India E-Bike Market Size, Share, Trends and Forecast by Propulsion Type, Battery Type, Power, Application, and Region, 2026-2034

India E-Bike Market Summary:

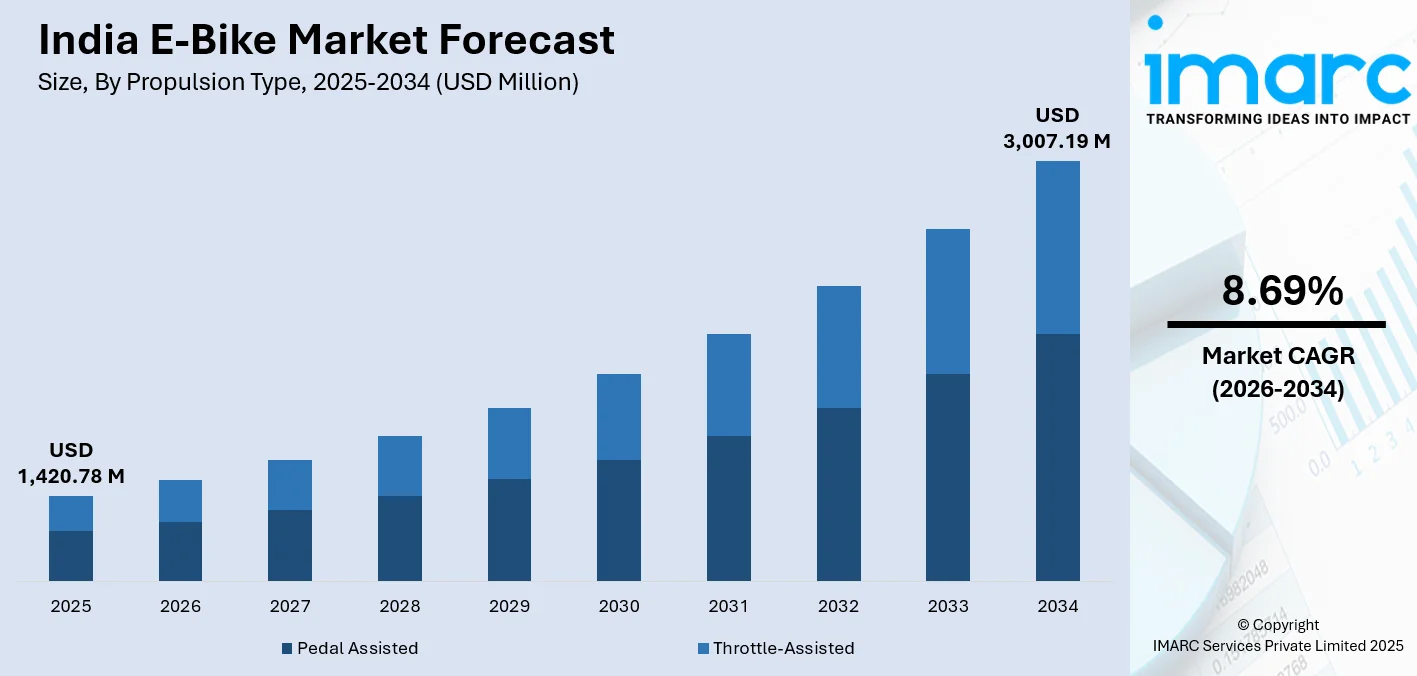

The India E-bike market size was valued at USD 1,420.78 Million in 2025 and is projected to reach USD 3,007.19 Million by 2034, growing at a compound annual growth rate of 8.69% from 2026-2034.

The Indian e-bike market is registering incredible growth due to the rising fuel cost, environmental consciousness, and supportive government incentives pushing the adoption of electric mobility solutions. The rising cases of urbanization, traffic snarls, and affordability associated with last-mile transportation solutions have increased the demand for market acceptance. Meanwhile, improvements in battery technology, rising environmental awareness with regard to healthy living and fitness benefits, also influence the trend towards the use of electric bicycles.

