India Eco-Friendly Cement Market Size, Share, Trends and Forecast by Type, Raw Material, Application, End User, and Region, 2026-2034

India Eco-Friendly Cement Market Summary:

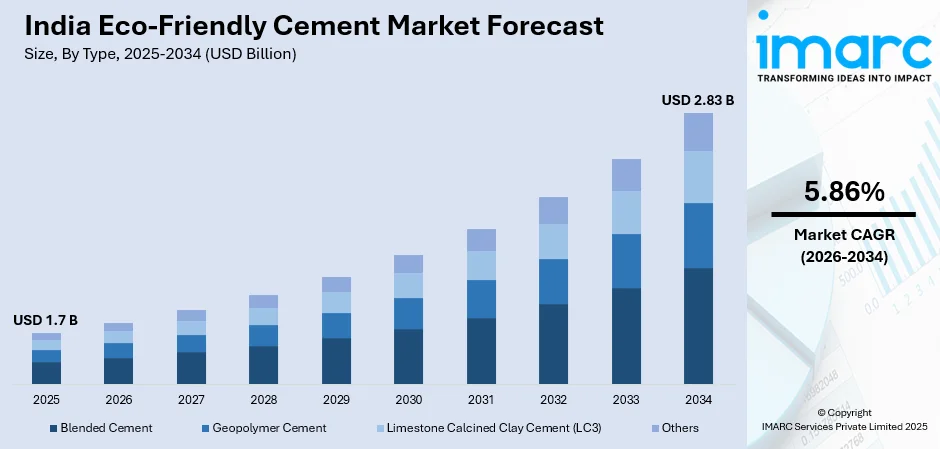

The India eco-friendly cement market size was valued at USD 1.7 Billion in 2025 and is projected to reach USD 2.83 Billion by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

The India eco-friendly cement market is witnessing substantial expansion driven by heightened environmental awareness, stringent government regulations mandating reduced carbon emissions, and the growing emphasis on sustainable construction practices. The increasing adoption of industrial by-products such as fly ash and slag in cement production is reducing reliance on traditional clinker-intensive manufacturing processes, positioning India as a key market for green cement innovation.

Key Takeaways and Insights:

- By Type: Blended Cement dominates the market with a share of 56% in 2025, driven by its lower carbon footprint, enhanced durability properties, and cost-effectiveness compared to traditional Portland cement formulations.

- By Raw Material: Fly Ash leads the market with a share of 40% in 2025, owing to its abundant availability from thermal power plants, cementitious properties, and government mandates promoting fly ash utilization in construction materials.

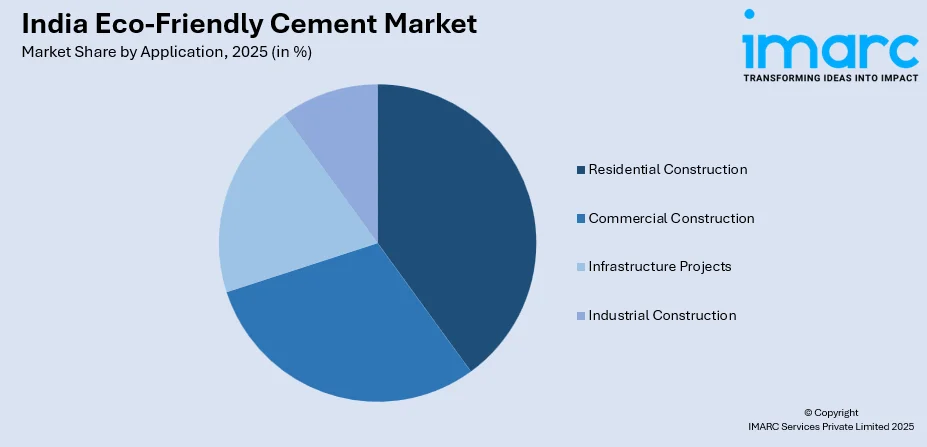

- By Application: Residential Construction represents the largest segment with a market share of 38% in 2025, supported by government affordable housing initiatives and growing consumer preference for sustainable building materials.

