India Eco-Friendly Bricks Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Eco-Friendly Bricks Market Overview:

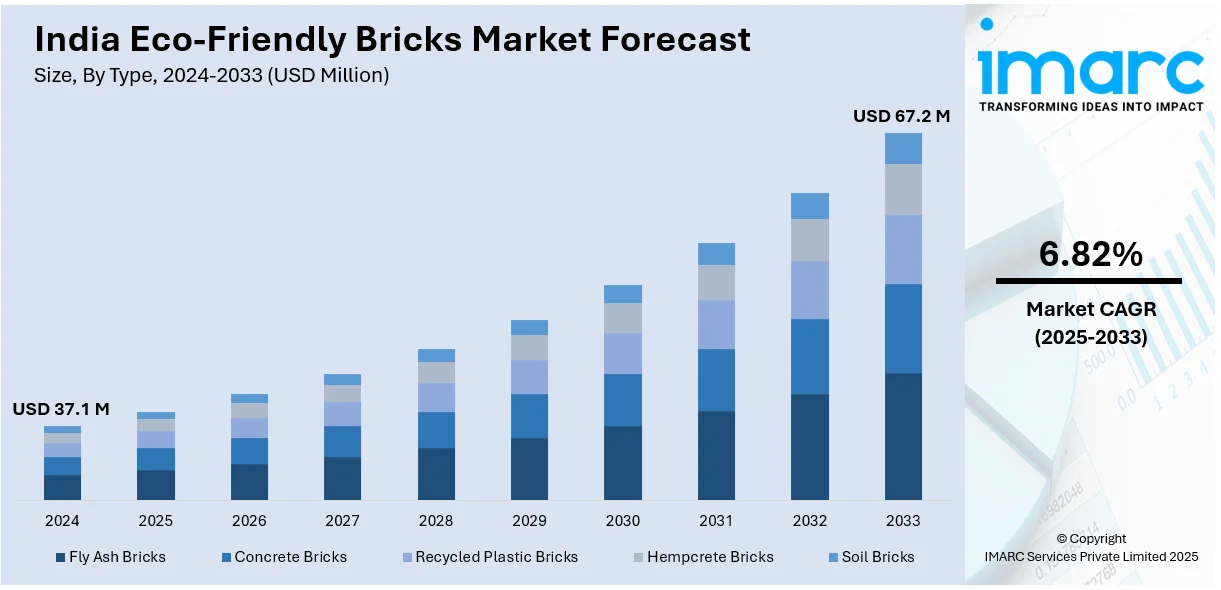

The India eco-friendly bricks market size reached USD 37.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 67.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.82% during 2025-2033. The market is driven by rising environmental concerns, government incentives, sustainable construction demand, waste recycling initiatives, energy efficiency focus, green building certifications, technological advancements, and increasing consumer preference for eco-friendly materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 37.1 Million |

| Market Forecast in 2033 | USD 67.2 Million |

| Market Growth Rate 2025-2033 | 6.82% |

India Eco-Friendly Bricks Market Trends:

Government Incentives and Regulations Promoting Green Building Materials

The Government of India plays an important role in promoting environmentally friendly construction materials, such as sustainable bricks, through incentives and regulations. As sustainability becomes a priority in national policy, a number of programs have been created to promote green construction methods and enhance the usage of ecologically responsible materials. The National Green Building Code (NGBC) is also contributing to the market growth, as it establishes requirements for sustainable development. This code requires the use of environmentally friendly materials, such as green bricks, in order to meet requirements for certifications such as Leadership in Energy and Environmental Design (LEED) and GRIHA. Moreover, initiatives like Pradhan Mantri Awas Yojana (PMAY), which is aimed at creating inexpensive and energy-efficient homes, are presenting lucrative opportunities for market expansion by boosting the demand for eco-friendly bricks, as they align with their sustainability goals. A report by the Indian Green Building Council (IGBC) indicates that green building adoption in India has increased at an annual rate of 20% over the past five years. By 2025, more than 10 billion square feet of construction projects are expected to receive green certification, further propelling market growth for sustainable construction materials.

To get more information on this market, Request Sample

Technological Advancements in Eco-Brick Production

Technological advancements are revolutionizing India’s eco-friendly bricks sector, driving the production of high-performance, cost-effective, and sustainable building materials. Innovations such as 3D printing and modular brick systems, which are enhancing strength, insulation properties, and environmental sustainability, while simultaneously reducing manufacturing costs and resource consumption, are impelling the market growth. One notable breakthrough is the rise of fly ash-based eco-bricks, which gained significant traction in 2023. Fly ash, a by-product of coal combustion, offers an abundant and cost-effective alternative for brick production, significantly lowering the carbon footprint of construction. According to a 2024 report by the Indian Construction Industry, fly ash bricks now account for over 25% of all new construction projects, marking a substantial increase from previous years. Additionally, interlocking brick technologies are reshaping the market by enabling faster and more efficient construction, while minimizing material wastage. The industry is also witnessing a shift toward solar-powered kilns, which were introduced in 2024 to reduce energy costs and emissions linked to brick firing. These energy-efficient kilns are projected to cut energy consumption in brick manufacturing by up to 40% over the next decade, further propelling the market demand for these solutions.

