India Edtech Hardware Market Size, Share, Trends and Forecast by Sector, End User, and Region, 2025-2033

India Edtech Hardware Market Overview:

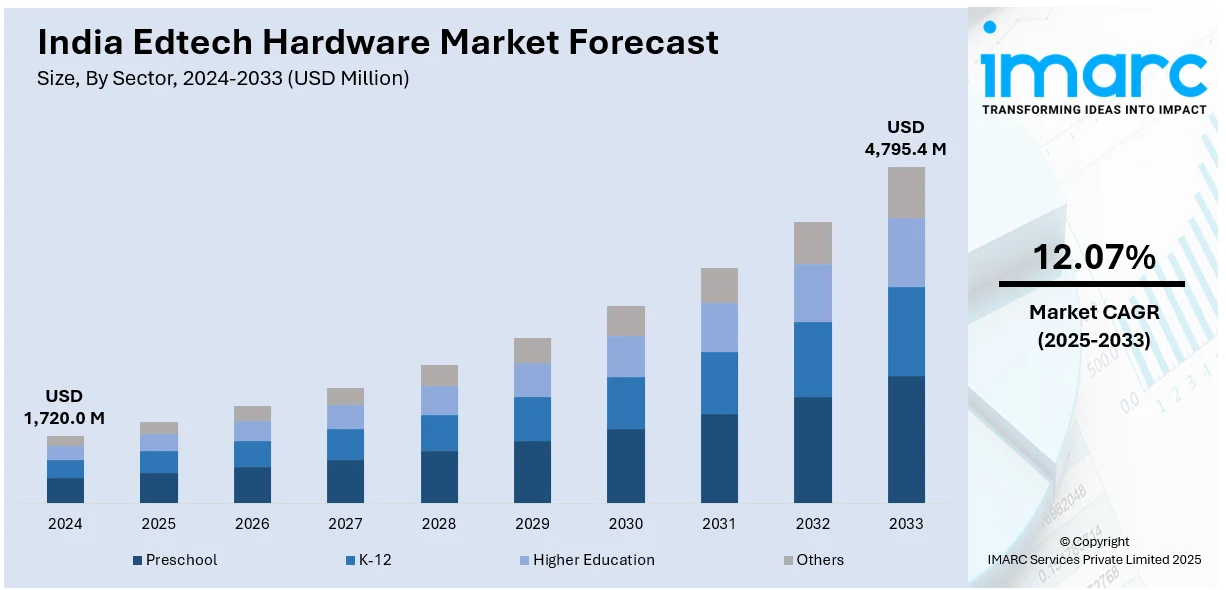

The India edtech hardware market size reached USD 1,720.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,795.4 Million by 2033, exhibiting a growth rate (CAGR) of 12.07% during 2025-2033. The market is driven by rising digital learning adoption, government initiatives, smart classroom expansion, affordable devices, increased internet penetration, AI-driven education tools, hybrid learning demand, virtual reality/augmented reality (VR/AR) integration, corporate upskilling, and growing investment in educational infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,720.0 Million |

| Market Forecast in 2033 | USD 4,795.4 Million |

| Market Growth Rate 2025-2033 | 12.07% |

India Edtech Hardware Market Trends:

Government Initiatives and Incentives Boosting Local Manufacturing

The proactive measures by the Government of India to boost domestic manufacturing are significantly influencing the EdTech hardware industry. For example, introduced in 2020, the Production-Linked Incentive (PLI) scheme provides cash incentives ranging from 4% to 6% on incremental sales, benefiting manufacturers across 14 sectors, including electronics. This initiative aims to reduce dependency on imports, particularly from China, and bolster local production capabilities. Since its launch, the PLI scheme has attracted over USD 17 Billion in investments, resulting in approximately 11 trillion INR (USD 131.6 Billion) in production and generating nearly one million jobs over four years. India has also established itself as a key global hub for electronics manufacturing, particularly in the smartphone sector. For example, Apple's iPhone exports surpassed USD 12 Billion in the 2023/24 fiscal year. Additionally, the government has approved incentives for around 27 IT hardware manufacturers, including industry leaders such as Dell, HP, and Lenovo, with expected production valued at around USD 42 Billion in the coming years. These initiatives enhance the availability of locally produced EdTech hardware but also make these devices more affordable, facilitating wider adoption across educational institutions and among students.

