India Electric Water Heater Market Size, Share, Trends and Forecast by Product Type, Capacity, Distribution Channel, End User, and Region, 2025-2033

India Electric Water Heater Market Size and Share:

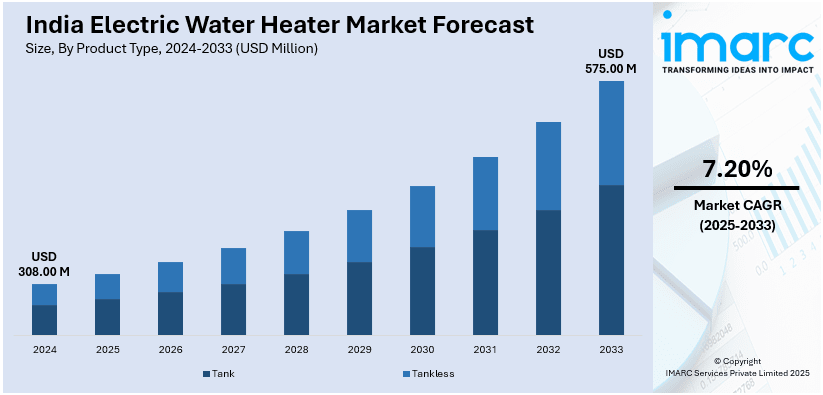

The India electric water heater market size was valued at USD 308.00 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 575.00 Million by 2033, exhibiting a CAGR of 7.20% from 2025-2033. The market is driven by rising urbanization, higher disposable incomes, and the demand for modern home appliances. Harsh winters in northern regions and limited access to gas-based systems further enhance adoption. Additionally, the expansion of online retail platforms enhances product accessibility, driving India electric water heater market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 308.00 Million |

|

Market Forecast in 2033

|

USD 575.00 Million |

| Market Growth Rate 2025-2033 | 7.20% |

The India electric water heater market is primarily driven by the increasing demand for energy-efficient and convenient home appliances. According to a 2023 research report, Indian consumers are progressively choosing energy-efficient home appliances, as evidenced by inverter compressors now representing more than 85% of air conditioning sales and 40% of refrigerator sales, a significant increase from 60% and 20% respectively three years prior. In response to this trend, Arzooo has collaborated with Dixon and Amber to provide smart home appliances. Rapid urbanization and rising disposable incomes are leading to a growing preference for modern amenities, including electric water heaters, particularly in urban and semi-urban areas. Additionally, the harsh winter conditions in northern India and the need for hot water in regions with limited access to gas-based systems further enhance demand. Moreover, government initiatives promoting energy-efficient appliances, such as the Bureau of Energy Efficiency’s (BEE) star rating system, encourage consumers to adopt electric water heaters, fostering the India electric water heater market growth.

To get more information on this market, Request Sample

Product innovation and technological progress are strong market drivers. Smart water heaters with Wi-Fi connectivity, temperature settings, and energy-saving modes are being launched by manufacturers, targeting technology-advanced consumers. Increased environmental awareness is also triggering the transition toward energy-efficient variants, cutting electricity usage and carbon emissions. Furthermore, the expansion of online retail platforms has made these products more accessible to a wider audience, enhancing market penetration. The increasing focus on renewable energy integration, such as solar-powered water heaters, is creating a positive India electric water heater market outlook. On 12th February 2025, The Ministry of Power released updated guidelines for tariff-based competitive bidding aimed at acquiring storage capacity from Pumped Storage Plants (PSPs) to enhance the integration of renewable energy in India. This initiative, in accordance with the National Electricity Plan 2023, aims to achieve a target of 74 GW/411 GWh of energy storage by the year 2031-32, which includes 27 GW/175 GWh specifically from PSPs.

