India Earthquake Resistant Building Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Earthquake Resistant Building Materials Market Overview:

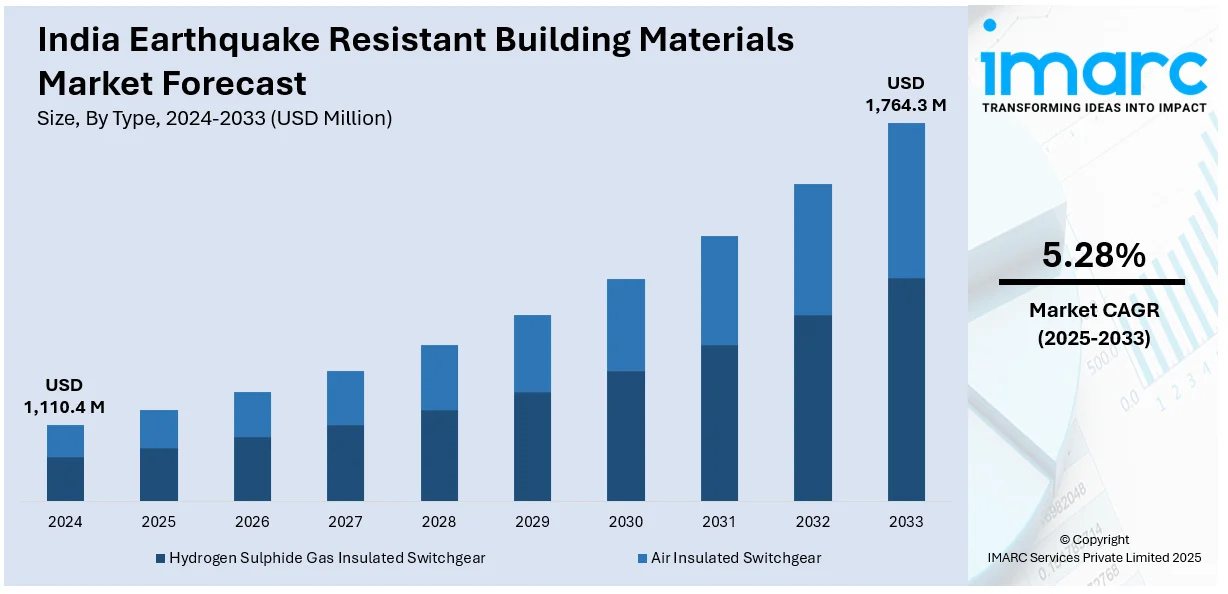

The India earthquake resistant building materials market size reached USD 1,110.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,764.3 Million by 2033, exhibiting a growth rate (CAGR) of 5.28% during 2025-2033. The market is growing due to rising seismic risks, stricter building regulations, and increasing adoption of fiber-reinforced concrete, base isolation systems, and shock-absorbing foundations. Moreover, government initiatives and urban expansion in earthquake-prone zones are driving demand for advanced seismic-resilient construction materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,110.4 Million |

| Market Forecast in 2033 | USD 1,764.3 Million |

| Market Growth Rate (2025-2033) | 5.28% |

India Earthquake Resistant Building Materials Market Trends:

Growing Use of Fiber-Reinforced Concrete for Seismic Safety

India is increasingly using fiber-reinforced concrete (FRC) for earthquake-resistant buildings, driven by its greater strength and flexibility. FRC demand is rising, with builders looking for materials that can endure high stress and minimize structural cracks during earthquakes. In addition, polypropylene and steel fibers are being used in concrete to enhance energy absorption to ensure no collapse. These products assist in distributing pressure equally, making the sudden collapse of the structure less likely. Similarly, FRC also improves ductility, an important characteristic for structures in seismic areas. The Indian Institute of Technology (IIT) Roorkee has been testing advanced FRC mixes to enhance seismic resistance in high-rise structures. Research has shown that high-performance fiber-reinforced concrete (HPFRC) can improve a building's ability to sustain repeated seismic shocks without major damage. Moreover, government housing projects in Uttarakhand and Himachal Pradesh are using fiber-reinforced slabs to minimize earthquake damage in residential and commercial buildings. Along with this, FRC is expected to become a standard in seismic-resistant construction across the country with ongoing research and wider adoption, further propelling the market growth.

