India Electric Vehicle Charging Station Market Size, Share, Trends and Forecast by Charging Station Type, Vehicle Type, Installation Type, Charging Level, Connector Type, Application, and Region, 2026-2034

India Electric Vehicle Charging Station Market Size and Share:

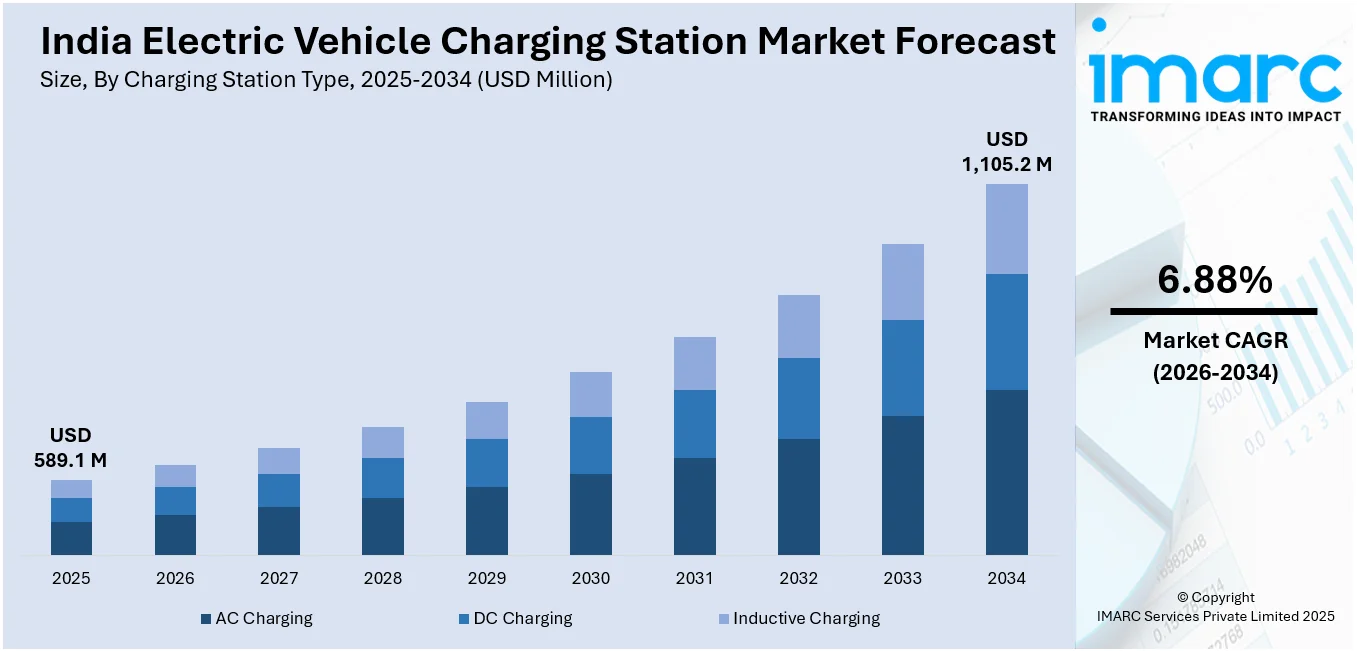

The India electric vehicle charging station market size was valued at USD 589.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,105.2 Million by 2034, exhibiting a CAGR of 6.88% during 2026-2034. North India currently dominates the market, holding a significant market share of over 33.8% in 2025on account of rapid urbanization, supportive government policies, and high vehicle concentration. The region is witnessing strong growth in charging infrastructure, with both public and private sectors actively investing to meet rising demand and promote the widespread adoption of electric mobility.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 589.1 Million |

| Market Forecast in 2034 | USD 1,105.2 Million |

| Market Growth Rate 2026-2034 | 6.88% |

The India electric vehicle charging station market is driven by several key factors. Government initiatives, such as FAME II and state EV policies, are providing subsidies and incentives to boost EV adoption and charging infrastructure. Rising environmental concerns and fuel price volatility are encouraging a shift toward cleaner mobility. Rapid urbanization, increased vehicle density, and growing awareness of electric mobility are further propelling demand. Advancements in battery technology and declining EV costs are making electric vehicles more accessible, which in turn increases the need for robust charging networks. Additionally, private sector participation and strategic partnerships between automakers, energy providers, and tech firms are accelerating deployment. Smart city projects and digital payment integration are also enhancing user convenience and driving market growth.