India Electric Water Heater Market Trends:

Rising Adoption of Solar-Powered Water Heaters

One of the significant India electric water heater market trends is the increasing adoption of solar-powered water heaters, driven by the growing emphasis on renewable energy and sustainability. With rising electricity costs and government incentives for solar energy adoption, consumers are shifting toward eco-friendly solutions. On 29th December 2024, Maharashtra was awarded an incentive of ₹260.91 crore by the central government in acknowledgment of its achievements in promoting residential rooftop solar panels, which has greatly enhanced clean energy production. This recognition underscores the state's commitment to advancing the adoption of solar energy over the last four years. Solar water heaters reduce energy bills and align with India’s commitment to reducing carbon emissions. This trend is particularly prominent in residential and commercial sectors, where long-term cost savings and environmental benefits are prioritized. Manufacturers are also innovating to integrate solar technology with electric water heaters, offering hybrid models to cater to diverse consumer needs.

Growing Popularity of Instant Water Heaters

Instant electric water heaters are gaining traction in India due to their compact design, energy efficiency, and quick heating capabilities. These heaters are ideal for urban households with limited space and for consumers seeking on-demand hot water solutions. The trend is further fueled by the increasing number of nuclear families and working professionals who prioritize convenience and time-saving appliances. On 6th September 2024, Racold introduced the Omnis Slim Electric Storage Water Heater and the Aures Pro 13 kW Tankless Water Heater, both of which incorporate advanced technology and promote energy efficiency. The Aures Pro provides immediate hot water without the necessity of a storage tank, addressing the requirements of contemporary households, whereas the Omnis Slim guarantees heating that is up to 25% quicker. Additionally, instant water heaters are cost-effective, as they consume less energy compared to storage heaters. Manufacturers are focusing on enhancing safety features, such as auto-cutoff and thermal insulation, to attract safety-conscious consumers, further driving the India electric water heater market demand.

Expansion of Smart and Connected Water Heaters

The integration of smart technology in electric water heaters is a key trend shaping the Indian market. Smart water heaters equipped with Wi-Fi connectivity, mobile app controls, and IoT-enabled features are gaining popularity among tech-savvy consumers. These appliances allow users to remotely monitor and control water temperature, schedule heating cycles, and track energy consumption, enhancing convenience and efficiency. On 8th November 2024, Crompton Greaves Consumer Electricals Ltd introduced a new television commercial for its 5-star rated water heaters, emphasizing energy efficiency and lower utility expenses. The campaign titled "Crompton Geyser On Energy Savings Full On!" highlights the convenience and intelligent features of their connected water heaters, targeting consumers who are mindful of energy consumption. The increasing use of smartphones and improved internet access in urban and semi-urban areas support the trend even more. In addition, businesses are giving voice-activated interoperability with virtual assistants including Google Assistant and Alexa top priority in order to meet the growing demand for connected home products in India's expanding smart home market.

India Electric Water Heater Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India electric water heater market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, capacity, distribution channel, and end user.

Analysis by Product Type:

- Tank

- Tankless

The tank-based electric water heater segment dominates the India market due to its widespread suitability for residential and commercial applications. These heaters are favored as they can store and provide enormous amounts of hot water, which makes them perfect for homes with high use needs. Their affordability and longevity add to their allure, especially in areas with protracted cold seasons. Furthermore, issues regarding excessive power consumption have been addressed by improvements in insulation and energy-efficient designs in tank water heaters, which is in line with customer desire for environmentally friendly solutions. The tank segment's position as the largest product type in the market is cemented by the availability of different capacities and price ranges that also satisfy a range of customer demands.

Analysis by Capacity:

- Less Than 100 Liters

- 100 to 400 Liters

- More Than 400 Liters

Electric water heaters with a capacity of less than 100 liters are primarily designed for small households or individual use. These compact units are energy-efficient and cost-effective, making them ideal for urban apartments and nuclear families. Their quick heating capability and lower electricity consumption appeal to budget-conscious consumers. This segment is also popular in regions with moderate hot water needs, driving demand for compact and space-saving solutions.