- By End User: Government and Public Sector accounts for the largest share of 44% in 2025, propelled by massive infrastructure investments and green public procurement policies favoring eco-friendly construction materials.

- Key Players: The India eco-friendly cement market features a competitive landscape with major cement manufacturers investing significantly in low-carbon cement portfolios, alternative fuel technologies, and carbon capture initiatives to align with national decarbonization targets.

To get more information on this market Request Sample

The India eco-friendly cement market is undergoing transformative growth driven by the construction sector's urgent need to reduce its environmental footprint. India's cement industry, responsible for nearly eight percent of national carbon dioxide emissions, faces the challenge of increasing production capacity while meeting stringent sustainability targets. The government's ambitious infrastructure development programs, including Bharatmala, PM Gati Shakti, and Pradhan Mantri Awas Yojana, are catalyzing demand for sustainable construction materials. Major cement producers are accelerating investments in fly ash-based blends, Portland limestone cement, and waste heat recovery systems to reduce emissions intensity. In 2025, Adani Cement (Ambuja Cements and ACC Ltd.) announced that approximately 85% of its cement portfolio now consists of blended green cement and concrete solutions, highlighting its commitment to sustainability. The implementation of green building certification requirements and carbon credit trading mechanisms is further incentivizing adoption of eco-friendly cement across residential, commercial, and infrastructure projects.

India Eco-Friendly Cement Market Trends:

Accelerating Adoption of Low-Carbon Cement Portfolios

Leading cement manufacturers are fast-tracking development of low-carbon cement portfolios to align with decarbonization and green procurement targets. Companies are launching specialized product lines tailored for green building certification projects, incorporating Portland limestone cement and fly ash-based blends that significantly reduce carbon emissions compared to traditional formulations. These initiatives respond to growing demand from developers seeking sustainable materials for LEED and GRIHA certified construction projects.

Integration of Alternative Fuels and Waste Co-Processing

Cement producers are scaling thermal substitution by co-processing municipal solid waste, biomass, and refuse-derived fuel in manufacturing operations. This strategy reduces dependence on imported petcoke and coal while lowering production costs and carbon intensity. For example, UltraTech Cement reported that in FY 25 it co‑processed 14.12 lakh tonnes of municipal solid waste (MSW), along with industrial and agro waste, as alternative fuels in its kilns, illustrating a significant shift toward waste-based fuel substitution. Several manufacturers have established partnerships with waste management companies to secure steady supplies of alternative fuels, particularly in Rajasthan and Tamil Nadu, demonstrating the industry's commitment to circular economy principles.

Expansion of Renewable Energy Integration in Production

The cement industry is significantly expanding renewable energy capacity through solar, wind, and waste heat recovery systems to reduce Scope 2 emissions. Major producers have set ambitious targets to derive substantial portions of their energy requirements from renewable sources, with some aiming for complete renewable energy transition by mid-century. For example, in June 2025, Shree Cement announced that over 60% of its total electricity consumption is now met through renewables, including solar, wind and waste‑heat‑recovery (WHR) systems. These investments align with India's broader goal of achieving over five hundred gigawatts of renewable energy capacity, creating favorable conditions for sustainable cement production.

Market Outlook 2026-2034:

The India eco-friendly cement market is positioned for robust expansion over the forecast period, driven by infrastructure-led demand, sustainability mandates, and technological advancements in low-carbon production processes. The government's focus on green public procurement and the implementation of carbon credit trading schemes will accelerate adoption across public and private construction sectors. Continued investments in alternative fuel technologies, carbon capture systems, and innovative cement formulations will enhance the industry's environmental credentials. The market generated a revenue of USD 1.7 Billion in 2025 and is projected to reach a revenue of USD 2.83 Billion by 2034, growing at a compound annual growth rate of 5.86% from 2026-2034.

