India Digital OOH Advertising Market Size, Share, Trends and Forecast by Format Type, Application, End User, and Region, 2026-2034

India Digital OOH Advertising Market Size and Share:

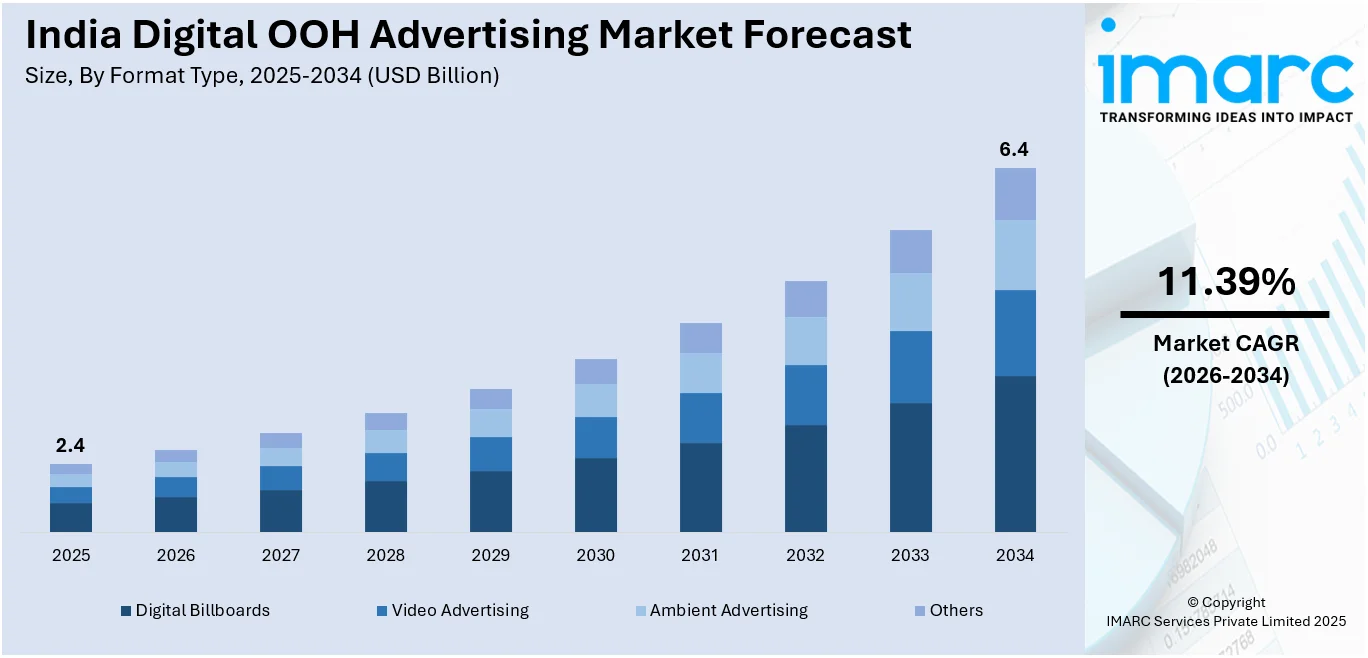

The India digital OOH advertising market size was valued at USD 2.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.4 Billion by 2034, exhibiting a CAGR of 11.39% during 2026-2034. West and Central India region currently dominates the market. The rise in commercial infrastructure like shopping malls, greater use of targeted marketing by SMEs, and progress in programmatic ad technology are contributing to market expansion. These factors are expected to positively influence the India digital OOH advertising market share in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2.4 Billion |

|

Market Forecast in 2034

|

USD 6.4 Billion |

| Market Growth Rate (2026-2034) | 11.39% |

Digital OOH advertising in India is expanding as urban infrastructure grows rapidly. The rise in smart city projects and metro rail expansions has opened new locations for digital billboards, transit media, and interactive displays. These installations allow brands to target high-footfall zones with dynamic, real-time messaging. As India's urban population rises and traffic congestion increases, commuters are spending more time in transit hubs and roadside corridors prime spots for digital signage exposure. Consumer engagement is also improving due to better screen technology and localized content. In recent months, Mumbai, Bengaluru, and Delhi have seen a surge in highway LED installations and in-transit digital panels, especially across metro stations and airports. In March 2025, Delhi Metro added programmatic-enabled displays across key Blue Line stations, enhancing real-time campaign adaptability. Additionally, smart kiosks with integrated Wi-Fi and QR-enabled promotions were deployed in parts of Hyderabad and Pune.