The 100 to 400 liters segment caters to medium to large households and small commercial establishments. These water heaters balance capacity and energy efficiency, meeting the demands of families with higher hot water usage. They are widely adopted in residential complexes and hospitality sectors, offering reliable performance and consistent hot water supply. Innovations in insulation and heating technology have further enhanced their appeal, making them a preferred choice in this segment.

Electric water heaters with a capacity exceeding 400 liters are designed for large commercial and industrial applications, such as hotels, hospitals, and gyms. These high-capacity units ensure a continuous supply of hot water for heavy usage environments. Their robust construction and advanced features, including multiple heating elements, cater to the specific needs of large-scale operations. This segment is driven by the growing hospitality and healthcare industries, where reliable hot water supply is critical.

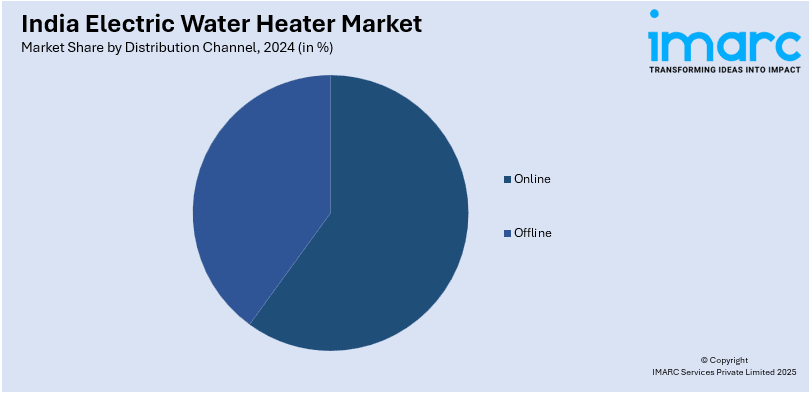

Analysis by Distribution Channel:

- Online

- Offline

As e-commerce platforms proliferate and consumer digital literacy rises, the online distribution channel is rapidly growing more significant in the Indian market. The ease with which consumers can browse a vast array of items from the comfort of their homes, compare prices, and read reviews is highly valued by them. Furthermore, online marketplaces frequently include alluring discounts, EMI choices, and home delivery services, all of which improve the entire purchasing experience. This segment is especially favored by tech-savvy urban consumers, playing a crucial role in the expansion of the market.

Offline distribution remains a significant channel in the electric water heater market, supported by established retail networks and consumer trust in physical stores. Customers prefer offline purchases for the ability to inspect products, seek expert advice, and ensure immediate availability. Specialty appliance stores, multi-brand outlets, and dealer networks play a crucial role in reaching both urban and rural consumers. The tactile shopping experience and after-sales support offered by offline channels continue to drive their popularity.

Analysis by End User:

- Residential

- Commercial

- Industrial

The residential sector represents the most significant consumer of electric water heaters, influenced by the trends of increasing urbanization and the growing preference for contemporary home appliances. The rise in disposable incomes, coupled with the desire for convenience in domestic settings, especially in colder climates, further propels this demand. Compact and energy-efficient models are especially favored by urban families and nuclear households, establishing this segment as a crucial contributor to market expansion.

The commercial sector includes a range of facilities, such as hotels, hospitals, fitness centers, and educational institutions, that need a consistent supply of hot water. In addition to their dependability, capacity, and energy economy, electric water heaters are considered the industry standard. The growth of the healthcare and hospitality sectors, as well as continuous infrastructure upgrades, are the main drivers of this market's rising demand.

High-capacity electric water heaters are used in the industrial sector to supply hot water for activities involving food processing and manufacturing that require large amounts of it. These heaters are designed to meet the particular requirements of industrial applications while being long-lasting and efficient. Although this segment holds a smaller market share relative to residential and commercial sectors, it is experiencing growth driven by industrialization and the integration of advanced heating technologies across diverse industries.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

The major factors driving North India's sizable industry are the harsh winters in regions including Uttarakhand, Himachal Pradesh, and Jammu & Kashmir. This requirement is being driven by the need for reliable hot water solutions in both residential and commercial settings. Additionally, the region's rising popularity of electric water heaters may be attributed in large part to increased urbanization and government programs that favor energy-efficient equipment.

