India Electric Two-Wheeler Components Market Size, Share, Trends and Forecast by Vehicle Type, Demand Category, Component Type, and Region, 2025-2033

India Electric Two-Wheeler Components Market Overview:

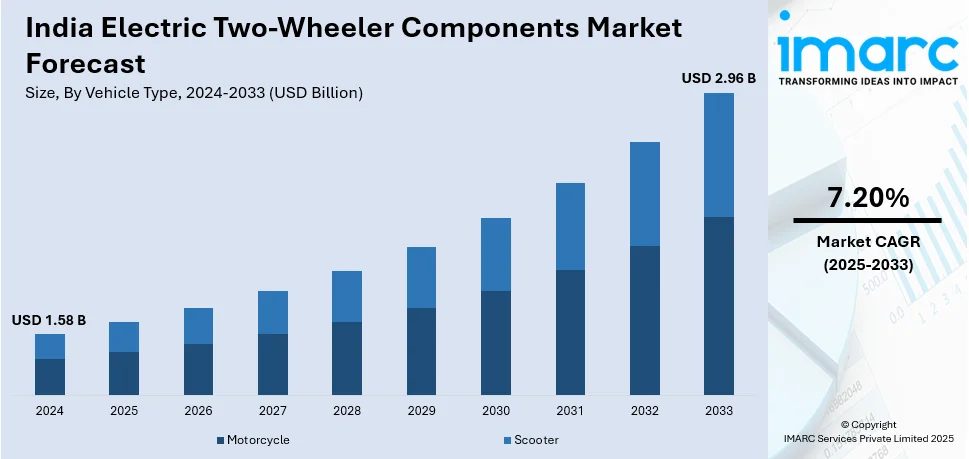

The India electric two-wheeler components market size reached USD 1.58 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.96 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The market is expanding due to government incentives under FAME II, rising fuel costs, increasing urbanization, and stringent emission norms. The growing adoption of lithium-ion batteries, advancements in motor and controller technologies, infrastructure expansion, and consumer preference for sustainable mobility solutions are further accelerating demand, strengthening supply chains.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.58 Billion |

| Market Forecast in 2033 | USD 2.96 Billion |

| Market Growth Rate (2025-2033) | 7.20% |

India Electric Two-Wheeler Components Market Trends:

Expansion of Localized Manufacturing and Supply Chains

The electric two-wheeler components market in India is witnessing increasing localization due to government policies aimed at reducing dependence on imports. Key initiatives, such as the Production-Linked Incentive (PLI) scheme and phased manufacturing programs, are encouraging domestic production of batteries, motors, and controllers. Several manufacturers are establishing partnerships with local suppliers to ensure cost efficiency, reduced lead times, and compliance with domestic regulatory standards. The localization trend is also fostering innovation, as Indian companies invest in R&D for indigenous electric drivetrains and advanced battery technologies. This shift is not only strengthening India’s position in the global EV supply chain but also ensuring long-term sustainability by minimizing reliance on Chinese and other international suppliers. For instance, in February 2025, PlugNride Motors launched the APKE PNR 100 and APKE PNR 200, marking a milestone in India’s EV industry. Certified by NATRAX, these indigenous high-speed electric two-wheelers offer 70 kmph speed and 120 km range per charge. The company aims to sell 20,000 units by FY 2026, emphasizing local manufacturing. With a focus on B2B and retail, PlugNride targets quick-commerce and urban commuters, aligning with India’s ‘Make in India’ initiative for sustainable mobility solutions.

To get more information on this market, Request Sample

Integration of Smart and Connected Components

The rapid digitization of electric two-wheelers is driving demand for advanced telematics, IoT-enabled batteries, and intelligent controllers. Manufacturers are integrating smart Battery Management Systems (BMS), predictive maintenance tools, and real-time diagnostics to enhance vehicle efficiency and safety. The increasing use of cloud connectivity and mobile applications allows users to monitor battery health, track performance, and optimize energy consumption. This trend aligns with India's push toward connected mobility and data-driven transportation solutions, which will enable fleet operators and consumers to make informed decisions about vehicle maintenance and usage. Furthermore, 5G connectivity and AI-driven analytics are expected to enhance vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication, creating a more integrated EV ecosystem. For instance, in January 2025, PURE EV launched X Platform 3.0, integrating Predictive AI to adapt to rider behavior and Cloud AI for over-the-air updates. The platform enhances performance with Thrill Mode, boosting torque by 25%. A Next-Gen TFT Dashboard offers seamless iOS and Android connectivity. Initially available in ePluto 7G Max and eTryst X, it will expand to all models by end-2025. This move strengthens PURE EV’s commitment to advanced electric mobility solutions, improving user experience and vehicle efficiency.

