India Electric Substation Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Electric Substation Market Overview:

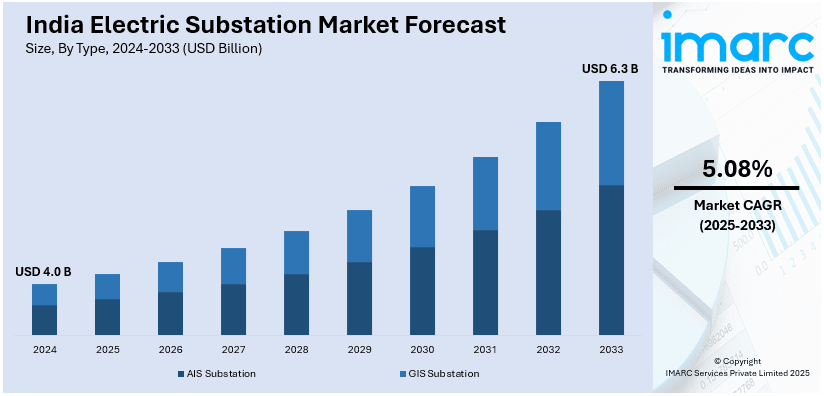

The India electric substation market size reached USD 4.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.3 Billion by 2033, exhibiting a growth rate (CAGR) of 5.08% during 2025-2033. The market is driven by rising electricity demand due to urbanization and industrial expansion, government investments in grid modernization, and increasing renewable energy integration. Smart grid adoption, infrastructure upgrades, and policies supporting efficient power transmission further propel market growth, enhancing reliability, reducing losses, and ensuring energy security across regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.0 Billion |

| Market Forecast in 2033 | USD 6.3 Billion |

| Market Growth Rate 2025-2033 | 5.08% |

India Electric Substation Market Trends:

Expansion of Renewable Energy Integration

India’s rapid renewable energy expansion is driving significant upgrades in electric substation infrastructure to accommodate fluctuating solar and wind power inputs. With the government’s target of integrating 20 GW of renewable energy through new transmission lines by 2026, substations are being modernized to enhance grid stability. High-voltage and hybrid substations, along with grid-scale energy storage systems, are crucial for managing variable power flows. Technologies such as Static Synchronous Compensators (STATCOMs) and advanced power transformers are being deployed to regulate voltage fluctuations and improve power quality. The Green Energy Corridor initiative is facilitating transmission expansion across Gujarat, Himachal Pradesh, Karnataka, Kerala, Rajasthan, Tamil Nadu, and Uttar Pradesh. As India moves toward its clean energy goals, modern substations play a pivotal role in supporting decentralized power generation and efficient energy distribution.

To get more information on this market, Request Sample

Growing Adoption of Smart Substations

The Indian electric substation market is experiencing greater adoption of smart substations, fueled by the demand for optimal energy management and grid modernization. Digital technologies like real-time monitoring systems, Intent of Things (IoT)-based sensors, and automation are revolutionizing conventional substations into intelligent power centers. Utilities are more and more adding Supervisory Control and Data Acquisition (SCADA) and advanced communication networks to enhance the operational efficiency, reduce downtime, and improve the reliability of power. Government programs encouraging digital transformation of the grid and smart city projects speed up this trend. The shift to intelligent substations also facilitates renewable integration by allowing greater demand-supply balancing, real-time analysis, and predictive maintenance, lowering operating expenses while improving energy security and transmission efficiency throughout the power grid.

Increased Investments in Grid Modernization

The Indian government and private sector are investing heavily in grid modernization to enhance power infrastructure and reduce transmission losses, aligning with India’s renewable energy integration goals. Aging substations are being upgraded with automation, digital control systems, and remote monitoring to improve efficiency. Gas-insulated substations (GIS) are gaining traction due to their space efficiency and reliability, especially in urban areas. Key initiatives like the Revamped Distribution Sector Scheme (RDSS) and the Green Energy Corridor project are accelerating modern substation deployment. With India targeting 175 GW of renewable energy integration by 2022 and 450 GW by 2030, the demand for high-voltage substations is rising. Grid modernization efforts are vital for a stable, resilient, and future-ready electricity network.

India Electric Substation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- AIS Substation

- GIS Substation

The report has provided a detailed breakup and analysis of the market based on the type. This includes AIS substation, and GIS substation.

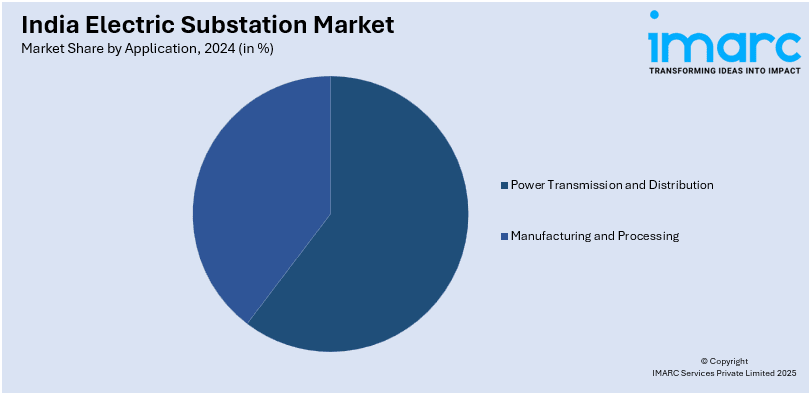

Application Insights:

- Power Transmission and Distribution

- Manufacturing and Processing

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power transmission and distribution, and manufacturing and processing.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Substation Market News:

- In February 2025, Power Grid Corporation of India (Powergrid) has acquired Khavda V-B1B2 Power Transmission Limited (KVB1B2) for Rs 651 million under a tariff-based competitive bidding process. The project involves augmenting transformation capacity at KPS1 and KPS2 substations in Gujarat under the BOOT model. Powergrid now holds the transmission license and regulatory approvals, ensuring efficient execution of the under-construction substations to enhance power transmission infrastructure.

- In September 2024, Tata Power Delhi Distribution (Tata Power-DDL) and Nissin Electric Co are set to launch India’s first micro substation project, aiming to provide stable electricity to remote areas lacking grid access. This initiative marks a significant step in enhancing India’s energy infrastructure, ensuring reliable power supply through advanced technology. The demonstration project will showcase innovative solutions for decentralized energy distribution, supporting rural electrification and strengthening sustainable power access across underserved regions.

India Electric Substation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | AIS Substation, GIS Substation |

| Applications Covered | Power Transmission and Distribution, Manufacturing and Processing |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric substation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric substation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric substation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric substation market in India was valued at USD 4.0 Billion in 2024.

The India electric substation market is projected to exhibit a CAGR of 5.08% during 2025-2033, reaching a value of USD 6.3 Billion by 2033.

The India electric substation market is witnessing significant growth mainly due to growing electricity demand, rapid urbanization, and expansion of renewable energy projects. Government investments in grid modernization, rural electrification programs, and the need for reliable power transmission and distribution infrastructure further support the rising deployment of advanced substations nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)