India E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2025-2033

India E-Invoicing Market:

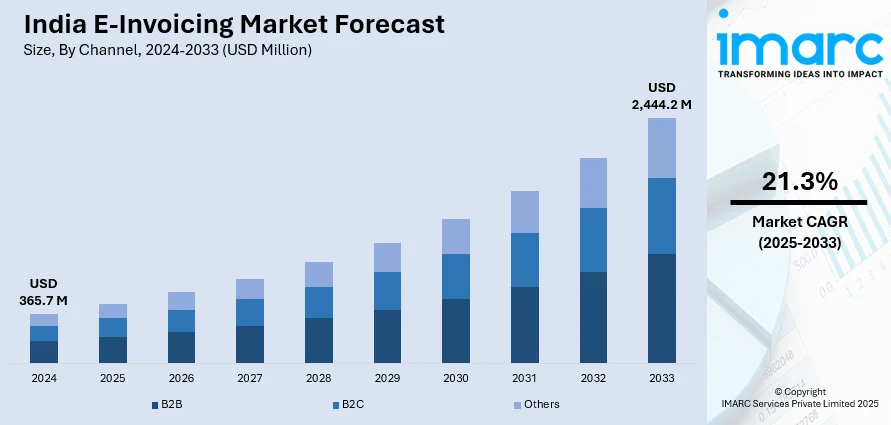

The India e-invoicing market size reached USD 365.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,444.2 Million by 2033, exhibiting a growth rate (CAGR) of 21.3% during 2025-2033. The expanding e-commerce industry, along with extensive web and software-based invoicing applications, is bolstering the market across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 365.7 Million |

|

Market Forecast in 2033

|

USD 2,444.2 Million |

| Market Growth Rate 2025-2033 | 21.3% |

India E-Invoicing Market Analysis:

- Major Market Drivers: The growing need across retail outlets in India for improving transactional documents to protect their customer data is stimulating the market. Moreover, the increasing fair competition policies by government bodies in the country are further acting as significant growth-inducing factors.

- Key Market Trends: The rising focus among key players on minimizing human errors and processing time while elevating data quality and invoice accuracy is one of the primary trends bolstering the market. Additionally, the implementation of stringent regulations by regulatory authorities operating across the country to keep track of the shadow economy and the loss of tax revenue is also positively influencing the market.

- Geographical Trends: West and Central India currently dominates the India e-invoicing market. E-invoicing in West and Central India is driven by the strong industrial and commercial presence. Furthermore, the escalating need for enhanced operational efficiency and compliance with tax obligations is driving the market.

- Challenges and Opportunities: The inflating concerns towards protecting sensitive financial data are among the primary challenges hindering the market in the country. However, the widespread integration of encryption and secure data storage practices to ensure the confidentiality and integrity of invoicing data is expected to fuel the market in the coming years.

To get more information of this market, Request Sample

India E-Invoicing Market Trends:

Increasing Regulatory Mandates

The introduction of e-invoicing regulations by government bodies in India to plug gaps in GST data reconciliation and minimize tax evasion is propelling the market. Moreover, e-invoicing can be directly integrated with the GST Network (GSTN). This not only simplifies tax filing for businesses but also reduces errors and discrepancies, thereby decreasing the administrative burden on both businesses and tax authorities. For example, in May 2023, the Ministry of Finance in India issued a notification that reduced the threshold limit for complying with the GST e-invoicing system from INR 10 to 5 Crores. Apart from this, government bodies are launching initiatives to promote the adoption of e-invoicing to lower audit risks, which is positively impacting the India e-invoicing market outlook. For instance, in July 2023, the Goods and Services Tax (GST) Council in India mandated to use of e-invoicing for taxpayers with turnovers above INR 1.5 crores. Additionally, the government in the country is enhancing the accuracy and efficiency of invoice processing, which is also bolstering the overall market. For example, in October 2023, the Goods and Services Tax Network (GSTN) in India published its advisory on downloading of invoices in JSON format from the GST portal. This helped taxpayers in the country manually view and download JSON e-invoices and automatically fetch these via GST Suvidha Provider or an authorized intermediary. Similarly, in February 2024, GSTN in India launched an improved electronic invoice key information portal, which showcased its ongoing commitment towards enhancing taxpayer services. Some of the common features in the portal include adherence to the Guidelines for Indian Government Websites (GIGW), daily IRN count statistics, support for the e-invoice QR Code Verifier app, etc.