Technological Innovations in Battery Chemistry and Energy Management

Advancements in solid-state batteries, sodium-ion technology, and fast-charging capabilities are shaping the future of electric two-wheeler components in India. Lithium-ion batteries remain dominant, but emerging alternatives such as lithium-iron-phosphate (LFP) and sodium-ion batteries are gaining traction due to cost-effectiveness, improved safety, and better thermal stability. Additionally, the market is witnessing a push toward energy-efficient powertrains that maximize range and durability. The introduction of swappable battery systems is also becoming a key differentiator, addressing range anxiety and enhancing vehicle uptime. Research into ultra-fast charging stations and wireless charging solutions is accelerating, driven by the need for convenient, high-efficiency energy replenishment. For instance, in October 2024, Emobi Manufacturing launched the AKX Commuter, a Made-in-India electric two-wheeler designed for last-mile delivery. It features fast charging, geo-fencing, and live tracking, improving fleet efficiency. Powered by Li-ion battery packs (1.5 kWh LFP, 2.3 kWh NMC), it offers a 75-120 km range. Emobi partnered with Livaah Innovations for dual-use battery integration. The company aims to enhance micro-mobility and expand globally, aligning with India’s sustainability goals and the growing demand for efficient urban transportation solutions. These innovations will be critical in boosting consumer confidence and accelerating EV adoption across urban and semi-urban markets.

India Electric Two-Wheeler Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on vehicle type, demand category, and component type.

Vehicle Type Insights:

- Motorcycle

- Scooter

A detailed breakup and analysis of the market based on the vehicle type have been provided in the report. This includes motorcycle and scooter.

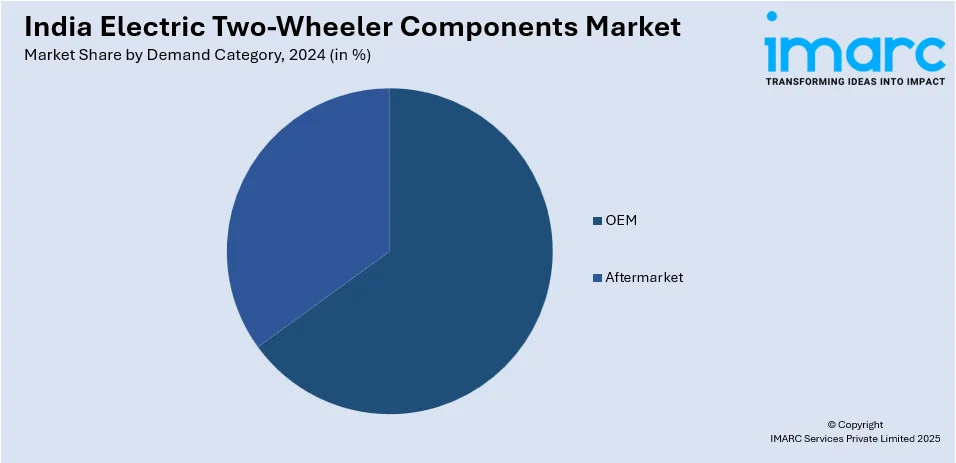

Demand Category Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the demand category have also been provided in the report. This includes OEM and aftermarket.

Component Type Insights:

- Battery Packs

- DC-DC Converter

- Controller and Inverter

- Motor

- On-Board Charges

- Others

A detailed breakup and analysis of the market based on the component type have also been provided in the report. This includes battery packs, DC-DC converter, controller and inverter, motor, on-board charges, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Electric Two-Wheeler Components Market News:

- In February 2025, Ather Energy expanded its R&D and testing facility, ‘The Juggernaut,’ in Bengaluru, covering 38,692 sq ft to enhance durability, safety, and performance validation. The IPO-bound company has invested ₹238.8 crore in R&D. The facility features advanced road simulators for rigorous component testing under Indian road conditions. Ather operates three R&D centers and two manufacturing plants, with an upcoming facility in Maharashtra, competing with Ola, Bajaj, Hero, and TVS in India's growing EV market.

