India Digital Payment Gateway Market Size, Share, Trends and Forecast by Type, Organization Size, Application, and Region, 2025-2033

India Digital Payment Gateway Market Overview:

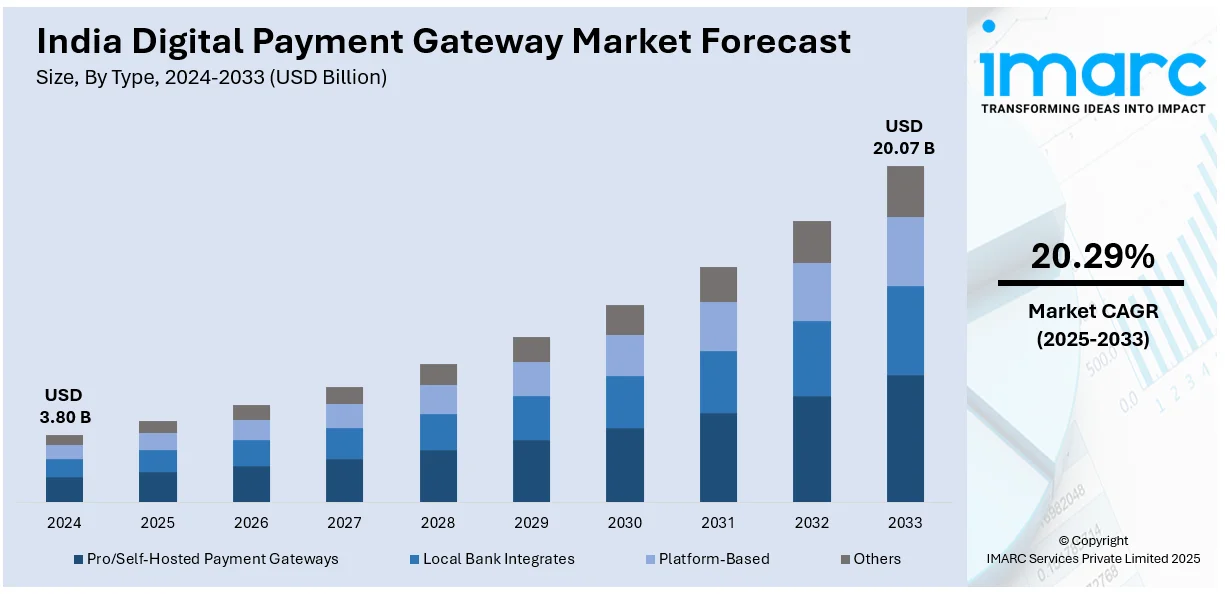

The India digital payment gateway market size reached USD 3.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 20.07 Billion by 2033, exhibiting a growth rate (CAGR) of 20.29% during 2025-2033. The market is driven by rising smartphone penetration, increasing internet connectivity, strong government initiatives like Digital India, growing e-commerce adoption, favorable regulatory policies, rising Unified Payments Interface (UPI) transactions, and expanding fintech innovations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.80 Billion |

| Market Forecast in 2033 | USD 20.07 Billion |

| Market Growth Rate 2025-2033 | 20.29% |

India Digital Payment Gateway Market Trends:

Surge in UPI Transactions and Real-Time Payments

The digital payment gateway market in India is experiencing exponential growth of UPI transactions because of the smartphone adoption, improvement in internet accessibility, and the government's active financial inclusion programs. For example, in 2024, the Union Cabinet approved a ₹1,500 crore scheme to promote low-value BHIM-UPI transactions among small merchants, aiming to strengthen the digital payment ecosystem. In addition, the real-time payment system, UPI, has revolutionized digital transactions by providing quick peer-to-peer (P2P) and merchant payment options, which are both convenient and affordable. Moreover, the implementation of UPI 2.0, together with AutoPay functions and UPI credit, and international payment system integration, enhances its growing usage. According to reports, in October 2024, UPI processed 16.58 billion transactions worth ₹23.49 lakh crore, marking a 45% year-on-year growth and underscoring India's shift towards a cashless economy. Furthermore, UPI-based solutions implemented by banks and fintech firms, and merchants result in the expansion of embedded finance and digital-first banking services. As a result, the expansion of UPI into rural areas through UPI Lite and offline payment initiatives is driving adoption to reach all segments of society and boosting the India digital payment gateway market share.

To get more information on this market, Request Sample

Rise of Contactless and Tokenized Payment Solutions

The India digital payment gateway market growth is spurred by users’ prioritizing security alongside convenience through contactless and tokenized payment solutions. In line with this, digital frauds in the market have triggered the Reserve Bank of India (RBI) and payment networks, such as Visa and Mastercard, to enforce tokenization strategies for security improvement. The process transition results in encrypted tokens that protect sensitive details and speed up transactions by decreasing fraud opportunities. Concurrently, numerous payment systems with Near Field Communication (NFC)-enabled tap-and-pay functions and QR-based payments, and biometric security methods are being rapidly integrated throughout urban retail areas and e-commerce sectors, and transit networks. Besides this, the Buy Now Pay Later (BNPL) service providers have adopted contactless payments to enable easy credit-based transactions. Additionally, digitally supported payment programs from governments, along with the rising adoption of payments through wearables, continue to form the path of digital commerce's future development. For example, in August 2024, Mastercard collaborated with boAt to enable tap-and-pay functionality on wearable devices, allowing users to tokenize their Mastercard cards for seamless transactions. Apart from this, businesses, along with consumers, are focusing on security combined with ease of payments, while tokenized and contactless payment technologies, thus enhancing the India digital payment gateway market outlook.