Key Takeaways and Insights:

- By Propulsion Type: Pedal assisted dominate the market with a share of 82% in 2025, driven by their optimal balance between manual pedaling and electric assistance, lower operating costs, and suitability for fitness-conscious urban commuters seeking eco-friendly transportation alternatives.

- By Battery Type: Lithium-ion battery leads the market with a share of 85% in 2025, owing to superior energy density, lighter weight, longer lifespan, faster charging capabilities, and enhanced performance characteristics compared to traditional lead-acid alternatives.

- By Power: Less than and equal to 250W represents the largest segment with a market share of 70% in 2025, attributable to regulatory compliance requirements, affordability, suitability for daily urban commuting, and alignment with government incentive programs targeting low-power electric vehicles.

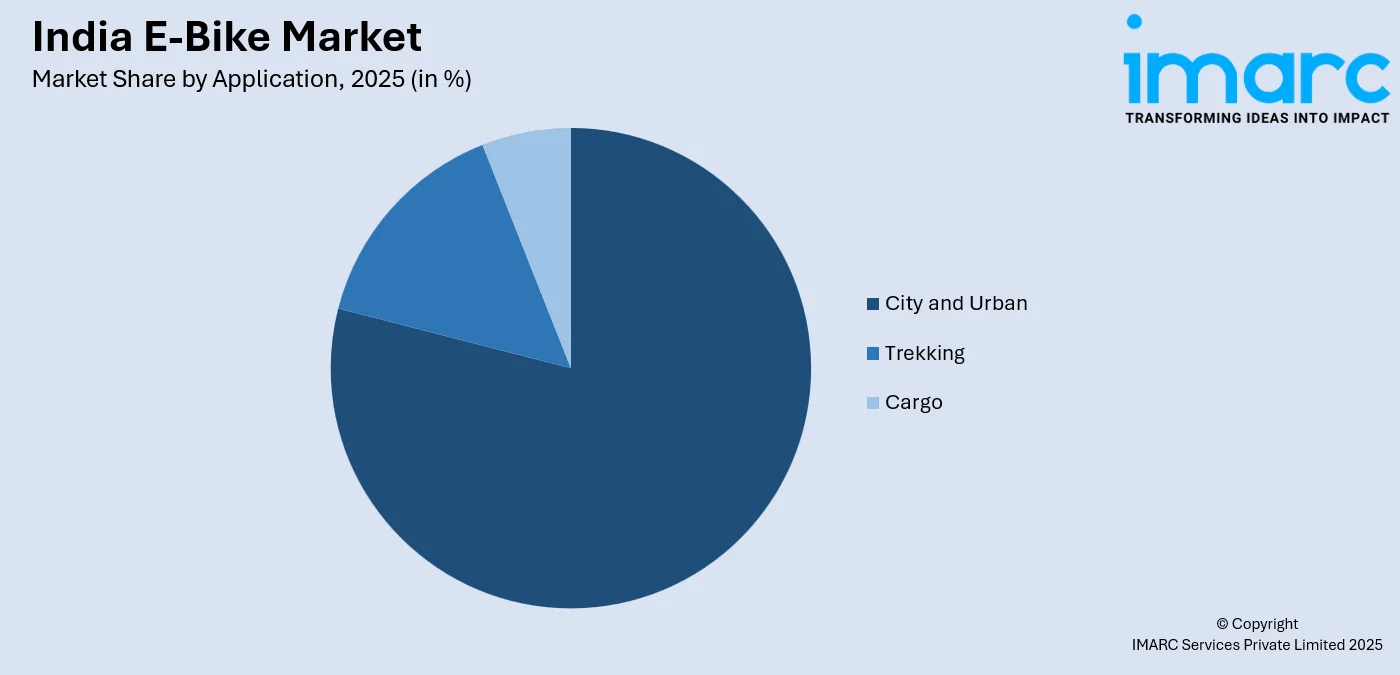

- By Application: City and urban dominates with a share of 79% in 2025, driven by growing urban population, traffic congestion challenges, last-mile connectivity requirements, and increasing adoption among daily commuters seeking efficient and eco-friendly transportation solutions.

- By Region: North India dominates the market with a share of 30% in 2025, supported by high urbanization levels, favorable government policies, established distribution networks, and growing consumer awareness regarding sustainable mobility options.

