India Digital Video Content Market Size, Share, Trends and Forecast by Business Model, Type, Device, and Region, 2025-2033

India Digital Video Content Market Overview:

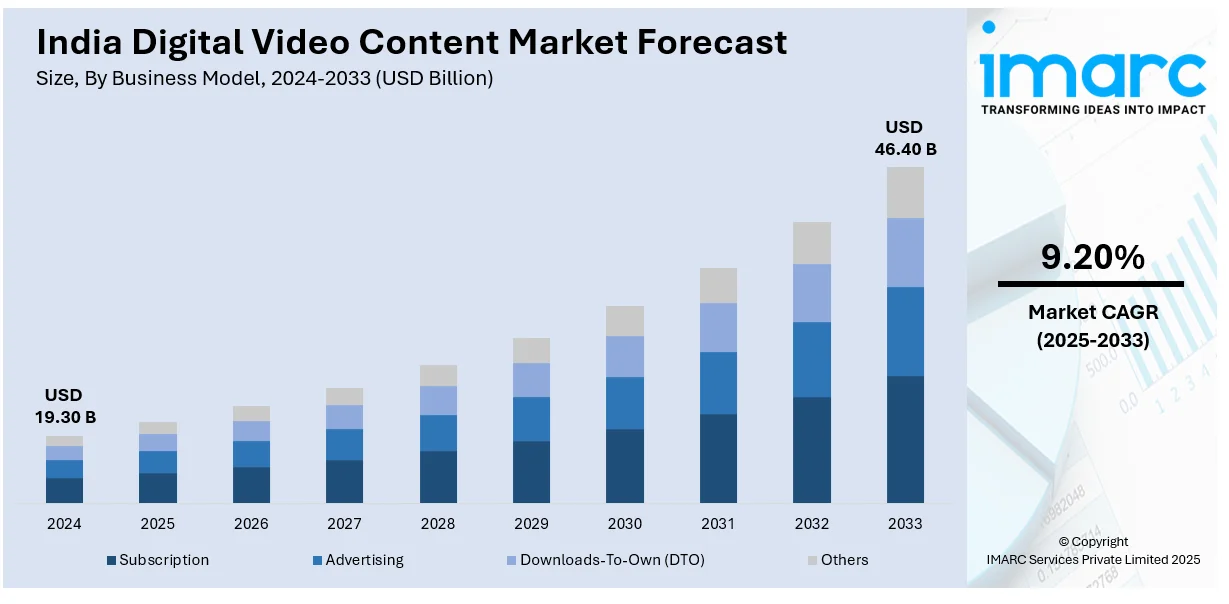

The India digital video content market size reached USD 19.30 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 46.40 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The increasing smartphone penetration, affordable data plans, rising internet accessibility, growing demand for regional content, expansion of OTT platforms, advancements in AI-driven content recommendations, digital advertising growth, changing consumer preferences, and increasing investments in original productions are expanding the India digital video content market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19.30 Billion |

| Market Forecast in 2033 | USD 46.40 Billion |

| Market Growth Rate (2025-2033) | 9.20% |

India Digital Video Content Market Trends:

Rising Demand for Regional and Vernacular Content

The India digital video content market growth is driven by an increase in demand for regional and vernacular content due to the increasing accessibility of the internet and smartphones across Tier 2 and Tier 3 cities. Notably, estimates issued on February 10, 2025, indicate that over 900 million Indians will be internet users by 2025. Growing smartphone use, affordable data plans, and evolving digital infrastructure will all contribute to this expansion. The government's Digital India strategy aims to improve healthcare delivery and make India a digitally equipped country through improved digital technology. With a diverse linguistic landscape, viewers are gravitating towards content that resonates with their cultural background and native language. Streaming platforms are investing heavily in localized content across various genres, including drama, comedy, and infotainment, to capture this growing audience base. Additionally, the rise of regional influencers and digital creators on platforms like YouTube, MX Player, and JioCinema is further fueling this trend. As more consumers prefer content in their native tongue, brands and advertisers are also tailoring their marketing strategies to target these segments effectively. This localization strategy is not only expanding audience reach but also fostering deeper engagement, making regional content a significant growth driver in the Indian digital video ecosystem.

