India Electric Insulator Market Size, Share, Trends and Forecast by Material, Voltage, Category, Installation, Product, Rating, Application, End Use Industry, and Region, 2025-2033

Market Overview:

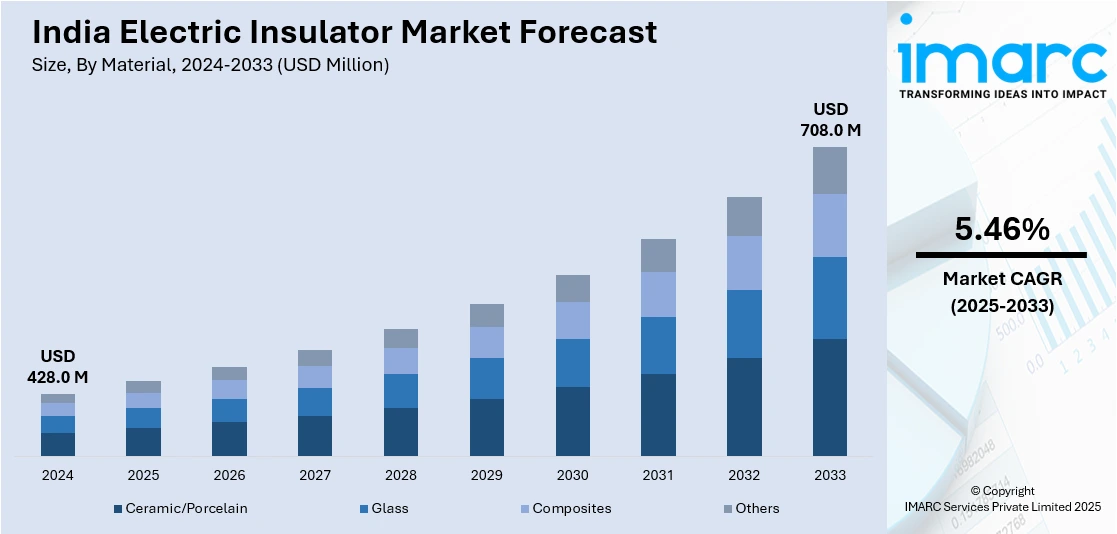

The India electric insulator market size reached USD 428.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 708.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.46% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 428.0 Million |

|

Market Forecast in 2033

|

USD 708.0 Million |

| Market Growth Rate (2025-2033) | 5.46% |

An electric insulator is a material that exhibits low electrical conductivity as it does not consist of a free-flowing electric charge. It demonstrates high resistance when a source of electromotive force (EMF) is applied to it and can efficiently assist in concentrating the flow of electric current while averting the current from flowing in the wrong direction. Composite materials, air, rubber, plastic, wood, glass, silk, ceramic, and paper are some of the common insulating materials used for coating wires and as dielectrics in capacitors. In India, electric insulators are gaining traction as they provide protection against the hazardous effects of electricity and are widely used in electricity transmission and distribution (T&D) networks.

To get more information on this market, Request Sample

The India electric insulator market is primarily driven by rapid urbanization, which has increased the need for heating, ventilation, and air conditioning (HVAC) systems in the country. The growing industrial sector has further escalated the electricity consumption, providing a positive impact on the electric insulator market. Additionally, the emerging trend of privatization of the electricity distribution sector has also increased the power generation capacity, thereby expanding the transmission and distribution (T&D) infrastructure in the region. Since insulators form an essential component of these networks, their expansion is creating a positive outlook for the market. Furthermore, the government is investing heavily in refurbishing the aging grid technology and establishing smart grid vision and green energy corridors to develop a sustainable and efficient electrical network that reaches every state.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India electric insulator market report, along with forecasts at the country level from 2025-2033. Our report has categorized the market based on material, voltage, category, installation, product, rating, application, and end use industry.

