India Distributed Energy Resources Market Size, Share, Trends and Forecast by Type, Connectivity, Technology, End-User, and Region, 2025-2033

India Distributed Energy Resources Market Overview:

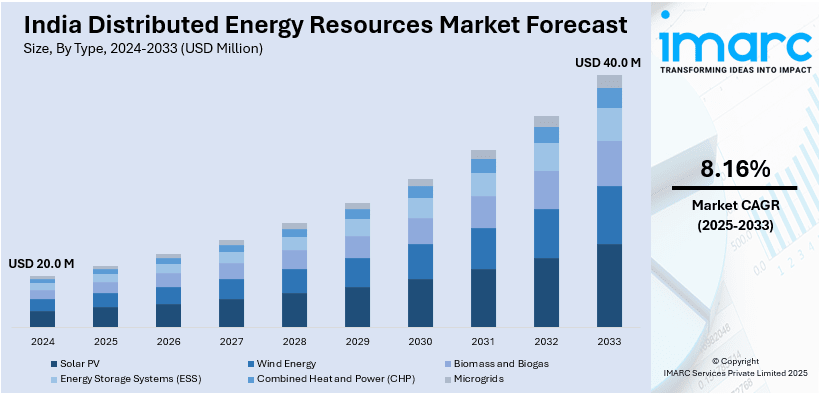

The India distributed energy resources market size reached USD 20.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 40.0 Million by 2033, exhibiting a growth rate (CAGR) of 8.16% during 2025-2033. The market is growing, fueled by the adoption of renewable energy, grid modernization, and technology. Microgrids, battery storage systems, and smart grid solutions are improving energy reliability, lowering carbon emissions, and enabling the government's clean energy objectives, thereby making the country's energy infrastructure more robust.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 20.0 Million |

| Market Forecast in 2033 | USD 40.0 Million |

| Market Growth Rate 2025-2033 | 8.16% |

India Distributed Energy Resources Market Trends:

Advancing Grid Reliability with Smart Solutions

India's market for distributed energy resources has registered substantial progress through the integration of advanced technologies for grid reliability enhancement. As India is advancing on the path towards integrating renewable energy, smart control, and monitoring strategies are gaining traction for the sustainability of the grid. Emphasis on developing the distribution network is important in support of rising demands for renewable energy and electric vehicle (EV) charging stations. For example, in October 2024, Hitachi Energy launched the Relion REF650, a smart protection and control relay designed to optimize medium voltage power distribution. Offering improved flexibility, modularity, and security, the REF650 supports efficient management of complex grid networks. It improves fault detection, quick response, and avoiding grid failure. This release fits the government initiatives under the Revamped Distribution Sector Scheme (RDSS) of modernizing India's power grid infrastructure. Addressing increasing power requirements, REF650 facilitates renewable energy sources and electric vehicle charging station integration. Its smart functionalities enhance grid resilience and operational efficiency, minimizing power outage risks. Meanwhile, as the energy transition gains pace, the uptake of smart grid technologies such as the REF650 is likely instrumental in ensuring a stable and consistent electricity supply in India.

To get more information on this market, Request Sample

Sustainable Energy Transition Through Microgrids

Solar microgrids with energy storage systems have emerged as a crucial part of India's energy sustainability plan. Microgrids provide stable power supply in isolated locations, curb fossil fuel usage, and allow for hassle-free integration of green energy sources. As the nation aims for net-zero emissions by 2070, microgrid schemes are likely to propel distributed energy resource growth. For instance, in September 2024, Honeywell commissioned India’s first on-grid solar microgrid with a 1.4 MWh battery energy storage system (BESS) in Lakshadweep. The microgrid provides clean and stable power to the island, reducing the reliance on diesel generators. Integrated with Honeywell’s Energy Management System (EMS) and Microgrid Controller, it ensures effective power distribution while maintaining grid stability. This project marked a major milestone in using BESS for renewable energy management. By reducing diesel consumption by 19.8 million liters and offsetting 58,000 Tons of carbon emissions, the microgrid significantly minimized environmental impact. It also set a benchmark for other island and remote grid systems, promoting clean energy adoption. The successful implementation of Honeywell’s microgrid in Lakshadweep highlighted the potential of battery storage in strengthening decentralized energy infrastructure, contributing to a greener and resilient energy future.