- In July 2024, BMW Motorrad India launched the BMW CE 04, its first premium electric scooter in India. This urban electric scooter delivers 42 hp, accelerates 0-50 km/h in 2.6 seconds, and reaches 120 km/h with a 130 km range. It features a liquid-cooled motor, lithium-ion battery, and a 10.25-inch TFT display. Available as a Completely Built-up Unit (CBU), the CE 04 aligns with BMW’s commitment to urban e-mobility solutions.

- In January 2025, SBD Technologies and Emobi partnered to enhance EV fleet adoption by integrating Emobi’s 120,000+ public charging locations into SBD’s FleetCharge solution. This collaboration simplifies fleet charging management, reducing range anxiety and optimizing operations with AI-driven insights. FleetCharge consolidates charging data, payments, and reporting for seamless fleet management. Emobi’s AI technology enhances charger reliability and data accuracy. Both companies aim to accelerate sustainable mobility by providing fleet operators with efficient and scalable EV charging infrastructure.

- In January 2025, Honda Motor Japan announced that it will establish a dedicated electric motorcycle production plant in India by 2028. The facility will manufacture a diverse range of electric two-wheelers, utilizing modular components for multiple models. Honda aims to align the total cost of ownership of EVs with traditional internal combustion models. This move reinforces Honda’s commitment to India’s EV transition and strengthens its manufacturing capabilities in the growing electric two-wheeler market.

- In February 2025, Ola Electric launched the Roadster X series, marking its entry into the electric motorcycle segment. Ola aims to strengthen its market presence, leveraging its 30% market share in electric two-wheelers. The company continues expanding its EV portfolio, manufacturing in Tamil Nadu, and developing battery technology in Bengaluru.

- In November 2024, Honda Motorcycle & Scooter India (HMSI) launched its first electric two-wheelers, ACTIVA e: and QC1, marking its entry into India's EV market. The ACTIVA e: features swappable battery technology with a 102 km range, while the QC1 has a fixed battery offering 80 km per charge. Both models prioritize advanced connectivity, safety, and performance. Deliveries are anticipated to start from February 2025 across select cities, reinforcing Honda’s commitment to sustainable mobility.

- In January 2024, Ather Energy expanded its use of Siemens Xcelerator software to accelerate electric vehicle development, improve product quality, and reduce design cycles. The adoption of Siemens' Product Lifecycle Management (PLM), virtual simulation, and physical testing solutions enhances efficiency and supports faster time-to-market for Ather's electric scooters. With over 1,600 charging points and 175 Experience Centers, Ather continues its expansion in India and Nepal. The collaboration aligns with Ather’s goal of advancing sustainable mobility using cutting-edge digital engineering tools.

- In June 2024, Musashi Auto Parts India began mass production of e-Axles for two-wheel EVs at its Bangalore facility, targeting 10,000 units in 2024 and 1 million by 2030. The e-Axle, designed for compact, lightweight, and quiet operation, will be used in Perfetto and Emobi's EVs. The initiative supports India's push to convert 80% of two-wheelers to EVs by 2030. Musashi, in partnership with Delta Electronics and Toyota Tsusho, aims to drive EV adoption and carbon neutrality worldwide.

India Electric Two-Wheeler Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Motorcycle, Scooter |

| Demand Categories Covered | OEM, Aftermarket |

| Component Types Covered | Battery Packs, DC-DC Converter, Controller and Inverter, Motor, On-Board Charges, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India electric two-wheeler components market performed so far and how will it perform in the coming years?

- What is the breakup of the India electric two-wheeler components market on the basis of vehicle type?

- What is the breakup of the India electric two-wheeler components market on the basis of demand category?

- What is the breakup of the India electric two-wheeler components market on the basis of component type?

- What are the various stages in the value chain of the India electric two-wheeler components market?

- What are the key driving factors and challenges in the India electric two-wheeler components market?

- What is the structure of the India Electric Two-Wheeler components market and who are the key players?

- What is the degree of competition in the India Electric Two-wheeler components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric two-wheeler components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India electric two-wheeler components market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric two-wheeler components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)