India Electric Rickshaw Market Report by Motor Power (<1000 W, 1000 – 15000 W, >1500 W), Battery Capacity (<101 Ah, >101 Ah), Battery Type (Li-ion Battery, Lead Acid Battery), Sales Channel (Organised, Unorganised), End User (Passenger Carrier, Load Carrier), and Region 2025-2033

Market Overview 2025-2033:

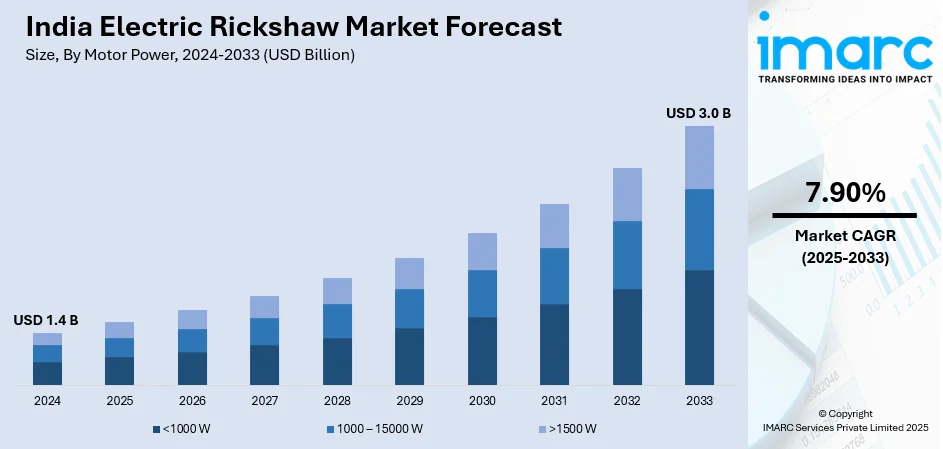

The India electric rickshaw market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.0 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Market Growth Rate (2025-2033) | 7.90% |

Electric rickshaws are battery-operated three-wheelers with a better economy and lower operational and maintenance costs. They comprise a motor, controller, harness, batteries and throttle. They are strong, non-conducting, lightweight, highly durable, and resistant to fire. They are eco-friendly as e-rickshaws do not have tailpipes and emit toxic pollutants into the air during operation. They are more comfortable to drive and cheaper compared to manually pulled rickshaws. In addition, they ensure a smooth driving experience on busy and congested roads while producing fewer vibrations and noise.

India Electric Rickshaw Market Trends:

The rising awareness among the masses of India about the benefits of using e-rickshaws represents one of the key factors driving the market. Besides this, the Government of India is promoting electric vehicles (EVs) in public transportation and fleets. This, along with rising incentives provided by governing authorities to the manufacturers of electric vehicles (EVs), is contributing to the growth of the market. Moreover, the affordable price of e-rickshaws and their maneuverability across urban roads of India are positively influencing the market. In addition, there is an increase in the demand for e-rickshaws due to the expected ban on fuel-powered vehicles. This, coupled with the rising fuel prices in the country, is offering lucrative growth opportunities to industry investors. Apart from this, due to the increasing urban population, there is a rise in the demand for cost-effective first and last-mile transportation in India. In line with this, rising concerns about environmental pollution due to the utilization of diesel-fueled vehicles are catalyzing the demand for e-rickshaws in the country. Additionally, key market players are extensively investing in research and development (R&D) activities to introduce improved e-rickshaws with powerful motors.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India electric rickshaw market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on motor power, battery capacity, battery type, sales channel and end user.

Breakup by Motor Power:

- <1000 W

- 1000 – 15000 W

- >1500 W

Breakup by Battery Capacity:

- <101 Ah

- >101 Ah

Breakup by Battery Type:

- Li-ion Battery

- Lead Acid Battery

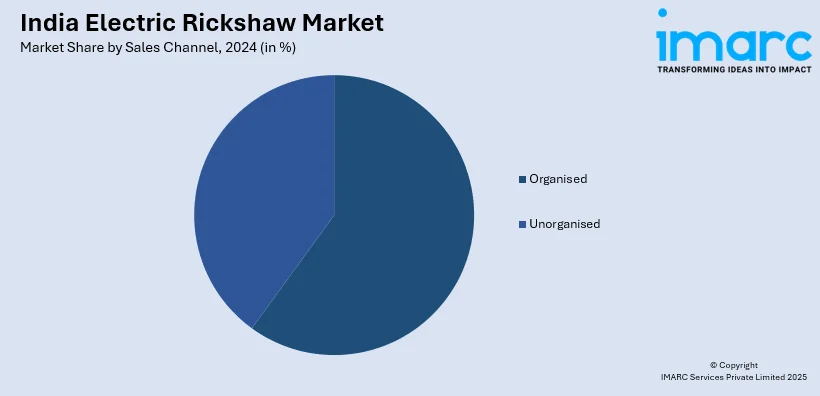

Breakup by Sales Channel:

- Organised

- Unorganised

Breakup by End User:

- Passenger Carrier

- Load Carrier

Breakup by Region:

- North India

- West and Central India

- South India

- East India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players being Adapt Motors Private Limited, ATUL Auto Limited, CityLife EV, E-Ashwa Automotive Private Limited, Goenka Electric Motor Vehicles Private Limited, Jezza Motors (Vani Electric Vehicles Pvt. Ltd), Kinetic Green Energy & Power Solutions Ltd, Lohia Auto Industries, Mini Metro EV LLP, Saera Electric Auto Private Limited, Terra Motors India Corp., Thukral Electric Bikes and Udaan E Rickshaw.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Motor Power, Battery Capacity, Battery Type, Sales Channel, End User, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | Adapt Motors Private Limited, ATUL Auto Limited, CityLife EV, E-Ashwa Automotive Private Limited, Goenka Electric Motor Vehicles Private Limited, Jezza Motors (Vani Electric Vehicles Pvt. Ltd), Kinetic Green Energy & Power Solutions Ltd, Lohia Auto Industries, Mini Metro EV LLP, Saera Electric Auto Private Limited, Terra Motors India Corp., Thukral Electric Bikes and Udaan E Rickshaw |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India electric rickshaw market was valued at USD 1.4 Billion in 2024.

We expect the India electric rickshaw market to exhibit a CAGR of 7.90% during 2025-2033.

The rising consumer awareness towards eco-friendly commuting solutions, such as electric rickshaw, for public transportation is primarily driving the India electric rickshaw market.

The sudden outbreak of the COVID-19 pandemic had led to the growing consumer inclination towards personal vehicles to combat the risk of the coronavirus infection, thereby limiting the demand for public transports, such as electric rickshaws, across the nation.

Based on the motor power, the India electric rickshaw market can be segmented into <1000 W, 1000 – 15000 W, and >1500 W. Among these, 1000 – 15000 W holds the majority of the total market share.

Based on the battery capacity, the India electric rickshaw market has been divided into <101 Ah and >101 Ah, where <101 Ah currently exhibits a clear dominance in the market.

Based on the battery type, the India electric rickshaw market can be categorized into li-ion battery and lead acid battery. Currently, lead acid battery accounts for the majority of the total market share.

Based on the sales channel, the India electric rickshaw market has been segregated into organized and unorganized, where the unorganized sales channel currently holds the largest market share.

Based on the end user, the India electric rickshaw market can be bifurcated into passenger carrier and load carrier. Currently, passenger carrier exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, West and Central India, South India, and East India, where North India currently dominates the India electric rickshaw market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Request Customization

Request Customization

.webp)

.webp)