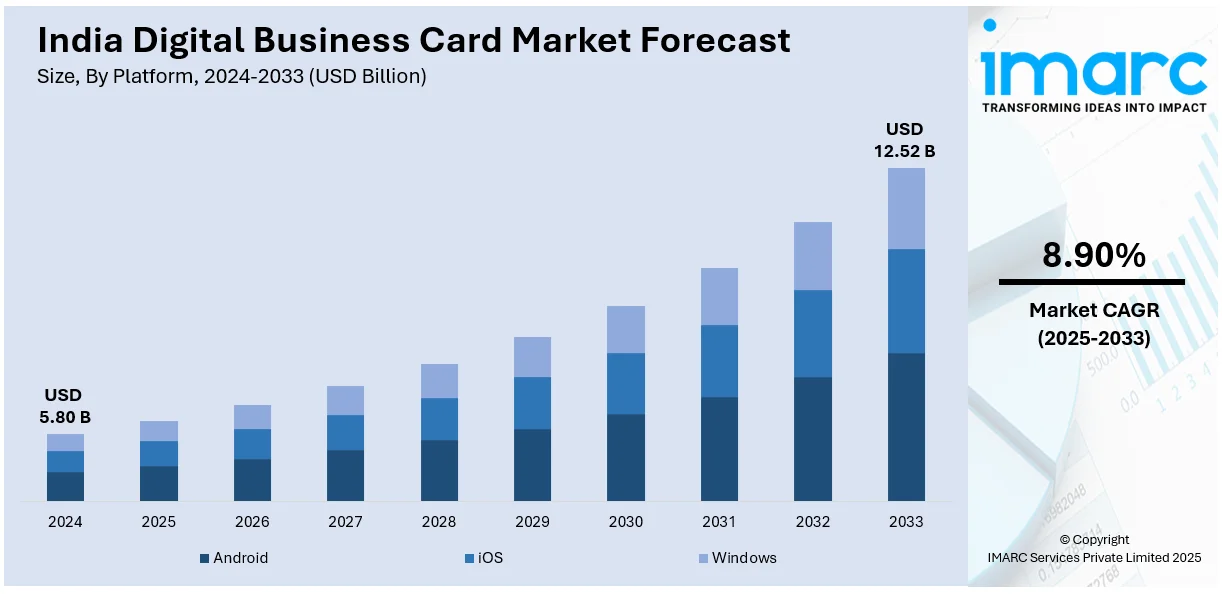

The India digital business card market size reached USD 5.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.52 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025-2033. The market is expanding due to rising smartphone penetration, the widespread digital adoption among businesses, and the demand for eco-friendly networking solutions. Key players focus on NFC-enabled cards, app-based solutions, and seamless CRM integration to enhance business connectivity.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.80 Billion |

| Market Forecast in 2033 | USD 12.52 Billion |

| Market Growth Rate 2025-2033 | 8.90% |

India Digital Business Card Market Trends:

Growing Adoption of Contactless and Paperless Networking Solutions

The India digital business card industry is proliferating as both professional and businesses are rapidly opting for paperless and contactless networking options. This intense inclination is influenced by elevating smartphone penetration, magnifying digitalization across key segments, and the demand for sustainable substitutes for conventional paper-based business cards. For instance, as per industry reports, in 2024, around 659 Million individuals across India owned a smartphone out of 1.42 Billion of the total population, exhibiting a smartphone penetration rate of 46.5%. Furthermore, digital business cards allow seamless information exchange through QR codes, near-field communication (NFC), and cloud-based sharing, enhancing convenience and reducing environmental impact. The COVID-19 pandemic further accelerated this trend as companies prioritized hygienic and remote-friendly communication methods. Additionally, businesses are incorporating digital business cards with customer relationship management (CRM) software to streamline contact management and lead generation. Organizations, especially in technology, finance, and corporate services, are investing in branded digital business cards to maintain a modern and professional image. As digital-first networking becomes the norm, the utilization of digital business cards is expected to grow among startups, freelancers, and enterprises seeking cost-effective and efficient communication tools.

To get more information on this market, Request Sample

Rising Demand from Small and Medium Enterprises (SMEs) and Startups

The increasing adoption of digital business cards among small and medium enterprises (SMEs) and startups is a major trend in the Indian market. Cost-conscious businesses are shifting to digital solutions to reduce printing expenses while improving networking efficiency. Digital business cards offer flexibility, allowing real-time updates and instant sharing across multiple platforms, making them ideal for dynamic business environments. The growing startup ecosystem, supported by government initiatives such as Startup India, is further driving demand for innovative digital networking solutions. For instance, as per industry reports, startup ecosystem across India is establishing itself as the third largest globally. In line with this, during March 2024, around 1,23,900 DPIIT-certified startups existed functionally. DPIIT is the Department for Promotion of Industry and Internal Trade announced the launch of several ventures through Startup India. Entrepreneurs and freelancers are leveraging digital business cards to establish a strong online presence, integrate social media links, and enhance brand visibility. Additionally, digital-first businesses in sectors like IT services, marketing, and consulting are using customized digital business cards to differentiate themselves. As digital transformation accelerates across industries, SMEs and startups are anticipated to play a crucial role in fueling the expansion of the digital business card market in India.

