India Eco-Friendly Cleaning Solutions Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, Form, and Region, 2025-2033

India Eco-Friendly Cleaning Solutions Market Overview:

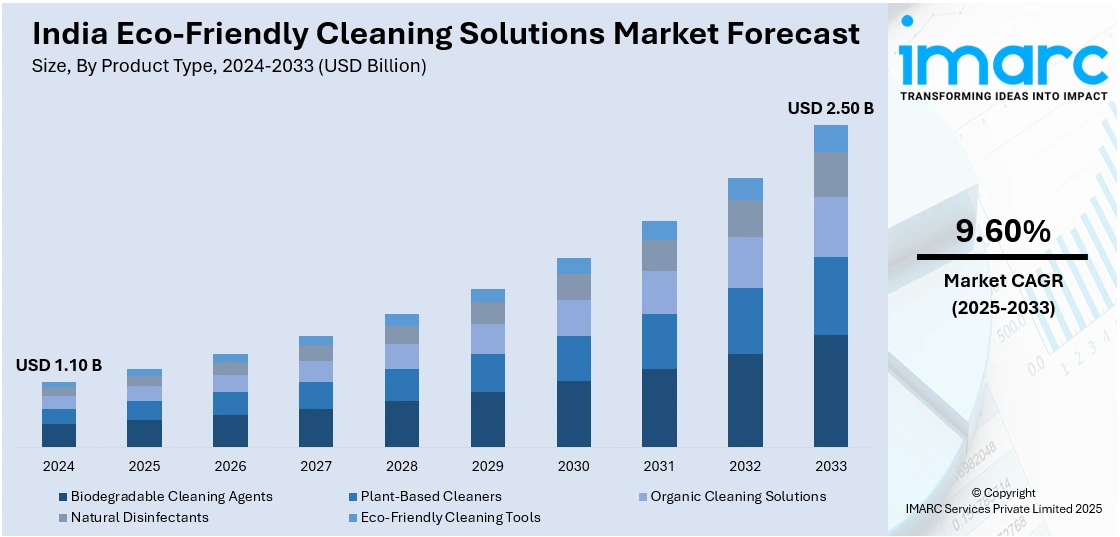

The India eco-friendly cleaning solutions market size reached USD 1.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.50 Billion by 2033, exhibiting a growth rate (CAGR) of 9.60% during 2025-2033. The market is fueled by environmental awareness, health sensitivity, and shift toward sustainability. Government initiatives for cleanliness and sustainability, like Swachh Bharat Abhiyan, along with wider access to information through online channels are shaping purchasing decisions. Brands that supply plant-based, cruelty-free, and eco-packaged products are also catching up with this shift which is further increasing the India eco-friendly cleaning solutions market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.10 Billion |

| Market Forecast in 2033 | USD 2.50 Billion |

| Market Growth Rate 2025-2033 | 9.60% |

India Eco-Friendly Cleaning Solutions Market Trends:

Emergence of Plant-Based and Non-Toxic Products

People in India prefer environmentally friendly cleaning products made of plant-based and non-toxic ingredients. As per the Centre for Science and Environment, 60-70% of cleaning agents in India fail to reveal their chemical contents, which can lead to health and environmental hazards. Furthermore, an average Indian home produces around 500 grams of plastic waste each month solely from cleaning supplies. Hence, households are moving toward cleaners that do not contain harsh chemicals such as ammonia, bleach, and phthalates, which could be harmful to human health as well as to the environment. Manufacturers are countering this by creating products that leverage the strength of natural forces like citrus extracts, essential oils, and biodegradable surfactants. While these formulations provide effective cleaning, they also conform to the consumers' preference for safer and more eco-friendly options. This shift toward plant-based and non-toxic ingredients is a part of a larger movement of health and environmental awareness among Indian consumers.

To get more information on this market, Request Sample

Sustainable Packaging and Minimal Waste

Packaging sustainability is emerging as a key trend in the Indian green cleaning solutions space.Consumers are becoming sensitive to the ecological costs of plastic waste and are opting for products packaged in recyclable, biodegradable, or reusable formats. Brands are adapting by embracing packaging solutions that reduce waste, including refillable packs and compostable packaging. In addition to this, various companies are selling concentrated cleaning chemicals that use fewer packaging materials and have lower carbon emissions during transport. Such focus on green packaging pleases environmentally mindful consumers and is also consistent with India's large-scale environmental vision and regulations toward plastic waste diminution.

Government Initiatives and Consumer Awareness

Government initiatives and growing consumer consciousness are taking center stage in stimulating the use of environmentally friendly cleaning solutions in India. Initiatives such as the "Swachh Bharat Abhiyan" (Clean India Campaign) have increased public awareness regarding cleanliness and hygiene, including the use of eco-friendly cleaning products. These campaigns have motivated consumers to choose products that are effective and environmentally friendly at the same time. Apart from this, the emergence of digital platforms has enabled access to information on the advantages of eco-friendly cleaning solutions, thus empowering consumers to make knowledgeable decisions. This blend of government patronage and consumer awareness is creating a favorable setting for the India eco-friendly cleaning solutions market growth and development.