To get more information on this market Request Sample

Large-scale investments are accelerating the shift toward renewable-powered EV infrastructure in India. Focus is growing on fleet-centric charging hubs, particularly in urban centers like Bengaluru. Collaborations across clean energy, tech, and consulting sectors are supporting scalable models that cut fuel use and emissions, signaling stronger alignment with long-term decarbonization goals. For instance, in September 2024, Amazon’s Climate Pledge Fund backed a project in Bengaluru to expand India’s EV charging station network. The initiative committed USD 2.65 Million to build renewable energy-powered charging hubs under the JOULE network. Targeting corporate EV fleets, the project aimed to support 5,500 EVs by 2030. Partners included Kazam, Greenko, and Deloitte. The expected environmental impact included saving 11.2 million liters of fuel and cutting 25,700 tons of CO₂ emissions.

India Electric Vehicle Charging Station Market Trends:

Rapid Scale-Up in Charging Infrastructure Demand

The growing shift toward electric mobility in India is fueling strong momentum in charging infrastructure development. As adoption rises across personal, commercial, and public transport segments, there is a marked push to establish widespread and accessible charging networks. Both government initiatives and private sector efforts are converging to improve grid readiness, support faster charging technologies, and expand reach across cities and highways. This movement is shaping the ecosystem around convenience, reliability, and interoperability, paving the way for a more integrated and efficient charging experience aligned with the country's broader electrification goals. For example, according to the India Brand Equity Foundation, the Indian EV market is forecasted to expand from USD 3.21 Billion in 2022 to USD 113.99 Billion by 2029, with a CAGR of 66.52%.

Boost in Public Charging Accessibility

Policy support continues to shape the direction of India’s electric mobility efforts, with renewed emphasis on strengthening charging infrastructure. Recent government initiatives have prioritized expanding the public charging network to make it more accessible and user-friendly across urban and semi-urban locations. This push is aimed at reducing range anxiety, encouraging adoption across segments, and enabling smoother integration of electric vehicles into daily transport routines. The focus is also shifting toward standardization, ease of use, and better geographic coverage, signaling a broader commitment to creating a dependable and future-ready charging ecosystem. For instance, the launch of the USD 1.31 Billion PM E-DRIVE scheme in October 2024 strengthened India’s EV transition, with USD 0.24 Billion allocated for public charging stations to enhance their reach and usability, as stated by the International Council on Clean Transportation (ICCT).

Push Toward Low-Carbon Mobility Solutions

India’s decarbonization goals are accelerating the shift toward cleaner transportation options, placing greater focus on the development of electric vehicle charging infrastructure. As part of broader environmental targets, the charging ecosystem is gaining importance in efforts to reduce emissions across urban and intercity travel. There is growing alignment between climate objectives and infrastructure planning, with increased attention on expanding coverage, improving energy efficiency, and integrating renewable energy sources. This direction supports a longer-term vision of sustainable mobility, where widespread charging access plays a critical role in reducing the environmental footprint of the transport sector. For example, as per Startup India, the country aims to decrease total projected carbon emissions by one billion tons by 2030.

India Electric Vehicle Charging Station Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India electric vehicle charging station market, along with forecasts at the regional level from 2026-2034. The market has been categorized based on charging station type, vehicle type, installation type, charging level, connector type, and application.

Analysis by Charging Station Type:

- AC Charging

- DC Charging

- Inductive Charging

DC charging stands as the largest component in 2025, holding around 63.7% of the market due to its ability to deliver high-speed charging, making it ideal for commercial use and highway applications. As EV adoption rises, especially in fleet operations and long-distance travel, the demand for fast and efficient charging solutions has grown. DC chargers significantly reduce charging time compared to AC chargers, improving turnaround for electric taxis, buses, and delivery vehicles. Government programs and infrastructure policies are also increasingly prioritizing the installation of DC fast chargers along highways and in urban centers. This emphasis on reducing range anxiety and improving convenience is pushing the expansion of DC charging networks, positioning them as a dominant force driving market growth.

Analysis by Vehicle Type:

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Hybrid Electric Vehicle (HEV)

Battery electric vehicle (BEV) led the market with around 75.1% of market share in 2025, owing to its complete reliance on external charging infrastructure. Unlike hybrid models, BEVs lack internal combustion engines or alternative fuel options, making access to reliable charging stations essential. The Indian government's strong policy push for zero-emission mobility, along with rising fuel costs, has accelerated BEV adoption across both personal and commercial segments. As BEVs gain popularity, especially in urban fleets and public transportation, the need for a widespread and efficient charging network becomes critical. This demand is encouraging investment in charging infrastructure, especially in high-density areas, thereby boosting the market.