India Eco-Friendly Cement Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Blended Cement | 56% |

| Raw Material | Fly Ash | 40% |

| Application | Residential Construction | 38% |

| End User | Government and Public Sector | 44% |

Type Insights:

- Blended Cement

- Geopolymer Cement

- Limestone Calcined Clay Cement (LC3)

- Others

The blended cement dominates with a market share of 56% of the total India eco-friendly cement market in 2025.

Blended cement maintains overwhelming market leadership driven by India's cement industry's voluntary commitment to reducing carbon emissions through increased utilization of supplementary cementitious materials. These formulations incorporate fly ash, granulated blast furnace slag, and pozzolanic materials that partially replace clinker, significantly lowering carbon dioxide emissions associated with calcination. According to a 2025 industry report, about 73% of India’s cement production is now blended cement (PPC, PSC, composite), underscoring widespread adoption of low‑carbon formulations. The adoption of best blending practices from international standards has accelerated domestic production of Portland Pozzolana Cement and Portland Slag Cement.

The segment benefits from enhanced performance characteristics including improved durability, superior sulfate resistance, and reduced heat of hydration compared to ordinary Portland cement. Bureau of Indian Standards specifications permit fly ash addition up to thirty-five percent in pozzolana cement, providing manufacturers flexibility in formulation optimization. Government mandates promoting blended cement utilization in public infrastructure projects further strengthen segment growth prospects.

Raw Material Insights:

- Fly Ash

- Slag

- Silica Fume

- Recycled Aggregates

- Others

The fly ash leads with a share of 40% of the total India eco-friendly cement market in 2025.

Fly ash dominates raw material utilization owing to its abundant availability from India's extensive thermal power generation infrastructure. The country generated 340.11 million tonnes of fly ash in FY 2024–25, of which about 332.63 million tonnes (≈ 98%) was successfully utilized, with a significant portion consumed by the cement industry for blended cement production. Government policies mandate fly ash utilization in cement and construction materials, creating consistent demand from manufacturers seeking compliance with environmental regulations while reducing production costs.

The cementitious properties of fly ash enhance concrete performance by improving workability, reducing permeability, and increasing long-term strength development. The Ministry of Power's Ash Track portal facilitates efficient coordination between thermal power plants and cement manufacturers for fly ash procurement. Infrastructure development for railway transportation and storage facilities is enabling movement of fly ash from surplus regions to manufacturing facilities across the country.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Residential Construction

- Commercial Construction

- Infrastructure Projects

- Industrial Construction

The residential construction dominates with a market share of 38% of the total India eco-friendly cement market in 2025.

Residential construction drives eco-friendly cement demand supported by the government's ambitious affordable housing programs, particularly Pradhan Mantri Awas Yojana with its substantial budget allocation for urban and rural housing development. As of 2025, more than 1.18 crore houses have been sanctioned under PMAY‑Urban, with over 88 lakh houses completed or delivered to beneficiaries. The growing middle class with increasing environmental awareness is driving preference for sustainable building materials in private housing projects. Green building certifications like GRIHA and IGBC are encouraging developers to specify eco-friendly cement for residential complexes.

The segment benefits from sustained demand in tier-two and tier-three cities witnessing rapid urbanization and housing development. Individual home builders are increasingly recognizing the durability and cost advantages of blended cement formulations for residential construction. The expansion of organized retail networks and technical support services enables broader access to eco-friendly cement products across residential construction markets.

End User Insights:

- Government and Public Sector

- Private Contractors

- Individual Home Builders

The government and public sector leads with a share of 44% of the total India eco-friendly cement market in 2025.

The government and public sector segment leads market consumption driven by massive infrastructure investments under flagship programs including Bharatmala highway development, PM Gati Shakti national master plan, and various railway modernization initiatives. As evidence of this push, in October 2025 the government approved four railway projects worth ₹24,634 crore under PM Gati Shakti — adding ~894 km of rail network and boosting freight capacity, which will directly drive cement demand for rail‑related construction. Green public procurement policies increasingly mandate utilization of low-carbon construction materials with Environmental Product Declarations in government tenders. The substantial budget allocations for road transport, highways, and public housing directly translate into sustained demand for eco-friendly cement.