India Digital Payment Gateway Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, organization size, and application.

Type Insights:

- Pro/Self-Hosted Payment Gateways

- Local Bank Integrates

- Platform-Based

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes pro/self-hosted payment gateways, local bank integrates, platform-based, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

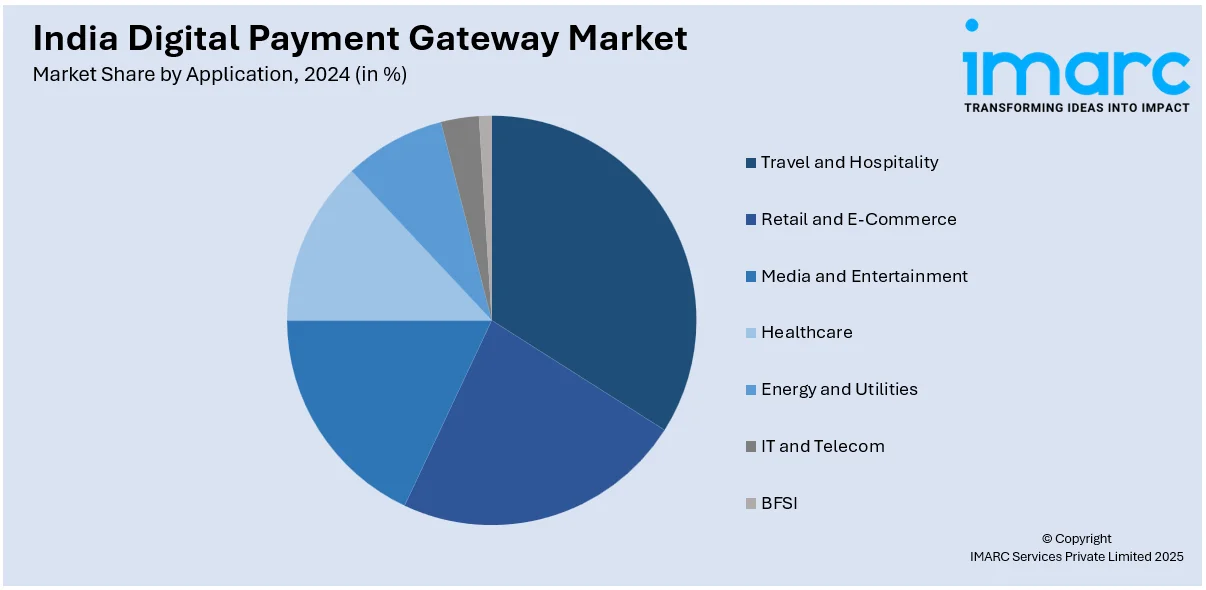

Application Insights:

- Travel and Hospitality

- Retail and E-Commerce

- Media and Entertainment

- Healthcare

- Energy and Utilities

- IT and Telecom

- BFSI

The report has provided a detailed breakup and analysis of the market based on the application. This includes travel and hospitality, retail and e-commerce, media and entertainment, healthcare, energy and utilities, IT and telecom, and BFSI.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Payment Gateway Market News:

- In March 2025, Mintoak, backed by PayPal and HDFC Bank, acquired Digiledge, marking India's first deal in the central bank digital currency (CBDC) space.This acquisition enhances Mintoak's capabilities in offering comprehensive CBDC-related payment solutions, benefiting partner banks like HDFC Bank, Axis Bank, and SBI.

- In January 2025, WhatsApp received approval to extend its payment services to all users in India, potentially reaching over 500 million individuals.This expansion aims to broaden the usage of the Unified Payments Interface (UPI) and enhance digital payment adoption.

India Digital Payment Gateway Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pro/Self-Hosted Payment Gateways, Local Bank Integrates, Platform-Based, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Applications Covered | Travel and Hospitality, Retail and E-Commerce, Media and Entertainment, Healthcare, Energy and Utilities, IT and Telecom, BFSI |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital payment gateway market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital payment gateway market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital payment gateway industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The digital payment gateway market in India was valued at USD 3.80 Billion in 2024.

The India digital payment gateway market is projected to exhibit a CAGR of 20.29% during 2025-2033, reaching a value of USD 20.07 Billion by 2033.

Key factors driving the India digital payment gateway market include rapid smartphone adoption, increased internet penetration, government initiatives promoting digital payments like Digital India, rising e-commerce activity, and the growing demand for secure, convenient payment methods from both individuals and businesses.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)