To get more information on this market, Request Sample

Growth of Short-Form Video and User-Generated Content

Short-form video content has emerged as a dominant force in India’s digital video market, fueled by the popularity of platforms like Instagram Reels, YouTube Shorts, and Josh. The preference for bite-sized, engaging videos is reshaping content consumption habits, particularly among younger demographics. The rise of user-generated content has enabled individuals to become creators, driving a decentralized content economy where entertainment, education, and brand promotions seamlessly integrate. Social media algorithms prioritize high-engagement videos, further bolstering the visibility of trending short-form content. For instance, Redseer Strategy Consulting reports that as of November 28, 2024, local short-form video platforms in India are on the verge of a major breakthrough, with new revenue sources developing and their monetization models rapidly altering. These platforms together bring in between USD 95 and USD 100 Million in advertising revenue, which accounts for 1–1.5 percent of India's USD 10 Billion digital advertising market. Additionally, the accessibility of advanced video editing tools and AI-driven content recommendations is enhancing user experiences, encouraging higher participation in content creation. This trend is compelling traditional streaming platforms to integrate short-video formats into their offerings, ensuring they remain relevant in an increasingly fast-paced digital environment, which in turn is positively impacting India digital video content market outlook. As a result, short-form video content is not just an entertainment medium but a key driver of digital engagement and monetization in India.

India Digital Video Content Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on business model, type, and device.

Business Model Insights:

- Subscription

- Advertising

- Downloads-To-Own (DTO)

- Others

The report has provided a detailed breakup and analysis of the market based on the business model. This includes subscription, advertising, Downloads-To-Own (DTO), and others.

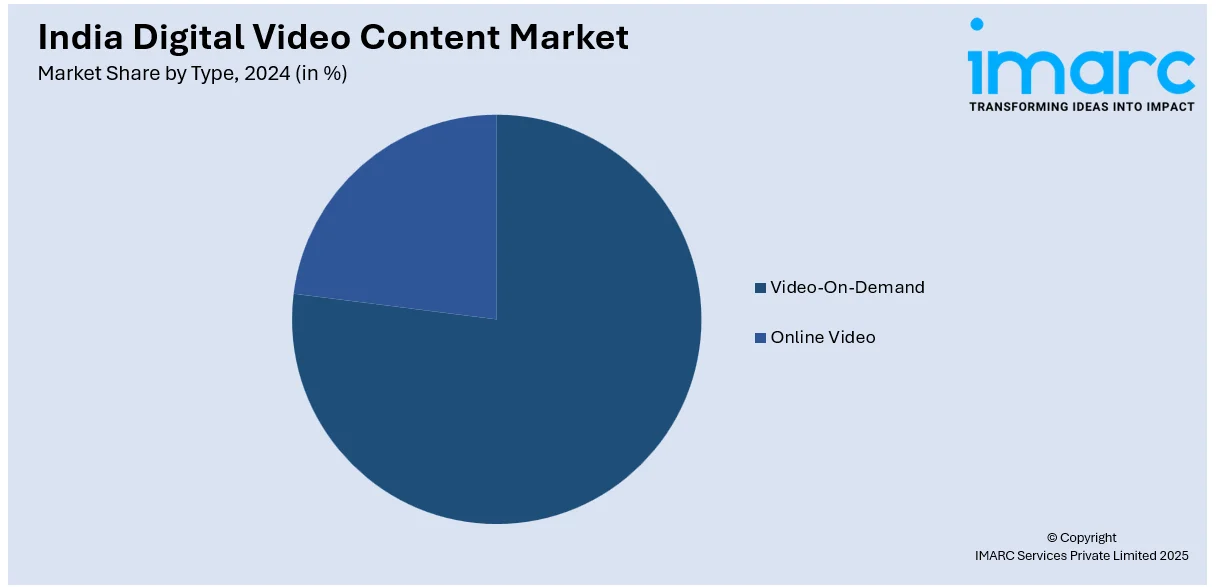

Type Insights:

- Video-On-Demand

- Online Video

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes video-on-demand and online video.

Device Insights:

- Laptop

- PC

- Mobile

- Others

A detailed breakup and analysis of the market based on the device have also been provided in the report. This includes laptop, PC, mobile, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Digital Video Content Market News:

- On January 14, 2025, DigiComm Marketing Services LLP, a digital marketing firm with headquarters in the National Capital Region, announced the launch of City News Channel-24 (CNC-24), a YouTube platform designed to provide timely news and perspectives on a range of subjects. The platform, which will be available on YouTube and popular social media platforms, will give a wide audience access to both local and international viewpoints.

India Digital Video Content Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Subscription, Advertising, Downloads-To-Own (DTO), Others |

| Types Covered | Video-On-Demand, Online Video |

| Devices Covered | Laptop, PC, Mobile, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India digital video content market performed so far and how will it perform in the coming years?

- What is the breakup of the India digital video content market on the basis of business model?

- What is the breakup of the India digital video content market on the basis of type?

- What is the breakup of the India digital video content market on the basis of device?

- What is the breakup of the India digital video content market on the basis of region?

- What are the various stages in the value chain of the India digital video content market?

- What are the key driving factors and challenges in the India digital video content market?

- What is the structure of the India digital video content market and who are the key players?

- What is the degree of competition in the India digital video content market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India digital video content market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India digital video content market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India digital video content industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)