India Drop Shipping Market Size, Share, Trends and Forecast by Product, and Region, 2025-2033

India Drop Shipping Market Overview:

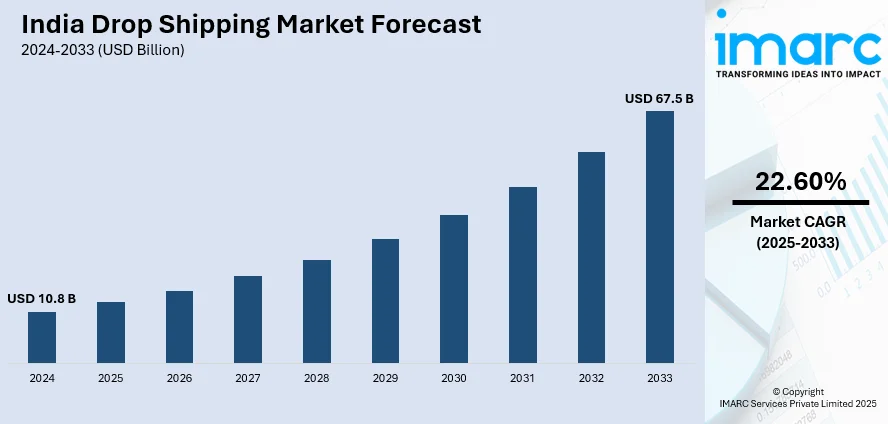

The India drop shipping market size reached USD 10.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 67.5 Billion by 2033, exhibiting a growth rate (CAGR) of 22.60% during 2025-2033. Rising internet penetration, growth of e-commerce platforms, increasing smartphone usage, low initial investment, no inventory management costs, ease of business setup, expanding digital payment infrastructure, access to global suppliers, rising demand for niche products, and government support for small businesses are expanding India drop shipping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.8 Billion |

| Market Forecast in 2033 | USD 67.5 Billion |

| Market Growth Rate 2025-2033 | 22.60% |

India Drop Shipping Market Trends:

Growing Popularity of Niche-Based Drop Shipping in India

The India drop shipping market growth is driven by the increase niche-based stores as entrepreneurs focus on specialized products rather than generic items. With increasing competition, sellers are targeting specific customer segments, such as eco-friendly products, fitness accessories, and ethnic fashion. The rise of digital marketing, particularly through Instagram and Facebook ads, has made it easier for drop shippers to reach targeted audiences. Additionally, platforms like Shopify, WooCommerce, and Indian marketplaces such as Meesho are supporting this trend by providing user-friendly tools for store management. For instance, Meesho, an e-commerce platform, stated in February 2025 that it would integrate more unbranded retailers and MSMEs into its platform in order to boost sales by 50% over the next year. By striking a balance between branded and unbranded products, this program hopes to enable small firms to prosper in online sales. By 2027, Meesho hopes to have onboarded 10 million small enterprises, a substantial increase from its present seller base of 1.3 million.In order to facilitate prompt and effective deliveries, the company is also growing its logistics relationships, especially in high-growth areas like West Bengal. Payment gateways like Razorpay and PayU have further facilitated seamless transactions, enhancing consumer trust. As Indian consumers become more comfortable with online shopping, niche drop shipping is expected to grow, offering better profit margins and lower competition compared to general stores. The trend is likely to strengthen as more entrepreneurs leverage artificial intelligence and data analytics to optimize product selection and customer engagement.

To get more information on this market, Request Sample

Integration of AI and Automation in Drop Shipping Operations

Automation and artificial intelligence (AI) are revolutionizing the Indian drop shipping market, making operations more efficient and scalable. AI-powered tools are being used for product selection, inventory management, and customer service, reducing manual workload and improving accuracy. Chatbots, predictive analytics, and automated email marketing are helping dropshippers personalize user experiences and boost conversions. Platforms such as Oberlo and Spocket integrate with Indian e-commerce stores, allowing seamless product sourcing from global suppliers. Additionally, AI-driven pricing optimization ensures competitive pricing, while fraud detection mechanisms minimize risks associated with online transactions. The increased reliance on automation has made drop shipping a more viable and less labor-intensive business model, encouraging new entrepreneurs to enter the industry. As AI technology continues to advance, Indian dropshippers will benefit from enhanced efficiency, reduced operational costs, and improved customer retention, thereby positively impacting the India drop shipping market outlook. Notably, India's notable progress in artificial intelligence (AI) under Prime Minister Modi's direction was reported by the Press Information Bureau on March 6, 2025. In order to establish India as a leader in AI worldwide, the government has set aside INR 10,300 Crore over five years to improve AI capabilities, including building a high-end computer center with 18,693 GPUs.

India Drop Shipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product.

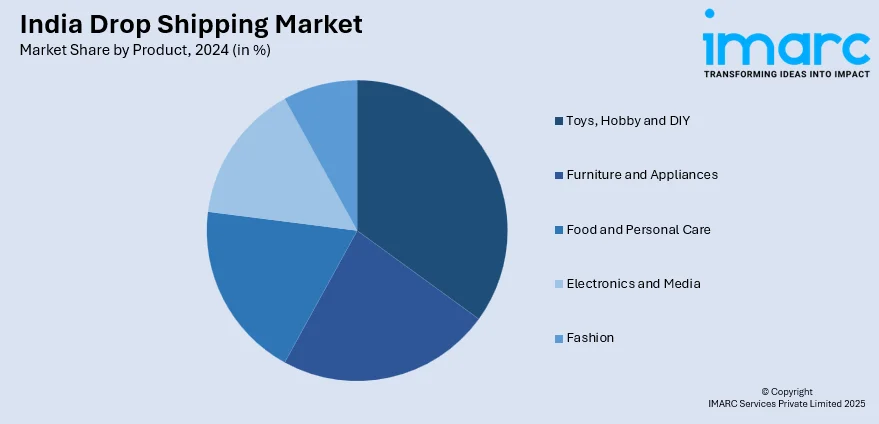

Product Insights:

- Toys, Hobby and DIY

- Furniture and Appliances

- Food and Personal Care

- Electronics and Media

- Fashion

The report has provided a detailed breakup and analysis of the market based on the product. This includes toys, hobby and DIY, furniture and appliances, food and personal care, electronics and media, and fashion.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Drop Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Toys, Hobby and DIY, Furniture and Appliances, Food and Personal Care, Electronics and Media, Fashion |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India drop shipping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India drop shipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India drop shipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The drop shipping market in India was valued at USD 10.8 Billion in 2024.

The India drop shipping market is projected to exhibit a CAGR of 22.60% during 2025-2033, reaching a value of USD 67.5 Billion by 2033.

The India drop shipping market is driven by robust growth in e-commerce platforms and social commerce, low startup costs and barriers to entry, expanding mobile/internet penetration paired with digital payment infrastructure, and improved logistics, including hyperlocal and same-day delivery, enabling broad merchant participation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)