India Dust Control Solutions Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2025-2033

India Dust Control Solutions Market Overview:

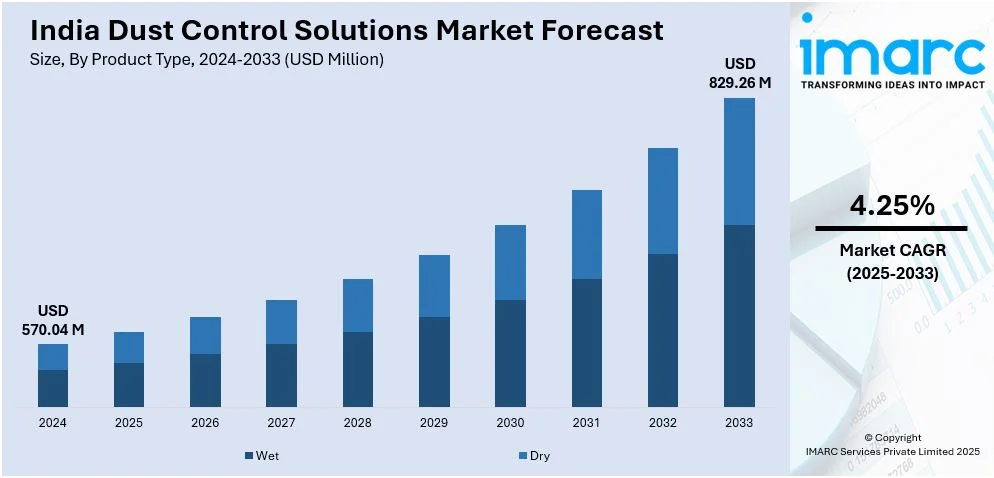

The India dust control solutions market size reached USD 570.04 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 829.26 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The strict environmental regulations, rising construction and mining activities, increasing awareness of occupational health hazards, growing infrastructure projects, industrial expansion, and the adoption of advanced dust suppression technologies to improve air quality and worker safety are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 570.04 Million |

| Market Forecast in 2033 | USD 829.26 Million |

| Market Growth Rate 2025-2033 | 4.25% |

India Dust Control Solutions Market Trends:

Rising Focus on Dust Management in Urban Development

Stricter dust control measures are becoming a priority in India's urban development sector. Regulatory bodies are enforcing advanced dust suppression technologies, including material covers, water sprinklers, and real-time air quality monitoring. This shift is driven by increasing pollution concerns and the need for compliance with evolving environmental regulations. Construction activities are integrating more efficient dust management solutions to mitigate health risks and improve air quality. With rapid urbanization and infrastructure expansion, industries are adopting innovative methods to reduce particulate emissions, signaling a broader shift toward sustainable and responsible building practices in major cities. For example, in December 2024, Mumbai Metropolitan Region Development Authority (MMRDA) implemented stricter dust control measures at Mumbai construction sites to tackle rising pollution levels. Enhanced regulations mandate advanced dust suppression systems, covering materials, and real-time air quality monitoring. This move reflects India’s growing focus on dust management in urban development, aligning with increasing demand for efficient dust control solutions in construction. The initiative supports cleaner air and compliance with evolving environmental standards.

To get more information on this market, Request Sample

Advancing Filtration Technology for Industrial Dust Control

Industries are increasingly adopting advanced dust collection and remote monitoring solutions to improve air quality and regulatory compliance. With rising industrialization and stricter environmental norms, demand for efficient filtration systems is growing across manufacturing, construction, and mining sectors. Companies are integrating smart monitoring technologies to enhance dust control efficiency and reduce maintenance downtime. The shift toward real-time data-driven filtration management is enabling better workplace safety and operational efficiency. As industries focus on sustainable air quality solutions, the adoption of high-performance dust control systems is becoming a key strategy for maintaining compliance and optimizing productivity. For instance, in March 2024, Donaldson India Filtration Systems established an experience center in Chakan, Pune, showcasing advanced dust collectors and iCue Connected Filtration Service for remote monitoring. This move aligns with India's growing demand for efficient dust control solutions amid rising industrialization and stricter environmental norms. The facility highlights Donaldson’s focus on enhancing filtration technology adoption in sectors like manufacturing, construction, and mining.