Breakup by Material:

- Ceramic/Porcelain

- Glass

- Composites

- Others

Breakup by Voltage:

- Low

- Medium

- High

Breakup by Category:

- Bushings

- Other Insulators

Breakup by Installation:

- Distribution Networks

- Transmission Lines

- Substations

- Railways

- Others

Breakup by Product:

- Pin Insulator

- Suspension Insulator

- Shackle Insulator

- Others

Breakup by Rating:

- <11 kV

- 11 kV

- 22 kV

- 33 kV

- 72.5 kV

- 145 kV

- Others

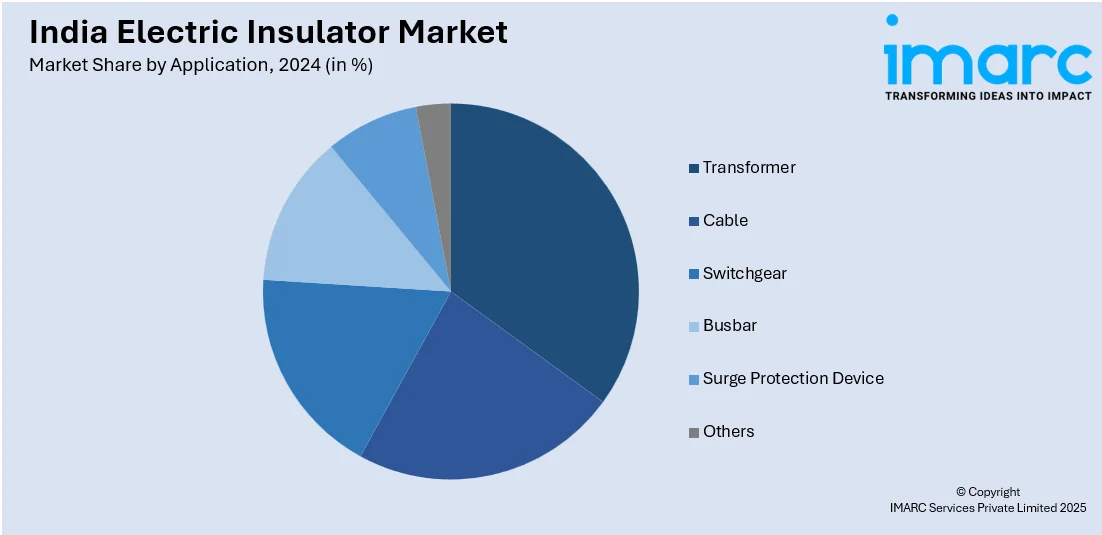

Breakup by Application:

- Transformer

- Cable

- Switchgear

- Busbar

- Surge Protection Device

- Others

Breakup by End Use Industry:

- Utilities

- Industries

- Others

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Material, Voltage, Category, Installation, Product, Rating, Application, End Use Industry, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric insulator market was valued at USD 428.0 Million in 2024.

We expect the India electric insulator market to exhibit a CAGR of 5.46% during 2025-2033.

The rising utilization of Heating, Ventilation and Air Conditioning (HVAC) systems, along with the continuous development of sustainable and efficient electrical networks, is primarily driving the India electric insulator market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of numerous manufacturing units for electric insulators.

Based on the material, the India electric insulator market has been divided into ceramic/porcelain, glass, composites, and others. Currently, ceramic/porcelain holds the largest market share.

Based on the voltage, the India electric insulator market can be segregated into low, medium, and high. Among these, high currently exhibits clear dominance in the market.

Based on the category, the India electric insulator market has been bifurcated into bushings and other insulators. Currently, bushings account for the majority of the total market share.

Based on the installation, the India electric insulator market can be segmented into distribution networks, transmission lines, substations, railways, and others, where distribution networks hold the largest market share.

Based on the product, the India electric insulator market has been divided into pin insulator, suspension insulator, shackle insulator, and others. Among these, pin insulator currently exhibits a clear dominance in the market.

Based on the rating, the India electric insulator market can be categorized into <11 kV, 11 kV, 22 kV, 33 kV, 72.5 kV, 145 kV, and others. Currently, 33kV accounts for the majority of the total market share.

Based on the application, the India electric insulator market has been segregated into transformer, cable, switchgear, busbar, surge protection device, and others. Among these, transformer currently exhibits a clear dominance in the market.

Based on the end use industry, the India electric insulator market can be bifurcated into utilities, industries, and others. Currently, utilities hold the largest market share.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where West and Central India currently dominates the India electric insulator market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)