India Digital Business Card Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on platform, user type, and vertical.

Platform Insights:

- Android

- iOS

- Windows

The report has provided a detailed breakup and analysis of the market based on the platform. This includes android, iOS, and windows.

User Type Insights:

- Business User

- Enterprise User

- Individual User

A detailed breakup and analysis of the market based on the user type have also been provided in the report. This includes business user, enterprise user, and individual user.

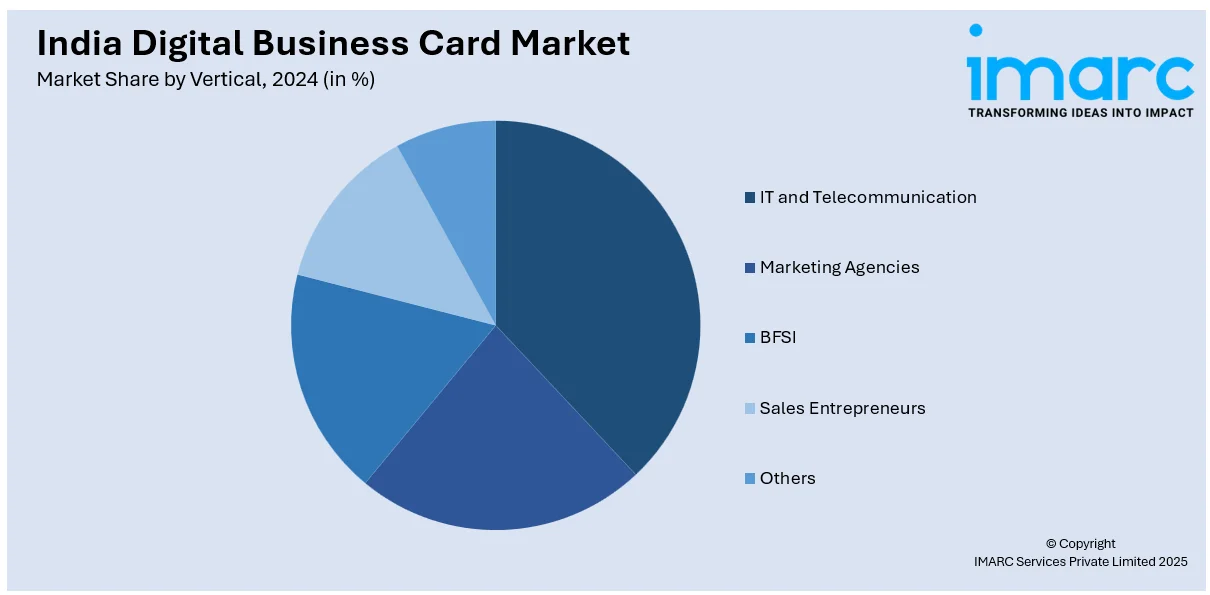

Vertical Insights:

- IT and Telecommunication

- Marketing Agencies

- BFSI

- Sales Entrepreneurs

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes IT and telecommunication, marketing agencies, BFSI, sales entrepreneurs, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Business Card Market News:

- In January 2024, mTap, a U.S.-based digital networking company, announced its business expansion across India by launching its digital business card platform that is developed to facilitate business cards through a link, single tap, or scan, reducing or terminating the dependence on physical business cards.

- In December 2024, MBG Card, as India-based SaaS firm, announced securing investment of USD 31.2 Million, which will be leveraged to boost marketing efforts and innovate product development for small and medium enterprises across India.

India Digital Business Card Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Android, iOS, Windows |

| User Types Covered | Business User, Enterprise User, Individual User |

| Verticals Covered | IT and Telecommunication, Marketing Agencies, BFSI, Sales Entrepreneurs, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India digital business card market performed so far and how will it perform in the coming years?

- What is the breakup of the India digital business card market on the basis of platform?

- What is the breakup of the India digital business card market on the basis of user type?

- What is the breakup of the India digital business card market on the basis of vertical?

- What is the breakup of the India digital business card market on the basis of region?

- What are the various stages in the value chain of the India digital business card market?

- What are the key driving factors and challenges in the India digital business card market?

- What is the structure of the India digital business card market and who are the key players?

- What is the degree of competition in the India digital business card market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital business card market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital business card market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital business card industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)