- Key Players: The India e-bike market exhibits a dynamic competitive landscape with established bicycle manufacturers and emerging electric mobility startups competing for market share. Key players are focusing on product innovation, battery technology advancement, and expanding distribution networks to capture growing consumer demand for sustainable transportation. Some of the players operating in the market include, Elecson, EMotorad (Inkodop Technologies Private Limited), Hero Lectro E-Cycles, Lekeamp, Ninety One Cycles, SK Ebicycle LLP, Stryder Cycle Pvt Ltd, Toutche Electric, Virtus Motors Private Limited, Voltebyk, and Voltrix Mobility Private Limited.

To get more information on this market Request Sample

The India e-bike market is undergoing transformative growth propelled by the convergence of environmental consciousness, economic practicality, and technological advancement. Rising fuel costs and growing concerns over vehicular emissions are driving consumers toward electric alternatives for daily commuting. India’s transition is also reflected in the broader e-2W landscape, where TVS Motor overtook Ola Electric to become the leading electric two-wheeler maker in 2025, underscoring intensifying competition and adoption in electric mobility. The government's comprehensive policy framework supporting electric vehicle adoption through subsidies, tax benefits, and infrastructure development is creating favorable market conditions. Urbanization and the associated traffic congestion challenges are positioning e-bikes as efficient last-mile connectivity solutions. The expanding fitness culture and health awareness among urban populations are contributing to pedal-assisted e-bike adoption. Continuous improvements in battery technology, including enhanced range and reduced charging times, are addressing consumer concerns and accelerating mainstream acceptance.

India E-Bike Market Trends:

Growing Adoption of Smart and Connected E-Bikes

The India e-bike market is witnessing significant integration of smart connectivity features that enhance user experience and functionality. Modern e-bikes are increasingly equipped with Internet of Things capabilities enabling smartphone connectivity, real-time performance monitoring, and GPS navigation. Recently, in December 2025, Indian e-mobility brand EMotorad launched the T-Rex Smart, touted as India’s first connected e-cycle with built-in Bluetooth and GPS that pairs with a dedicated app for real-time trip tracking, route history, and performance insights, highlighting the shift toward intelligent e-bike offerings in the country. Connected features include mobile applications for vehicle diagnostics, battery health tracking, trip planning, and anti-theft systems.

Expansion of Last-Mile Delivery Applications

E-bikes are increasingly being adopted for commercial last-mile delivery operations across India's rapidly growing e-commerce and food delivery sectors. The surge in online shopping and hyperlocal delivery services has created substantial demand for cost-effective and efficient delivery vehicles. For example, Sun Mobility partnered with Swiggy in 2023 to power over 15,000 e-bikes in Swiggy’s last-mile delivery fleet using battery-swapping technology, demonstrating large-scale industry adoption of e-bikes for deliveries. E-bikes offer significant advantages including lower operating costs, ability to navigate congested urban streets, and reduced environmental impact. Cargo-specific e-bike models with enhanced load-carrying capacity are being developed to meet commercial requirements. This commercial application segment is emerging as a significant growth driver for the overall market.

Advancement in Battery Technology and Range Enhancement

Continuous technological improvements in battery systems are addressing range anxiety concerns that previously limited e-bike adoption. Lithium-ion battery technology advancements are delivering higher energy density, longer cycle life, and faster charging capabilities. For instance, Wardwizard Innovations partnered with Battery Smart in 2025 to introduce a battery-swapping “battery-as-a-service” model for its Joy e-bikes, enabling riders to swap depleted batteries at stations across major cities, a move that directly tackles range anxiety and charging convenience. Manufacturers are introducing removable and swappable battery systems that offer convenience for apartment dwellers lacking dedicated charging facilities.

Market Outlook 2026-2034:

The Indian e-bike market is set to undergo tremendous growth in the forecast period with the help of encouraging government policies, technological innovation, and the shift in consumer behaviour. The lowering of the acquisition price with the help of government policies and production-linked incentives is set to make the product attractive to the mass market. The development of the overall electric vehicle segment with government standards on the safety of batteries and investments in infrastructure is set to boost market dynamics. Urbanization and the tremendous growth in the urban population by the end of the decade are set to fuel market demands. The market generated a revenue of USD 1,420.78 Million in 2025 and is projected to reach a revenue of USD 3,007.19 Million by 2034, growing at a compound annual growth rate of 8.69% from 2026-2034.