West and Central India, which comprises the states of Maharashtra, Gujarat, and Madhya Pradesh, has a significant need for electric water heaters. Urbanization and growing disposable incomes are driving this need. The region's mix of metropolitan and semi-urban areas, together with the growth of the hotel sector, contributes to market expansion. Energy-efficient versions are growing in popularity as individual's awareness of sustainability and cost savings increases.

South India's temperate temperature makes it a region with a high need for electric water heaters, particularly in metropolitan areas and commercial facilities including hotels and hospitals. Due to the growth of their infrastructure and the need for contemporary conveniences, important states such as Tamil Nadu, Karnataka, and Kerala are involved. The region's focus on energy efficiency and the rising acceptance of solar-integrated water heaters are also influencing market developments.

Electric water heaters are being progressively used in eastern India, which includes states including West Bengal, Odisha, and Bihar, as a result of urbanization and better economic conditions. Even though demand is currently lower than in other industries, this sector is developing primarily as an outcome of government initiatives to promote energy efficiency and rising consumer awareness of contemporary appliances. The region’s potential lies in untapped rural markets and rising infrastructure projects.

Competitive Landscape:

The competitive landscape of the market is characterized by a combination of established corporations and emerging players seeking to establish their presence. Leading companies are focusing on product innovation, introducing energy-efficient and smart water heaters that feature advanced capabilities such as Wi-Fi connectivity and temperature control. In order to reach a larger audience, businesses are expanding their distribution channels by using online platforms. Organizations are increasingly using mergers, acquisitions, and strategic alliances to increase their market exposure and technological know-how. In addition, companies are investing in marketing techniques that educate customers about the benefits of energy-efficient goods, supporting their competitive edge by coordinating with sustainability and governmental programs.

The report provides a comprehensive analysis of the competitive landscape in the India electric water heater market with detailed profiles of all major companies.

Latest News and Developments:

- December 24, 2024: A.O. Smith introduced the Elegance Neo Series of water heaters in India, which are offered in both vertical and horizontal configurations. These electric water heaters are rated with a BEE 5-star efficiency and are available in capacities of 10 and 15 litres, with prices starting at INR 9,800. Additionally, they are backed by a warranty of up to seven years.

- December 02, 2024: Surya Roshni unveiled the Qube+ series of electric water heaters, which boast 5-star ratings from the Bureau of Energy Efficiency, signifying outstanding energy efficiency and performance. These heaters come with complimentary standard installation and home service options, making them suitable for a variety of requirements and improving convenience for both residential and commercial users.

- August 14, 2024: Symphony Limited made its debut in the smart water geyser sector by unveiling three distinct series: Spa, Sauna, and Soul. These innovative products incorporate AI-enabled controllers along with state-of-the-art water filtration systems. The newly introduced electric water heaters provide features such as voice notifications, customizable timer options, and improved safety mechanisms.

India Electric Water Heater Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tank, Tankless |

| Capacities Covered | Less Than 100 Liters, 100 to 400 Liters, More Than 400 Liters |

| Distribution Channels Covered | Online, Offline |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India electric water heater market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India electric water heater market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India electric water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India electric water heater market was valued at USD 308.00 Million in 2024.

The growth is driven by rising urbanization, higher disposable incomes, demand for modern appliances, harsh winters in northern regions, limited access to gas-based systems, and government initiatives promoting energy-efficient appliances such as the BEE star rating system. Technological advancements, such as smart and solar-powered water heaters, and the expansion of online retail platforms also contribute to market growth.

The India electric water heater market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 575.00 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)