India Digital Health Records Market Size, Share, Trends and Forecast by Component, Deployment Mode, Application, End User, and Region, 2025-2033

India Digital Health Records Market Overview:

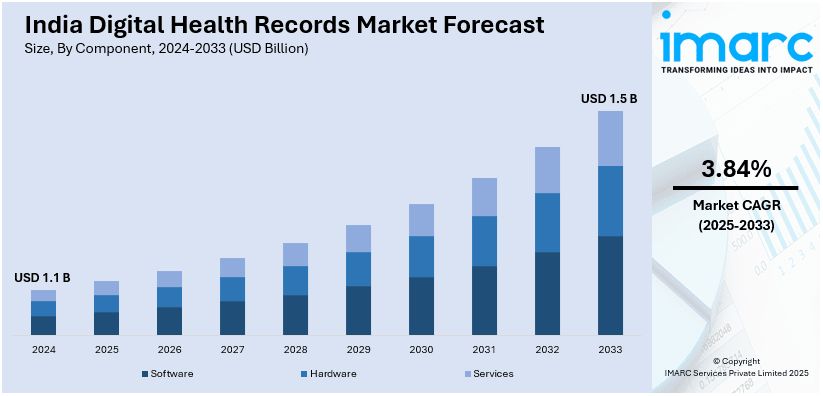

The India digital health records market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.5 Billion by 2033, exhibiting a growth rate (CAGR) of 3.84% during 2025-2033. The market is witnessing significant growth, driven by the growing adoption of electronic health records systems by healthcare providers and the emergence of interoperability and data security standards.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 1.5 Billion |

| Market Growth Rate 2025-2033 | 3.84% |

India Digital Health Records Market Trends:

Growing Adoption of Electronic Health Records (EHR) Systems by Healthcare Providers

The adoption of Electronic Health Records (EHR) systems among healthcare providers in India is rapidly increasing, driven by both government initiatives and the growing need for improved healthcare management. For instance, in September 2024, over 67 crore Ayushman Bharat Health Accounts (ABHA) were created, linking 42 crore health records for secure, seamless access, improving healthcare delivery and record management. There have been several programs launched by the Indian government for digitizing healthcare data, such as, the National Digital Health Mission (NDHM), which promotes EHR integration in any health facility. Hospitals, clinics, and healthcare providers make the shift to such systems due to the pressure of efficient patient data management, improved clinical decision-making, and patient care outcome benefits. Its major function is efficient storage and retrieval of patient information, reduced manual paperwork, and error-prone activities. This digitization of the healthcare system also facilitates real-time data sharing among the different service providers and enhances continuity of care. With telemedicine flourishing, there is increased demand for interoperable electronic health data that facilitates communication between patients and health providers. With time, as the healthcare providers understand the long-term cost benefits and operational efficiencies offered by EHR, these technologies literally have saturation. They are all accelerating a country's digital health records market.

To get more information on this market, Request Sample

Emergence of Interoperability and Data Security Standards

Interoperability and data security are becoming critical trends in India’s digital health records market, as the healthcare sector embraces digitalization. Interoperability ensures that health records can be easily shared across different systems and healthcare providers, which is crucial for improving patient care and reducing medical errors. The Indian government, through its National Health Stack (NHS) initiative, is promoting the adoption of interoperable standards for health data exchange. This includes frameworks that ensure the seamless sharing of patient data across different healthcare platforms and systems, enhancing collaboration between various healthcare stakeholders. Additionally, as patient data becomes more digitized, ensuring robust data security protocols is paramount to gaining public trust. The increase in cybersecurity threats, including data breaches, has made it necessary for healthcare providers to implement advanced security measures to protect sensitive health information. For instance, in 2024, cyber threats from servers hosted in India surged by 54% compared to 2023, with incidents exceeding 7 million, highlighting growing cybersecurity concerns. To address these concerns, regulatory bodies in India are setting stringent guidelines for the protection and privacy of health data. With the government pushing for a unified digital health infrastructure, the demand for secure, interoperable EHR systems is expected to continue growing. These trends are shaping the future of India’s digital health records market, creating opportunities for innovation and addressing critical challenges in healthcare data management.

India Digital Health Records Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on component, deployment mode, application, and end user.

Component Insights:

- Software

- Hardware

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software, hardware, and services.

Deployment Mode Insights:

- Cloud-Based

- On-Premises

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes cloud-based and on-premises.

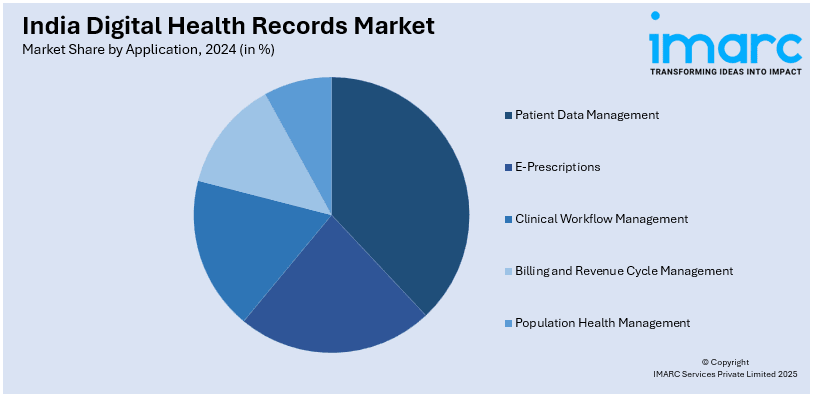

Application Insights:

- Patient Data Management

- E-Prescriptions

- Clinical Workflow Management

- Billing and Revenue Cycle Management

- Population Health Management

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes patient data management, e-prescriptions, clinical workflow management, billing and revenue cycle management, and population health management.

End User Insights:

- Hospitals and Clinics

- Diagnostic Centers

- Pharmacies

- Insurance Providers

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic centers, pharmacies, insurance providers, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Health Records Market News:

- In March 2025, Livlong 365, an OPD healthcare platform, announced that it anticipates significant user growth by FY2026 with its Ayushman Bharat Health Account (ABHA) integration. This initiative will strengthen ABHA linkages, drive digital health adoption, and streamline healthcare services, supporting the Ayushman Bharat Digital Mission’s objective of a unified digital health ecosystem.

India Digital Health Records Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Hardware, Services |

| Deployment Modes Covered | Cloud-Based, On-Premises |

| Applications Covered | Patient Data Management, E-Prescriptions, Clinical Workflow Management, Billing and Revenue Cycle Management, Population Health Management |

| End Users Covered | Hospitals and Clinics, Diagnostic Centers, Pharmacies, Insurance Providers, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital health records market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital health records market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital health records industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India digital health records market was valued at USD 1.1 Billion in 2024.

The India digital health records market is projected to exhibit a CAGR of 3.84% during 2025-2033, reaching a value of USD 1.5 Billion by 2033.

The India digital health records market is driven by government initiatives like the Ayushman Bharat Digital Mission, aiming to create a unified digital health ecosystem. The increasing prevalence of chronic diseases necessitating efficient data management, advancements in cloud-based solutions and rising internet penetration further enhance accessibility and adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)