Analysis by Installation Type:

- Portable Charger

- Fixed Charger

Fixed charger led the market with around 83.8% of market share in 2025. This is due to the widespread deployment of fixed chargers across residential complexes, commercial hubs, and public spaces. These chargers offer stable, high-capacity charging solutions, ideal for regular daily use. Their reliability, ease of integration with existing power infrastructure, and lower maintenance needs make them preferred over portable options. As urban EV adoption increases, fixed charging stations provide the necessary support for users seeking convenient and permanent solutions. Government programs and smart city initiatives further promote fixed charger installations, reinforcing their role as a key factor driving market growth in India.

Analysis by Charging Level:

- Level 1

- Level 2

- Level 3

Level 3 led the market with around 58.7% of market share in 2025, owing to its ability to deliver high-speed DC charging, making it ideal for time-sensitive users and commercial fleets. These chargers significantly reduce charging durations compared to Level 1 and Level 2, supporting quick turnaround for electric buses, taxis, and long-distance travelers. The increasing push for fast-charging infrastructure in urban areas and highways, backed by government initiatives and infrastructure targets, is accelerating Level 3 charger deployment. Their role in minimizing range anxiety and enhancing EV usability is driving demand, making them a key driver of market growth.

Analysis by Connector Type:

- Combines Charging Station (CCS)

- CHAdeMO

- Normal Charging

- Tesla Supercharger

- Type-2 (IEC 621196)

- Others

Combines charging station (CCS) led the market with around 43.8% of market share in 2025 due to its compatibility with both AC and DC charging, offering flexibility and faster charging capabilities. As EV manufacturers increasingly adopt CCS as the standard, infrastructure providers are prioritizing its deployment to ensure wide vehicle compatibility. CCS supports fast-charging needs, making it suitable for both personal and commercial EV segments. Its ability to serve multiple vehicle types with a single connector improves efficiency and reduces installation complexity. Growing BEV adoption and the push for standardized, future-ready infrastructure are driving CCS expansion across India’s charging network.