Adoption by SMEs

The growing number of small and medium enterprises that are using e-invoicing to enhance accuracy, streamline their operations, and comply with government mandates is augmenting the India e-invoicing market demand. For example, TallyPrime is an ISO-certified GST Suvidha Provider, which offers connected e-invoicing software for businesses in India. In line with this, Webtel's e-invoicing solution offers multiple auto-validation of data to ensure 100% accuracy and compliance to SMEs across the country. Moreover, the shifting preferences from traditional paper-based or manual invoicing systems to digital platforms are elevating the India e-invoicing market revenue. For instance, Marg ERP, one of the popular accounting software providers among SMEs in India, integrates e-invoicing features that allow small businesses to validate, generate, and report invoices seamlessly. This minimizes errors, reduces manual data entry, ensures timely and accurate tax filing, etc. Another example is Zoho Invoice, which offers a user-friendly e-invoicing module tailored for small and medium enterprises operating in the country. Zoho's solution provides real-time tracking, automatic updates, and customizable invoice templates to ensure compliance with the latest GST regulations.

Rising Concerns Over Data

With the rising digitization of financial transactions, the need for data security and privacy is inflating. This, in turn, is one of the India e-invoicing market's recent opportunities. For instance, in December 2023, the Reserve Bank of India (RBI) launched a dedicated cloud facility for the financial sector. The cloud facility aims to enhance scalability, privacy, and business continuity. Similarly, in August 2023, government bodies in India passed the Digital Personal Data Protection (DPDP) Act to foster an environment conducive to protect the personal data of citizens across the country. E-invoicing solution providers across the country are incorporating advanced security measures to protect sensitive financial data. For example, in June 2022, the Goods and Service Tax Network (GSTN), which manages the GST portal in India from an IT perspective, added invoice registration portals to facilitate invoice flow in higher numbers and at greater speeds. Furthermore, the Indian government launched this initiative as a means of minimizing tax revenue leaks. In line with this, it allowed a more stable invoice verification and provided a variety for enterprises to choose the most effective portal for their needs.

India E-Invoicing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the India e-invoicing market forecast at the country and regional levels for 2025-2033. Our report has categorized the market based on the channel, deployment type, and application.

Breakup by Channel:

- B2B

- B2C

- Others

B2B holds the largest market share

The report has provided a detailed breakup and analysis of the market based on the channel. This includes B2B, B2C, and others. According to the report, B2B represented the largest segmentation.

The rising need for streamlining invoice management and reduced audit risks is propelling the growth in this segmentation. In B2B environments, businesses often engage in high-frequency transactions that require meticulous documentation and compliance with regulatory standards. The mandatory e-invoicing system, enforced by the Indian government for companies with turnovers exceeding certain thresholds, aims to enhance transparency and accuracy in these transactions. For example, in April 2021, the Government in India made e-invoicing mandatory for all B2B transactions.

Breakup by Deployment Type:

- Cloud-based

- On-premises

Cloud-based currently exhibits a clear dominance in the India e-invoicing market share

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes cloud-based and on-premises. According to the report, cloud-based represented the largest segmentation.

Cloud-based e-invoicing is gaining extensive traction in the country, as it offers scalability, accessibility, and cost-effectiveness, which are particularly appealing to businesses of all sizes. Unlike on-premise solutions, cloud-based platforms offer flexibility and can be accessed from anywhere, making it easier for companies to manage their invoicing processes remotely. Apart from this, cloud-based e-invoicing solutions eliminate the need for expensive hardware, continuous updates, and dedicated IT staff, thereby making them an economical choice for small and medium enterprises (SMEs) that may have limited financial resources. Providers, such as Zoho Invoice, QuickBooks, and ClearTax, offer subscription-based pricing models, which is increasing the India e-invoicing market's recent price. In line with this, Vyapar is a free business accounting software built for small businesses across the country that helps to organize the data to meet the firm’s specific requirements.

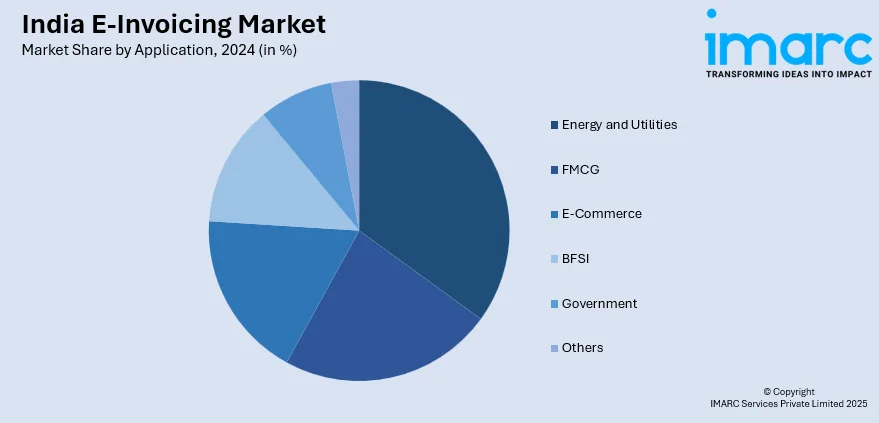

Breakup by Application:

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

As per the India e-invoicing market overview, E-commerce accounts for the majority of the total market share

The report has provided a detailed breakup and analysis of the market based on the application. This includes energy and utilities, FMCG, E-commerce, BFSI, government, and others. According to the report, e-commerce represented the largest segmentation.

E-invoicing in the E-commerce industry is slightly different than for the rest of the industries. E-commerce operators generate an IRN on behalf of their suppliers. The mandatory e-invoicing regulations implemented by the Indian government are accelerating the adoption in the E-commerce sector, ensuring compliance and enhancing transparency in financial transactions. According to the India e-invoicing market statistics, E-commerce companies, including Amazon India and Flipkart, widely integrate e-invoicing solutions to automate their billing processes, reduce manual errors, and expedite GST reporting.

Breakup by Region:

- North India

- West and Central India

- South India

- East India

West and Central India currently dominates the market

The report has provided a detailed breakup and analysis of the market based on the region. This includes North India, West and Central India, South India, and East India. According to the report, West and Central India accounted for the largest market share.

The rising number of large enterprises and SMEs that engage in high-volume transactions, thereby making e-invoicing a critical tool for ensuring compliance and operational efficiency, is propelling the market in the Western part of India. Moreover, the increasing financial and manufacturing hubs in states, including Gujarat and Maharashtra, are also acting as another significant growth-inducing factor. In June 2023, the Finance Department in Gujarat issued an amendment, which stated the preparation of e-invoices and other documents for registered persons. In Central India, states, like Madhya Pradesh and Chhattisgarh, are also adopting e-invoicing, particularly within the agricultural, mining, and manufacturing sectors.

Competitive Landscape:

- The India e-invoicing market is characterized by a diverse array of companies offering innovative solutions to cater to the varied needs of businesses across sectors. Additionally, they aid businesses in complying with regulatory mandates while enhancing operational efficiency and accuracy. Besides this, some of the prominent players are introducing a suite of cloud-based financial management applications, which will continue to drive the market in the country over the forecasted period.

- The competitive landscape of the industry has also been examined along with the profiles of the key players.

India E-Invoicing Market Recent Developments:

- April 2024: The Goods and Services Tax Network (GSTN) department in India issued an advisory for businesses required to generate an e-invoice if their turnover exceeds INR 5 Crores in FY 2023-24.

- February 2024: The Government in India, along with States and Union Territories, introduced an e-invoice system that provides users with a variety of efficient features, enabling quick actions like verification of enablement status, IRN searches, resolution of grievances, access to the IRP Portal, and the mobile app.

- February 2024: GSTN in India developed an improved e-invoice key information portal for enhancing taxpayer services across the country.

- June 2023: The GSTN launched an e-invoice QR Code Verifier app on the Google Play Store to enable users to verify e-invoices quickly and conveniently.

India E-Invoicing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India e-invoicing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India e-invoicing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India e-invoicing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the India e-invoicing market to exhibit a CAGR of 21.3% during 2025-2033.

The rising need for transparency in invoicing, along with the growing adoption of e-invoicing, as it helps in reducing human errors and processing time, while increasing data quality and invoice accuracies, is primarily driving the India e-invoicing market growth.

The sudden outbreak of the COVID-19 pandemic has led to the escalating deployment of e-invoicing, owing to the changing consumer inclination from conventional brick-and-mortar distribution channels towards online retail platforms for the purchase of various products and services.

Based on the channel, the India e-invoicing market can be segregated into B2B, B2C, and others. Among these, B2B holds the largest market share.

Based on the deployment type, the India e-invoicing market has been bifurcated into cloud-based and on-premises, where cloud-based currently exhibits a clear dominance in the market.

Based on the application, the India e-invoicing market can be categorized into energy and utilities, FMCG, E-commerce, BFSI, government, and others. Currently, E-commerce accounts for the majority of the total market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India e-invoicing market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)