India E-Bike Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Propulsion Type |

Pedal Assisted |

82% |

|

Battery Type |

Lithium-Ion Battery |

85% |

| Power | Less Than and Equal to 250W |

70% |

|

Application |

City and Urban |

79% |

| Region | North India |

30% |

Propulsion Type Insights:

- Pedal Assisted

- Throttle-Assisted

The pedal assisted dominates with a market share of 82% of the total India e-bike market in 2025.

The pedal-assisted e-bikes continue to hold a dominant position within the Indian market, as they uniquely offer the ability to combine the physiological exercise benefit of cycling with assistance from an electric motor. This range of e-bikes has been well-accepted by health-conscious commuters who want the health benefit of cycling but also want assistance from the motor when they ride on tough terrain or for long distances. The cost of operation of these e-bikes is less compared to fully motorized options.

The pedal-assisted segment has seen significant adoption among daily commuters looking for an effective means of transportation that can help them meet their fitness objectives. Infrastructural changes such as the construction of cycling lanes by urban cities have boosted the appeal of using pedal-assisted e-bikes. This category is also encouraged by the presence of policy structures that support the adoption of low-powered electric bicycles.

Battery Type Insights:

- Lithium-Ion Battery

- Lead-Acid Battery

The lithium-ion battery leads with a share of 85% of the total India e-bike market in 2025.

Lithium-ion batteries have established clear dominance in the India e-bike market owing to their superior technical characteristics and performance advantages. These batteries offer significantly higher energy density compared to lead-acid alternatives, enabling longer range on a single charge while maintaining lighter overall vehicle weight. Indian battery major Exide Industries is now in advanced talks with multiple electric two‑wheeler manufacturers to supply lithium‑ion cells from its upcoming 6 GWh gigafactory in Bengaluru, a move that underscores how lithium‑ion technology is becoming central to powering the next generation of India’s EVs, including e‑bikes.

The segment benefits from continuous technological advancement that is improving energy density, reducing charging times, and enhancing battery management systems. Lithium-ion batteries support faster charging capabilities essential for urban users requiring quick turnaround between trips. Manufacturers are increasingly incorporating smart battery management features that optimize performance and extend battery lifespan. The growing availability of lithium-ion battery manufacturing capacity in India is supporting cost reduction and supply chain stability.

Power Insights:

- Less Than and Equal to 250W

- Above 250W

The less than and equal to 250W dominates with a market share of 70% of the total India e-bike market in 2025.

E-bikes with power output up to 250W dominate the Indian market primarily due to favorable regulatory treatment and alignment with government incentive programs. This power category qualifies for various subsidies and benefits under electric vehicle promotion schemes, making these models more affordable for consumers. The 250W power output is well-suited for typical urban commuting requirements, providing adequate assistance for navigating city streets and moderate inclines without excessive energy consumption.

The segment appeals to budget-conscious consumers seeking economical transportation solutions with manageable initial investment and low operating costs. Lower power e-bikes generally feature simpler construction with reduced maintenance requirements, enhancing their total cost of ownership advantage. The regulatory classification of sub-250W e-bikes as bicycles rather than motor vehicles in many jurisdictions eliminates registration and licensing requirements, further enhancing consumer convenience and adoption.

Application Insights:

Access the comprehensive market breakdown Request Sample

- City and Urban

- Trekking

- Cargo

The city and urban leads with a share of 79% of the total India e-bike market in 2025.

City and urban applications command the largest share of the India e-bike market, reflecting the primary use case for electric bicycles among Indian consumers. Urban commuters represent the core customer base, seeking efficient transportation solutions for daily travel to workplaces, educational institutions, and other routine destinations. E-bikes offer compelling advantages in congested urban environments, including ability to navigate traffic, ease of parking, and independence from fuel price fluctuations.