India Eco-Friendly Cleaning Solutions Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, distribution channel, and form.

Product Type Insights:

- Biodegradable Cleaning Agents

- Plant-Based Cleaners

- Organic Cleaning Solutions

- Natural Disinfectants

- Eco-Friendly Cleaning Tools

The report has provided a detailed breakup and analysis of the market based on the product type. This includes biodegradable cleaning agents, plant-based cleaners, organic cleaning solutions, natural disinfectants, and eco-friendly cleaning tools.

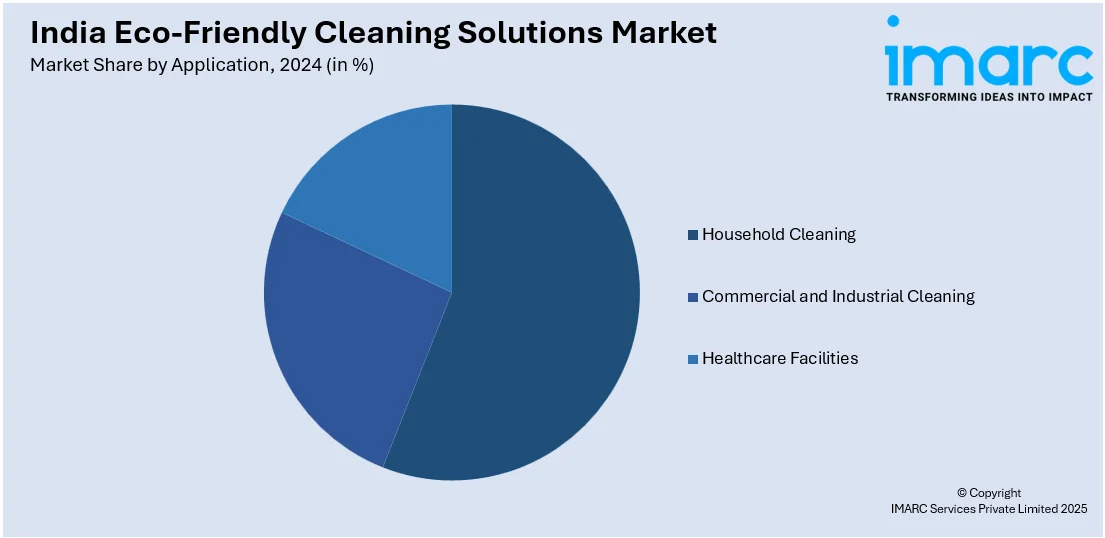

Application Insights:

- Household Cleaning

- Commercial and Industrial Cleaning

- Healthcare Facilities

The report has provided a detailed breakup and analysis of the market based on the application. This includes household cleaning, commercial and industrial cleaning, and healthcare facilities.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Form Insights:

- Liquid Cleaners

- Powder Cleaners

- Spray Cleaners

The report has provided a detailed breakup and analysis of the market based on the form. This includes liquid cleaners, powder cleaners, and spray cleaners.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Eco-Friendly Cleaning Solutions Market News:

- In September 2023, Hindustan Unilever (HUL), the largest consumer goods company in India, made a groundbreaking move by testing a novel technology to create vital raw materials for detergents, such as Soda Ash and Silicate, according to ET. The main goal of this effort is to significantly reduce greenhouse gas emissions (GHG).

- TABBSZ, a startup established in Mumbai in 2024, provides innovative environmentally friendly cleaning products. Established by Shashank Noronha, TABBSZ provides cleaners for various surfaces, including floor, toilet, and glass, as well as laundry detergent, dishwashing tablets, washing machine descalers, and moisturizing foam washes. These environmentally friendly cleaning tablets have attracted 15,000 users, supplying products to approximately 4,000 customers with a repeat purchase rate of 12%.

India Eco-Friendly Cleaning Solutions Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Biodegradable Cleaning Agents, Plant-Based Cleaners, Organic Cleaning Solutions, Natural Disinfectants, Eco-Friendly Cleaning Tools |

| Applications Covered | Household Cleaning, Commercial and Industrial Cleaning, Healthcare Facilities |

| Distribution Channels Covered | Online, Offline |

| Forms Covered | Liquid Cleaners, Powder Cleaners, Spray Cleaners |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India eco-friendly cleaning solutions market performed so far and how will it perform in the coming years?

- What is the breakup of the India eco-friendly cleaning solutions market on the basis of product type?

- What is the breakup of the India eco-friendly cleaning solutions market on the basis of application?

- What is the breakup of the India eco-friendly cleaning solutions market on the basis of distribution channel?

- What is the breakup of the India eco-friendly cleaning solutions market on the basis of form?

- What is the breakup of the India eco-friendly cleaning solutions market on the basis of region?

- What are the various stages in the value chain of the India eco-friendly cleaning solutions market?

- What are the key driving factors and challenges in the India eco-friendly cleaning solutions market?

- What is the structure of the India eco-friendly cleaning solutions market and who are the key players?

- What is the degree of competition in the India eco-friendly cleaning solutions market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India eco-friendly cleaning solutions market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India eco-friendly cleaning solutions market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India eco-friendly cleaning solutions industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)