To get more information on this market, Request Sample

Integration of Advanced Technologies in Educational Hardware

The adoption of cutting-edge technologies like artificial intelligence (AI), virtual reality (VR), and augmented reality (AR) in educational hardware is transforming the learning landscape in India. These innovations create immersive and personalized learning experiences, making education more interactive and effective. By integrating these technologies, educational hardware fosters engagement, facilitates real-time feedback, and accommodates diverse learning styles and preferences. In line with this, the rising adoption of online learning is acting as another significant growth-inducing factor. The India online education market is expected to generate USD 7.57 Billion in revenue by 2025, growing at an annual rate of 25.76%. This rapid expansion is anticipated to drive the market volume to USD 18.94 Billion by 2029. This growth aligns with the escalating shift towards digitalization in education, positioning India as a significant player in the EdTech landscape.

India Edtech Hardware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on sector and end user.

Sector Insights:

- Preschool

- K-12

- Higher Education

- Others

The report has provided a detailed breakup and analysis of the market based on the sector. This includes preschool, K-12, higher education, and others.

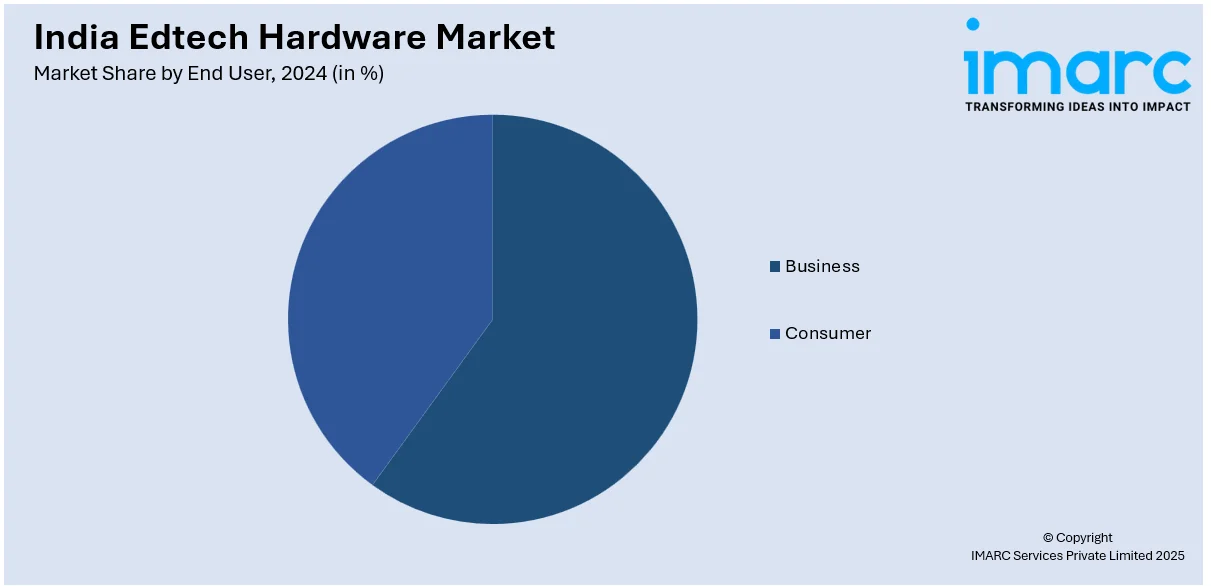

End User Insights:

- Business

- Consumer

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes business and consumer.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Edtech Hardware Market News:

- September 2024: SMART Technologies launched its Transformative Interactive Displays for Education in India, featuring the SMART Board MX Series® and SMART Board GX Series®. These displays are designed to enhance classroom engagement by integrating locally developed, technology-driven solutions tailored to Indian schools.

- February 2024: India unveiled its first AI-powered education tablet, developed domestically with support from the EPIC Foundation. Engineered by VVDN Technologies in collaboration with MediaTek India and CoRover.ai, the tablet aims to bridge the digital divide while promoting sustainable electronic waste management.

India Edtech Hardware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Preschool, K-12, Higher Education, Others |

| End Users Covered | Business, Consumer |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India edtech hardware market performed so far and how will it perform in the coming years?

- What is the breakup of the India edtech hardware market on the basis of sector?

- What is the breakup of the India edtech hardware market on the basis of end user?

- What are the various stages in the value chain of the India edtech hardware market?

- What are the key driving factors and challenges in the India edtech hardware market?

- What is the structure of the India edtech hardware market and who are the key players?

- What is the degree of competition in the India edtech hardware market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India edtech hardware market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India edtech hardware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India edtech hardware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)