Public sector projects benefit from established procurement frameworks that specify blended cement usage and sustainability compliance requirements. The implementation of carbon disclosure mandates under Central Pollution Control Board guidelines is reinforcing preference for eco-friendly materials in government construction. Smart city development and urban infrastructure modernization programs create consistent demand across multiple states and union territories.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents a rapidly growing market for eco-friendly cement, driven by extensive highway development under Bharatmala and affordable housing projects across Uttar Pradesh, Rajasthan, and Punjab. The region benefits from proximity to thermal power plants providing abundant fly ash supplies. Major cement manufacturers have expanded retail networks and grinding capacities to serve infrastructure-intensive northern states.

South India demonstrates strong adoption of sustainable cement solutions, supported by established manufacturing facilities in Tamil Nadu, Karnataka, and Andhra Pradesh. The region hosts pioneering carbon capture initiatives and waste heat recovery installations by major producers. Growing residential construction in metropolitan areas and industrial corridor development drive consistent demand for eco-friendly cement products.

East India presents emerging opportunities for eco-friendly cement growth, propelled by infrastructure development in Odisha, West Bengal, and northeastern states. The region's expanding railway connectivity and port development projects create substantial demand. Cement manufacturers are establishing clinker and grinding facilities to serve growing markets while capitalizing on export opportunities to Bangladesh and Nepal.

West India leads market development anchored by Maharashtra and Gujarat's industrial and infrastructure investments. The region hosts major cement manufacturing hubs with advanced sustainability practices including alternative fuel utilization and renewable energy integration. Smart city initiatives and commercial construction activity in Mumbai, Pune, and Ahmedabad drive premium eco-friendly cement demand.

Market Dynamics:

Growth Drivers:

Why is the India Eco-Friendly Cement Market Growing?

Rising Demand for Eco-Friendly Cement

Eco-friendly cement is seeing increasing demand across construction, housing, and industrial projects. Developers and builders are prioritizing low-carbon solutions to meet sustainability goals, particularly for green-certified projects. For example, in November 2025, NCL Industries commissioned a new cement‑grinding plant near Anakapalle (Visakhapatnam) that is explicitly designed to produce eco‑friendly cement variants, supported by a 5 MW captive solar power plant, signaling that manufacturers are scaling capacity to meet green‑cement demand. Manufacturers offering specialized products that align with eco-conscious construction practices are gaining a competitive advantage. This shift reflects a broader market trend where sustainable materials are becoming essential for modern construction, encouraging the cement industry to innovate and expand offerings that reduce carbon footprints without compromising performance.

Stringent Environmental Regulations and Carbon Reduction Mandates

Environmental regulations and growing expectations for carbon reduction are pushing cement manufacturers to adopt sustainable production practices. Green building standards, including LEED, GRIHA, and IGBC, are influencing material selection among developers and contractors. For instance, in August 2024, UltraTech Cement raised US $500 million through a sustainability‑linked loan, explicitly linking financing to its emissions‑reduction and green energy targets under its ESG roadmap, highlighting how major manufacturers are actively aligning operations with sustainability goals. Industry players are voluntarily implementing emissions reduction initiatives to meet these evolving expectations. As awareness of environmental responsibility increases, the adoption of eco-friendly cement is accelerating, and manufacturers capable of delivering low-carbon solutions are better positioned to serve a market that prioritizes sustainability.

Growing Consumer and Developer Environmental Awareness

Rising environmental awareness among consumers, builders, and developers is driving preference for construction materials with lower carbon footprints. Climate change impacts and environmental concerns are influencing choices, with developers increasingly highlighting sustainability as a market differentiator. Media campaigns, education, and advocacy have strengthened the perception of eco-friendly construction as essential. Consequently, green cement products that demonstrate tangible environmental benefits are in higher demand, creating opportunities for manufacturers to align offerings with the expectations of eco-conscious stakeholders across India’s construction ecosystem.