India Distributed Energy Resources Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, connectivity, technology, and end-user.

Type Insights:

- Solar PV

- Wind Energy

- Biomass and Biogas

- Energy Storage Systems (ESS)

- Combined Heat and Power (CHP)

- Microgrids

The report has provided a detailed breakup and analysis of the market based on the type. This includes solar PV, wind energy, biomass and biogas, energy storage systems (ESS), combined heat and power (CHP), and microgrids.

Connectivity Insights:

- On-Grid

- Off-Grid

- Hybrid Systems

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes on-grid, off-grid, and hybrid systems.

Technology Insights:

- Distributed Generation

- Distributed Storage

- Demand Response Technologies

- Smart Grid and IoT Integration

The report has provided a detailed breakup and analysis of the market based on the technology. This includes distributed generation, distributed storage, demand response technologies, and smart grid and IoT integration.

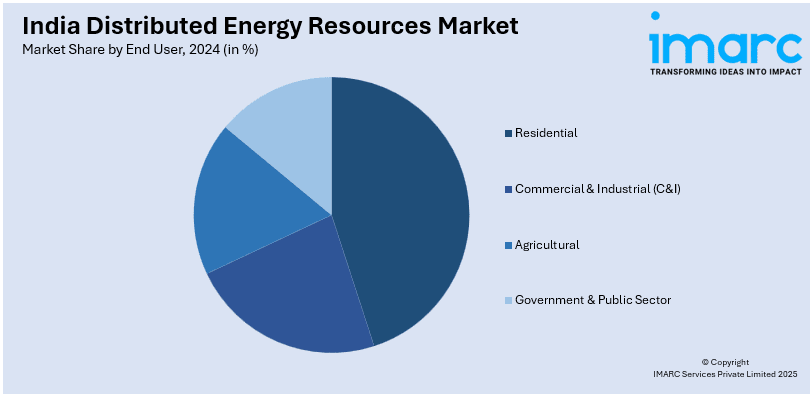

End User Insights:

- Residential

- Commercial & Industrial (C&I)

- Agricultural

- Government & Public Sector

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial & industrial (C&I), agricultural, and government & public sector.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Distributed Energy Resources Market News:

- March 2025: Senvion India surpassed 1 GW of installed wind turbine capacity, supporting renewable energy growth. With 80% localization under the 'Make in India' initiative, the milestone boosted local manufacturing, enhanced energy security, and strengthened India’s distributed energy resources industry.

- January 2025: The Ministry of New and Renewable Energy (MNRE) notified the revised Quality Control Order for solar photovoltaic products. Enforcing stricter standards for modules, inverters, and batteries, it improved product reliability, enhanced safety, and supported the growth of distributed energy resources in India.

India Distributed Energy Resources Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solar PV, Wind Energy, Biomass and Biogas, Energy Storage Systems (ESS), Combined Heat and Power (CHP), Microgrids |

| Connectivities Covered | On-Grid, Off-Grid, Hybrid Systems |

| Technologies Covered | Distributed Generation, Distributed Storage, Demand Response Technologies, Smart Grid and IoT Integration |

| End Users Covered | Residential, Commercial & Industrial (C&I), Agricultural, Government & Public Sector |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India distributed energy resources market performed so far and how will it perform in the coming years?

- What is the breakup of the India distributed energy resources market on the basis of type?

- What is the breakup of the India distributed energy resources market on the basis of connectivity?

- What is the breakup of the India distributed energy resources market on the basis of technology?

- What is the breakup of the India distributed energy resources market on the basis of end user?

- What are the various stages in the value chain of the India distributed energy resources market?

- What are the key driving factors and challenges in the India distributed energy resources market?

- What is the structure of the India distributed energy resources market and who are the key players?

- What is the degree of competition in the India distributed energy resources market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India distributed energy resources market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India distributed energy resources market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India distributed energy resources industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)