India Eco-Friendly Bricks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Fly Ash Bricks

- Concrete Bricks

- Recycled Plastic Bricks

- Hempcrete Bricks

- Soil Bricks

The report has provided a detailed breakup and analysis of the market based on the type. This includes fly ash bricks, concrete bricks, recycled plastic bricks, hempcrete bricks, and soil bricks.

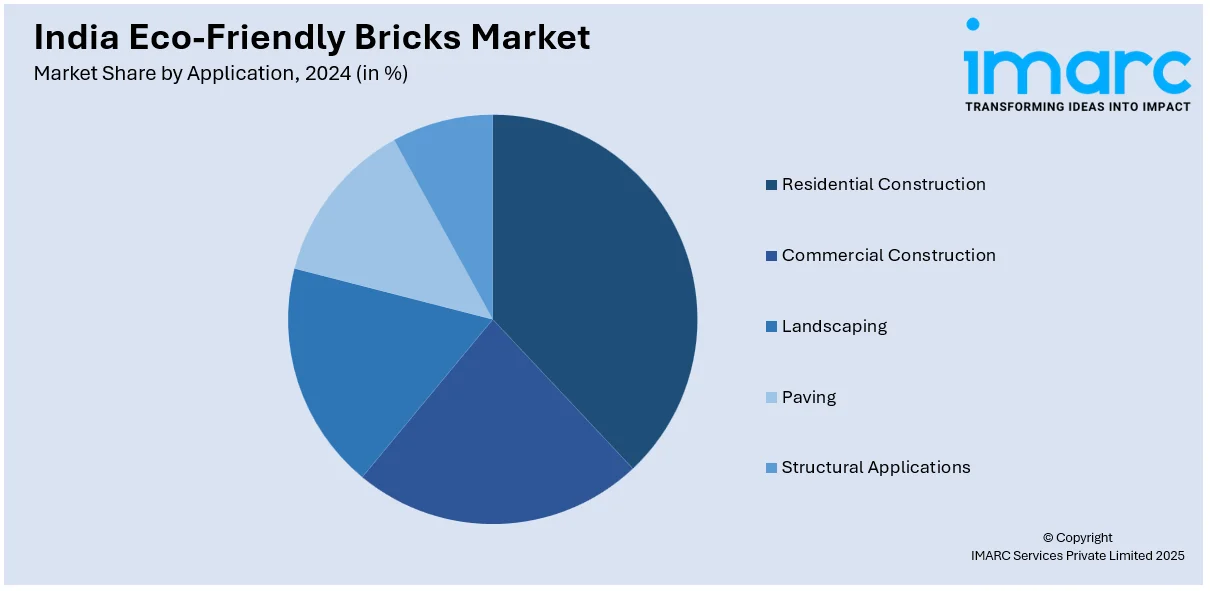

Application Insights:

- Residential Construction

- Commercial Construction

- Landscaping

- Paving

- Structural Applications

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential construction, commercial construction, landscaping, paving, and structural applications.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Eco-Friendly Bricks Market News:

- March 2025: Kunjpreet Arora and Lokesh Puri Goswami, two innovators from Udaipur, developed eco-friendly interlocking bricks using recycled materials, including single-use plastic, construction waste, and industrial waste. These sustainable bricks not only promote environmental conservation but also help reduce construction costs by up to 20%.

- January 2025: Wienerberger India achieved the lowest carbon footprint with Porotherm Smart Bricks, according to a Life Cycle Analysis (LCA) conducted by LEAD Consultancy and Engineering Services (India) Pvt Ltd. Porotherm Smart Bricks, including Porotherm HP, Porotherm Plus, FB Exteria, and Grinded bricks, have a remarkable GWP of 97.103 Kg CO2e per ton, outperforming other materials and having a lifespan of 150 years.

India Eco-Friendly Bricks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fly Ash Bricks, Concrete Bricks, Recycled Plastic Bricks, Hempcrete Bricks, Soil Bricks |

| Applications Covered | Residential Construction, Commercial Construction, Landscaping, Paving, Structural Applications |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India eco-friendly bricks market performed so far and how will it perform in the coming years?

- What is the breakup of the India eco-friendly bricks market on the basis of type?

- What is the breakup of the India eco-friendly bricks market on the basis of application?

- What are the various stages in the value chain of the India eco-friendly bricks market?

- What are the key driving factors and challenges in the India eco-friendly bricks market?

- What is the structure of the India eco-friendly bricks market and who are the key players?

- What is the degree of competition in the India eco-friendly bricks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India eco-friendly bricks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India eco-friendly bricks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India eco-friendly bricks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)