Market Restraints:

What Challenges the India Eco-Friendly Cement Market is Facing?

Higher Production Costs and Price Sensitivity

Eco-friendly cement production often requires higher upfront investments in alternative technologies and more sophisticated manufacturing processes compared to conventional cement. India's price-sensitive construction market, where cost considerations heavily influence material selection, creates adoption barriers for premium-priced sustainable products. The absence of significant financial incentives or subsidies for green cement production limits cost competitiveness in mass-market segments.

Raw Material Availability and Supply Chain Constraints

The limited availability of alternative green raw materials and logistical challenges in transporting fly ash and slag from surplus to deficit regions constrain market expansion. India's transition toward renewable energy is expected to reduce fly ash generation from thermal power plants over coming decades. Transportation infrastructure limitations and inconsistent supply from industrial sources create procurement challenges for manufacturers dependent on supplementary cementitious materials.

Awareness Gaps and Technical Knowledge Limitations

Limited awareness among contractors, masons, and individual builders regarding eco-friendly cement benefits and application techniques hinders broader market penetration. Technical misconceptions about performance characteristics of blended cements persist in certain regions. The lack of comprehensive training programs and technical support networks restricts adoption beyond organized construction segments.

Competitive Landscape:

The India eco-friendly cement market features an evolving competitive landscape with major cement producers accelerating investments in sustainable manufacturing capabilities. Leading manufacturers are developing specialized low-carbon cement portfolios, implementing waste heat recovery systems, and expanding renewable energy integration across production facilities. Strategic acquisitions and capacity expansions are reshaping market structure, with companies prioritizing regions demonstrating strong infrastructure-driven demand. Producers are pursuing science-based emission reduction targets, securing sustainability-linked financing, and obtaining environmental certifications to differentiate offerings. The competitive focus is shifting toward innovation in alternative fuel utilization, carbon capture technologies, and circular economy initiatives that align with national decarbonization objectives.

Recent Developments:

- In September 2025, JK Cement Ltd. became the first Indian company to commercially launch LC‑3 cement (Portland Calcined Clay–Limestone Cement), reducing CO₂ emissions by up to 40% vs OPC. The Noida International Airport is India’s first large-scale project using this low-carbon cement.

- In November 2025, Adani Cement (Ambuja Cements & ACC) became the first Indian cement companies to have their near‑term and net-zero targets validated by the Science Based Targets initiative (SBTi). In addition, they adopted TNFD recommendations, committing to nature-positive manufacturing and biodiversity conservation. Their portfolio now includes blended green cement and concrete solutions.

India Eco-Friendly Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended Cement, Geopolymer Cement, Limestone Calcined Clay Cement (LC3), Others |

| Raw Materials Covered | Fly Ash, Slag, Silica Fume, Recycled Aggregates, Others |

| Applications Covered | Residential Construction, Commercial Construction, Infrastructure Projects, Industrial Construction |

| End Users Covered | Government and Public Sector, Private Contractors, Individual Home Builders |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India eco-friendly cement market size was valued at USD 1.7 Billion in 2025.

The India eco-friendly cement market is expected to grow at a compound annual growth rate of 5.86% from 2026-2034 to reach USD 2.83 Billion by 2034.

Blended cement dominated the India eco-friendly cement market with a 56% share in, driven by its lower carbon footprint, enhanced durability characteristics, and cost-effectiveness compared to traditional Portland cement formulations.

Key factors driving the India eco-friendly cement market include massive government infrastructure investments, stringent environmental regulations and carbon reduction mandates, growing consumer environmental awareness, and expanding adoption of green building certification requirements.

Major challenges include higher production costs compared to conventional cement, raw material availability and supply chain constraints for alternative materials, limited technical awareness among contractors and builders, and infrastructure limitations for fly ash transportation from surplus to deficit regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)