To get more information on this market Request Sample

A major pull factor is the format's compatibility with data-driven campaigns. Programmatic buying is slowly entering the Indian OOH space, allowing automated ad placements and dynamic creative optimization. In April 2025, multiple campaigns by food tech platforms in Bengaluru featured dayparted ads, highlighting breakfast offers in the morning and dinner promotions in the evening. Meanwhile, a premium apparel brand ran weather-triggered creatives in Mumbai, showcasing rainwear during peak showers. These examples reflect how brands are using environmental triggers and real-time updates to personalize content for viewers on the move. The ability to measure effectiveness through footfall tracking and mobile integrations is also pushing media planners to treat digital OOH as a performance-linked medium rather than just a branding tool.

India Digital OOH Advertising Market Trends:

Rising Adoption Across Business Segments

The market is witnessing strong momentum due to its ease of deployment and cost efficiency, which have made it an appealing choice for businesses. The increasing development of shopping centers and commercial spaces, along with broader infrastructure upgrades across cities, is expanding the footprint of digital advertising formats. Improvements in programmatic technology are also helping brands optimize outdoor campaigns more effectively. A growing number of businesses, particularly SMEs, are adopting DOOH to enhance brand exposure and connect with specific audience segments. By December 2024, over 5.70 Crore MSMEs employing 24.14 Crore people had registered on the Udyam Registration Portal and Udyam Assist Platform, indicating the expanding potential advertiser base. Businesses are also drawn to DOOH's ability to show multiple messages on a single screen, increasing ad value. Additionally, the increasing presence of high-quality digital displays capable of delivering timely and relevant content is shaping stronger campaign outcomes. New use cases, such as the integration of LCD screens in public buses for in-transit advertising, are adding to the market's expansion. These factors collectively contribute to a positive outlook for the digital OOH advertising segment in India, with greater reach and more adaptive communication strategies becoming central to its growth.

Shift Toward Real-Time Targeting

Digital OOH advertising in India is shifting from static content to real-time communication. Brands are looking for more flexible formats that allow them to tailor messages instantly based on traffic patterns, time of day, or audience demographics. This move aligns with the need for more precise outdoor marketing without relying solely on fixed schedules or manual updates. The demand for responsive content is rising due to growing urban mobility and increased smartphone usage. In February 2025, a leading online education brand launched a campaign across metro transit screens in Chennai, updating its messaging hourly to reflect live enrollment deadlines. Similarly, a retail chain in Ahmedabad displayed rotating offers based on peak shopping hours, made possible through real-time backend integrations. This adaptability ensures brands maintain relevance across changing consumer moods and local events. As technology continues to advance and digital display inventory grows, the market is experiencing a clear transition toward dynamic, moment-driven advertising. The use of location data and automated content switches is expected to shape how advertisers plan their campaigns, enhancing visibility and impact. This development is steadily pushing India digital OOH advertising market growth while giving brands stronger tools to influence consumer behavior.

SME Participation Enhancing Market Depth

Smaller businesses are beginning to see digital OOH as an accessible and effective way to reach local audiences. Earlier viewed as a space for large brands with national budgets, this format is now drawing attention from regional players who want visibility in specific areas. Custom targeting options and shorter campaign durations are encouraging adoption among SMEs. The trend is visible in Tier 2 and Tier 3 cities, where new entrants are using digital billboards outside malls, bus terminals, and business districts. In January 2025, a Jaipur-based clothing startup ran a 10-day campaign on LED screens near major traffic crossings, promoting its seasonal sale with city-specific creatives. Around the same time, a chain of dental clinics in Lucknow used transit shelter displays to broadcast service offers tied to local holidays. These campaigns reflect how SMEs are tailoring their outreach efforts through outdoor digital tools. Lower entry costs, combined with growing availability of inventory, are making it easier for local firms to test and optimize their marketing. As more small enterprises step in, the overall media landscape is becoming more diverse and competitive. This expansion of the advertiser base is expected to strengthen the India digital OOH advertising market and widen its operational scope.

India Digital OOH Advertising Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India digital OOH advertising market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on format type, application, and end user.