The segment benefits from rapidly expanding urban populations and associated mobility challenges that make e-bikes attractive transportation alternatives. Growing cycling infrastructure in major metropolitan areas, including dedicated bike lanes and parking facilities, is enhancing the practicality of urban e-bike usage. The cost-effectiveness of e-bikes for short to medium distance urban travel compared to ride-sharing services or personal vehicle ownership appeals to price-sensitive commuters and young professionals seeking economical mobility solutions.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 30% share of the total India e-bike market in 2025.

North India represents the largest regional market for e-bikes, driven by high urbanization rates, substantial population concentration, and favorable state-level policy support for electric vehicles. The region encompasses major metropolitan centers including Delhi NCR, which serves as a significant demand hub for urban mobility solutions. States in the region have implemented progressive policies supporting electric vehicle adoption through subsidies, tax exemptions, and infrastructure development initiatives.

The region benefits from established distribution networks for two-wheelers that facilitate e-bike market penetration. Higher average income levels and greater consumer awareness regarding environmental issues and sustainable transportation contribute to stronger e-bike adoption rates. The presence of multiple e-bike manufacturers and startups headquartered in North India ensures product availability and after-sales service accessibility. Growing traffic congestion in northern metropolitan areas is driving consumer consideration of alternative transportation modes including electric bicycles.

Market Dynamics:

Growth Drivers:

Why is the India E-Bike Market Growing?

Favorable Government Policies and Incentive Programs

The Indian government has implemented comprehensive policy frameworks supporting electric vehicle adoption that are significantly accelerating e-bike market growth. Central and state-level incentive programs provide substantial subsidies reducing initial purchase costs for consumers. Under the PM E‑Drive scheme launched in 2024 with a ₹10,900 crore budget, India has provided targeted support for electric two‑ and three‑wheelers and expanded charging infrastructure, achieving nearly 50 % of its adoption targets for e‑2Ws and e‑3Ws by mid‑2025, underscoring the effectiveness of current EV incentives. Production-linked incentive schemes are encouraging domestic manufacturing, strengthening supply chains, and improving product availability. Tax benefits including reduced goods and services tax rates on electric vehicles enhance affordability for price-sensitive consumers.

Rising Fuel Prices and Economic Considerations

Escalating fuel costs are creating compelling economic incentives for consumers to transition toward electric mobility solutions including e-bikes. The significant cost differential between electricity and petroleum-based fuels translates to substantial operational savings for regular commuters. A 2025 study by the Council on Energy, Environment and Water (CEEW) found that electric two‑wheelers cost around ₹1.48 per kilometre to operate, compared with ₹2.46 per kilometre for petrol models, underscoring the tangible running‑cost advantage driving EV adoption in India. E-bikes offer dramatically lower per-kilometer running costs compared to conventional two-wheelers, making them particularly attractive for daily commuters covering moderate distances. Reduced maintenance requirements compared to internal combustion vehicles further enhance the total cost of ownership advantage.

Environmental Consciousness and Sustainability Awareness

Growing environmental awareness among Indian consumers, particularly urban youth, is driving preference for sustainable transportation alternatives. Concerns regarding air quality in major cities and the health impacts of vehicular emissions are motivating conscious transportation choices. E-bikes produce zero direct emissions during operation, offering environmentally responsible mobility without compromising convenience or practicality. Yulu’s shared e‑mobility operations have enabled over 100 million green deliveries across Indian urban centres by June 2024, helping prevent more than 25 million kg of CO₂ emissions, a clear indication of how eco‑friendly EV adoption is taking hold in cities. The visible impact of pollution in urban areas has heightened public sensitivity toward emission-free transportation options. Corporate sustainability initiatives are encouraging employees to adopt green commuting practices, creating workplace-driven demand for e-bikes.

Market Restraints:

What Challenges the India E-Bike Market is Facing?

High Upfront Acquisition Costs

The higher initial purchase price of e-bikes compared to conventional bicycles presents a significant adoption barrier for price-sensitive Indian consumers. Quality e-bikes with reliable battery systems and adequate range command premium pricing that exceeds typical budget allocations for personal transportation. While lifecycle cost analysis favors e-bikes, the upfront investment requirement limits market penetration among lower-income segments. Limited availability of attractive financing options specifically designed for e-bike purchases constrains accessibility for consumers lacking immediate purchasing capacity.