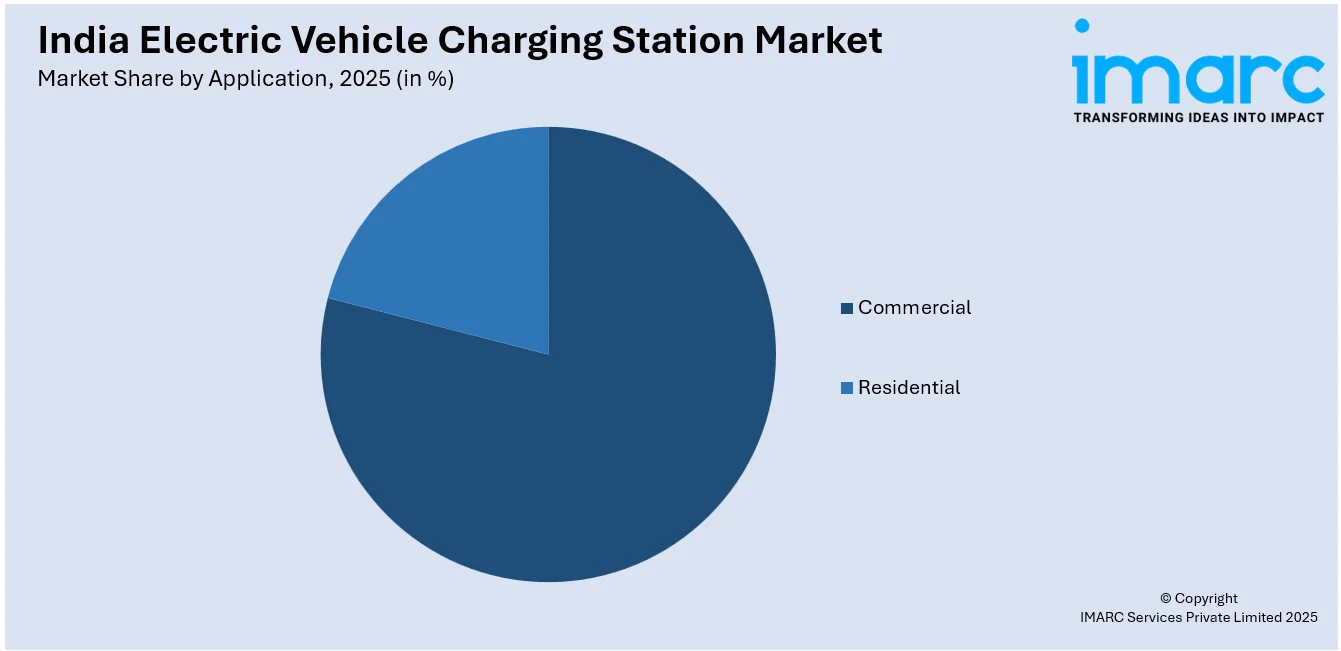

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

Commercial led the market with around 79.2% of market share in 2025. This is due to the rapid growth of electric fleets, ride-hailing services, public transport, and logistics operations. These sectors require high-capacity, fast-charging infrastructure to ensure efficient operations and minimal downtime. Urban centers and highway corridors are witnessing increased deployment of commercial charging stations to meet rising demand. Additionally, government incentives and public-private partnerships are supporting the expansion of commercial EV infrastructure. The emphasis on electrifying public and commercial transport fleets, along with the need for scalable charging solutions, makes the commercial segment a primary driver of market growth in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2025, North India accounted for the largest market share of over 33.8%, owing to strong government initiatives, high urbanization, and early EV adoption in key states like Delhi, Uttar Pradesh, and Haryana. These states offer policy incentives, dedicated EV mobility schemes, and active support for infrastructure development. Delhi, in particular, has aggressively promoted public and private EV charging networks through subsidies and mandates. The presence of dense population centers and major commercial transport hubs further increases demand for reliable charging infrastructure. This combination of policy support, economic activity, and concentrated vehicle use drives the region’s leadership in market growth.

Competitive Landscape:

India electric vehicle charging station market is experiencing strong growth, driven by strategic partnerships, government-backed initiatives, and technology collaborations. Automakers are teaming up with energy providers and tech startups to expand infrastructure and improve accessibility. The government is actively supporting these efforts through policy incentives and funding schemes focused on both urban and highway networks. Startups and established firms are working on R&D to boost charger efficiency and integrate smart features. Product launches are increasingly aimed at faster, more compact, and networked charging units. Among all these, partnerships and collaborations are the most common practice, helping companies scale quickly and align with national electrification goals. These joint efforts are shaping the future of EV charging in India.

The report provides a comprehensive analysis of the competitive landscape in the India electric vehicle charging station market with detailed profiles of all major companies, including:

- ABB Ltd.

- Ather Energy Limited

- Bolt.Earth

- BrightBlu

- ChargeZone

- Charzer

- Delta Electronics, Inc.

- Exicom

- GLIDA

- Jio-bp

- Statiq

- Tata Power Company Limited

Latest News and Developments:

- February 2025: TATA.ev announced plans to more than double India’s charging infrastructure to 400,000 points by 2027. The initiative included installing 30,000 public fast chargers and launching the TATA. Ev Mega Charger network and introducing TATA.ev Verified Chargers and a 24/7 Charging Helpline to improve EV charging accessibility and reliability.

- December 2024: Hyundai Motor India (HMIL) planned to establish 600 EV fast charging stations across India in seven years, focusing on highways and cities. It aims for 50 operational DC fast chargers. HMIL also signed an MoU with Tamil Nadu to set up 100 stations by 2027.

- December 2024: ThunderPlus partnered with Delta Electronics India to launch the country’s first locally made fast chargers specifically designed for two-wheelers and three-wheelers, addressing the growing demand for electric vehicles in India.

- April 2024: Terra Charge launched two Made-in-India EV chargers, KIWAMI and TAKUMI, to meet the growing demand for efficient charging solutions. Designed for fleet operators and premium properties, the chargers were manufactured with locally sourced components and feature advanced connectivity.

India Electric Vehicle Charging Station Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Charging Station Types Covered | AC Charging, DC Charging, Inductive Charging |

| Vehicle Types Covered | Battery Electric Vehicle (BEV), Plug-in Hybrid Electric Vehicle (PHEV), Hybrid Electric Vehicle (HEV) |

| Installation Types Covered | Portable Charger, Fixed Charger |

| Charging Levels Covered | Level 1, Level 2, Level 3 |

| Connector Types Covered | Combines Charging Station (CCS), CHAdeMO, Normal Charging, Tesla Supercharger, Type-2 (IEC 621196), Others |

| Applications Covered | Residential, Commercial |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | ABB Ltd., Ather Energy Limited, Bolt.Earth, BrightBlu, ChargeZone, Charzer, Delta Electronics, Inc., Exicom, GLIDA, Jio-bp, Statiq, Tata Power Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric vehicle charging station market from 2020-2034.

- The India electric vehicle charging station market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric vehicle charging station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The electric vehicle charging station market in the India was valued at USD 589.1 Million in 2025.

The India electric vehicle charging station market is growing due to rising EV adoption, supportive government policies and subsidies, expansion of charging infrastructure, growing fuel price concerns, and increasing private sector investments in smart and fast-charging technologies across urban and highway networks.

The electric vehicle charging station market is projected to exhibit a CAGR of 6.88% during 2026-2034, reaching a value of USD 1,105.2 Million by 2034.

DC charging accounted for the largest share, holding around 63.7% of the market in 2025.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)