Analysis by Format Type:

- Digital Billboards

- Video Advertising

- Ambient Advertising

- Others

Digital billboards have emerged as a leading segment within India digital OOH advertising market outlook, offering a flexible and visually engaging medium for brand messaging. Their ability to deliver multiple advertisements on a single screen, combined with real-time content updates, is attracting advertisers across sectors. These billboards are highly visible in urban intersections, highways, and airport routes, enhancing recall and impact. Brands benefit from programmable scheduling and contextual targeting, improving audience reach during peak hours. With low maintenance and high creative flexibility, digital billboards dominate market spending today, reinforcing their role as a key driver shaping the future of India’s digital outdoor advertising landscape.

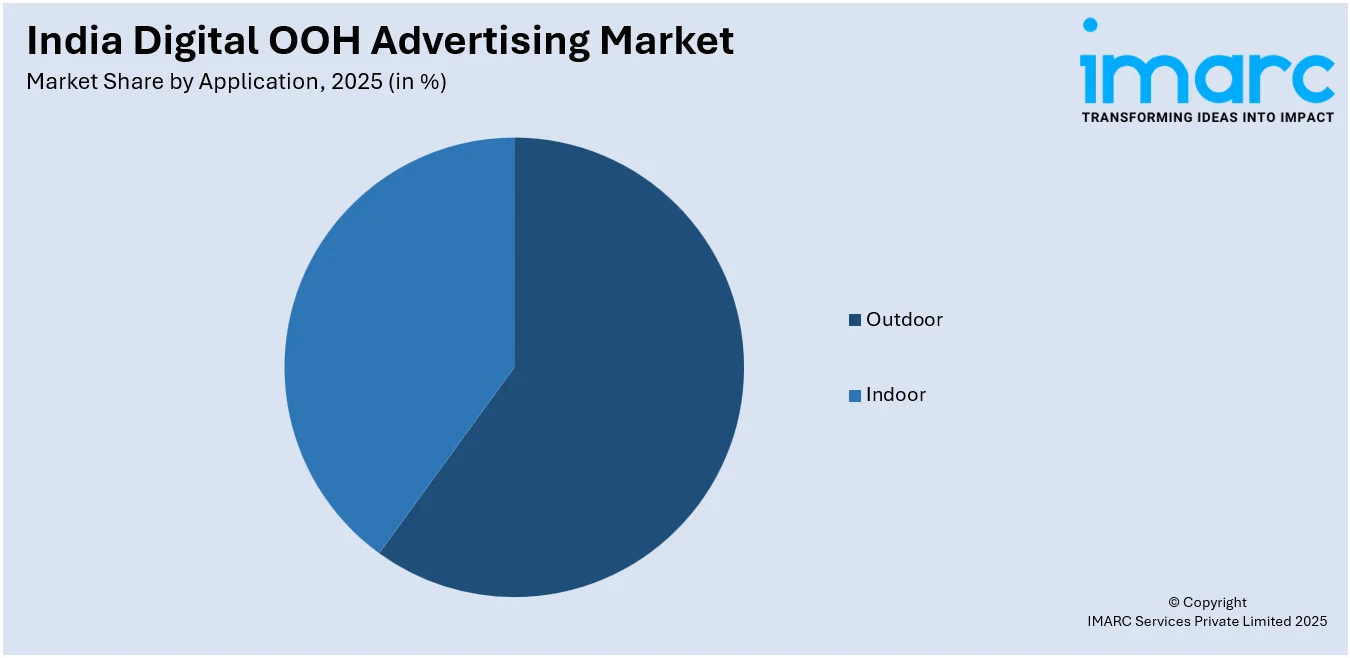

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Outdoor

- Indoor

Outdoor segment dominates the India digital OOH advertising market, offering widespread visibility across streets, transit systems, and public gathering spaces. These formats including digital hoardings, transport shelters, and LED walls enable advertisers to reach high-traffic areas without relying on personal devices. Their permanence in busy zones ensures repeated impressions, improving brand recognition. As India’s urban areas expand, outdoor DOOH formats are being adopted more for location-specific campaigns. In 2024, major campaigns were deployed across flyovers and metro corridors in Delhi and Bengaluru, reflecting the growing reliance on outdoor formats to drive reach. Their effectiveness continues to shape market leadership in the segment.