Limited Charging Infrastructure and Range Anxiety

Inadequate public charging infrastructure outside major metropolitan areas creates practical limitations for e-bike adoption and usage. Consumer concerns regarding battery range and charging accessibility, commonly termed range anxiety, influence purchase decisions and usage patterns. The absence of standardized charging protocols and interoperable charging facilities adds complexity for users traveling beyond familiar routes. Apartment dwellers and consumers lacking dedicated parking facilities face challenges establishing convenient home charging arrangements, limiting practical adoption among significant urban demographics.

Consumer Awareness and Perception Gaps

Limited consumer awareness regarding e-bike capabilities, benefits, and operational characteristics constrains market expansion beyond early adopters. Misconceptions about battery reliability, range limitations, and long-term performance create hesitation among potential buyers. The nascent nature of the e-bike market means many consumers lack exposure to product demonstrations or word-of-mouth recommendations from existing users. Service and maintenance concerns regarding specialized components and battery systems influence risk-averse consumers toward familiar conventional transportation options.

Competitive Landscape:

The India e-bike market exhibits a dynamic and evolving competitive landscape characterized by diverse participants ranging from established bicycle manufacturers to emerging electric mobility startups. Market players are differentiating through product innovation, battery technology advancement, design aesthetics, and pricing strategies. Established bicycle brands leverage existing distribution networks and brand recognition while investing in electric product development. Electric vehicle startups bring technology-first approaches emphasizing smart connectivity, advanced battery systems, and direct-to-consumer sales models. Competition is driving rapid product iteration, feature enhancement, and price optimization benefiting consumers. Strategic partnerships between manufacturers, component suppliers, and technology providers are strengthening product development capabilities. Investment in domestic manufacturing capacity is expanding as players position for anticipated demand growth.

Some of the key players include:

- Elecson

- EMotorad (Inkodop Technologies Private Limited)

- Hero Lectro E-Cycles

- Lekeamp

- Ninety One Cycles

- SK Ebicycle LLP

- Stryder Cycle Pvt Ltd

- Toutche Electric

- Virtus Motors Private Limited

- Voltebyk

- Voltrix Mobility Private Limited

Recent Developments:

- In November 2025, Bengaluru-based Ultraviolette Automotive has launched its India-made electric motorcycles in the United Kingdom, marking a significant step in its global expansion and export strategy. The launch strengthens the company’s international presence and highlights India’s growing capabilities in high-performance electric two-wheelers.

India E-Bike Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Propulsion Types Covered | Pedal Assisted, Throttle-Assisted |

| Battery Types Covered | Lithium-Ion Battery, Lead-Acid Battery |

| Powers Covered | Less Than and Equal to 250W, Above 250W |

| Applications Covered | City and Urban, Trekking, Cargo |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Elecson, EMotorad (Inkodop Technologies Private Limited), Hero Lectro E-Cycles, Lekeamp, Ninety One Cycles, SK Ebicycle LLP, Stryder Cycle Pvt Ltd, Toutche Electric, Virtus Motors Private Limited, Voltebyk, Voltrix Mobility Private Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India E-Bike market size was valued at USD 1,420.78 Million in 2025.

The India E-Bike market is expected to grow at a compound annual growth rate of 8.69% from 2026-2034 to reach USD 3,007.19 Million by 2034.

The pedal assisted dominated the market with an 82% share, driven by its optimal balance between manual pedaling and electric assistance, fitness benefits, lower operating costs, and appeal to health-conscious urban commuters.

Key factors driving the India E-Bike market include favorable government policies and incentive programs, rising fuel prices creating economic advantages, growing environmental consciousness, expanding urbanization, advancements in battery technology, and increasing health and fitness awareness among consumers.

Major challenges include high upfront vehicle costs limiting mass market accessibility, limited charging infrastructure in remote areas, consumer awareness gaps regarding product capabilities, range anxiety concerns, inconsistent government incentives across states, and competition from established transportation alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)