India Dust Control Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type and application.

Product Type Insights:

- Wet

- Wet Scrubbers

- Wet Electrostatic Precipitators (WEPS)

- Dry

- Bag Dust Collectors

- Cyclone Dust Collectors

- Electrostatic Dust Collectors

- Vacuum Dust Collectors

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes wet (wet scrubbers and wet electrostatic precipitators (WEPS)) and dry (bag dust collectors, cyclone dust collectors, electrostatic dust collectors, vacuum dust collectors, and others).

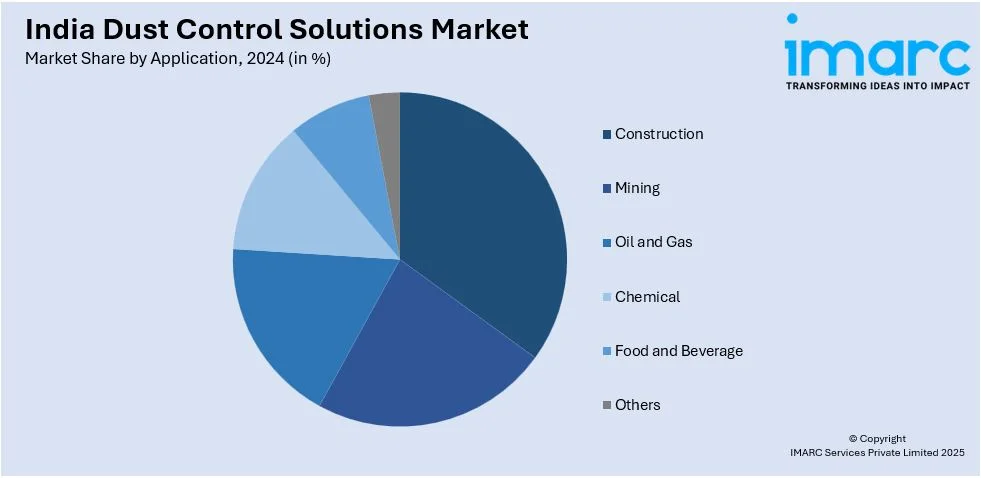

Application Insights:

- Construction

- Mining

- Oil and Gas

- Chemical

- Food and Beverage

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction, mining, oil and gas, chemical, food and beverage, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Dust Control Solutions Market News:

- In February 2025, Nagpur Municipal Corporation (NMC) announced its plans to introduce a mobile sprinkling vehicle to control dust pollution in the city. This initiative aims to improve air quality by reducing airborne dust from roads and construction sites. The move highlights the increasing adoption of advanced dust suppression technologies in India’s urban areas, reflecting the rising demand for efficient dust control solutions to meet environmental standards and public health concerns.

- In June 2024, Bosch Power Tools expanded its 18V cordless lineup, catering to industries requiring efficient dust control solutions in India. With growing industrialization and stricter workplace safety regulations, demand for advanced dust management tools is rising. Bosch’s latest innovations enhance productivity in sectors like construction and manufacturing, aligning with India's increasing focus on efficient, cordless, and high-performance dust control technologies.

India Dust Control Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Construction, Mining, Oil and Gas, Chemical, Food and Beverage, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India dust control solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the India dust control solutions market on the basis of product type?

- What is the breakup of the India dust control solutions market on the basis of application?

- What are the various stages in the value chain of the India dust control solutions market?

- What are the key driving factors and challenges in the India dust control solutions?

- What is the structure of the India dust control solutions market and who are the key players?

- What is the degree of competition in the India dust control solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India dust control solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India dust control solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India dust control solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)