To get more information on this market, Request Sample

Rising Adoption of Base Isolation Technology in High-Risk Zones

Base isolation technology is gaining traction in India’s earthquake-prone regions, helping structures absorb seismic shocks more effectively. This approach uses rubber bearings and lead dampers to reduce the impact of ground movement on buildings. The trend is driven by urban expansion in areas vulnerable to earthquakes, such as Delhi, Gujarat, and the Northeastern states. Base isolation technology significantly reduces structural vibrations, ensuring that buildings remain functional even after strong earthquakes. Moreover, metro stations in Kolkata and Ahmedabad have implemented base isolation to enhance structural resilience, ensuring uninterrupted operations during seismic activity. These implementations indicate a growing preference for passive seismic protection methods, particularly in high-rise and public infrastructure projects. Additionally, in Mumbai’s commercial sector, developers have started integrating base isolators into skyscrapers to ensure long-term safety. The growing awareness of seismic risks, coupled with government incentives for disaster-resistant infrastructure, is encouraging the adoption of this technology. As engineering solutions evolve, base isolation is expected to become a fundamental feature in India’s earthquake-resistant construction sector, ensuring greater safety and durability for future structures.

India Earthquake Resistant Building Materials Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Hydrogen Sulphide Gas Insulated Switchgear

- Air Insulated Switchgear

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydrogen sulphide gas insulated switchgear and air insulated switchgear.

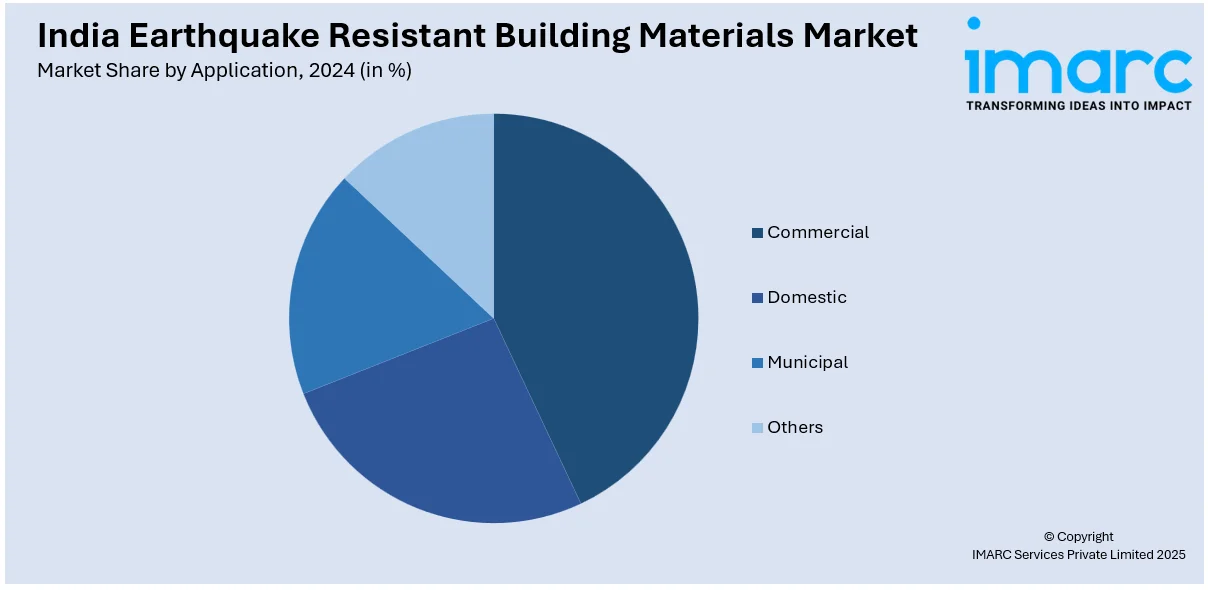

Application Insights:

- Commercial

- Domestic

- Municipal

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes commercial, domestic, municipal and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Earthquake Resistant Building Materials Market News:

- March 2024: Jindal Stainless supplied 1,000 Tons of 316L stainless steel for India's first diagrid earthquake-resistant building in Chennai, redefining construction with no columns. This strengthens the demand for seismic-resistant materials.

- January 2024: Larsen & Toubro implemented earthquake-resistant materials in Ayodhya Temple, using rolled compacted concrete, granite, and sandstone instead of steel and cement. This drives demand for seismic-resistant materials in India.

India Earthquake Resistant Building Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydrogen Sulphide Gas Insulated Switchgear, Air Insulated Switchgear |

| Applications Covered | Commercial, Domestic, Municipal, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India earthquake resistant building materials market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India earthquake resistant building materials market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India earthquake resistant building materials industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The earthquake resistant building materials market in India was valued at USD 1,110.4 Million in 2024.

The India earthquake resistant building materials market is projected to exhibit a CAGR of 5.28% during 2025-2033, reaching a value of USD 1,764.3 Million by 2033.

The India earthquake resistant building materials market is experiencing significant growth due to rapid urbanization in seismic-prone zones, growing awareness about disaster-resilient infrastructure, and stricter government building codes. Increasing infrastructure investments, coupled with advancements in construction technologies, further support demand for durable, safe, and sustainable building materials across residential and commercial projects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)