Analysis by End User:

- Retail

- Recreation

- Banking

- Transportation

- Education

- Others

Retail segment is driving the India digital OOH advertising market due to their close proximity to consumer decision points. Digital displays installed within malls, supermarkets, and storefronts offer brands a chance to deliver targeted offers at the moment of purchase intent. These screens often promote limited-time deals, festive collections, or loyalty programs. In December 2024, major retail hubs in Pune and Surat introduced motion-triggered ad displays, enhancing shopper interaction. Such innovations drive sales and increase footfall, prompting more brands to invest in retail-based DOOH. This segment now dominates ad volume within commercial retail zones, reinforcing its market strength.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

West and Central India are leading the India digital OOH advertising market, driven by rapid urbanization and infrastructure upgrades. Cities like Mumbai, Pune, Indore, and Nagpur have seen a rise in LED installations across roads, malls, and transport networks. These regions have benefited from the early deployment of smart city initiatives and local government support for tech-driven public spaces. In Q4 2024, new DOOH formats were launched in key intersections in Ahmedabad and Raipur, improving real-time advertising capabilities. Strong brand demand, higher consumer footfall, and better digital infrastructure have helped these zones dominate the DOOH market in terms of share and visibility. Moreover, some of the factors driving the West and Central India digital OOH advertising market include the growing construction of shopping malls, increasing awareness about the benefits of digital advertising, and rising adoption of digital transit. As regional investments and adoption continue to grow, West and Central India are expected to play a major role in shaping the India digital OOH advertising market forecast over the coming years.

Competitive Landscape:

Top companies in the India digital OOH advertising market are accelerating growth through the integration of cutting-edge technologies and well-planned alliances. These players are embracing tools such as programmatic advertising, AI-driven content delivery, and geotargeting to serve highly personalized and real-time messaging across screens in public spaces. Investments in next-generation digital signage solutions such as interactive kiosks, gesture recognition, and augmented reality are enhancing audience engagement and contributing to higher returns on ad spend. Strategic tie-ups with data analytics firms and ad tech platforms are also helping advertisers optimize campaign delivery and measurement. By combining location intelligence with behavioral data, firms are improving ad relevance and impact, especially in transit zones, malls, and urban hotspots.

The report also offers a detailed competitive landscape of the India digital OOH advertising space. It includes analysis of market structure, key player market shares, player positioning, top strategies adopted, and a visual evaluation through a competitive dashboard and company evaluation quadrant.

Latest News and Developments:

- March 2025: Bright Outdoor Media expanded its digital LED network in Mumbai by installing three new LED billboards. The new installations aim to enhance advertising capabilities and increase visibility in key locations across the city.

- February 2025: Doohit, a unified platform for OOH and DOOH advertising, made its soft launch at the DDX Asia 2025 event in Mumbai. The platform offers streamlined media inventory management, real-time bookings, and campaign tracking. Integrated with Roadstar, it provides valuable audience insights, enhancing advertising effectiveness.

- January 2025: Times OOH launched Digital Bus Shelters in Bengaluru, expanding its premium advertising assets. The 20 strategically placed shelters feature high-definition screens, offering dynamic, real-time content for brands targeting India’s vibrant market.

- December 2024: Aditya Birla Sun Life Insurance (ABSLI) launched an AI-driven interactive digital billboard as part of its #BoodheHokeKyaBanoge campaign. This DOOH advertising initiative invites participants to upload selfies, which are transformed into AI-generated images depicting their future selves in retirement. These personalized visuals are then displayed in real-time on the digital billboard, creating an engaging and memorable experience for the audience.

- October 2024: Tirupati Edible Oils launched the "Har Tyohaar Healthy Tyohaar, Healthy Waali Happiness" campaign in Ahmedabad in collaboration with Times OOH. This DOOH initiative features the brand's message on 114 digital billboards strategically placed across the city.

India Digital OOH Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Format Types Covered | Digital Billboards, Video Advertising, Ambient Advertising, Others |

| Applications Covered | Outdoor, Indoor |

| End Users Covered | Retail, Recreation, Banking, Transportation, Education, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital OOH advertising market from 2020-2034.

- The India digital OOH advertising market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within the region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital OOH advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital OOH advertising market in India was valued at USD 2.4 Billion in 2025.

The India digital OOH advertising market is projected to exhibit a CAGR of 11.39% during 2026-2034, reaching a value of USD 6.4 Billion by 2034.

Key factors driving the India digital OOH advertising market include rising urban infrastructure, increased SME marketing adoption, cost-effective digital formats, real-time content delivery, and growing use of programmatic technology. These elements are expanding reach, enhancing engagement, and improving campaign efficiency across various commercial and transit locations.

In 2025, West and Central India dominated the digital OOH advertising market, driven by the rapid expansion of urban infrastructure, high footfall in commercial zones, increased deployment of LED displays in transit areas, and early adoption of tech-enabled formats by local advertisers and governments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)